Free 810025 Iowa Template

Things You Should Know About This Form

-

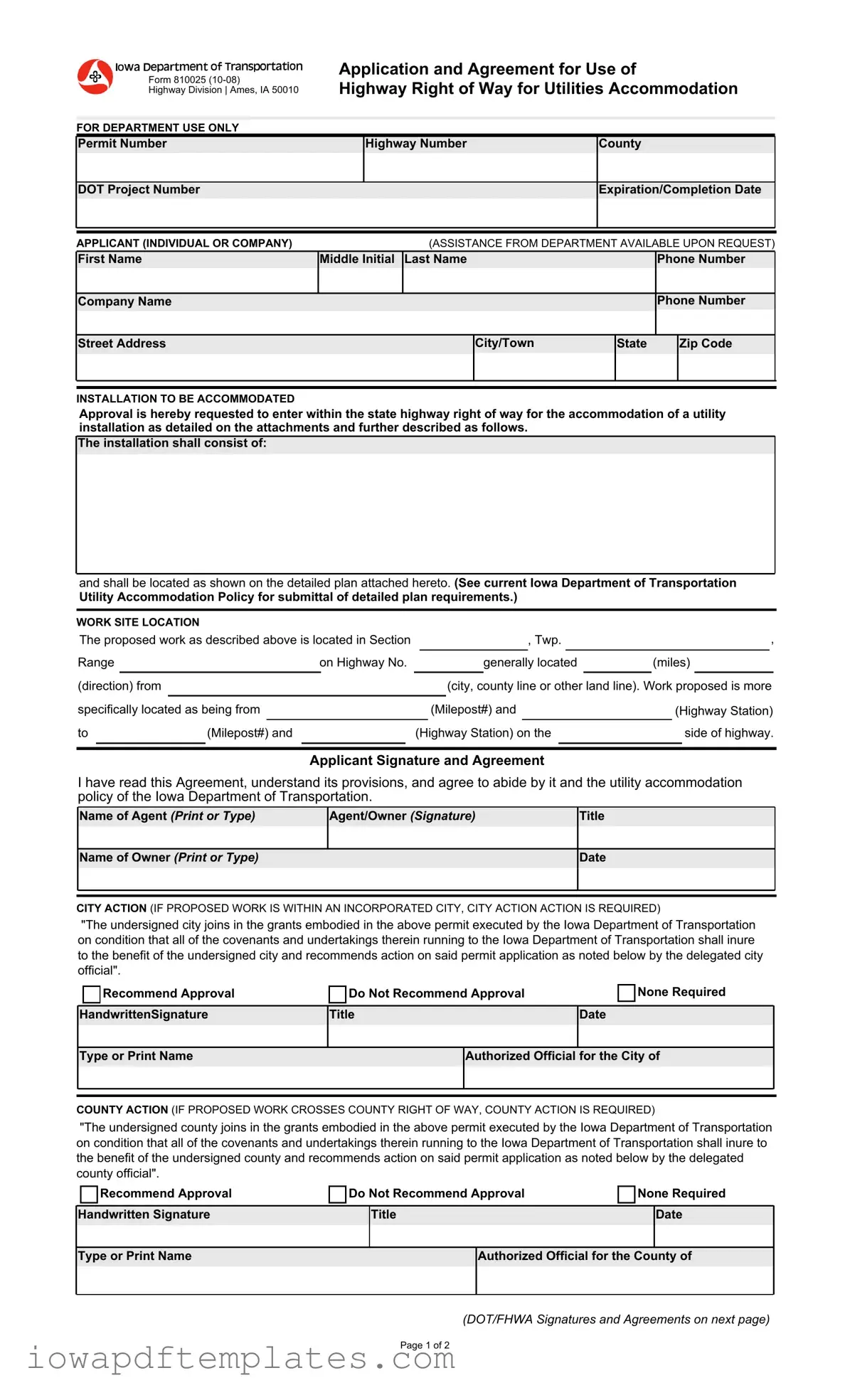

What is the purpose of the 810025 Iowa form?

The 810025 Iowa form is used for reporting specific information required by the state of Iowa. This may include details related to taxes, business operations, or compliance with state regulations. Understanding its purpose is essential for accurate completion and timely submission.

-

Who needs to file the 810025 Iowa form?

Individuals or businesses that meet certain criteria set by the state of Iowa must file the 810025 form. Typically, this includes those who have specific tax obligations or regulatory requirements. It is important to review the eligibility criteria to determine if filing is necessary.

-

What information is required on the 810025 Iowa form?

The form requires various pieces of information, including:

- Personal or business identification details

- Financial data related to the reporting period

- Any additional documentation that supports the entries made on the form

Providing complete and accurate information helps ensure compliance with state regulations.

-

When is the 810025 Iowa form due?

The due date for submitting the 810025 form typically aligns with specific tax deadlines or reporting periods established by the state. It is crucial to check the latest guidelines from the Iowa Department of Revenue or other relevant authorities to avoid late fees or penalties.

-

Where can I obtain the 810025 Iowa form?

The 810025 Iowa form can be obtained from the Iowa Department of Revenue's website or through designated state offices. Additionally, some tax preparation software may include the form for electronic filing. Always ensure you are using the most current version of the form.

Form Features

| Fact Name | Details |

|---|---|

| Form Number | 810025 |

| State | Iowa |

| Purpose | This form is used for specific administrative purposes in Iowa. |

| Governing Law | Iowa Administrative Code |

| Filing Method | Can be filed online or submitted by mail. |

| Deadline | Submission deadlines vary based on the specific use of the form. |

| Contact Information | For questions, contact the Iowa Department of Administrative Services. |

Discover Other PDFs

What Does a Job Application Look Like - Indicate if your current employer can be contacted for additional reference.

Iowa Tags and Title - Exemptions must be clearly marked and justified to avoid unnecessary fees.

When engaging in the sale of a vehicle, it's crucial to utilize a proper Motor Vehicle Bill of Sale to protect both parties involved in the transaction. This form not only provides essential information about the vehicle but also serves as a record of the sale, ensuring clarity and legality. You can conveniently find and download the necessary template for this form at PDF Templates.

Rent Reimbursement Form 2022 - Claims must be filed by June 1, 2003, to be eligible for reimbursement without an extension.

Key takeaways

- Complete the 810025 Iowa form accurately to ensure proper processing.

- Gather all necessary information before starting, including personal details and relevant financial data.

- Double-check all entries for accuracy to avoid delays in processing.

- Use clear and legible handwriting if filling out the form by hand.

- Submit the form by the specified deadline to avoid penalties or issues.

- Keep a copy of the completed form for your records after submission.

- Contact the appropriate Iowa agency if you have questions about the form or its requirements.

- Review any instructions provided with the form to ensure compliance with all regulations.

