Free Iowa 411179 Template

Things You Should Know About This Form

-

What is the purpose of the Iowa 411179 form?

The Iowa 411179 form is used to apply for a certificate of title and/or registration for a leased vehicle in the state of Iowa. It collects necessary information about the owner, lessee, vehicle, and any applicable security interests.

-

Who should complete the Iowa 411179 form?

The form should be completed by the leasing company, the owner of the vehicle, or the lessee. It is essential for any party involved in the leasing of the vehicle to provide accurate information to ensure proper registration and title issuance.

-

What information is required on the form?

The form requires various details, including:

- Owner and lessee information (names, addresses, identification numbers)

- Vehicle information (VIN, make, model, year, type, color, etc.)

- Security interest information (if applicable)

- Purchase price and any exemptions claimed

-

Where should the completed form be submitted?

The completed form must be submitted to the County Treasurer's office. The specific office depends on the gross vehicle weight rating (GVWR) of the vehicle and the residence of the lessee or owner.

-

What is the significance of the GVWR in the application process?

The GVWR determines where the application should be submitted. If the GVWR is less than 10,000 pounds, it should be presented to the Treasurer of the lessee’s residence. If it is 10,000 pounds or more, it should go to the Treasurer of the owner's residence or where the primary user resides.

-

Can exemptions be claimed on the Iowa 411179 form?

Yes, exemptions can be claimed for various reasons, such as transfers by gift, purchases by non-profit organizations, or vehicles used solely in interstate commerce. Specific exemption codes must be listed on the form to substantiate the claim.

-

What happens if the information on the form is incorrect?

Providing incorrect information can lead to delays in processing the application or potential legal consequences. It is crucial to ensure that all details are accurate and complete before submission.

-

Is there a fee associated with the registration?

Yes, there is typically a fee for new registration. However, exemptions may apply based on the circumstances of the vehicle purchase or ownership. It is important to check the specific fee requirements and exemptions that may be available.

-

Who can I contact for assistance with the Iowa 411179 form?

For assistance, individuals can contact their local County Treasurer's office or the Iowa Department of Transportation. These offices can provide guidance on completing the form and the registration process.

Form Features

| Fact Name | Description |

|---|---|

| Form Title | Application for Certificate of Title and/or Registration for a Leased Vehicle |

| Form Number | 411179 |

| Last Revised | December 2008 |

| Governing Law | Iowa Code Chapter 321 |

| Submission Location | County Treasurer of lessee’s residence if GVWR is less than 10,000 lbs. |

| Owner Information | Requires details of the leasing company and owner including ID numbers. |

| Lessee Information | Information for up to two lessees must be provided, including addresses. |

| Fee Exemptions | Various exemptions apply, including non-profit organizations and certain transfers. |

Discover Other PDFs

Iowa W 4P - Payers can utilize alternative methods for withholding if they prefer not to use the flat 5% rate.

To ensure a smooth rental experience, both landlords and tenants in California should utilize a California Residential Lease Agreement form, as it details vital aspects like the rent, security deposits, and lease duration. For those looking for an adaptable document, they can visit californiapdf.com/editable-residential-lease-agreement/ to access customizable versions that cater to specific needs, ultimately protecting the interests of both parties throughout the lease period.

Iowa Master Electrician License Requirements - Licenses obtained through examination require clear proof of passing the respective tests focusing on electrical knowledge.

Key takeaways

When filling out the Iowa 411179 form, there are several important points to keep in mind to ensure a smooth process.

- Choose the Correct Section: The form requires you to check the appropriate box for either the owner or lessee. This step is crucial for proper processing.

- Accurate Information: Fill in all required fields accurately, including names, addresses, and identification numbers. Inaccurate information can lead to delays or complications.

- Vehicle Details: Provide complete vehicle information, including VIN, make, model, and type. This helps in correctly identifying the vehicle for registration.

- Security Interests: If there are any liens or security interests on the vehicle, list them clearly. This is important for establishing ownership rights.

