Printable Durable Power of Attorney Document for Iowa State

Things You Should Know About This Form

What is a Durable Power of Attorney in Iowa?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone you trust to make decisions on your behalf if you become unable to do so yourself. This can include decisions related to your finances, healthcare, and other personal matters. The key feature of a DPOA is that it remains in effect even if you become incapacitated, unlike a standard Power of Attorney which may become void under such circumstances.

Who can be appointed as an agent in a Durable Power of Attorney?

You can choose almost anyone to be your agent, but there are some important considerations. Your agent should be someone you trust implicitly, as they will have significant authority over your affairs. Common choices include:

- Family members

- Close friends

- Professional advisors, such as attorneys or accountants

Keep in mind that the person you choose must be at least 18 years old and mentally competent. It's also wise to discuss your intentions with your chosen agent before finalizing the document.

What powers can I grant to my agent through a Durable Power of Attorney?

The powers you grant can be tailored to your specific needs. Generally, you can give your agent the authority to:

- Manage your financial affairs, including paying bills and handling bank accounts.

- Make healthcare decisions on your behalf, such as consenting to or refusing medical treatment.

- Handle real estate transactions, including buying or selling property.

- Manage your investments and business interests.

It’s important to clearly outline the powers you wish to grant to avoid any confusion later. You can also specify any limitations or conditions that apply.

How do I create and execute a Durable Power of Attorney in Iowa?

Creating a DPOA in Iowa is a straightforward process. Follow these steps:

- Choose your agent wisely and discuss your wishes with them.

- Obtain a Durable Power of Attorney form. You can find templates online or consult an attorney for assistance.

- Complete the form, clearly specifying the powers you wish to grant.

- Sign the document in the presence of a notary public. In Iowa, notarization is required for the DPOA to be valid.

- Provide copies of the signed document to your agent, healthcare providers, and any financial institutions that may need it.

Once executed, your Durable Power of Attorney is effective immediately unless you specify otherwise. Regularly review the document to ensure it still reflects your wishes.

File Data

| Fact Name | Description |

|---|---|

| Definition | The Iowa Durable Power of Attorney form allows an individual to designate another person to manage their financial and legal affairs if they become incapacitated. |

| Governing Law | This form is governed by Iowa Code Chapter 633B, which outlines the requirements and powers granted under a Durable Power of Attorney. |

| Durability | The "durable" aspect means that the authority granted remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are mentally competent to do so. |

| Agent Responsibilities | The appointed agent has a fiduciary duty to act in the best interest of the principal and must manage the principal’s affairs responsibly. |

Discover Other Common Forms for Iowa

Iowa Lease Agreement - Clarifies the use of personal property in connection with the lease.

The Employee Handbook form serves as a fundamental document in the workplace, outlining company policies, procedures, and expectations. This essential guide helps employees understand their rights and responsibilities while fostering a positive work environment. By providing clarity and consistency, the handbook plays a vital role in supporting workplace culture and compliance. For a comprehensive resource, you can refer to the Employee Policy Manual.

How to File Operating Agreement Llc - An Operating Agreement can define roles, including managers and members' responsibilities.

Key takeaways

Understanding the Iowa Durable Power of Attorney form is crucial for anyone looking to plan for the future. Here are some key takeaways to consider:

- The form allows you to appoint someone you trust to make decisions on your behalf if you become unable to do so.

- It is essential to choose an agent who understands your values and wishes.

- The Durable Power of Attorney remains effective even if you become incapacitated, unlike a regular Power of Attorney.

- You can specify the powers granted to your agent, which may include financial, medical, or legal decisions.

- It is advisable to discuss your intentions with your agent before completing the form to ensure they are willing to accept the responsibility.

- The form must be signed in the presence of a notary public to be legally valid in Iowa.

- Make sure to keep a copy of the signed document in a safe place and provide copies to your agent and relevant family members.

- Review the document periodically to ensure it still reflects your wishes and make updates if necessary.

