Free Iowa 44 017B Template

Things You Should Know About This Form

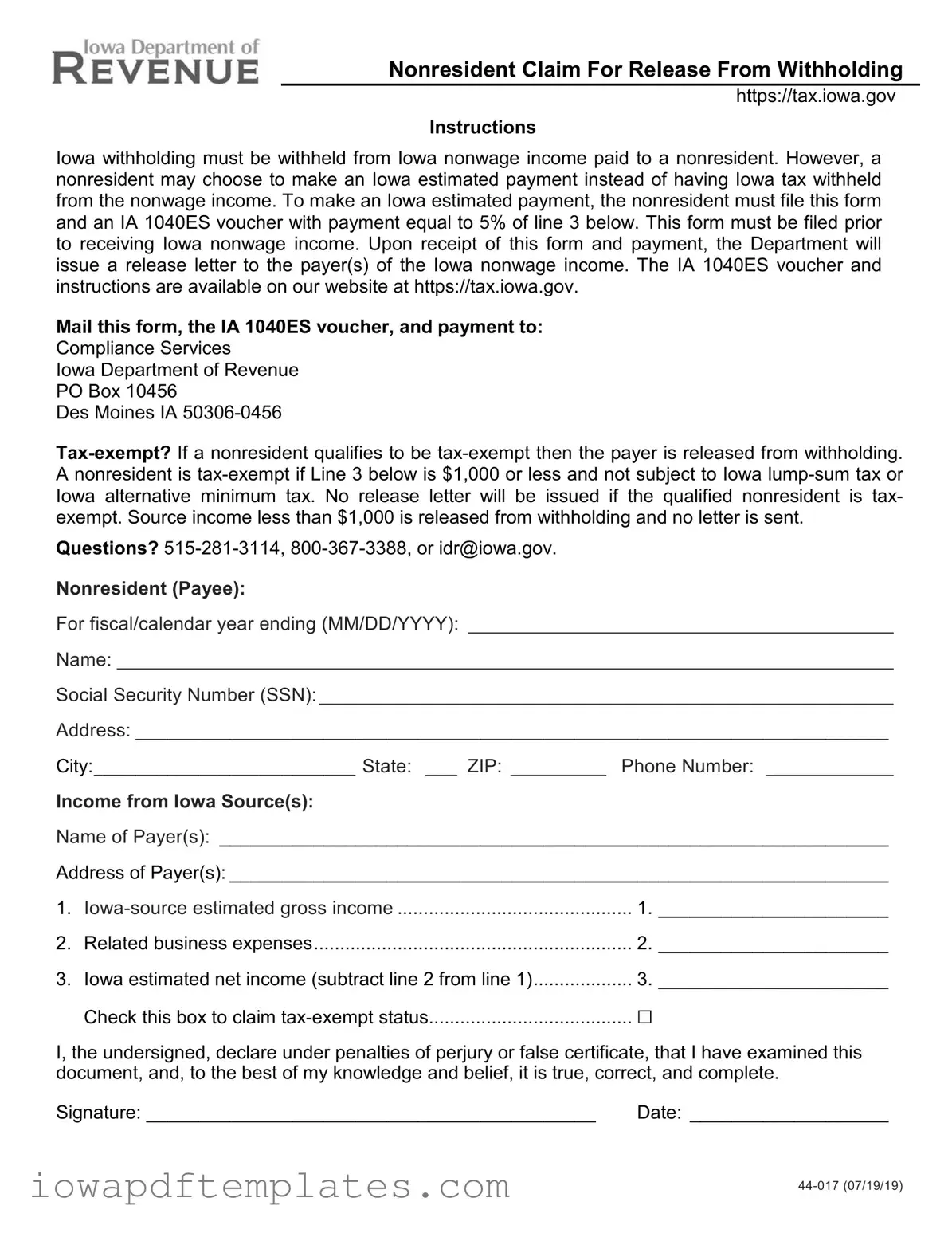

- Fill in your personal information, including your name, Social Security Number, and address.

- Provide details about your Iowa-source income and any related business expenses.

- Calculate your estimated net income by subtracting your expenses from your gross income.

- If applicable, check the box to claim tax-exempt status if your estimated net income is $1,000 or less.

- Sign and date the form before submitting it.

What is the Iowa 44 017B form?

The Iowa 44 017B form is a document used by nonresidents to claim a release from Iowa withholding on nonwage income. This form allows nonresidents to opt for making an estimated tax payment instead of having taxes withheld from their income earned in Iowa.

Who needs to file the Iowa 44 017B form?

Nonresidents who expect to receive nonwage income from Iowa sources and prefer to make an estimated tax payment should file this form. It is particularly useful for those whose Iowa-source income is significant enough that they want to manage their tax payments more proactively.

