Free Iowa 44 019A Template

Things You Should Know About This Form

What is the Iowa 44 019A form?

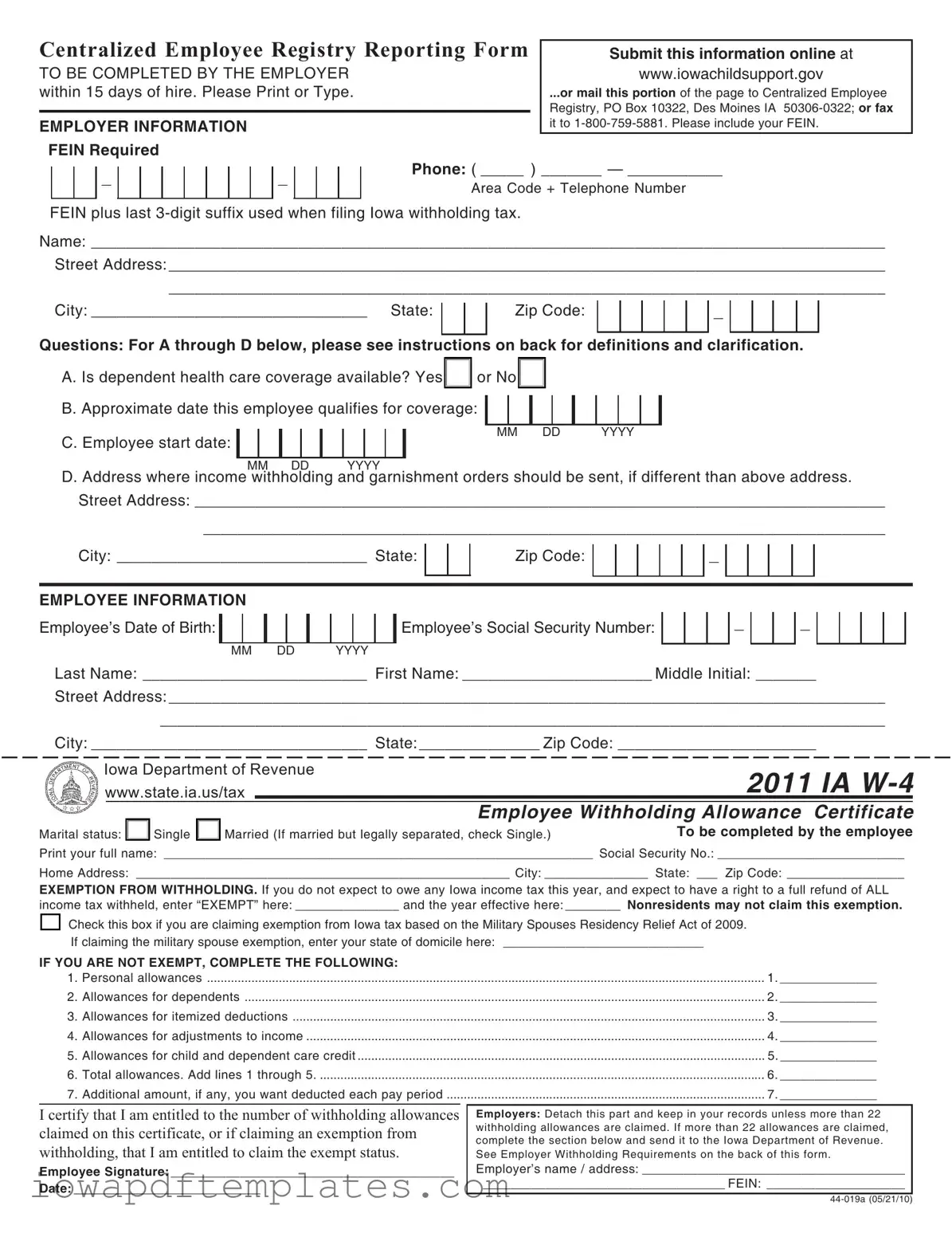

The Iowa 44 019A form, also known as the Centralized Employee Registry Reporting Form, is a document that employers in Iowa must complete when hiring or rehiring an employee. This form collects essential information about the employee and their eligibility for health care coverage. Employers are required to submit this information online or via mail or fax within 15 days of the employee's hire date.

Who needs to fill out the Iowa 44 019A form?

Any employer doing business in Iowa who hires or rehires an employee must fill out this form. It is important for employers to comply with this requirement to ensure proper reporting for child support and income withholding purposes. The information provided helps maintain accurate records for the Centralized Employee Registry.

How should I submit the Iowa 44 019A form?

Employers can submit the Iowa 44 019A form in several ways:

- Online at www.iowachildsupport.gov .

- By mailing the completed form to Centralized Employee Registry, PO Box 10322, Des Moines, IA 50306-0322.

- By faxing it to 1-800-759-5881.

Regardless of the submission method, it is crucial to include the Federal Employer Identification Number (FEIN) to ensure proper processing.

What information is required on the form?

The Iowa 44 019A form requires both employer and employee information. Employers must provide their name, address, and FEIN. Employees must fill out their name, date of birth, Social Security number, and address. Additionally, the form includes questions regarding health care coverage availability and the employee's start date. This information is vital for compliance with state regulations.

What happens if I don’t submit the form on time?

