Free Iowa 35 003A Template

Things You Should Know About This Form

What is the Iowa 35 003A form?

The Iowa 35 003A form is a Construction Contract Claim for Refund. It is used by governmental units, nonprofit organizations, and certain businesses to claim refunds on sales and use taxes paid for construction projects. This form must be completed and submitted to the Iowa Department of Revenue.

Who can file the Iowa 35 003A form?

Eligible filers include governmental units, private nonprofit educational institutions, nonprofit museums, businesses located in economic development areas, rural water districts, and Habitat for Humanity. If you belong to one of these categories and have paid sales or use tax on a construction project, you can file this claim.

What information is required to complete the form?

To complete the Iowa 35 003A form, you will need to provide the following information:

- Description of the project.

- Final settlement date of the contract.

- Confirmation that the contract was in writing, including the date it was signed.

- Whether you have previously filed a claim for this project.

- If applicable, a copy of any tax credit certificate received.

Additionally, you must list all contractors and subcontractors involved in the project, along with the amounts and taxes to be refunded.

What is the deadline for filing this claim?

The claim must be filed within one year of the final settlement date of the contract. Make sure to submit your form on time to avoid missing out on your refund.

Is it necessary for the contract to be in writing?

Yes, the contract must be in writing to be eligible for a refund. If the contract is not documented in writing, your claim will not be processed.

What should I do if I have previously filed a claim for the same project?

If you have previously filed a claim for the same project, you should indicate this on the form. Providing this information helps the Iowa Department of Revenue process your current claim accurately.

How do I submit the completed form?

Once you have completed the Iowa 35 003A form, submit it along with the original contractor’s statements to the Tax Management Division at the Iowa Department of Revenue. The mailing address is:

Tax Management Division

Iowa Department of Revenue

PO Box 10465

Des Moines, IA 50306-0465

What happens if I do not provide the required breakdown of local option sales tax?

If you fail to provide the necessary breakdown of local option sales tax by county, it may delay the processing of your refund claim. Ensure that all information is complete and accurate to avoid any hold-ups.

Form Features

| Fact Name | Details |

|---|---|

| Form Title | Construction Contract Claim for Refund |

| Governing Law | Section 423.4 of the Code of Iowa |

| Filing Deadline | The claim must be filed within one year of the final settlement date of the contract. |

| Written Contract Requirement | The contract must be in writing to qualify for a refund. |

| Tax Credit Certificate | If claiming a refund for which a tax credit certificate was received, a copy must be included with the claim. |

| Submission Address | Completed forms must be submitted to the Tax Management Division, Iowa Department of Revenue, PO Box 10465, Des Moines, IA 50306-0465. |

| Contractor Information | Only contractors and subcontractors involved in the project should be listed on the form. |

| Local Option Tax Summary | A detailed local option tax summary must be provided, broken down by county, to process the claim. |

Discover Other PDFs

Iowa State Taxes - Reportable Social Security benefits must be calculated based on the Iowa worksheet.

To further assist landlords and tenants in this essential process, they can access a comprehensive resource for creating a Residential Lease Agreement by visiting californiapdf.com/editable-residential-lease-agreement, where they will find tools and templates designed to facilitate clear and effective agreements.

Iowa Dot Districts - The 810025 may include penalties for non-compliance or inaccuracies that should be understood.

Key takeaways

Filling out the Iowa 35 003A form is essential for those seeking a refund related to construction contracts. Here are some key takeaways to ensure the process goes smoothly:

- Eligibility Requirements: Ensure that the contract is in writing. Only written contracts qualify for a refund.

- Timely Submission: Submit your claim within one year of the final settlement date of the contract. Missing this deadline may result in denial of your claim.

- Previous Claims: Disclose whether you have previously filed a claim for the same project. This information is crucial for processing your current request.

- Tax Credit Certificates: If you are claiming a refund for which you have received a tax credit certificate, include a copy of that certificate with your claim.

- Complete Information: Fill out all required fields, including the local option tax summary on the reverse side. Incomplete forms will delay processing.

- Contractor Details: List all contractors and subcontractors involved in the project. Ensure that their names and the amounts of tax to be refunded are accurately recorded.

- Signature Requirement: The form must be signed and dated. The signature certifies that the information provided is true and complete, which is vital for your claim's validity.

By following these guidelines, you can navigate the refund process more effectively and increase the likelihood of a successful claim.