When should I file the Iowa 44 017B form?

This form must be filed before you receive any Iowa nonwage income. It’s important to submit it in advance to ensure that you are not subject to withholding on that income.

What are the steps to complete the Iowa 44 017B form?

What happens after I submit the Iowa 44 017B form?

Once you submit the form along with the IA 1040ES voucher and payment, the Iowa Department of Revenue will review your submission. If everything is in order, they will issue a release letter to the payer(s) of your Iowa nonwage income, allowing them to refrain from withholding taxes.

What if my Iowa-source income is less than $1,000?

If your estimated net income from Iowa sources is $1,000 or less, you may be tax-exempt. In this case, the payer is automatically released from withholding, and no release letter will be issued. This means you won’t need to file the form if your income falls within this threshold.

How do I make an estimated payment using the Iowa 44 017B form?

To make an estimated payment, complete the Iowa 44 017B form and the IA 1040ES voucher. The payment should equal 5% of your estimated net income (as calculated on line 3 of the form). Submit both documents along with your payment to the Iowa Department of Revenue.

Where do I send the completed Iowa 44 017B form?

Mail your completed form, the IA 1040ES voucher, and your payment to:

Compliance ServicesIowa Department of Revenue

PO Box 10456

Des Moines, IA 50306-0456

Who can I contact if I have questions about the Iowa 44 017B form?

If you have questions, you can reach out to the Iowa Department of Revenue at 515-281-3114 or 800-367-3388. You can also email them at idr@iowa.gov for assistance.

Form Features

| Fact Name | Details |

|---|---|

| Form Purpose | This form allows nonresidents to claim a release from Iowa withholding on nonwage income. |

| Estimated Payment Option | Nonresidents can opt to make an estimated payment instead of withholding by filing this form and an IA 1040ES voucher. |

| Filing Deadline | The form must be submitted before receiving Iowa nonwage income to ensure proper processing. |

| Tax-Exempt Criteria | A nonresident qualifies as tax-exempt if their income is $1,000 or less and not subject to certain Iowa taxes. |

| Release Letter Issuance | The Iowa Department of Revenue will issue a release letter to the payer upon receiving the form and payment. |

| Mailing Address | Completed forms, along with payment, should be mailed to Compliance Services, Iowa Department of Revenue, PO Box 10456, Des Moines, IA 50306-0456. |

| Contact Information | For questions, individuals can contact the Iowa Department of Revenue at 515-281-3114 or 800-367-3388. |

| Governing Laws | This form is governed by Iowa Code Chapter 422 and related tax regulations. |

Discover Other PDFs

Iowa Dot Districts - Taxpayers should ensure their information matches what is on file with the Iowa Department of Revenue on the 810025.

To facilitate a smooth exchange, it's essential to utilize a well-structured document like the Motor Vehicle Bill of Sale. By completing this form, both parties can ensure that all pertinent details are accurately recorded. For your convenience, you can find a suitable template by visiting PDF Templates, allowing you to fill out the necessary information with ease.

Iowa Lead Safety - Sellers must provide any available records or reports pertaining to lead hazards.

Key takeaways

Here are some key takeaways regarding the Iowa 44 017B form, which is used by nonresidents to claim a release from withholding on Iowa nonwage income:

- Eligibility for Estimated Payments: Nonresidents can opt to make an Iowa estimated payment instead of having taxes withheld. To do this, they must file the Iowa 44 017B form along with an IA 1040ES voucher, submitting payment equal to 5% of their estimated net income.

- Filing Requirements: This form must be submitted before receiving any Iowa nonwage income. It is essential to ensure timely filing to avoid unnecessary withholding.

- Tax-Exempt Status: If a nonresident’s Iowa-source estimated net income is $1,000 or less, they may qualify for tax-exempt status. In such cases, no release letter will be issued, and the payer will not withhold taxes.

- Contact Information: For questions or assistance, nonresidents can reach out to the Iowa Department of Revenue at 515-281-3114, 800-367-3388, or via email at idr@iowa.gov.

Sample - Iowa 44 017B Form

Nonresident Claim For Release From Withholding

https://tax.iowa.gov

Instructions

Iowa withholding must be withheld from Iowa nonwage income paid to a nonresident. However, a nonresident may choose to make an Iowa estimated payment instead of having Iowa tax withheld from the nonwage income. To make an Iowa estimated payment, the nonresident must file this form and an IA 1040ES voucher with payment equal to 5% of line 3 below. This form must be filed prior to receiving Iowa nonwage income. Upon receipt of this form and payment, the Department will issue a release letter to the payer(s) of the Iowa nonwage income. The IA 1040ES voucher and instructions are available on our website at https://tax.iowa.gov.

