Printable Articles of Incorporation Document for Iowa State

Things You Should Know About This Form

What is the Iowa Articles of Incorporation form?

The Iowa Articles of Incorporation form is a legal document that establishes a corporation in the state of Iowa. This form outlines essential information about the corporation, including its name, purpose, and the details of its registered agent. Filing this form is a crucial step in the process of creating a corporation, as it officially recognizes the business as a separate legal entity.

Who needs to file the Articles of Incorporation?

Any individual or group looking to start a corporation in Iowa must file the Articles of Incorporation. This includes businesses ranging from small startups to larger enterprises. If you plan to operate as a corporation, completing this form is a necessary step to ensure compliance with state laws.

What information is required on the form?

The Articles of Incorporation form typically requires the following information:

- The name of the corporation, which must be unique and not already in use by another entity in Iowa.

- The purpose of the corporation, which describes what the business will do.

- The registered agent's name and address, who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue.

- The names and addresses of the incorporators, who are the individuals responsible for filing the form.

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation in Iowa either online or by mail. For online filing, visit the Iowa Secretary of State's website and follow the instructions. If you choose to file by mail, print the completed form, sign it, and send it to the appropriate office along with the required filing fee.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Iowa varies depending on the type of corporation you are forming. As of the latest information, the fee typically ranges from $50 to $100. It's essential to check the Iowa Secretary of State's website for the most current fee schedule.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, online filings are processed more quickly, often within a few business days. Mail filings may take longer, sometimes up to several weeks. To ensure your corporation is established promptly, consider filing online if possible.

Can I change the Articles of Incorporation after filing?

Yes, changes can be made to the Articles of Incorporation after they have been filed. If your corporation's structure, purpose, or other key details change, you will need to file an amendment to update the original Articles. This process also requires a fee and must be done through the Iowa Secretary of State’s office.

Do I need an attorney to file the Articles of Incorporation?

While it is not legally required to have an attorney to file the Articles of Incorporation, consulting with one can be beneficial. An attorney can help ensure that all information is correctly filled out and that your corporation complies with Iowa laws. This can save time and prevent potential legal issues in the future.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, your corporation is officially formed. You will receive a certificate of incorporation from the state. After this, you will need to obtain any necessary business licenses, set up a corporate bank account, and fulfill other ongoing compliance requirements, such as holding annual meetings and filing annual reports.

Where can I find the Articles of Incorporation form?

The Articles of Incorporation form can be found on the Iowa Secretary of State's website. This site provides the most current version of the form, along with instructions for filling it out and filing it. It’s important to use the latest form to ensure compliance with state regulations.

File Data

| Fact Name | Details |

|---|---|

| Purpose | The Iowa Articles of Incorporation form is used to legally establish a corporation in the state of Iowa. |

| Governing Law | The formation of corporations in Iowa is governed by the Iowa Business Corporation Act, Chapter 490 of the Iowa Code. |

| Filing Requirement | To create a corporation, the Articles of Incorporation must be filed with the Iowa Secretary of State. |

| Information Needed | The form requires basic information such as the corporation's name, purpose, and registered agent. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Duration | The corporation can be established for a perpetual duration unless specified otherwise in the Articles. |

| Initial Directors | The form may require the names and addresses of the initial directors of the corporation. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Amendments | If changes are needed after filing, amendments to the Articles can be made by submitting a separate form. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record, accessible to anyone. |

Discover Other Common Forms for Iowa

Homeschooling in - This letter confirms your plans for home-based education.

The New York Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in New York State. It outlines key details about the corporation, such as its name, purpose, and structure. To gain a deeper understanding and access various resources, including templates, you can refer to PDF Templates. Understanding how to complete this form correctly can pave the way for a smooth business launch—start filling out the form by clicking the button below.

Iowa Gun Laws for Out of State Travelers - This form can greatly reduce the risk of misunderstandings during a firearm sale.

Key takeaways

When filling out and using the Iowa Articles of Incorporation form, consider the following key takeaways:

- Ensure that the name of your corporation is unique and complies with Iowa naming rules.

- Provide a clear purpose for your corporation. This should outline what your business will do.

- Include the registered agent's name and address. This person or entity will receive legal documents on behalf of the corporation.

- List the initial directors. Include their names and addresses to establish governance.

- Specify the number of shares the corporation is authorized to issue. This affects ownership and investment opportunities.

- Understand the filing fee associated with submitting the Articles of Incorporation. This varies based on the type of corporation.

- Consider including provisions for the management structure of the corporation, if applicable.

- Review the completed form for accuracy before submission. Errors can delay the incorporation process.

- File the Articles of Incorporation with the Iowa Secretary of State. This can typically be done online or by mail.

