Free Iowa 31 116A Template

Things You Should Know About This Form

What is the Iowa 31 116A form used for?

The Iowa 31 116A form is designed for energy purchasers who intend to use energy in ways that do not qualify for the residential energy exemption from Iowa sales tax. It is not a claim for a refund but serves as a declaration to the seller regarding how the energy will be used.

Who needs to complete the Iowa 31 116A form?

This form must be completed by anyone purchasing energy that will be used for taxable purposes. If you are using energy in a residential setting for non-residential activities, you will need to fill out this form and provide it to your energy supplier.

What information do I need to provide on the form?

You will need to include several details, including:

- Your name and address.

- The seller's name and address.

- The general nature of your business.

- Your daytime telephone number.

- The type of energy purchased (electricity, gas, etc.).

- The percentage of energy used that does not qualify for the residential exemption.

- Meter and utility account numbers, if applicable.

If the fuel is not metered, you must attach an explanation of how the energy is purchased and stored.

What supporting documentation is required?

Documentation must accompany the form to validate the taxable uses of energy. This documentation should clearly specify how the energy will be used. Without proper documentation, the seller may not accept the certificate.

How often do I need to update the Iowa 31 116A form?

Your energy supplier will require an updated form at least every three years. It’s essential to keep your records current to ensure compliance with state regulations.

What should I do with the completed form?

Once you have completed the Iowa 31 116A form, provide it to your energy supplier. Both the purchaser and the seller should keep a copy for their records. Do not send the form to the Iowa Department of Revenue.

What happens if I do not complete this form?

If you fail to complete and provide the Iowa 31 116A form when required, you may be liable for sales tax on your energy purchases. It is crucial to comply with this requirement to avoid potential penalties and ensure proper tax treatment.

Form Features

| Fact Name | Fact Description |

|---|---|

| Form Purpose | This form is used to document energy purchases that do not qualify for the residential energy exemption from Iowa sales tax. |

| Governing Law | The form is governed by Iowa sales tax regulations, specifically regarding energy use exemptions. |

| Who Completes the Form | The purchaser of the energy must complete this form and provide it to the seller. |

| Record Keeping | Both the purchaser and seller should keep a copy of the completed form for their records. |

| Types of Energy | The form can be used for electricity, gas, and other specified types of energy. |

| Taxable Use Specification | The form requires the purchaser to specify how the energy will be used, detailing any taxable uses. |

| Percentage of Taxable Use | Purchasers must indicate the percentage of energy used for non-residential purposes that does not qualify for the exemption. |

| Documentation Requirement | Supporting documentation must be attached to the form to validate the taxable uses claimed. |

| Signature Requirement | An authorized signature is required, affirming the truthfulness of the information provided on the form. |

| Form Update Frequency | Energy suppliers will require an updated form every three years to maintain accurate records. |

Discover Other PDFs

Iowa Tags and Title - Lessee information is needed for both primary and secondary lessees, if applicable.

For those looking to formalize their business operations, a well-crafted document can be found through our informative guide on the important aspects of Operating Agreement creation. This template serves as a vital resource for establishing clear governance and procedures within your LLC.

Iowacourts Gov - Form 4.16 provides flexibility in the enforcement of sentencing orders based on changing circumstances.

Key takeaways

Here are some key takeaways about filling out and using the Iowa 31 116A form:

- Purpose of the Form: The Iowa 31 116A form is not for claiming refunds. Instead, it is used by purchasers to inform sellers about energy that will be used for taxable purposes.

- Who Should Complete It: This form must be completed by energy purchasers who do not qualify for the residential energy exemption from Iowa sales tax.

- Keep Copies: Both the purchaser and seller should keep copies of the completed form for their records.

- Documentation Required: Supporting documentation must be attached to the form. This documentation should clearly outline the taxable uses of the energy purchased.

- Updating the Form: Energy suppliers require an updated form at least every three years. Be prepared to provide documentation on how the energy is utilized.

- Non-Residential Use: Energy billed to a residence can be taxable if used for non-residential purposes, such as running a business from home.

