Printable General Power of Attorney Document for Iowa State

Things You Should Know About This Form

What is a General Power of Attorney in Iowa?

A General Power of Attorney is a legal document that allows one person, known as the principal, to appoint another person, called the agent or attorney-in-fact, to act on their behalf. This authority can cover a wide range of financial and legal matters, making it a powerful tool for managing one’s affairs, especially if the principal becomes unable to do so themselves.

What powers can be granted through a General Power of Attorney?

In Iowa, a General Power of Attorney can grant the agent a variety of powers, including but not limited to:

- Managing bank accounts

- Paying bills

- Buying or selling property

- Handling investments

- Filing taxes

- Making legal decisions

The principal can specify which powers are granted and can limit the scope of authority if desired.

Do I need to have a lawyer to create a General Power of Attorney?

While it is not legally required to have a lawyer to create a General Power of Attorney in Iowa, it is highly advisable. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes. They can also provide guidance on the implications of granting such powers.

How do I execute a General Power of Attorney in Iowa?

To execute a General Power of Attorney in Iowa, follow these steps:

- Complete the General Power of Attorney form, ensuring all necessary details are included.

- Sign the document in the presence of a notary public.

- Provide copies to your agent and any relevant institutions, such as banks or healthcare providers.

Make sure to keep the original document in a safe place.

Can I revoke a General Power of Attorney?

Yes, you can revoke a General Power of Attorney at any time, as long as you are mentally competent. To revoke, you should create a written revocation document and provide copies to your agent and any institutions that have a copy of the original power of attorney. It is also wise to destroy the original document to prevent any confusion.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, the General Power of Attorney remains in effect unless it specifically states otherwise. This means the agent can continue to act on behalf of the principal. However, if the principal wishes to have the power revoked or limited in such situations, they should consult with a legal professional to draft the appropriate provisions.

Can the agent be held liable for their actions?

Yes, the agent can be held liable if they act outside the authority granted in the General Power of Attorney or if they fail to act in the best interest of the principal. It is crucial for the agent to understand their responsibilities and to keep accurate records of all transactions made on behalf of the principal.

Is a General Power of Attorney effective immediately?

A General Power of Attorney can be effective immediately upon signing, unless the document specifies a different effective date. If you want the power to become effective only upon a certain event, such as incapacitation, you should create a Springing Power of Attorney instead.

What should I consider before granting someone power of attorney?

Before granting someone power of attorney, consider the following:

- Trustworthiness of the agent

- The scope of authority you are comfortable granting

- Potential conflicts of interest

- Your long-term plans and wishes

It’s essential to choose someone who understands your values and will act in your best interest.

File Data

| Fact Name | Details |

|---|---|

| Definition | The Iowa General Power of Attorney form allows an individual (the principal) to grant authority to another person (the agent) to manage their financial and legal affairs. |

| Governing Law | This form is governed by Iowa Code Chapter 633B, which outlines the rules and regulations for powers of attorney in Iowa. |

| Durability | The Iowa General Power of Attorney can be made durable, meaning it remains effective even if the principal becomes incapacitated. |

| Agent's Authority | The agent can perform a wide range of tasks, including managing bank accounts, selling property, and making healthcare decisions if specified. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent to do so. |

| Signing Requirements | The form must be signed by the principal and, in some cases, witnessed or notarized to be legally valid in Iowa. |

Discover Other Common Forms for Iowa

Non Disclosure Agreement - The NDA reinforces trust between the parties in a business context.

A California Residential Lease Agreement form is a legally binding document used between a landlord and a tenant to outline the terms of renting property in California. It covers essential agreements such as rent amount, deposit details, and the duration of the lease. For further information and resources, you can visit https://californiapdf.com/editable-residential-lease-agreement/. Ensuring clarity and mutual understanding, this form safeguards both parties' interests during the rental period.

How to File Operating Agreement Llc - This document details the rights and responsibilities of each member in an LLC.

Iowa Medical Power of Attorney Form - This legal document is crucial for individuals who want to ensure their medical preferences are honored when they are unable to communicate.

Key takeaways

When filling out and using the Iowa General Power of Attorney form, keep these key takeaways in mind:

- Understand the Purpose: This form allows you to appoint someone to make decisions on your behalf. It's essential for managing financial and legal matters if you become unable to do so.

- Choose Your Agent Wisely: Select a trusted individual, such as a family member or close friend, who will act in your best interest. The relationship you have with your agent is crucial.