- Understand that your agent has a fiduciary duty to act in your best interest, and you can revoke the power at any time while you are still competent.

- Consulting with a legal professional can provide clarity and ensure that the document meets all legal requirements.

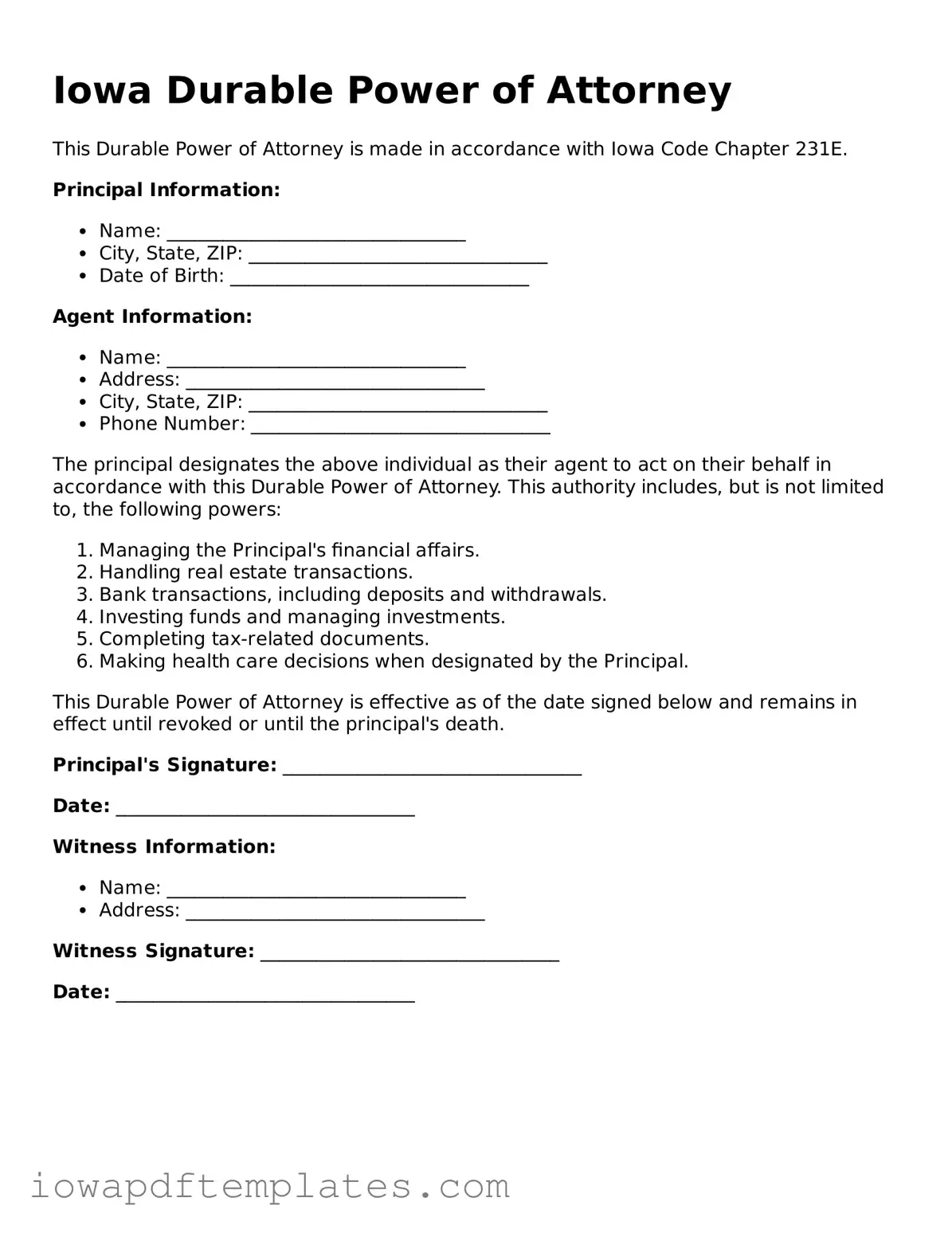

Sample - Iowa Durable Power of Attorney Form

Iowa Durable Power of Attorney

This Durable Power of Attorney is made in accordance with Iowa Code Chapter 231E.