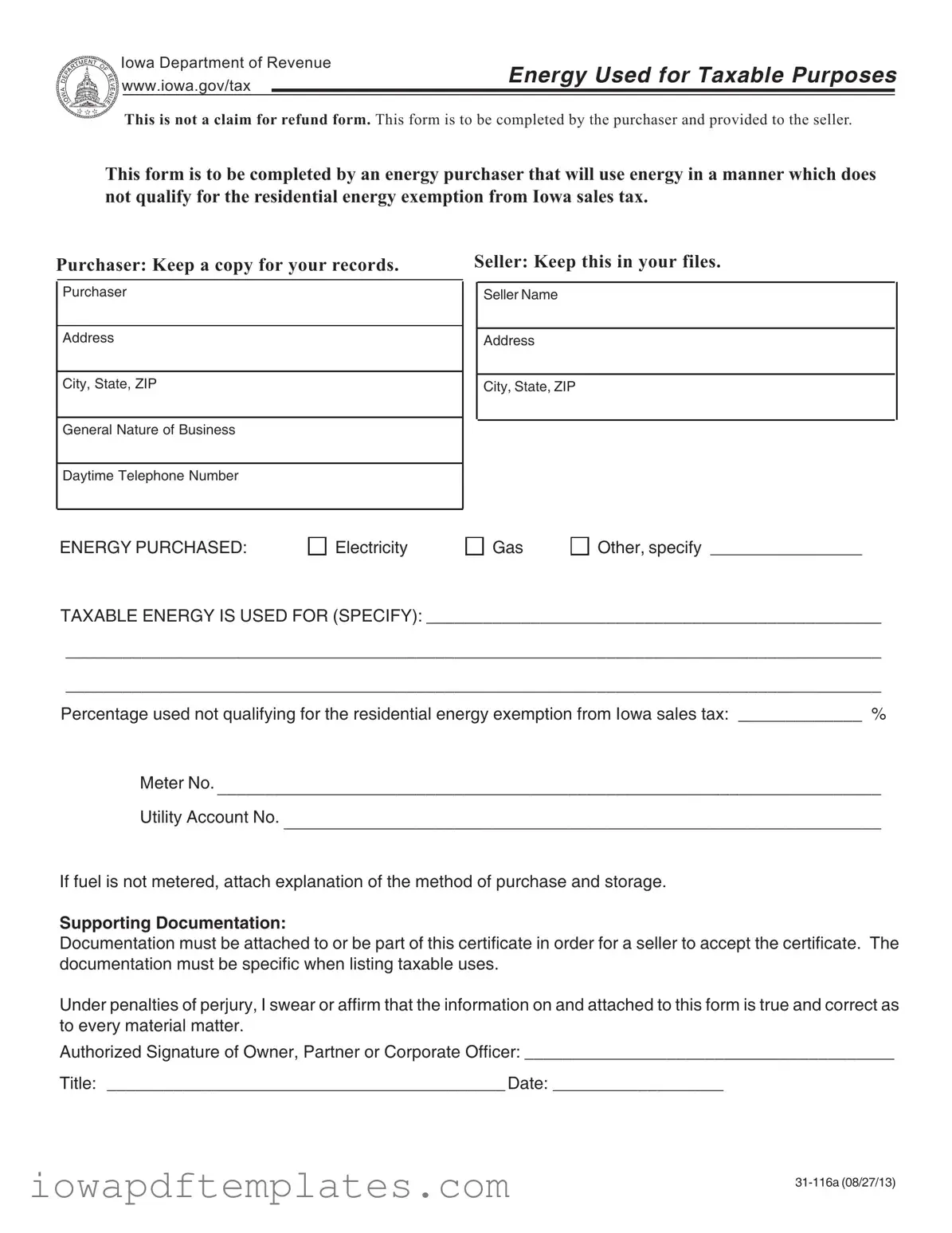

Sample - Iowa 31 116A Form

Iowa Department of Revenue

www.iowa.gov/tax

Energy Used for Taxable Purposes

This is not a claim for refund form. This form is to be completed by the purchaser and provided to the seller.

This form is to be completed by an energy purchaser that will use energy in a manner which does not qualify for the residential energy exemption from Iowa sales tax.

Purchaser: Keep a copy for your records.

Purchaser

Seller: Keep this in your files.