- Be Specific: Clearly outline the powers you are granting. You can specify what decisions your agent can make, whether related to finances, property, or healthcare.

- Review Regularly: Life changes, and so do circumstances. Regularly review your power of attorney to ensure it still reflects your wishes and needs.

- Consult a Professional: If you have questions or concerns, consider seeking advice from a legal professional. They can help ensure that the document meets your needs and complies with state laws.

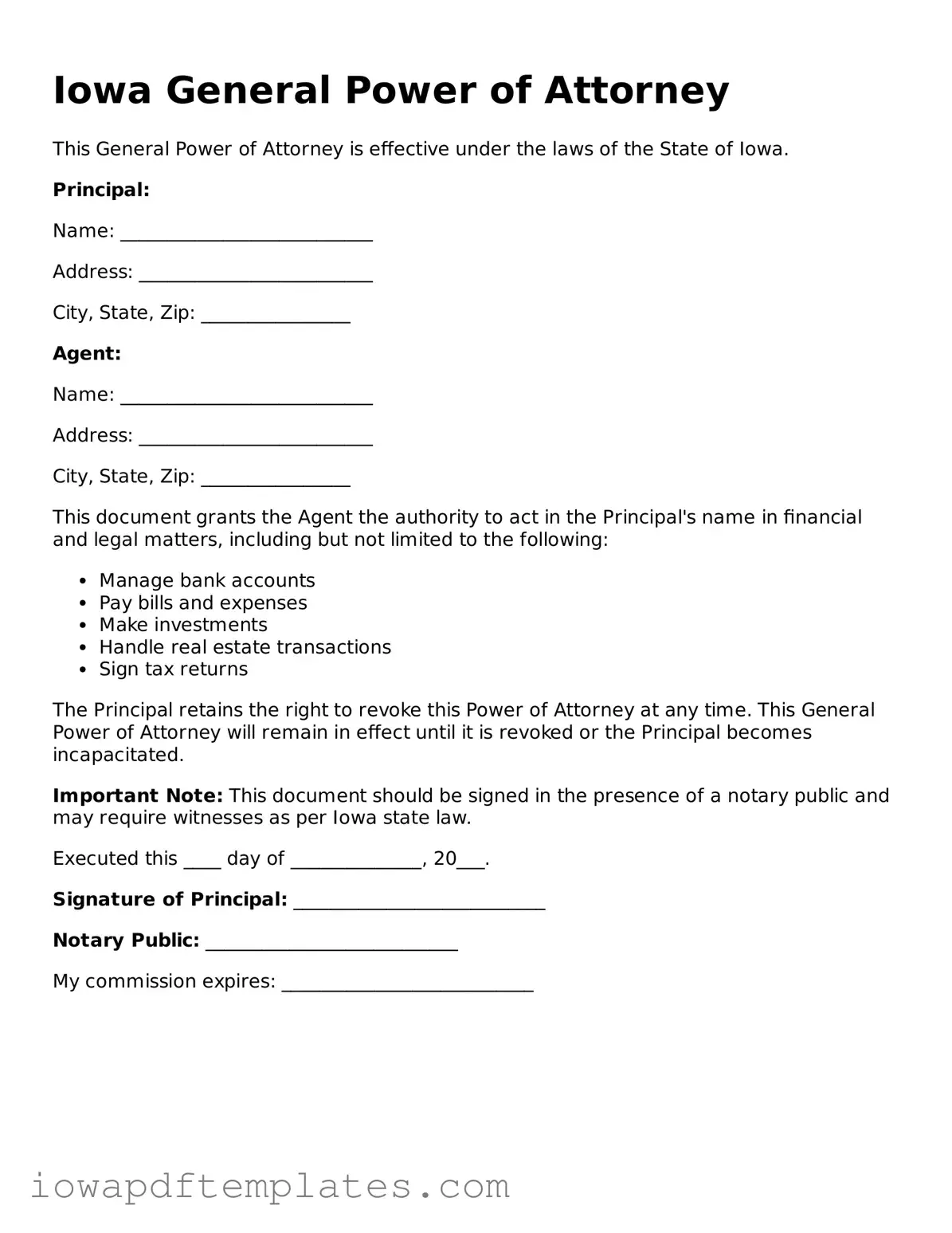

Sample - Iowa General Power of Attorney Form

Iowa General Power of Attorney

This General Power of Attorney is effective under the laws of the State of Iowa.