Mail this form, the IA 1040ES voucher, and payment to:

Compliance Services

Iowa Department of Revenue

PO Box 10456

Des Moines IA

Questions?

Nonresident (Payee):

For fiscal/calendar year ending (MM/DD/YYYY): ________________________________________

Name: _________________________________________________________________________

Social Security Number (SSN):______________________________________________________

Address: ________________________________________________________________________

City:_________________________ State: ___ ZIP: _________ Phone Number: ____________

Income from Iowa Source(s):

Name of Payer(s): ________________________________________________________________

Address of Payer(s): _______________________________________________________________

1. |

1. ______________________ |

|

2. |

Related business expenses |

2. ______________________ |

3. |

Iowa estimated net income (subtract line 2 from line 1) |

3. ______________________ |

|

Check this box to claim |

☐ |

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this document, and, to the best of my knowledge and belief, it is true, correct, and complete.

Signature: ___________________________________________ |

Date: ___________________ |

Similar forms

The Iowa 44 017B form is similar to the IRS Form W-8BEN, which is used by non-U.S. persons to certify their foreign status and claim tax treaty benefits. Both forms allow nonresidents to avoid withholding on certain types of income by providing necessary documentation to the respective tax authorities. The W-8BEN is specifically designed for foreign individuals receiving income from U.S. sources, while the Iowa form focuses on nonresidents earning income within Iowa. Completing either form accurately is essential to ensure compliance and avoid unnecessary withholding.

Another related document is the IRS Form 1040NR, which is the U.S. Nonresident Alien Income Tax Return. This form is filed by nonresident aliens to report income earned in the U.S. and claim deductions. Like the Iowa 44 017B, it allows nonresidents to report their income and potentially minimize their tax liability. Both forms require detailed information about income sources, and filing them correctly is crucial to ensure that nonresidents are not overtaxed on their earnings.

The Iowa 44 017B also shares similarities with the IRS Form 1040ES, which is used for estimated tax payments. Nonresidents can use the Iowa form to make estimated payments instead of having taxes withheld from their income. Both forms require taxpayers to calculate their expected income and determine the appropriate payment amount. This proactive approach helps avoid penalties for underpayment and ensures that tax obligations are met in a timely manner.

A California Residential Lease Agreement form is a legally binding document used between a landlord and a tenant to outline the terms of renting property in California. It covers essential agreements such as rent amount, deposit details, and the duration of the lease. Ensuring clarity and mutual understanding, this form safeguards both parties' interests during the rental period. For a comprehensive template, you can refer to the following resource: https://californiapdf.com/editable-residential-lease-agreement/.

Additionally, the Iowa 44 017B is akin to the IRS Form 8833, which is used to disclose a treaty-based return position. This form allows taxpayers to explain their claim for tax treaty benefits, similar to how the Iowa form allows nonresidents to claim tax-exempt status. Both forms require a clear declaration of the taxpayer's status and provide a mechanism to avoid withholding when certain conditions are met.

The IRS Form 1099-MISC is another document that relates to the Iowa 44 017B. This form is used to report various types of income paid to nonemployees, including nonresident aliens. While the Iowa form focuses on withholding and estimated payments, the 1099-MISC serves as a record of income received. Both documents are essential for ensuring proper tax reporting and compliance for nonresidents receiving income from U.S. sources.

Similar to the Iowa 44 017B, the IRS Form 8288-B is used for withholding tax on the disposition of U.S. real property interests by foreign persons. This form allows foreign sellers to apply for a withholding certificate to reduce or eliminate withholding. Both forms serve to protect nonresidents from excessive withholding and require the submission of supporting documentation to the appropriate tax authority.

The Iowa 44 017B form is also comparable to the IRS Form 8862, which is used to claim the Earned Income Credit after disallowance. While the context differs, both forms require taxpayers to provide information that supports their claim for tax benefits. In both cases, accurate completion is crucial to ensure that taxpayers receive the benefits they are entitled to without unnecessary complications.

Moreover, the Iowa 44 017B has similarities with the IRS Form 4506-T, which is used to request a transcript of tax return information. While this form is not directly related to withholding or estimated payments, it can provide essential documentation for nonresidents needing to verify their income or tax status. Both forms facilitate communication with tax authorities and assist in maintaining compliance with tax obligations.

Lastly, the Iowa 44 017B is akin to the IRS Form 941, which is the Employer's Quarterly Federal Tax Return. While this form is primarily for employers to report income taxes withheld from employees, it shares the common theme of withholding tax responsibilities. Both documents emphasize the importance of timely and accurate reporting to avoid penalties and ensure compliance with tax laws.