Seller Name

Address

Address

City, State, ZIP

City, State, ZIP

General Nature of Business

Daytime Telephone Number

ENERGY PURCHASED:

Electricity

Gas

Other, specify ________________

TAXABLE ENERGY IS USED FOR (SPECIFY): ________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

Percentage used not qualifying for the residential energy exemption from Iowa sales tax: _____________ %

Meter No. ______________________________________________________________________

Utility Account No. _______________________________________________________________

If fuel is not metered, attach explanation of the method of purchase and storage.

Supporting Documentation:

Documentation must be attached to or be part of this certificate in order for a seller to accept the certificate. The documentation must be specific when listing taxable uses.

Under penalties of perjury, I swear or affirm that the information on and attached to this form is true and correct as to every material matter.

Authorized Signature of Owner, Partner or Corporate Officer: _______________________________________

Title: __________________________________________ Date: __________________

Energy Used for Taxable Purposes

Residential energy is exempt from Iowa state sales tax. It remains subject to any applicable local option sales tax.

Residential energy includes metered electricity, metered natural gas, propane, heating fuel, and kerosene.

Energy billed to a residence is taxable when used for

If it is impractical to separately meter and bill the energy, complete the Energy Used for Taxable Purposes form

Seller: Keep this certificate in your files.

Purchaser: Keep a copy of this certificate for your records.

Do not send to the Iowa Department of Revenue.

Similar forms

The Iowa 31 116A form shares similarities with the IRS Form W-9. Both documents require the individual or business to provide identifying information, such as name and address. The W-9 form is used to request the taxpayer identification number (TIN) for reporting purposes, while the Iowa 31 116A focuses on the use of energy for taxable purposes. Each form must be completed accurately to avoid issues with compliance, making them essential for record-keeping and tax obligations.

Another document akin to the Iowa 31 116A is the IRS Form 8832. This form allows businesses to elect their classification for federal tax purposes. Like the Iowa form, it requires detailed information about the entity and its operations. Both forms aim to clarify tax responsibilities, ensuring that the appropriate taxes are paid based on the usage of resources—energy in the case of the Iowa form and business structure in the case of Form 8832.

The Iowa 31 116A form also resembles the State of Iowa's Sales Tax Exemption Certificate (Form 31-014). This certificate is used by purchasers to claim exemption from sales tax for specific purchases. Both documents require the purchaser to specify the nature of the use, whether taxable or exempt. They help maintain transparency in transactions and ensure compliance with state tax laws.

Similar to the Iowa 31 116A, the IRS Form 1040 Schedule C is used by sole proprietors to report income and expenses from business activities. Both forms require detailed information about the nature of the business or use of resources. They also play a critical role in determining tax liabilities, making accuracy essential for both forms.

The Iowa 31 116A is also comparable to the IRS Form 4562, which is used to claim depreciation and amortization on assets. Both forms require detailed information about the use of resources—energy for the Iowa form and physical assets for Form 4562. They help ensure that taxpayers accurately report their financial activities and comply with tax regulations.

For those looking to navigate the intricacies of starting a business, understanding the necessary documentation is crucial. A valuable resource in this process can be found in the PDF Templates, which provide essential guidelines for completing forms like the Articles of Incorporation, ensuring that all required information is accurately captured to facilitate a successful corporation setup.

Another similar document is the Iowa Department of Revenue's Certificate of Exemption (Form 31-014). This form allows buyers to make tax-exempt purchases for specific purposes. Like the Iowa 31 116A, it requires the buyer to provide details about the intended use of the purchased goods. Both forms are critical in facilitating proper tax treatment for various transactions.

The Iowa 31 116A form also has parallels with the IRS Form 8822, which is used to change an address for tax purposes. While the focus is different, both forms require accurate information to ensure compliance with tax regulations. The need for up-to-date information is a common thread that runs through both forms, emphasizing the importance of maintaining accurate records.

Similar to the Iowa 31 116A is the Iowa Department of Revenue’s Application for Sales Tax Exemption (Form 31-007). This application allows businesses to apply for sales tax exemption based on specific criteria. Both forms require detailed information about the nature of the business or use, ensuring that the correct tax treatment is applied to purchases.

Lastly, the Iowa 31 116A shares characteristics with the IRS Form 1099-MISC, which reports various types of income. Both forms require accurate reporting of information to ensure compliance with tax laws. They serve different purposes but are both essential for maintaining transparency and accountability in financial transactions.