Principal:

Name: ___________________________

Address: _________________________

City, State, Zip: ________________

Agent:

Name: ___________________________

Address: _________________________

City, State, Zip: ________________

This document grants the Agent the authority to act in the Principal's name in financial and legal matters, including but not limited to the following:

- Manage bank accounts

- Pay bills and expenses

- Make investments

- Handle real estate transactions

- Sign tax returns

The Principal retains the right to revoke this Power of Attorney at any time. This General Power of Attorney will remain in effect until it is revoked or the Principal becomes incapacitated.

Important Note: This document should be signed in the presence of a notary public and may require witnesses as per Iowa state law.

Executed this ____ day of ______________, 20___.

Signature of Principal: ___________________________

Notary Public: ___________________________

My commission expires: ___________________________

Similar forms

The Iowa General Power of Attorney form shares similarities with the Durable Power of Attorney. Both documents allow an individual, known as the principal, to designate another person, the agent, to make decisions on their behalf. The key difference lies in the durability of the authority granted. A Durable Power of Attorney remains effective even if the principal becomes incapacitated, whereas a standard General Power of Attorney may not. This makes the Durable Power of Attorney particularly useful for long-term planning, ensuring that the agent can continue to act in the principal's best interests during times of incapacity.

Another document that resembles the Iowa General Power of Attorney is the Medical Power of Attorney. This specific type of power of attorney focuses solely on healthcare decisions. Like the General Power of Attorney, it allows the principal to appoint someone to make decisions on their behalf. However, the Medical Power of Attorney is limited to medical and health-related matters, ensuring that the appointed agent can make critical decisions regarding treatment options, medical procedures, and end-of-life care when the principal is unable to do so themselves.

The Financial Power of Attorney is another closely related document. This form is specifically tailored for financial matters, allowing the agent to manage the principal's financial affairs. While the General Power of Attorney can encompass both financial and health decisions, the Financial Power of Attorney is more focused. It grants the agent authority over banking transactions, property management, and investment decisions, providing a clear framework for financial responsibilities without overlapping into healthcare issues.

A Living Will is also similar to the General Power of Attorney, but it serves a different purpose. While the General Power of Attorney allows an agent to make decisions on behalf of the principal, a Living Will outlines the principal's wishes regarding medical treatment in situations where they cannot communicate. This document is particularly important for end-of-life decisions, ensuring that the principal's preferences are respected. Though both documents deal with healthcare, the Living Will is directive in nature, while the General Power of Attorney is more about delegation.

The Revocation of Power of Attorney document is related as well. This form is used to cancel any existing power of attorney, including the General Power of Attorney. If a principal wishes to change their agent or revoke the authority granted to an agent, this document provides a clear and formal way to do so. It ensures that all parties are aware of the change, preventing any confusion or misuse of authority that may arise from an outdated power of attorney.

Another document that parallels the General Power of Attorney is the Springing Power of Attorney. This type of power of attorney becomes effective only under certain conditions, typically when the principal becomes incapacitated. Like the General Power of Attorney, it allows the agent to act on behalf of the principal, but the activation of authority is contingent on the principal's health status. This can provide peace of mind for those who want to maintain control over their affairs until they are unable to do so.

When dealing with the complexities of vehicle transactions, it's important to have the right documentation in place. A Motor Vehicle Bill of Sale serves as a vital record for both parties involved, capturing essential details of the sale, including the vehicle's specifications and the agreed-upon price. This legal form not only protects the interests of both the buyer and seller but also ensures transparency in the transaction process. For those looking to easily manage this paperwork, you can explore various options for creating your document, such as the PDF Templates available online.

The Trust Agreement is also similar in that it allows for the management of assets, but it operates differently. A Trust Agreement creates a legal entity that holds and manages the principal's assets for the benefit of designated beneficiaries. While a General Power of Attorney grants authority to an agent to act on behalf of the principal, a Trust Agreement involves a trustee who manages the trust according to the terms set forth by the principal. This can be beneficial for estate planning, asset protection, and tax considerations.

Lastly, the Authorization for Release of Information document is akin to the General Power of Attorney in that it allows a third party to access specific information on behalf of the principal. This document is often used in medical or financial contexts, granting permission for the agent to obtain sensitive information. However, unlike the General Power of Attorney, which grants broader decision-making powers, this authorization is limited to information access, ensuring that the principal's privacy is respected while still allowing for necessary communication with relevant parties.