- Exemptions: If you believe you qualify for a registration fee exemption, check the appropriate box and provide any necessary codes. Ensure that you follow the guidelines for exemptions.

- Sign and Date: Don’t forget to sign and date the form. This certification is legally binding and affirms that the information provided is true and correct.

By following these key takeaways, you can navigate the Iowa 411179 form with confidence and ensure that your application is processed efficiently.

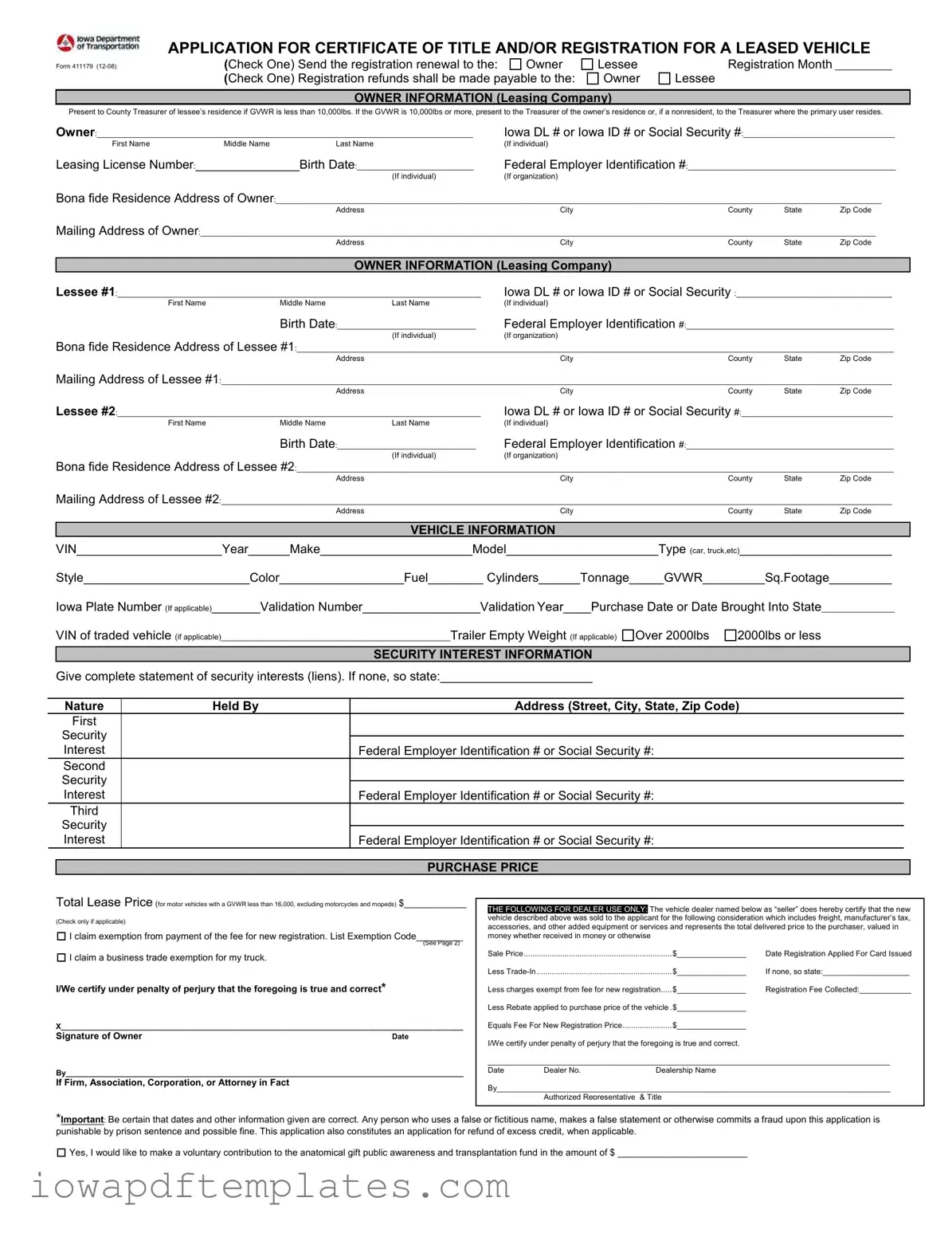

Sample - Iowa 411179 Form

APPLICATION FOR CERTIFICATE OF TITLE AND/OR REGISTRATION FOR A LEASED VEHICLE

Form 411179 |

(Check One) Send the registration renewal to the: |

Owner |

Lessee |

Registration Month ___________ |

|

(Check One) Registration refunds shall be made payable to the: |

Owner |

Lessee |

|

OWNER INFORMATION (Leasing Company)