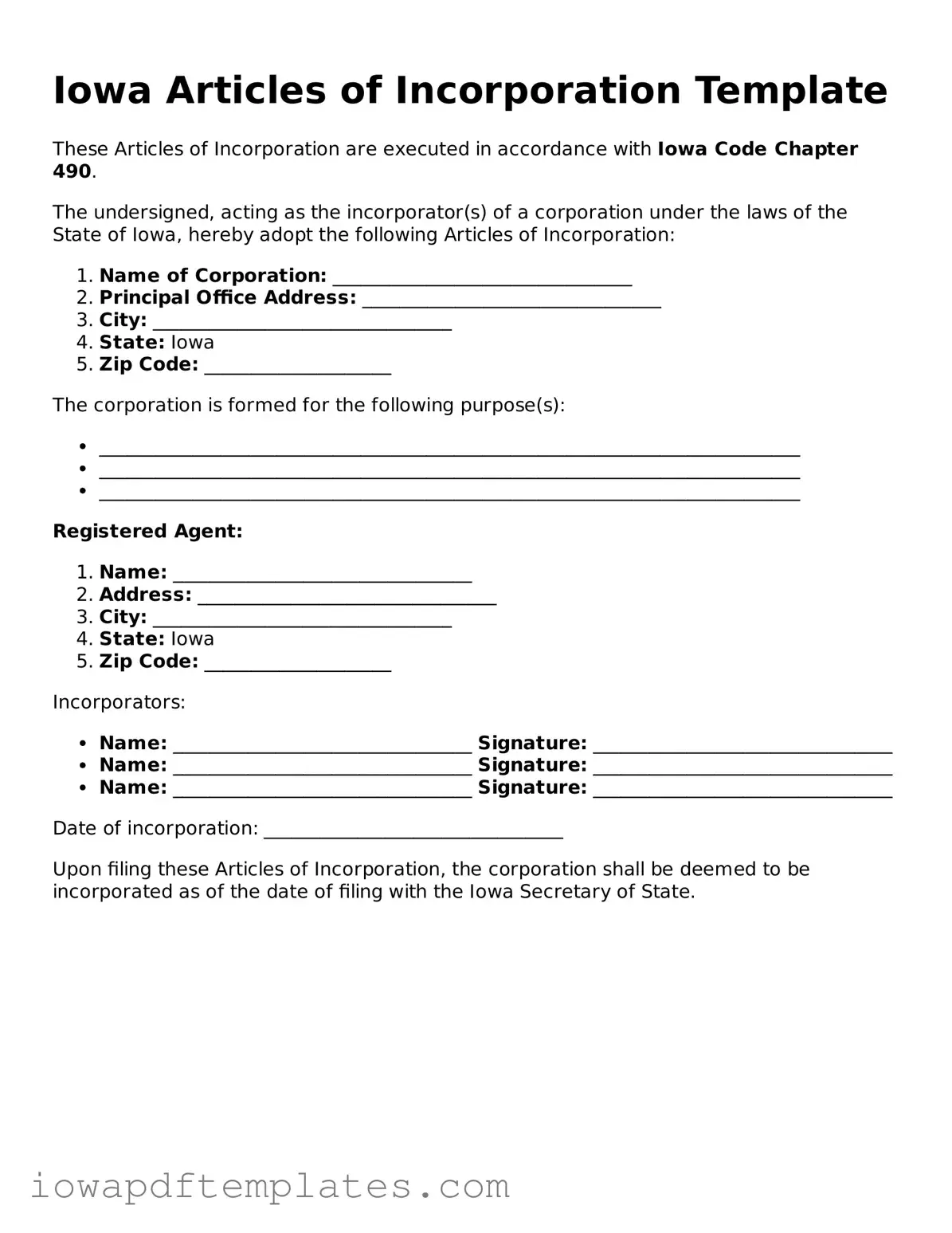

Sample - Iowa Articles of Incorporation Form

Iowa Articles of Incorporation Template

These Articles of Incorporation are executed in accordance with Iowa Code Chapter 490.

The undersigned, acting as the incorporator(s) of a corporation under the laws of the State of Iowa, hereby adopt the following Articles of Incorporation:

- Name of Corporation: ________________________________

- Principal Office Address: ________________________________

- City: ________________________________

- State: Iowa

- Zip Code: ____________________

The corporation is formed for the following purpose(s):

- ___________________________________________________________________________

- ___________________________________________________________________________

- ___________________________________________________________________________

Registered Agent:

- Name: ________________________________

- Address: ________________________________

- City: ________________________________

- State: Iowa

- Zip Code: ____________________

Incorporators:

- Name: ________________________________ Signature: ________________________________

- Name: ________________________________ Signature: ________________________________

- Name: ________________________________ Signature: ________________________________

Date of incorporation: ________________________________

Upon filing these Articles of Incorporation, the corporation shall be deemed to be incorporated as of the date of filing with the Iowa Secretary of State.

Similar forms

The Iowa Articles of Incorporation form shares similarities with the Certificate of Formation used in many states. Both documents serve as foundational legal instruments for establishing a corporation. They outline essential details such as the corporation's name, purpose, registered agent, and the number of shares authorized. While the terminology may vary slightly from state to state, the primary function of both documents is to formally recognize the existence of a corporation under state law, allowing it to operate legally and engage in business activities.

Another document comparable to the Iowa Articles of Incorporation is the Bylaws of a corporation. While the Articles of Incorporation establish the corporation's existence, the Bylaws provide the internal rules governing the corporation's operations. Bylaws typically detail the responsibilities of directors and officers, procedures for meetings, and voting rights. Together, these documents create a framework for both external recognition and internal governance, ensuring that the corporation functions smoothly and in compliance with legal requirements.

For those looking to establish a Limited Liability Company, a well-crafted foundational Operating Agreement template is crucial. This document not only defines the management structure and operational procedures but also clarifies the rights and responsibilities of each member involved, helping to prevent potential conflicts down the line.

The Operating Agreement is another document that parallels the Iowa Articles of Incorporation, particularly for limited liability companies (LLCs). Like the Articles of Incorporation, the Operating Agreement is essential for defining the structure and management of the entity. It outlines the roles of members, distribution of profits, and procedures for decision-making. While the Articles of Incorporation focus on the formal creation of a corporation, the Operating Agreement addresses the operational aspects of an LLC, ensuring clarity and reducing potential disputes among members.

Lastly, the Statement of Information is similar to the Iowa Articles of Incorporation in that it provides vital information about a corporation after its formation. This document is typically required to be filed periodically and includes details such as the corporation's address, the names of its officers and directors, and the nature of its business activities. While the Articles of Incorporation establish the corporation's legal existence, the Statement of Information ensures that the state has up-to-date records about the corporation's operational status, enhancing transparency and accountability.