Sample - 810025 Iowa Form

ﯘۣۦۡǔүҚҗҗқھǔǜҚҗﮟҗү۶

ﯜۛۜ۫Кǔﯚ۪ۣۧۢǔﭣǔﯠۡۙۧﮞǔﯢﯠǔھҗҗҚҗ

ﯠۤۤ۠ۗКۣۨۢǔКۢۘǔﯠۛۦۙۙۡۙۢۨǔۣۚۦǔЎۧۙǔۣۚ

ﯜۛۜ۫КǔﯼۛۜۨǔۣۚǔﯤКǔۣۚۦǔЎۨ۠ۨۙۧǔﯠۣۣۗۗۡۡۘКۣۨۢ

ﯘﮓﯼǔﯚﯗﮔﯠﯼЌﯞﯗﯟЌǔЎﯽﯗǔﮓﯟﮐﯦ

ﮔۙۦۡۨǔﯟ۩ۡۖۙۦ |

|

ﯜۛۜ۫Кǔﯟ۩ۡۖۙۦ |

ﯙۣ۩ۢۨ |

|

|

|||

|

|

|

|

|

|

|

|

|

ﯚﮓЌǔﮔۦۣ۞ۙۗۨǔﯟ۩ۡۖۙۦ |

|

|

|

|

ﯗۤۦКۣۨۢﮡﯙۣۣۡۤ۠ۙۨۢǔﯚКۨۙ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ﯠﮔﮔﮐﯢﯙﯠﯟЌǔǜﯢﯟﯚﯢЏﯢﯚЎﯠﮐǔﮓﯼǔﯙﮓﯞﮔﯠﯟﯦ۶ |

|

|

ǜﯠﯽﯽﯢﯽЌﯠﯟﯙﯗǔﯘﯼﮓﯞǔﯚﯗﮔﯠﯼЌﯞﯗﯟЌǔﯠЏﯠﯢﮐﯠﯡﮐﯗǔЎﮔﮓﯟǔﯼﯗﮕЎﯗﯽЌ۶ |

|||||

ﯘۦۧۨǔﯟКۡۙ |

ﯞۘۘ۠ۙǔﯢۢۨК۠ |

ﮐКۧۨǔﯟКۡۙ |

|

|

ﮔۣۜۢۙǔﯟ۩ۡۖۙۦ |

|||

|

|

|

|

|

|

|

|

|

ﯙۣۡۤКۢǔﯟКۡۙ |

|

|

|

|

|

|

ﮔۣۜۢۙǔﯟ۩ۡۖۙۦ |

|

|

|

|

|

|

|

|

|

|

ﯽۨۦۙۙۨǔﯠۘۘۦۙۧۧ |

|

|

|

ﯙۨﮡЌۣ۫ۢ |

|

ﯽۨКۨۙ |

|

ﯧۤǔﯙۣۘۙ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ﯢﯟﯽЌﯠﮐﮐﯠЌﯢﮓﯟǔЌﮓǔﯡﯗǔﯠﯙﯙﮓﯞﯞﮓﯚﯠЌﯗﯚ

ﯠۤۤۦۣ۪К۠ǔۧǔۜۙۦۙۖǔۦۙۥ۩ۙۧۨۙۘǔۣۨǔۙۢۨۙۦǔ۫ۨۜۢǔۨۜۙǔۧۨКۨۙǔۜۛۜ۫Кǔۦۛۜۨǔۣۚǔ۫КǔۣۚۦǔۨۜۙǔКۣۣۗۗۡۡۘКۣۨۢǔۣۚǔКǔ۩ۨ۠ۨ ۢۧۨК۠۠КۣۨۢǔКۧǔۘۙۨК۠ۙۘǔۣۢǔۨۜۙǔКۨۨКۗۜۡۙۢۨۧǔКۢۘǔۚ۩ۦۨۜۙۦǔۘۙۧۗۦۖۙۘǔКۧǔۣۣۚ۠۠۫ۧﮠ ЌۜۙǔۢۧۨК۠۠КۣۨۢǔۧۜК۠۠ǔۣۗۢۧۧۨǔۣۚﮤ

КۢۘǔۧۜК۠۠ǔۖۙǔۣ۠ۗКۨۙۘǔКۧǔۣۧۜ۫ۢǔۣۢǔۨۜۙǔۘۙۨК۠ۙۘǔۤ۠КۢǔКۨۨКۗۜۙۘǔۜۙۦۣۙۨﮠ ǜﯽۙۙǔۗ۩ۦۦۙۢۨǔﯢۣ۫КǔﯚۙۤКۦۨۡۙۢۨǔۣۚǔЌۦКۣۢۧۤۦۨКۣۨۢ Ўۨ۠ۨǔﯠۣۣۗۗۡۡۘКۣۨۢǔﮔۣ۠ۗǔۣۚۦǔۧ۩ۖۡۨۨК۠ǔۣۚǔۘۙۨК۠ۙۘǔۤ۠Кۢǔۦۙۥ۩ۦۙۡۙۢۨۧﮠ۶

ﯤﮓﯼﮏǔﯽﯢЌﯗǔﮐﮓﯙﯠЌﯢﮓﯟ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Ќۜۙǔۤۦۣۣۤۧۙۘǔۣ۫ۦﭞǔКۧǔۘۙۧۗۦۖۙۘǔКۣ۪ۖۙǔۧǔۣ۠ۗКۨۙۘǔۢǔﯽۣۙۗۨۢ |

|

|

|

|

|

|

ﮞǔЌ۫ۤﮠ |

|

|

|

|

|

|

ﮞ |

||||||||||

ﯼКۢۛۙ |

|

|

|

ۣۢǔﯜۛۜ۫Кǔﯟۣﮠ |

|

|

|

|

ۛۙۢۙۦК۠۠ǔۣ۠ۗКۨۙۘ |

|

ǜۡ۠ۙۧ۶ |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ǜۘۦۣۙۗۨۢ۶ǔۚۦۣۡ |

|

|

|

|

|

|

|

|

|

ǜۗۨﮞǔۣۗ۩ۢۨǔ۠ۢۙǔۣۦǔۣۨۜۙۦǔ۠Кۢۘǔ۠ۢۙ۶ﮠǔﯤۣۦﭞǔۤۦۣۣۤۧۙۘǔۧǔۣۡۦۙ |

||||||||||||||

ۧۤۙۗۚۗК۠۠ǔۣ۠ۗКۨۙۘǔКۧǔۖۙۢۛǔۚۦۣۡ |

|

|

|

ǜﯞۣ۠ۙۤۧۨǗ۶ǔКۢۘ |

|

|

|

ǜﯜۛۜ۫КǔﯽۨКۣۨۢ۶ |

||||||||||||||||

ۣۨ |

ǜﯞۣ۠ۙۤۧۨǗ۶ǔКۢۘ |

ǜﯜۛۜ۫КǔﯽۨКۣۨۢ۶ ۣۢǔۨۜۙ |

|

|

|

ۧۘۙǔۣۚǔۜۛۜ۫Кﮠ |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ﯠۤۤ۠ۗКۢۨǔﯽۛۢКۨ۩ۦۙǔКۢۘǔﯠۛۦۙۙۡۙۢۨ

ﯢǔۜК۪ۙǔۦۙКۘǔۨۜۧǔﯠۛۦۙۙۡۙۢۨﮞǔ۩ۢۘۙۦۧۨКۢۘǔۨۧǔۤۦۣ۪ۣۧۢۧﮞǔКۢۘǔКۛۦۙۙǔۣۨǔКۖۘۙǔۖǔۨǔКۢۘǔۨۜۙǔ۩ۨ۠ۨǔКۣۣۗۗۡۡۘКۣۨۢ ۣۤ۠ۗǔۣۚǔۨۜۙǔﯢۣ۫КǔﯚۙۤКۦۨۡۙۢۨǔۣۚǔЌۦКۣۢۧۤۦۨКۣۨۢﮠ