Present to County Treasurer of lessee’s residence if GVWR is less than 10,000lbs. If the GVWR is 10,000lbs or more, present to the Treasurer of the owner’s residence or, if a nonresident, to the Treasurer where the primary user resides.

Owner:_______________________________________________________________________________________ |

Iowa DL # or Iowa ID # or Social Security #:___________________________________ |

||

First Name |

Middle Name |

Last Name |

(If individual) |

Leasing License Number:_______________Birth Date:___________________________ |

Federal Employer Identification #:________________________________________________ |

||

|

|

(If individual) |

(If organization) |

Bona fide Residence Address of Owner:____________________________________________________________________________________________________________________________________________

|

|

Address |

City |

County |

State |

Zip Code |

Mailing Address of Owner:____________________________________________________________________________________________________________________________________________________________ |

||||||

|

|

Address |

City |

County |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

OWNER INFORMATION (Leasing Company) |

|

|

|

|

Lessee #1:____________________________________________________________________________________ |

Iowa DL # or Iowa ID # or Social Security :____________________________________ |

|||||

First Name |

Middle Name |

Last Name |

(If individual) |

|

|

|

|

Birth Date:________________________________ |

Federal Employer Identification #:________________________________________________ |

||||

|

|

(If individual) |

(If organization) |

|

|

|

Bona fide Residence Address of Lessee #1:__________________________________________________________________________________________________________________________________________

|

|

Address |

City |

County |

State |

Zip Code |

Mailing Address of Lessee #1:___________________________________________________________________________________________________________________________________________________________ |

||||||

|

|

Address |

City |

County |

State |

Zip Code |

Lessee #2:____________________________________________________________________________________ |

Iowa DL # or Iowa ID # or Social Security #:___________________________________ |

|||||

First Name |

Middle Name |

Last Name |

(If individual) |

|

|

|

|

Birth Date:________________________________ |

Federal Employer Identification #:________________________________________________ |

||||

|

|

(If individual) |

(If organization) |

|

|

|

Bona fide Residence Address of Lessee #2:__________________________________________________________________________________________________________________________________________

Address |

City |

County |

State |

Zip Code |

Mailing Address of Lessee #2:___________________________________________________________________________________________________________________________________________________________ |

||||

Address |

City |

County |

State |

Zip Code |

VEHICLE INFORMATION

VIN_____________________Year______Make______________________Model______________________Type (car, truck,etc)______________________

Style________________________Color__________________Fuel________ Cylinders______Tonnage_____GVWR_________Sq.Footage_________

Iowa Plate Number (If applicable)_______Validation Number_________________Validation Year____Purchase Date or Date Brought Into State_________________

VIN of traded vehicle (if applicable)_____________________________________________________Trailer Empty Weight (If applicable)

Over 2000lbs

2000lbs or less

|

|

|

SECURITY INTEREST INFORMATION |

|

|

Give complete statement of security interests (liens). If none, so state:______________________ |

|

||

|

|

|

|

|

|

Nature |

Held By |

Address (Street, City, State, Zip Code) |

|

|

First |

|

|

|

|

Security |

|

|

|

|

|

|

||

|

Interest |

|

Federal Employer Identification # or Social Security #: |

|

|

Second |

|

|

|

|

Security |

|

|

|

|

|

|

||

|

Interest |

|

Federal Employer Identification # or Social Security #: |

|

|

Third |

|

|

|

|

Security |

|

|

|

|

|

|

||

|

Interest |

|

Federal Employer Identification # or Social Security #: |

|

PURCHASE PRICE

Total Lease Price (for motor vehicles with a GVWR less than 16,000, excluding motorcycles and mopeds) $____________

(Check only if applicable)

I claim exemption from payment of the fee for new registration. List Exemption Code_________

I claim exemption from payment of the fee for new registration. List Exemption Code_________

(See Page 2)

I claim a business trade exemption for my truck.