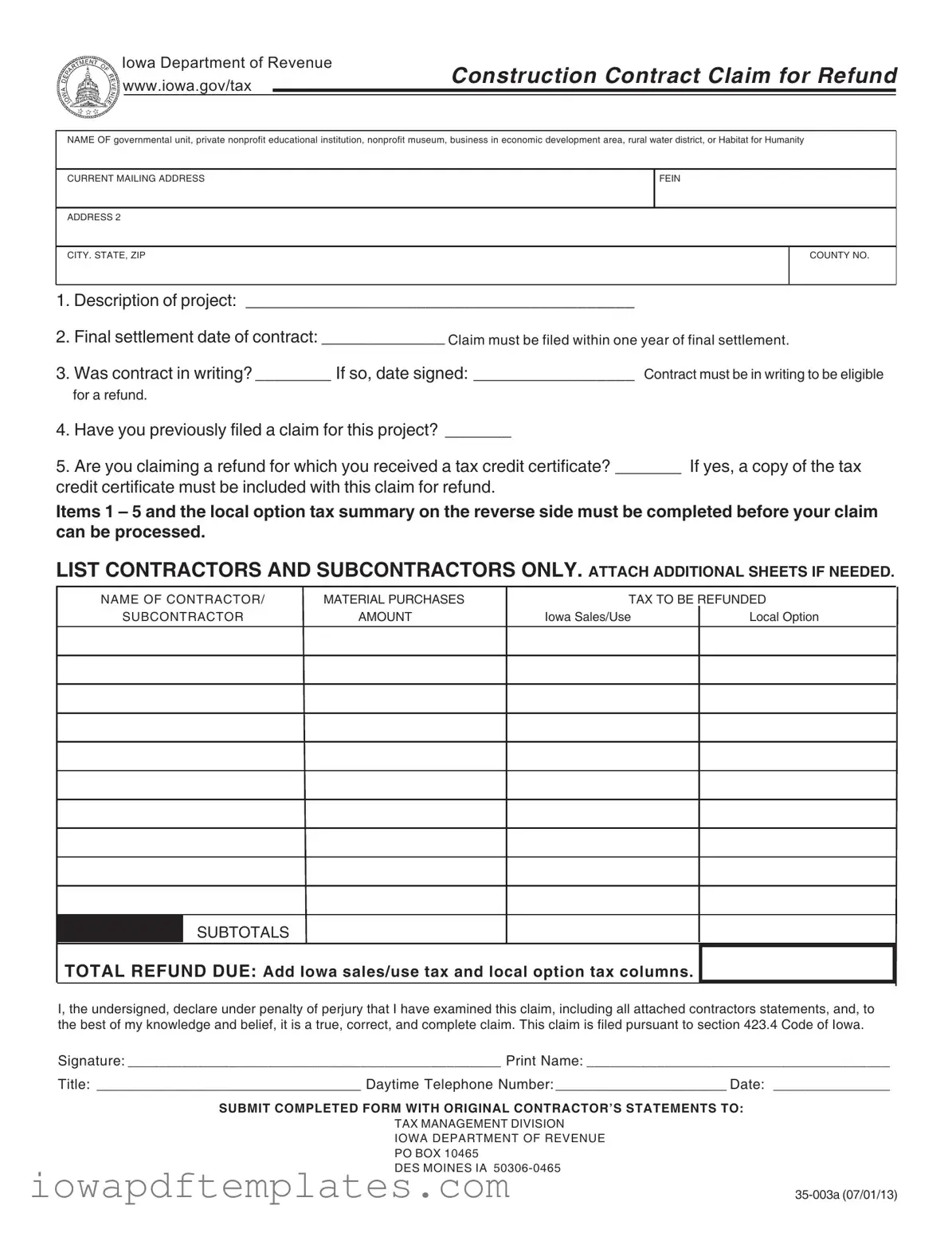

Sample - Iowa 35 003A Form

Iowa Department of Revenue

www.iowa.gov/tax

Construction Contract Claim for Refund

NAME OF governmental unit, private nonprofit educational institution, nonprofit museum, business in economic development area, rural water district, or Habitat for Humanity

CURRENT MAILING ADDRESS

FEIN

ADDRESS 2

CITY. STATE, ZIP

COUNTY NO.

1.Description of project: _________________________________________

2.Final settlement date of contract: _____________ Claim must be filed within one year of final settlement.

3. Was contract in writing? ________ If so, date signed: _________________ Contract must be in writing to be eligible

for a refund.

4.Have you previously filed a claim for this project? _______

5.Are you claiming a refund for which you received a tax credit certificate? _______ If yes, a copy of the tax credit certificate must be included with this claim for refund.

Items 1 – 5 and the local option tax summary on the reverse side must be completed before your claim can be processed.

LIST CONTRACTORS AND SUBCONTRACTORS ONLY. ATTACH ADDITIONAL SHEETS IF NEEDED.

NAME OF CONTRACTOR/ |

MATERIAL PURCHASES |

SUBCONTRACTOR |

AMOUNT |

TAX TO BE REFUNDED

Iowa Sales/Use |

Local Option |

SUBTOTALS

TOTAL REFUND DUE: Add Iowa sales/use tax and local option tax columns.