ﯟКۡۙǔۣۚǔﯠۛۙۢۨΝΧẽẴẹếΝẺẽΝỄẻẰΨ

ﯠۛۙۢۨﮡﮓ۫ۢۙۦ ΧẴẲẹẬếỀẽẰΨ

Ќۨ۠ۙ

ﯟКۡۙǔۣۚǔﮓ۫ۢۙۦ ΧẽẴẹếΝẺẽΝỄẻẰΨ

ﯚКۨۙ

ﯙﯢЌﯦǔﯠﯙЌﯢﮓﯟǔǜﯢﯘǔﮔﯼﮓﮔﮓﯽﯗﯚǔﯤﮓﯼﮏǔﯢﯽǔﯤﯢЌﯜﯢﯟǔﯠﯟǔﯢﯟﯙﮓﯼﮔﮓﯼﯠЌﯗﯚǔﯙﯢЌﯦﮞǔﯙﯢЌﯦǔﯠﯙЌﯢﮓﯟǔﯠﯙЌﯢﮓﯟǔﯢﯽǔﯼﯗﮕЎﯢﯼﯗﯚ۶

ǔǖЌۜۙǔ۩ۢۘۙۦۧۛۢۙۘǔۗۨǔ۞ۣۢۧǔۢǔۨۜۙǔۛۦКۢۨۧǔۣۙۡۖۘۙۘǔۢǔۨۜۙǔКۣ۪ۖۙǔۤۙۦۡۨǔۙۙۗ۩ۨۙۘǔۖǔۨۜۙǔﯢۣ۫КǔﯚۙۤКۦۨۡۙۢۨǔۣۚǔЌۦКۣۢۧۤۦۨКۣۨۢ ۣۢǔۣۣۗۢۘۨۢǔۨۜКۨǔК۠۠ǔۣۚǔۨۜۙǔۣ۪ۗۙۢКۢۨۧǔКۢۘǔ۩ۢۘۙۦۨКﭞۢۛۧǔۨۜۙۦۙۢǔۦ۩ۢۢۢۛǔۣۨǔۨۜۙǔﯢۣ۫КǔﯚۙۤКۦۨۡۙۢۨǔۣۚǔЌۦКۣۢۧۤۦۨКۣۨۢǔۧۜК۠۠ǔۢ۩ۦۙ ۣۨǔۨۜۙǔۖۙۢۙۚۨǔۣۚǔۨۜۙǔ۩ۢۘۙۦۧۛۢۙۘǔۗۨǔКۢۘǔۦۣۙۗۡۡۙۢۘۧǔКۣۗۨۢǔۣۢǔۧКۘǔۤۙۦۡۨǔКۤۤ۠ۗКۣۨۢǔКۧǔۣۢۨۙۘǔۣۖۙ۠۫ǔۖǔۨۜۙǔۘۙ۠ۙۛКۨۙۘǔۗۨ ۣۚۚۗК۠ǖﮠ

ﯼۣۙۗۡۡۙۢۘǔﯠۤۤۦۣ۪К۠ |

ﯚۣǔﯟۣۨǔﯼۣۙۗۡۡۙۢۘǔﯠۤۤۦۣ۪К۠ |

ﯟۣۢۙǔﯼۙۥ۩ۦۙۘ |

|

|

|

ﯜКۢۘ۫ۦۨۨۙۢﯽۛۢКۨ۩ۦۙ |

Ќۨ۠ۙ |

ﯚКۨۙ |

|

|

|

ЌۤۙǔۣۦǔﮔۦۢۨǔﯟКۡۙ

ﯠ۩ۣۨۜۦۙۘǔﮓۚۚۗК۠ǔۣۚۦǔۨۜۙǔﯙۨǔۣۚ

ﯙﮓЎﯟЌﯦǔﯠﯙЌﯢﮓﯟǔǜﯢﯘǔﮔﯼﮓﮔﮓﯽﯗﯚǔﯤﮓﯼﮏǔﯙﯼﮓﯽﯽﯗﯽǔﯙﮓЎﯟЌﯦǔﯼﯢﯛﯜЌǔﮓﯘǔﯤﯠﯦﮞǔﯙﮓЎﯟЌﯦǔﯠﯙЌﯢﮓﯟǔﯢﯽǔﯼﯗﮕЎﯢﯼﯗﯚ۶

ǔǖЌۜۙǔ۩ۢۘۙۦۧۛۢۙۘǔۣۗ۩ۢۨǔ۞ۣۢۧǔۢǔۨۜۙǔۛۦКۢۨۧǔۣۙۡۖۘۙۘǔۢǔۨۜۙǔКۣ۪ۖۙǔۤۙۦۡۨǔۙۙۗ۩ۨۙۘǔۖǔۨۜۙǔﯢۣ۫КǔﯚۙۤКۦۨۡۙۢۨǔۣۚǔЌۦКۣۢۧۤۦۨКۣۨۢ ۣۢǔۣۣۗۢۘۨۢǔۨۜКۨǔК۠۠ǔۣۚǔۨۜۙǔۣ۪ۗۙۢКۢۨۧǔКۢۘǔ۩ۢۘۙۦۨКﭞۢۛۧǔۨۜۙۦۙۢǔۦ۩ۢۢۢۛǔۣۨǔۨۜۙǔﯢۣ۫КǔﯚۙۤКۦۨۡۙۢۨǔۣۚǔЌۦКۣۢۧۤۦۨКۣۨۢǔۧۜК۠۠ǔۢ۩ۦۙǔۣۨ ۨۜۙǔۖۙۢۙۚۨǔۣۚǔۨۜۙǔ۩ۢۘۙۦۧۛۢۙۘǔۣۗ۩ۢۨǔКۢۘǔۦۣۙۗۡۡۙۢۘۧǔКۣۗۨۢǔۣۢǔۧКۘǔۤۙۦۡۨǔКۤۤ۠ۗКۣۨۢǔКۧǔۣۢۨۙۘǔۣۖۙ۠۫ǔۖǔۨۜۙǔۘۙ۠ۙۛКۨۙۘ ۣۗ۩ۢۨǔۣۚۚۗК۠ǖﮠ