I claim a business trade exemption for my truck.

I/We certify under penalty of perjury that the foregoing is true and correct*

X_____________________________________________________________________________________________

Signature of OwnerDate

By____________________________________________________________________________________________

If Firm, Association, Corporation, or Attorney in Fact

THE FOLLOWING FOR DEALER USE ONLY: The vehicle dealer named below as “seller” does hereby certify that the new vehicle described above was sold to the applicant for the following consideration which includes freight, manufacturer’s tax, accessories, and other added equipment or services and represents the total delivered price to the purchaser, valued in money whether received in money or otherwise

Sale Price |

$________________ |

Date Registration Applied For Card Issued |

Less |

$________________ |

If none, so state:____________________ |

Less charges exempt from fee for new registration |

$________________ |

Registration Fee Collected:____________ |

Less Rebate applied to purchase price of the vehicle .$________________ |

|

|

Equals Fee For New Registration Price |

$________________ |

|

I/We certify under penalty of perjury that the foregoing is true and correct.

_____________________________________________________________________________________________

Date |

Dealer No. |

Dealership Name |

By___________________________________________________________________________________________ |

||

|

Authorized Representative |

& Title |

*Important: Be certain that dates and other information given are correct. Any person who uses a false or fictitious name, makes a false statement or otherwise commits a fraud upon this application is punishable by prison sentence and possible fine. This application also constitutes an application for refund of excess credit, when applicable.

Yes, I would like to make a voluntary contribution to the anatomical gift public awareness and transplantation fund in the amount of $ _________________________

Yes, I would like to make a voluntary contribution to the anatomical gift public awareness and transplantation fund in the amount of $ _________________________

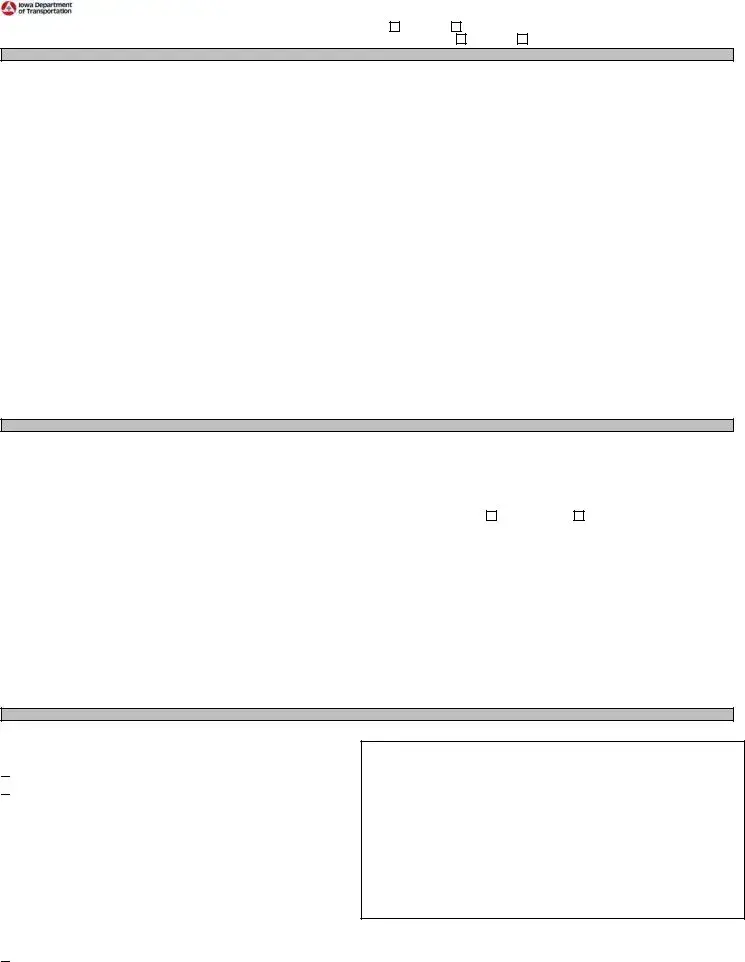

PRIMARY USER INFORMATION (Complete only if the lessee is not the primary user)