I, the undersigned, declare under penalty of perjury that I have examined this claim, including all attached contractors statements, and, to the best of my knowledge and belief, it is a true, correct, and complete claim. This claim is filed pursuant to section 423.4 Code of Iowa.

Signature: ________________________________________________ Print Name: _______________________________________

Title: __________________________________ Daytime Telephone Number: ______________________ Date: _______________

SUBMIT COMPLETED FORM WITH ORIGINAL CONTRACTOR’S STATEMENTS TO:

TAX MANAGEMENT DIVISION

IOWA DEPARTMENT OF REVENUE

PO BOX 10465

DES MOINES IA

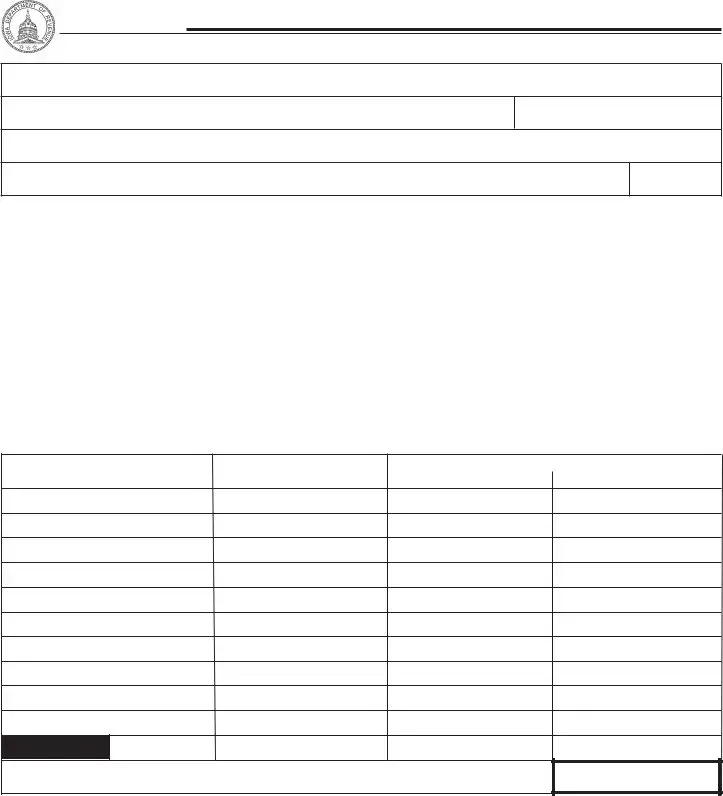

Local Option Tax Summary

Construction Contract Claim for Refund

County |

|

Number |

Local Option Sales Tax |

|

|

01 |

|

|

|

02 |

|

|

|

03 |

|

|

|

04 |

|

|

|

05 |

|

|

|

06 |

|

|

|

07 |

|

|

|

08 |

|

|

|

09 |

|

|

|

10 |

|

|

|

11 |

|

|

|

12 |

|

|

|

13 |

|

|

|

14 |

|

|

|

15 |

|

|

|

16 |

|

|

|

17 |

|

|

|

18 |

|

|

|

19 |

|

|

|

20 |

|

|

|

21 |

|

|

|

22 |

|

|

|

23 |

|

|

|

24 |

|

|

|

25 |

|

|

|

26 |

|

|

|

27 |

|

|

|

28 |

|

|

|

29 |

|

|

|

30 |

|

|

|

31 |

|

|

|

32 |

|

|

|

33 |

|

|

|

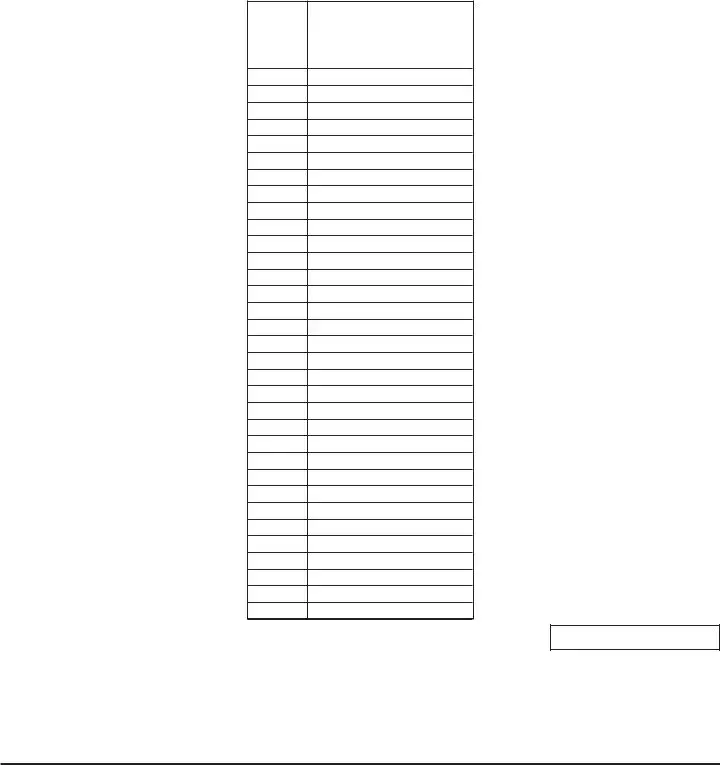

County |

|

Number |

Local Option Sales Tax |

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

County |

|

Number |

Local Option Sales Tax |

|

|

67 |

|

|

|

68 |

|

|

|

69 |

|

|

|

70 |

|

|

|

71 |

|

|

|

72 |

|

|

|

73 |

|

|

|

74 |

|

|

|

75 |

|

|

|

76 |

|

|

|

77 |

|

|

|

78 |

|

|

|

79 |

|

|

|

80 |

|

|

|

81 |

|

|

|

82 |

|

|

|

83 |

|

|

|

84 |

|

|

|

85 |

|

|

|

86 |

|

|

|

87 |

|

|

|

88 |

|

|

|

89 |

|

|

|

90 |

|

|

|

91 |

|

|

|

92 |

|

|

|

93 |

|

|

|

94 |

|

|

|

95 |

|

|

|

96 |

|

|

|

97 |

|

|

|

98 |

|

|

|

99 |

|

|

|

Total Local Option Sales Tax

Instructions: |

Report the total local option sales tax as found on all the contractor’s statements attached to this claim for refund. They must be |

|

broken down by county in order to process your claim. The totals should match the local option sales tax subtotal on the front side |

|

of the form. This information is necessary to make appropriate distributions of the local option sales tax. Failure to provide this |

|

breakdown will delay processing of your refund claim. |

IOWA COUNTIES AND COUNTY NUMBERS

|

|

|

|

|

|

Similar forms

The Iowa 35 003A form is similar to the IRS Form 4506-T, which is used to request a transcript of tax returns. Both documents require detailed information about the requester, including their name and address. Just as the Iowa form seeks specific project details for a construction refund, the IRS form asks for information on the tax years for which transcripts are requested. Both forms emphasize the importance of accuracy and completeness, as any discrepancies can lead to delays in processing.