ﯼۣۙۗۡۡۙۢۘǔﯠۤۤۦۣ۪К۠ |

ﯚۣǔﯟۣۨǔﯼۣۙۗۡۡۙۢۘǔﯠۤۤۦۣ۪К۠ |

ﯟۣۢۙǔﯼۙۥ۩ۦۙۘ |

|

|

|

|

|

ﯜКۢۘ۫ۦۨۨۙۢǔﯽۛۢКۨ۩ۦۙ |

|

Ќۨ۠ۙ |

ﯚКۨۙ |

|

|

|

|

ЌۤۙǔۣۦǔﮔۦۢۨǔﯟКۡۙ

ﯠ۩ۣۨۜۦۙۘǔﮓۚۚۗК۠ǔۣۚۦǔۨۜۙǔﯙۣ۩ۢۨǔۣۚ

Χ́ήόẢΝẴẲẹẬếỀẽẰẾΝẬẹắΝẲẽẰẰẸẰẹếẾΝẺẹΝẹẰểếΝẻẬẲẰΨ

ﮔКۛۙǔҚǔۣۚǔқ

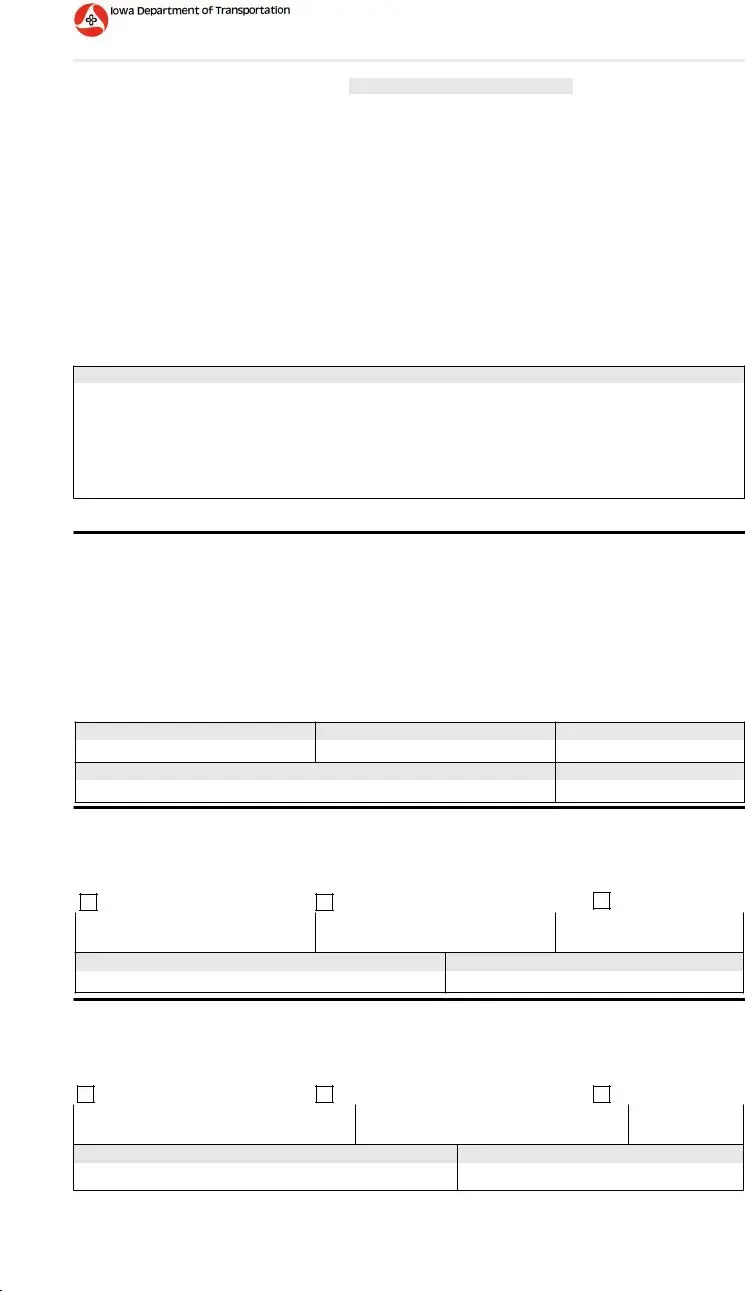

ﯘﮓﯼǔﯚﯗﮔﯠﯼЌﯞﯗﯟЌǔЎﯽﯗǔﮓﯟﮐﯦ

ǔﯽۤۙۗК۠ǔﯼۙۥ۩ۦۙۡۙۢۨۧﮤǔۢǔКۣۘۘۨۢǔۣۨǔۨۜۙǔۧۨۤ۩۠Кۣۨۢۧǔۣۖۙ۠۫ﮞǔۨۜۙǔۣۣۚ۠۠۫ۢۛǔۧۤۙۗК۠ǔۦۙۥ۩ۦۙۡۙۢۨۧǔۧۜК۠۠ǔКۤۤ۠ǔۣۨǔۨۜۧǔۤۙۦۡۨﮤ

ﯘﯗﯚﯗﯼﯠﮐǔﯜﯢﯛﯜﯤﯠﯦǔﯠﯚﯞﯢﯟﯢﯽЌﯼﯠЌﯢﮓﯟǔﯠﯙЌﯢﮓﯟǔǜﯤﯜﯗﯟǔﯼﯗﮕЎﯢﯼﯗﯚ۶ |

|

|

|

|

||||

ﯼۣۙۗۡۡۙۢۘǔﯠۤۤۦۣ۪К۠ |

ﯚۣǔﯟۣۨǔﯼۣۙۗۡۡۙۢۘǔﯠۤۤۦۣ۪К۠ |

|

|

ﯟۣۢۙǔﯼۙۥ۩ۦۙۘ |

||||

|

|

|

|

|

|

|

|

|

ﯠ۩ۣۨۜۦۙۘǔﯘﯜﯤﯠǔﯼۙۤۦۙۧۙۢۨК۪ۨۙǔﯽۛۢКۨ۩ۦۙ |

|

|

|

|

|

ﯚКۨۙ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ﯚﯗﮔﯠﯼЌﯞﯗﯟЌǔﮓﯘǔЌﯼﯠﯟﯽﮔﮓﯼЌﯠЌﯢﮓﯟǔﯘﯢﯟﯠﮐǔﯠﯙЌﯢﮓﯟ |

|

|

|

|

|

|

|

|

ﯠۤۤ۠ۗКۣۨۢǔﯠۤۤۦۣ۪ۙۘ |

ﯠۤۤ۠ۗКۣۨۢǔﯚۙۢۙۘ |

ﮔۙۦۡۨǔﯟ۩ۡۖۙۦ |

|

|

||||

ﯠ۩ۣۨۜۦۙۘǔﯜۛۜ۫КǔﯚۧۨۦۗۨǔﯼۙۤۦۙۧۙۢۨК۪ۨۙ |

|

ﯽۛۢКۨ۩ۦۙ |

|

|

ﯚКۨۙ |

|||

ΧỄẻẰΝẺẽΝẽẴẹếΨ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ﯟۣۨۗۙǔۣۚǔۣۢۨۙۢۨۢǔۣۨǔۧۨКۦۨǔۣۗۢۧۨۦ۩ۣۗۨۢǔۣۦǔۡКۢۨۙۢКۢۗۙǔК۪ۗۨۨۙۧǔۣۢǔۨۜۙǔۜۛۜ۫Кǔۦۛۜۨǔۣۚǔ۫КǔۧۜК۠۠ǔۖۙǔۡКۘۙǔۣۨﮤ |