Principal Information:

- Name: ________________________________

- City, State, ZIP: ________________________________

- Date of Birth: ________________________________

Agent Information:

- Name: ________________________________

- Address: ________________________________

- City, State, ZIP: ________________________________

- Phone Number: ________________________________

The principal designates the above individual as their agent to act on their behalf in accordance with this Durable Power of Attorney. This authority includes, but is not limited to, the following powers:

- Managing the Principal's financial affairs.

- Handling real estate transactions.

- Bank transactions, including deposits and withdrawals.

- Investing funds and managing investments.

- Completing tax-related documents.

- Making health care decisions when designated by the Principal.

This Durable Power of Attorney is effective as of the date signed below and remains in effect until revoked or until the principal's death.

Principal's Signature: ________________________________

Date: ________________________________

Witness Information:

- Name: ________________________________

- Address: ________________________________

Witness Signature: ________________________________

Date: ________________________________

Similar forms

The Iowa Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents allow one person to designate another to handle their financial and legal matters. However, the General Power of Attorney typically becomes invalid if the principal becomes incapacitated, while the Durable Power of Attorney remains effective even in such situations. This makes the Durable Power of Attorney a more robust option for long-term planning.

Another related document is the Medical Power of Attorney. This form specifically allows an individual to appoint someone to make healthcare decisions on their behalf. While the Durable Power of Attorney focuses on financial and legal matters, the Medical Power of Attorney addresses medical care and treatment. Both documents empower someone to act on behalf of another, but in different areas of life.

The Living Will is also similar in that it deals with decision-making during incapacitation. A Living Will outlines a person's wishes regarding medical treatment and end-of-life care. While the Durable Power of Attorney can cover financial and legal decisions, the Living Will focuses solely on health-related choices. Together, they provide a comprehensive approach to planning for future needs.

The Revocable Trust shares some characteristics with the Durable Power of Attorney. Both documents allow for the management of assets and can help avoid probate. However, a Revocable Trust is a legal entity that holds assets, while the Durable Power of Attorney grants authority to an individual to act on behalf of another. The trust can provide more control over how assets are distributed after death, while the Durable Power of Attorney is effective during the principal's lifetime.

The Health Care Proxy is another document that resembles the Medical Power of Attorney. This form specifically designates someone to make health care decisions for another person if they are unable to do so themselves. While both documents serve similar purposes in health care decision-making, the Health Care Proxy may not cover financial matters, which is where the Durable Power of Attorney comes into play.

The Financial Power of Attorney also aligns closely with the Durable Power of Attorney. Both documents allow one person to manage another's financial affairs. However, the Financial Power of Attorney may be limited in scope, focusing solely on financial matters, whereas the Durable Power of Attorney can encompass a broader range of legal decisions. This distinction can be important depending on the individual's needs.

The New York ATV Bill of Sale form is a legal document that records the purchase or sale of an all-terrain vehicle in the state of New York. This form provides essential details about the transaction, ensuring both buyer and seller have a clear record of the sale. If you're ready to make a purchase or sell your ATV, fill out the form by clicking the button below. For your convenience, you can also access helpful resources, including various forms on PDF Templates.

Lastly, the Guardianship document is similar in that it involves decision-making on behalf of another person. A Guardianship is established through a court process and gives one person legal authority to make decisions for someone deemed incapacitated. While the Durable Power of Attorney is a proactive measure that individuals can set up themselves, Guardianship is often a reactive solution that involves legal proceedings. Both serve to protect the interests of those who cannot make decisions for themselves, but they operate in different ways.