Another document akin to the Iowa 35 003A is the IRS Form 1065, which is filed by partnerships to report income, deductions, and other important financial information. Like the Iowa form, it requires a declaration under penalty of perjury, ensuring that the information provided is truthful. Both forms also necessitate supporting documentation; the Iowa form requires contractor statements, while Form 1065 requires various schedules and attachments to substantiate the reported figures.

The Iowa 35 003A also shares similarities with the W-9 form, which is used to provide taxpayer identification information to businesses. Both documents require the submission of accurate information to avoid issues with tax authorities. The Iowa form collects details about contractors and subcontractors involved in a project, while the W-9 collects information about individuals or entities receiving payments. Each form serves to ensure proper tax reporting and compliance.

Additionally, the Iowa 35 003A is comparable to the Form 941, which employers use to report payroll taxes. Both forms require specific financial data, such as amounts owed or refunded. They also have strict deadlines for submission; the Iowa form must be filed within a year of contract settlement, while Form 941 must be filed quarterly. Timeliness is crucial for both forms to ensure compliance with tax regulations.

The Iowa 35 003A form is also similar to the 1099-MISC form, which reports payments made to non-employees. Both documents require detailed breakdowns of financial transactions. While the Iowa form focuses on tax refunds related to construction contracts, the 1099-MISC form is used to report various types of income. Both forms help ensure that the correct amounts are reported to tax authorities, promoting transparency and accountability.

Understanding the intricacies of various tax-related forms is crucial for any applicant. For those navigating options like the Iowa 35 003A or the IRS Form 941, having a reliable PDF Templates can simplify the process, ensuring all necessary details are meticulously documented and submitted on time to avoid complications.

Moreover, the Iowa 35 003A resembles the Schedule C, which sole proprietors use to report income and expenses. Both documents require a summary of financial activity related to specific projects or services. The Iowa form asks for a detailed account of contractors and their tax amounts, while Schedule C requires a breakdown of income and expenses. Each form aims to provide a clear picture of financial dealings for tax purposes.

Lastly, the Iowa 35 003A has parallels with the Form 8888, which is used to allocate tax refunds to multiple accounts. Both forms deal with refunds and require careful attention to detail. The Iowa form specifies the amount of tax to be refunded based on construction projects, while Form 8888 allows taxpayers to direct their refunds to different accounts. Each form plays a role in ensuring that taxpayers receive their entitled amounts efficiently and accurately.