|

|

||||||

ﮐۣۗК۠ǔﯚﮓЌǔﯙۣۢۨКۗۨǔﮔۙۦۣۧۢǔǜЌۤۙǔۣۚǔﮔۦۢۨǔﯟКۡۙ۶ |

|

|

|

|

|

ﮔۣۜۢۙǔﯟ۩ۡۖۙۦ |

||

|

|

|

|

|

|

|

|

|

ﯽۨۦۙۙۨǔﯠۘۘۦۙۧۧ |

|

|

ﯙۨﮡЌۣ۫ۢ |

|

ﯽۨКۨۙ |

|

ﯧﯢﮔǔﯙۣۘۙ |

|

|

|

|

|

|

|

ﯢﯠ |

|

|

ﯠﯛﯼﯗﯗﯞﯗﯟЌﯽ

Ќۜۙǔ۩ۨ۠ۨǔۣۗۡۤКۢﮞǔۣۗۦۣۤۦКۣۨۢﮞǔКۤۤ۠ۗКۢۨﮞǔۤۙۦۡۨǔۣۜ۠ۘۙۦǔۣۦǔ۠ۗۙۢۧۙۙﮞǔǜۜۙۦۙۢКۚۨۙۦǔۦۙۚۙۦۦۙۘǔۣۨǔКۧǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦ۶ǔКۛۦۙۙۧ ۫ۨۜǔۨۜۙǔﯢۣ۫КǔﯚۙۤКۦۨۡۙۢۨǔǜۜۙۦۙКۚۨۙۦǔۦۙۚۙۦۦۙۘǔۣۨǔКۧǔﯚۙۤКۦۨۡۙۢۨ۶ǔۨۜКۨǔۨۜۙǔۣۣۚ۠۠۫ۢۛǔۧۨۤ۩۠КۣۨۢۧǔКۢۘǔۣۨۜۧۙǔۧۤۙۗК۠ǔۦۙۥ۩ۦۙۡۙۢۨۧ Кۧǔ۠ۧۨۙۘǔۣۢǔۨۜۧǔۤКۛۙǔۧۜК۠۠ǔۣ۪ۛۙۦۢǔ۩ۢۘۙۦǔۨۜۧǔۤۙۦۡۨﮠ ﯠﮠǔǔﯛۙۢۙۦК۠

ҚﮠǔǔЌۜۙǔۢۧۨК۠۠КۣۨۢǔۧۜК۠۠ǔۡۙۙۨǔۨۜۙǔۦۙۥ۩ۦۙۡۙۢۨۧǔۣۚǔۣ۠ۗК۠ǔۡ۩ۢۗۤК۠ﮞǔۣۗ۩ۢۨﮞǔۧۨКۨۙﮞǔКۢۘǔۚۙۘۙۦК۠ǔﯢۣ۫КǔۚۦКۢۗۜۧۙǔۦ۩۠ۙۧǔКۢۘ ۦۙۛ۩۠Кۣۨۢۧﮞǔۦۙۛ۩۠КۣۨۢۧǔКۢۘǔۘۦ۪ۙۗۨۙۧǔۣۚǔۨۜۙǔﯢۣ۫КǔﯽۨКۨۙǔﯙۣۡۡۙۦۗۙǔﯙۣۣۡۡۧۧۢﮥǔۨۜۙǔﯚۙۤКۦۨۡۙۢۨǔۣۚǔﯟКۨ۩ۦК۠ǔﯼۣۙۧ۩ۦۗۙۧﮞǔК۠۠ ۦ۩۠ۙۧǔКۢۘǔۦۙۛ۩۠КۣۨۢۧǔۣۚǔۨۜۙǔﯚۙۤКۦۨۡۙۢۨǔКۢۘǔКۢǔۣۨۜۙۦǔ۠К۫ۧǔۣۦǔۦۙۛ۩۠КۣۨۢۧǔКۤۤ۠ۗКۖ۠ۙﮠ қﮠǔǔЌۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔۧۜК۠۠ǔۖۙǔۚ۩۠۠ǔۦۣۙۧۤۢۧۖ۠ۙǔۣۚۦǔКۢǔۚ۩ۨ۩ۦۙǔКۘ۞۩ۧۨۡۙۢۨۧǔۣۚǔۨۜۙǔۚКۗ۠ۨۙۧǔ۫ۨۜۢǔۨۜۙǔۙۧۨКۖ۠ۧۜۙۘǔۜۛۜ۫К ۦۛۜۨﮟۣۚﮟ۫КǔۗК۩ۧۙۘǔۖǔۜۛۜ۫Кǔۣۗۢۧۨۦ۩ۣۗۨۢǔۣۦǔۡКۢۨۙۢКۢۗۙǔۣۤۙۦКۣۨۢۧﮠ Ҝﮠǔǔﯟۣۢﮟۣۗۡۤ۠Кۢۗۙǔ۫ۨۜǔКۢǔۣۚǔۨۜۙǔۨۙۦۡۧǔۣۚǔۨۜۙǔﯚۙۤКۦۨۡۙۢۨǛۧǔۣۤ۠ۗﮞǔۤۙۦۡۨǔۣۦǔКۛۦۙۙۡۙۢۨﮞǔۡКǔۖۙǔۣۗۢۧۘۙۦۙۘǔۗК۩ۧۙǔۣۚۦ ۧۜ۩ۨﮟۣۘ۫ۢǔۣۚǔ۩ۨ۠ۨǔۣۗۢۧۨۦ۩ۣۗۨۢǔۣۤۙۦКۣۨۢۧǔۣۦǔۣ۫ۨۜۜ۠ۘۢۛǔۣۚǔۦۣۙ۠ۗКۣۨۢǔۦۙۡۖ۩ۦۧۙۡۙۢۨǔ۩ۢۨ۠ǔۣۗۡۤ۠КۢۗۙǔۧǔКۧۧ۩ۦۙۘﮞǔۣۦ ۦ۪ۣۙۗКۣۨۢǔۣۚǔۨۜۙǔۤۙۦۡۨﮠǔǔЌۜۙǔۣۗۧۨǔۣۚǔКۢǔۣ۫ۦﭞǔۗК۩ۧۙۘǔۣۨǔۖۙǔۤۙۦۣۚۦۡۙۘǔۖǔۨۜۙǔﯽۨКۨۙǔۢǔۦۣ۪ۙۡК۠ǔۣۚǔۣۢۢﮟۣۗۡۤ۠ۢۛǔۣۗۢۧۨۦ۩ۣۗۨۢ ۫۠۠ǔۖۙǔКۧۧۙۧۧۙۘǔКۛКۢۧۨǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦﮠ ڽﮠǔǔЌۜۙǔۣ۫ۦﭞǔۘۙۧۗۦۖۙۘǔۢǔۨۜۧǔۤۙۦۡۨǔۧۜК۠۠ǔۖۙǔۣۗۡۤ۠ۙۨۙۘǔКۧǔۤۦۣۣۤۧۙۘǔۢǔۣۗۡۤ۠Кۢۗۙǔ۫ۨۜǔۨۜۙǔۧۨۤ۩۠КۣۨۢۧǔКۢۘǔۧۤۙۗК۠ ۦۙۥ۩ۦۙۡۙۢۨۧǔ۫ۨۜۢǔۣۢۙǔۙКۦǔۚۦۣۡǔۨۜۙǔۘКۨۙǔﯚۙۤКۦۨۡۙۢۨǔКۤۤۦۣ۪К۠ǔۧǔۦ۪ۙۗۙۙۘǔۣۚۦǔۧКۘǔۦۙۥ۩ۙۧۨﮠǔǔﯘК۠۩ۦۙǔۣۢǔۨۜۙǔۤКۦۨǔۣۚǔۨۜۙ ﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔۣۨǔКۖۘۙǔۖǔۨۜۙǔۧۨۤ۩۠Кۣۨۢۧǔۣۦǔۢǔۣۗۢۧۨۦ۩ۗۨۢۛǔۨۜۙǔۣ۫ۦﭞǔۘۙۧۗۦۖۙۘǔКۧǔۧۨۤ۩۠КۨۙۘǔКۢۘǔ۫ۨۜۢǔۨۜۙǔۨۡۙǔۚۦКۡۙǔۧۨКۨۙۘ ۧۜК۠۠ǔۦۙۢۘۙۦǔۨۜۧǔКۛۦۙۙۡۙۢۨǔКۢۘǔۦۙۥ۩ۙۧۨǔۢ۩۠۠ǔКۢۘǔ۪ۣۘﮠǔǔЌۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔКۣ۠ۧǔКۛۦۙۙۧǔۣۨǔۧК۪ۙǔۨۜۙǔﯽۨКۨۙǔۣۚǔﯢۣ۫КǔКۢۘǔۨۜۙ ﯚۙۤКۦۨۡۙۢۨǔۜКۦۡ۠ۙۧۧǔۣۚǔКۢǔۘКۡКۛۙۧǔۣۦǔۣ۠ۧۧۙۧǔۨۜКۨǔۡКǔۖۙǔۧ۩ۧۨКۢۙۘǔۖǔКۢǔۤۙۦۣۧۢﮞǔۣۦǔۤۙۦۣۧۢۧﮞǔۣۢǔКۣۗۗ۩ۢۨǔۣۚǔۨۜۙ ۣۣۗۢۘۨۢۧǔКۢۘǔۦۙۥ۩ۦۙۡۙۢۨۧǔۣۚǔۨۜۧǔКۛۦۙۙۡۙۢۨﮠ ﯡﮠǔǔﯙۣۢۧۨۦ۩ۣۗۨۢǔКۢۘǔﯞКۢۨۙۢКۢۗۙ