Primary User #1:___________________________________________________________________________ |

Iowa DL # or Iowa ID:______________________________________________________________ |

||

First Name |

Middle Name |

Last Name |

(If individual) |

|

Birth Date:________________________________ |

Federal Employer Identification #:________________________________________________ |

|

|

|

(If individual) |

(If organization) |

Bona fide Residence Address of Primary User #1:___________________________________________________________________________________________________________________________________

|

|

Address |

City |

County |

State |

Zip Code |

Mailing Address of Primary User #1:____________________________________________________________________________________________________________________________________________________ |

||||||

|

|

Address |

City |

County |

State |

Zip Code |

Primary User #2:___________________________________________________________________________ |

Iowa DL # or Iowa ID #:_____________________________________________________________ |

|||||

First Name |

Middle Name |

Last Name |

(If individual) |

|

|

|

|

Birth Date:________________________________ |

Federal Employer Identification #:________________________________________________ |

||||

|

|

(If individual) |

(If organization) |

|

|

|

Bona fide Residence Address of Primary User #2:___________________________________________________________________________________________________________________________________

Address |

City |

County |

State |

Zip Code |

Mailing Address of Primary User #2 :____________________________________________________________________________________________________________________________________________________ |

||||

Address |

City |

County |

State |

Zip Code |

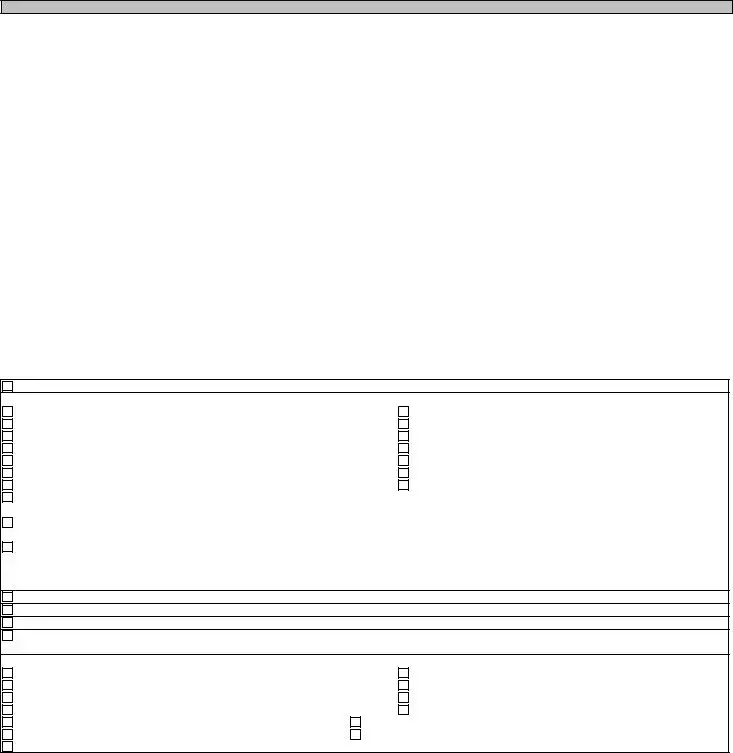

FEE FOR NEW REGISTRATION - EXEMPTIONS

Owner Name_________________________________________________VIN________________________________________________________

If claiming an exemption from payment of the fee for new registration, check the appropriate box below and complete any required additional information. Any applicable exemption code must be listed above the signature line of this title application form.