ҚﮠǔǔЌۜۙǔۣ۠ۗКۣۨۢﮞǔۣۗۢۧۨۦ۩ۣۗۨۢǔКۢۘǔۡКۢۨۙۢКۢۗۙǔۣۚǔۨۜۙǔ۩ۨ۠ۨǔۢۧۨК۠۠Кۣۨۢǔۣ۪ۗۙۦۙۘǔۖǔۨۜۧǔКۤۤ۠ۗКۣۨۢǔۧۜК۠۠ǔۖۙǔۢǔКۣۗۗۦۘКۢۗۙǔ۫ۨۜ ۨۜۙǔۗ۩ۦۦۙۢۨǔﯚۙۤКۦۨۡۙۢۨǛۧǔЎۨ۠ۨǔﯠۣۣۗۗۡۡۘКۣۨۢǔﮔۣ۠ۗﮠ қﮠǔǔﯡۣۙۚۦۙǔۖۙۛۢۢۢۛǔКۢǔۣ۫ۦﭞǔۢǔۨۜۙǔۜۛۜ۫Кǔۦۛۜۨﮟۣۚﮟ۫Кﮞǔۨǔۧǔۨۜۙǔۦۣۙۧۤۢۧۖ۠ۨǔۣۚǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔۣۨǔۣۖۨКۢǔКۢǔۙКۧۙۡۙۢۨ ۚۦۣۡǔۨۜۙǔۘۦКۢКۛۙǔۘۧۨۦۗۨǔۚǔۢۙۗۙۧۧКۦﮠǔǔЌۜۙǔﯚۙۤКۦۨۡۙۢۨǔКۧۧ۩ۡۙۧǔۣۢǔۦۣۙۧۤۢۧۖ۠ۨǔۣۚۦǔК۪ۘۧۢۛǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔۣۚǔۙКۗۜ ۣ۠ۗКۣۨۢǔۣۚǔКǔۘۦКۢКۛۙǔۘۧۨۦۗۨǔۗۦۣۧۧۢۛﮠǔǔﯢۨǔۧǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǛۧǔۦۣۙۧۤۢۧۖ۠ۨǔۣۨǔۣ۠ۗКۨۙǔۨۜۙۧۙǔۗۦۣۧۧۢۛۧǔКۢۘǔۣۖۨКۢǔКۢ ۢۙۗۙۧۧКۦǔۙКۧۙۡۙۢۨۧǔۣۦǔۤۙۦۣۡۧۧۢǔۚۦۣۡǔۨۜۙǔۘۦКۢКۛۙǔۘۧۨۦۗۨﮠǔǔﯽۙۙǔﯙۣۘۙǔۣۚǔﯢۣ۫КﮞǔﯙۜКۤۨۙۦǔڽңүǔۣۚۦǔКۣۘۘۨۢК۠ǔۣۢۚۦۡКۣۨۢﮠ ҜﮠǔǔﯠǔۣۗۤǔۣۚǔۨۜۙǔКۤۤۦۣ۪ۙۘǔۤۙۦۡۨǔۧۜК۠۠ǔۖۙǔК۪К۠Кۖ۠ۙǔۣۢǔۨۜۙǔ۞ۣۖǔۧۨۙǔКۨǔК۠۠ǔۨۡۙۧǔۣۚۦǔۙКۡۢКۣۨۢǔۖǔﯚۙۤКۦۨۡۙۢۨǔۣۚۚۗК۠ۧﮠ ڽﮠǔǔﯠ۠۠ǔۨۦКۚۚۗǔۣۗۢۨۦۣ۠ǔۢۗ۠۩ۘۢۛǔۧۛۢǔۤ۠КۗۙۡۙۢۨǔКۢۘǔۚ۠КۛۛۢۛǔКۦۙǔۨۜۙǔۦۣۙۧۤۢۧۖ۠ۨǔۣۚǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦﮠǔǔЌۜۙǔۣۦۛۢК۠ǔۤ۠Кۗۙۡۙۢۨ ۣۚǔۧۛۢۧǔКۢۘǔۨۜۙۦǔۦۣ۪ۙۡК۠ǔ۩ۣۤۢǔۣۣۗۡۤ۠ۙۨۢǔۣۚǔۨۜۙǔۣ۫ۦﭞǔۧۜК۠۠ǔۖۙǔКۣۗۗۡۤ۠ۧۜۙۘǔۖǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦﮠ ھﮠǔǔﮓۤۙۦКۣۨۢۧǔۢǔۨۜۙǔۣۗۢۧۨۦ۩ۣۗۨۢǔКۢۘǔۡКۢۨۙۢКۢۗۙǔۣۚǔۧКۘǔ۩ۨ۠ۨǔۢۧۨК۠۠КۣۨۢǔۧۜК۠۠ǔۖۙǔۗКۦۦۙۘǔۣۢǔۢǔۧ۩ۗۜǔКǔۡКۢۢۙۦǔКۧǔۣۨǔۗК۩ۧۙ ۡۢۡ۩ۡǔۢۨۙۦۚۙۦۙۢۗۙǔۣۨǔۣۦǔۘۧۨۦКۣۗۨۢǔۣۚǔۨۦКۚۚۗǔۣۢǔۧКۘǔۜۛۜ۫Кﮠ ңﮠǔǔﯠۚۨۙۦǔﯟۣ۪ۙۡۖۙۦǔқڽﮞǔқҗҗүﮞǔК۠۠ǔۤۙۦۣۧۢۢۙ۠ǔۢǔۨۜۙǔۜۛۜ۫Кǔۦۛۜۨﮟۣۚﮟ۫КǔۧۜК۠۠ǔ۫ۙКۦǔﯠﯟﯽﯢǔҚҗҮǔﯙ۠КۧۧǔқǔКۤۤКۦۙ۠ǔКۨǔК۠۠ǔۨۡۙۧǔ۫ۜۙۢ ۣۙۤۧۙۘǔۣۨǔۨۦКۚۚۗǔۣۦǔۣۗۢۧۨۦ۩ۣۗۨۢǔۙۥ۩ۤۡۙۢۨﮠ ﯙﮠǔǔﮐКۖ۠ۨ

ҚﮠǔǔЌۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔۧۜК۠۠ǔۢۘۙۡۢۚǔКۢۘǔۧК۪ۙǔۜКۦۡ۠ۙۧۧǔۨۜۙǔﯽۨКۨۙǔۣۚǔﯢۣ۫КﮞǔۨۧǔКۛۙۢۗۙۧǔКۢۘǔۣۙۡۤ۠ۙۙۧﮞǔۚۦۣۡǔКۢǔКۢۘǔК۠۠

ۗК۩ۧۙۧǔۣۚǔКۣۗۨۢﮞǔۧ۩ۨۧǔКۨǔ۠К۫ǔۣۦǔۢǔۙۥ۩ۨﮞǔۣۚۦǔۣ۠ۧۧۙۧﮞǔۘКۡКۛۙۧﮞǔۗ۠КۡۧǔۣۦǔۘۙۡКۢۘۧﮞǔКۢۘǔۚۦۣۡǔКۢǔКۢۘǔК۠۠ǔ۠Кۖ۠ۨǔКۢۘǔۙۤۙۢۧۙ ۣۚǔ۫ۜКۣ۪ۨۧۙۙۦǔۢКۨ۩ۦۙﮞǔКۦۧۢۛǔۣ۩ۨǔۣۚǔۣۦǔۢǔۣۣۗۢۢۙۗۨۢǔ۫ۨۜǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǛۧǔ۩ۧۙǔۣۦǔۣۗۗ۩ۤКۢۗǔۣۚǔۨۜۙǔۤ۩ۖ۠ۗǔۜۛۜ۫Кﮠ қﮠǔǔЌۜۙǔۧۨКۨۙǔۣۚǔﯢۣ۫КǔКۢۘǔۨۜۙǔﯚۙۤКۦۨۡۙۢۨǔКۧۧ۩ۡۙǔۣۢǔۦۣۙۧۤۢۧۖ۠ۨǔۣۚۦǔۘКۡКۛۙۧǔۣۨǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǛۧǔۤۦۣۤۙۦۨǔۣۗۗКۣۧۢۙۘ ۖǔКۢǔۣۗۢۧۨۦ۩ۣۗۨۢǔۣۦǔۡКۢۨۙۢКۢۗۙǔۣۤۙۦКۣۨۢۧǔۣۢǔۧКۘǔۜۛۜ۫Кǔۚǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔۜКۧǔۖۙۙۢǔۣۢۨۚۙۘǔۢǔКۣۗۗۦۘКۢۗۙǔ۫ۨۜ ۧۨۤ۩۠Кۣۨۢǔۢ۩ۡۖۙۦǔﯚﮠҜﮠǔۣۦǔۚǔۨۜۙǔۚКۗ۠ۨۙۧǔКۦۙǔۣۢۨǔۣ۠ۗКۨۙۘǔۢǔКۣۗۗۦۘКۢۗۙǔ۫ۨۜǔۨۜۧǔۤۙۦۡۨﮠ ҜﮠǔǔЌۜۙǔﯽۨКۨۙǔۣۚǔﯢۣ۫КﮞǔۨۧǔКۛۙۢۗۙۧǔۣۦǔۣۙۡۤ۠ۙۙۧﮞǔ۫۠۠ǔۖۙǔ۠Кۖ۠ۙǔۣۚۦǔۙۤۙۢۧۙǔۢۗ۩ۦۦۙۘǔۖǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔۢǔۨۧǔ۩ۧۙǔКۢۘ ۣۗۗ۩ۤКۢۗǔۣۚǔۨۜۙǔۜۛۜ۫Кǔۦۛۜۨﮟۣۚﮟ۫Кǔۣۢ۠ǔ۫ۜۙۢǔۢۙۛ۠ۛۙۢۗۙǔۣۚǔۨۜۙǔﯽۨКۨۙﮞǔۨۧǔКۛۙۢۗۙۧǔۣۦǔۣۙۡۤ۠ۙۙۧﮞǔۧǔۨۜۙǔۣۧ۠ۙǔۤۦۣۡКۨۙ ۗК۩ۧۙǔۣۚǔۧ۩ۗۜǔۙۤۙۢۧۙﮠǔǔﯤۜۙۨۜۙۦǔۢǔۣۗۢۨۦКۗۨﮞǔۣۨۦۨǔۣۦǔۣۨۜۙۦ۫ۧۙﮞǔۨۜۙǔ۠Кۖ۠ۨǔۣۚǔۨۜۙǔﯽۨКۨۙﮞǔۨۧǔКۛۙۢۗۙۧǔКۢۘǔۣۙۡۤ۠ۙۙۧﮞǔۧǔ۠ۡۨۙۘ ۣۨǔۨۜۙǔۦۙКۣۧۢКۖ۠ۙﮞǔۘۦۙۗۨǔۙۤۙۢۧۙǔۣۨǔۦۙۤКۦǔۘКۡКۛۙۘǔ۩ۨ۠ۨۙۧﮞǔКۢۘǔۢǔۣۢǔ۪ۙۙۢۨǔ۫۠۠ǔۧ۩ۗۜǔ۠Кۖ۠ۨǔۙۨۙۢۘǔۣۨǔۣ۠ۧۧǔۣۚǔۤۦۣۚۨۧǔۣۦ ۖ۩ۧۢۙۧۧﮞǔۢۘۦۙۗۨﮞǔۧۤۙۗК۠ﮞǔۣۗۢۧۙۥ۩ۙۢۨК۠ǔۣۦǔۢۗۘۙۢۨК۠ǔۘКۡКۛۙۧﮠ ﯚﮠǔﯟۣۨۚۗКۣۨۢ

ҚﮠǔǔЌۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔۧǔۦۣۙۧۤۢۧۖ۠ۙǔۣۚۦǔۣۗۢۨКۗۨۢۛǔﯢۣ۫КǔﮓۢۙﮟﯙК۠۠ǔǜҚﮟүҗҗﮟқҰқﮟүҰүҰ۶ǔКۢۘǔۦۙۥ۩ۙۧۨǔۨۜۙǔۣ۠ۗКۣۨۢǔۣۚǔКۢ ۩ۢۘۙۦۛۦۣ۩ۢۘǔ۩ۨ۠ۨۙۧǔۣۚۦۨﮟۙۛۜۨǔǜڽү۶ǔۣۜ۩ۦۧǔۣۖۙۚۦۙǔۙۗК۪Кۣۨۢﮠǔǔﯡۣۙۚۦۙǔۖۙۛۢۢۢۛǔۣ۫ۦﭞǔۢǔۨۜۙǔۜۛۜ۫Кǔۦۛۜۨﮟۣۚﮟ۫Кﮞǔۨۜۙǔﮔۙۦۡۨ ﯜۣ۠ۘۙۦǔۧۜК۠۠ǔКۣ۠ۧǔۣۗۢۨКۗۨǔКۢǔۣۨۜۙۦǔﭞۣۢ۫ۢǔ۩ۨ۠ۨǔۣ۠ۗКۨۙۘǔۢǔۨۜۙǔКۦۙКǔۣۚǔۨۜۙǔۤۦۣۣۤۧۙۘǔۣ۫ۦﭞﮠ қﮠǔǔЌۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔКۛۦۙۙۧǔۣۨǔ۪ۛۙǔۨۜۙǔﯚۙۤКۦۨۡۙۢۨǔۣۚۦۨﮟۙۛۜۨǔۣۜ۩ۦۧǔۣۢۨۗۙǔۣۚǔۨۧǔۣۢۨۙۢۨۢǔۣۨǔۧۨКۦۨǔۣۗۢۧۨۦ۩ۣۗۨۢǔۣۦǔۣۨǔۤۙۦۣۚۦۡ ۦۣ۩ۨۢۙǔۡКۢۨۙۢКۢۗۙǔۣۢǔۨۜۙǔۜۛۜ۫Кǔۦۛۜۨﮟۣۚﮟ۫КﮠǔǔﯽКۘǔۣۢۨۗۙǔۧۜК۠۠ǔۖۙǔۡКۘۙǔۣۨǔۨۜۙǔۣۗۢۨКۗۨǔۤۙۦۣۧۢǔۣ۫ۜۧۙǔۢКۡۙǔۧǔۣۧۜ۫ۢǔۣۢ ۨۜۧǔۤКۛۙﮠ ҜﮠǔǔЌۜۙǔﯚۙۤКۦۨۡۙۢۨǔۧۜК۠۠ǔ۪ۛۙǔۨۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔКۨǔ۠ۙКۧۨǔۣۚۦۨﮟۙۛۜۨǔۣۜ۩ۦۧǔۣۢۨۗۙǔۣۚǔКۢǔۤۦۣۣۤۧۙۘǔۣۗۢۧۨۦ۩ۣۗۨۢǔۣۦǔۡКۢۨۙۢКۢۗۙ ۣ۫ۦﭞﮞǔۣۢǔۙۨۜۙۦǔۙۧۨۢۛǔۣۦǔۢۙ۫۠ǔКۗۥ۩ۦۙۘǔۦۛۜۨﮟۣۚﮟ۫Кǔ۫ۜۙۢǔۨۜۙǔۤۦۣۣۤۧۙۘǔۣ۫ۦﭞǔ۫۠۠ǔۖۙǔۨۙۢǔۚۙۙۨǔۣۚǔКǔ۩ۨ۠ۨǔۣ۠ۗКۣۨۢǔКۧ ۤۦ۪ۣۙ۩ۧ۠ǔКۤۤۦۣ۪ۙۘǔۖǔۨۜۙǔﯚۙۤКۦۨۡۙۢۨǔۖǔۤۙۦۡۨǔۣۦǔ۫ۦۨۨۙۢǔКۛۦۙۙۡۙۢۨﮠǔǔЌۜۙǔﮔۙۦۡۨǔﯜۣ۠ۘۙۦǔۧۜК۠۠ǔۖۙǔۦۣۙۧۤۢۧۖ۠ۙǔ۫ۨۜۢǔۨۜۧ ۨۡۙۚۦКۡۙǔۣۨǔКۦۦКۢۛۙǔۣۨǔۤۦۣۨۙۗۨǔۨۧǔۚКۗ۠ۨۙۧﮠ

ﯚۣۧۗ۠ۧ۩ۦۙǔﯽۨКۨۙۡۙۢۨﮤǔЌۜۙǔۣۢۚۦۡКۣۨۢǔۚ۩ۦۢۧۜۙۘǔۣۢǔۨۜۧǔۣۚۦۡǔ۫۠۠ǔۖۙǔ۩ۧۙۘǔۖǔۨۜۙǔﯚۙۤКۦۨۡۙۢۨǔۣۚǔЌۦКۣۢۧۤۦۨКۣۨۢǔۣۨǔۘۙۨۙۦۡۢۙǔКۤۤۦۣ۪К۠ǔۣۦ ۘۙۢК۠ǔۣۚǔۨۜۙǔКۤۤ۠ۗКۣۨۢﮠǔǔﯘК۠۩ۦۙǔۣۨǔۤۦۣ۪ۘۙǔК۠۠ǔۣۢۚۦۡКۣۨۢǔ۫۠۠ǔۦۙۧ۩۠ۨǔۢǔۘۙۢК۠ǔۣۚǔۨۜۙǔКۤۤ۠ۗКۣۨۢﮠǔǔﯢۣۢۚۦۡКۣۨۢǔۚ۩ۦۢۧۜۙۘǔۧǔۤ۩ۖ۠ۗǔۣۢۚۦۡКۣۨۢ КۢۘǔۣۗۤۙۧǔۡКǔۖۙǔۤۦۣ۪ۘۙۘǔۣۨǔۨۜۙǔۤ۩ۖ۠ۗǔ۩ۣۤۢǔۦۙۥ۩ۙۧۨﮠ

ﮔКۛۙǔқǔۣۚǔқ

Similar forms

The 810025 Iowa form is similar to the 810026 Iowa form, which is also used for tax-related purposes. Both forms are designed to report income and expenses, ensuring that taxpayers accurately disclose their financial information to the state. The primary difference lies in the specific types of income each form addresses, with the 810026 focusing more on business income while the 810025 is more general.

Another document that resembles the 810025 is the 810027 Iowa form. This form is specifically for individuals who are self-employed. Like the 810025, it requires detailed reporting of income and expenses, but it includes additional sections tailored for self-employment deductions. This ensures that self-employed individuals can maximize their tax benefits while remaining compliant with state regulations.

The 810028 Iowa form is another related document. It serves as an amendment form for previously filed tax returns. Similar to the 810025, it requires comprehensive financial details. However, the 810028 is specifically used when taxpayers need to correct errors or report additional income after their initial filing.

The 810029 Iowa form is akin to the 810025 in that it focuses on tax credits available to Iowa residents. While the 810025 primarily reports income, the 810029 allows taxpayers to apply for various credits. Both forms require similar financial data, but the 810029 emphasizes eligibility for credits based on income levels.

Understanding the importance of a Release of Liability document in recreational activities can help individuals navigate potential risks involved in various events. Such forms are critical for protecting both organizers and participants by clearly outlining the risks associated with participation. By agreeing to the terms, signers acknowledge their understanding of their personal responsibility in taking on those risks.

The 810030 Iowa form is another similar document, as it pertains to property tax assessments. While the 810025 deals with income taxes, the 810030 focuses on property taxes. Both forms require detailed financial information, but they cater to different aspects of taxation, with the 810030 specifically assessing property values and tax liabilities.

The 810031 Iowa form shares similarities with the 810025 in that it is used for reporting capital gains and losses. Taxpayers must provide detailed information about their investments and sales. Both forms require meticulous record-keeping, but the 810031 focuses solely on investment-related income, while the 810025 covers a broader range of income sources.

Lastly, the 810032 Iowa form is comparable to the 810025 as it relates to estate taxes. While the 810025 is for individual income reporting, the 810032 is specifically for reporting the value of estates for tax purposes. Both forms require detailed financial disclosures, but they serve different taxpayer needs in terms of income versus estate valuation.