UT01 – Transfer by gift, please explain:

UT02 – Purchaser is one of the following |

|

a. Rehabilitation Facility. |

b. Rehabilitation Facility for Mentally Retarded Children. |

c. Care Facility (residential/intermediate for the Mentally Retarded). |

d. Care Facility (residential) for the Mentally ill. |

e. Educational Institution (Private, |

f. |

g. Government. |

h. Hospital licensed under Iowa Code Chapter 135B. |

i. Community Healthy Center. |

j. Migrant Health Center. |

k. Community Mental Health Center. |

l. Legal Aid Organization. |

m. |

n. |

o. |

|

UT03 |

|

a. Vehicle transferred from a sole proprietorship or partnership to a corporation or LLC (or vice versa) with the ownership remaining exactly the same and for the purpose of continuing the same business.

b. Corporate Merger – vehicle transferred pursuant to statute to the surviving corporation for no consideration, the merging corporation being dissolved the moment the merger occurs and receiving no benefit from the merger.

Termination date of prior business:Date of creation of new entity:

UT04 - Purchased by a licensed dealership for resale. Dealer License #:

UT05 - Purchased for rental. Purchaser’s sales tax permit #:

UT06 - Leased vehicle used solely in interstate commerce.

UT07 – Vehicle registered and/or operated under Iowa Code Section 326 (reciprocity) with gross weight of 13 tons or more and with 25% of the mileage outside of Iowa. Both weight and mileage must be met to be eligible for exemption.

UT08 - Other: |

|

|

a. Manufactured housing or mobile Home. |

|

b. Inheritance or court order (e.g.: divorce). |

c. Vehicle Purchased outside Iowa with no intent to use in Iowa. (A |

d. Homemade vehicle. |

|

e. Sales, Use, or Occupational tax paid to another state at time of purchase. |

f. Name dropped. |

|

g. Name added. |

|

h. Even trade or down trade. |

i. Delivered to a resident Native American Indian on the reservation. |

j. |

|

k. Transfer to or from a living or irrevocable trust. |

l. Other, please explain_________________________________ |

|

s. Salvage vehicle. |

|

|

|

|

|

Similar forms

The Iowa 411179 form is similar to the Application for Certificate of Title (Form MV-1) used in many states. This document serves as a request to obtain a vehicle title after a purchase or transfer. Like the Iowa form, the MV-1 requires information about the vehicle, including the VIN, make, model, and year. Both forms also ask for the owner's and lessee's information, ensuring that the title is correctly assigned. The MV-1 may also include sections for security interests, making it essential for individuals who have financed their vehicles.

Understanding the details surrounding vehicle registration is vital for all vehicle owners in Iowa. To assist you with the process, it's beneficial to consult various related documents that ensure compliance with state regulations. One useful resource is the PDF Templates which provide templates that can simplify completing the necessary forms, ensuring that all required information is captured accurately for a smooth registration experience.

Another document comparable to the Iowa 411179 form is the Vehicle Registration Application (Form MV-2). This form is used to register a vehicle with the state after purchase or lease. Similar to the 411179, the MV-2 collects details about the vehicle and the owner. Both forms require verification of the owner's identity and may ask for a driver's license number or Social Security number. They also include sections for any exemptions that may apply, such as those for government or nonprofit organizations.

The Bill of Sale is another document that shares similarities with the Iowa 411179 form. A Bill of Sale serves as proof of the transaction between the buyer and seller of a vehicle. Like the Iowa form, it includes information about the vehicle and the parties involved. Both documents may be required for registration or titling purposes. The Bill of Sale, however, primarily focuses on the transaction details, including the sale price, while the Iowa form emphasizes registration and title transfer.

Lastly, the Odometer Disclosure Statement is relevant when discussing the Iowa 411179 form. This document is required by federal law for the sale of most vehicles and ensures that the buyer is aware of the vehicle's mileage at the time of sale. Similar to the Iowa form, the Odometer Disclosure Statement collects information about the vehicle and the parties involved in the transaction. Both documents aim to protect consumers by providing transparency regarding the vehicle's history and condition, although the Odometer Disclosure is specifically focused on mileage verification.