Failure to submit the Iowa 44 019A form within the required 15-day timeframe can lead to penalties for the employer. Timely submission is essential not only for compliance with state law but also for ensuring that the employee's information is properly recorded for child support and income withholding purposes. Employers should prioritize this task to avoid any potential issues.

Can I make changes to the information provided on the Iowa 44 019A form?

Yes, if there are any changes to the information provided on the Iowa 44 019A form, such as a change in the employee's address or health care coverage status, the employer must update the records accordingly. It is important to keep all information accurate and current to ensure compliance with state regulations and to facilitate proper processing of income withholding and garnishment orders.

Form Features

| Fact Name | Description |

|---|---|

| Form Purpose | The Iowa 44 019A form is used for reporting employee information to the Centralized Employee Registry. |

| Submission Timeline | Employers must submit the form within 15 days of hiring or rehiring an employee. |

| Submission Methods | The form can be submitted online, mailed to the Centralized Employee Registry, or faxed to 1-800-759-5881. |

| FEIN Requirement | Employers must include their Federal Employer Identification Number (FEIN) on the form. |

| Dependent Coverage Inquiry | The form includes questions about the availability of dependent health care coverage. |

| Employee Information Section | It requires detailed employee information, including name, address, date of birth, and Social Security number. |

| Exemption from Withholding | Employees may claim exemption from Iowa income tax withholding under specific conditions outlined in the form. |

| Allowances for Withholding | The form provides a section for employees to claim personal and dependent allowances for tax withholding purposes. |

| Governing Laws | This form is governed by Iowa Code § 252E.1 and related tax regulations. |

Discover Other PDFs

Iowa Universal Application - Indicate "Non-Applicable" or "N/A" for non-applicable questions.

The New York Motorcycle Bill of Sale form is a legal document that records the transfer of ownership of a motorcycle from one party to another. This form serves as proof of the transaction and includes essential details about the motorcycle and the parties involved. Understanding its components is crucial for ensuring a smooth transfer process, and for more information, you can visit https://nydocuments.com/.

Iowacourts Gov - Form 4.5 provides a means to request a temporary protective order on an emergency basis without a hearing.

Key takeaways

- The Iowa 44 019A form is essential for employers to report new hires to the Centralized Employee Registry.

- Submit the completed form within 15 days of hiring an employee to avoid penalties.

- Employers can submit the form online, by mail, or via fax. Include your FEIN for identification.

- Provide accurate employer information, including name, address, and phone number.

- Answer questions A through D regarding dependent health care coverage and income withholding details.

- Collect the employee’s personal information, including their date of birth and Social Security number.

- Employees must complete the Iowa W-4 section for tax withholding allowances accurately.

- Claim exemptions only if eligible; nonresidents cannot claim exemption from Iowa income tax.

- Employers must keep a record of the W-4 forms and follow specific filing requirements for employees claiming more than 22 allowances.

- Failure to comply with reporting requirements may result in penalties for both employers and employees.

Sample - Iowa 44 019A Form

Centralized Employee Registry Reporting Form |

Submit this information online at |

|||||||||||||||||

TO BE COMPLETED BY THE EMPLOYER |

|

|

www.iowachildsupport.gov |

|||||||||||||||

within 15 days of hire. Please Print or Type. |

|

|

...or mail this portion of the page to Centralized Employee |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registry, PO Box 10322, Des Moines IA |

EMPLOYER INFORMATION |

|

|

|

|

|

|

it to |

|||||||||||

FEIN Required |

|

|

|

|

|

|

|

|||||||||||

|

|

|

_ |

|

|

|

|

|

|

|

_ |

|

|

|

Phone: ( _____ ) _______ — ___________ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Area Code + Telephone Number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

FEIN plus last

Name: ____________________________________________________________________________________________

Street Address: ___________________________________________________________________________________

___________________________________________________________________________________

City: ________________________________ State:

Zip Code:

_

Questions: For A through D below, please see instructions on back for definitions and clarification.

A. Is dependent health care coverage available? Yes |

|

or No |

|

|

|

|

|

|

|||||||||||||

B. Approximate date this employee qualifies for coverage: |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Employee start date: |

|

|

|

|

|

|

|

|

|

|

|

MM DD |

|

YYYY |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YYYY

D. Address where income withholding and garnishment orders should be sent, if different than above address.

Street Address: ________________________________________________________________________________

_______________________________________________________________________________

City: _____________________________ State: |

|

|

Zip Code: |

|

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE INFORMATION

Employee’s Date of Birth:

MM DD

Employee’s Social Security Number:

YYYY

_

_

Last Name: __________________________ First Name: ______________________ Middle Initial: _______

Street Address: ___________________________________________________________________________________

____________________________________________________________________________________

City: ________________________________ State: ______________ Zip Code: _______________________

Iowa Department of Revenue |

2011 IA |

|

||||||

www.state.ia.us/tax |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Withholding Allowance Certificate |

||

|

|

|

|

|

|

|||

Marital status: |

|

Single |

|

Married (If married but legally separated, check Single.) |

To be completed by the employee |

|||

Print your full name: ______________________________________________________________ Social Security No.: ___________________________

Home Address: ______________________________________________________ City: _______________ State: ___ Zip Code: _________________

EXEMPTION FROM WITHHOLDING. If you do not expect to owe any Iowa income tax this year, and expect to have a right to a full refund of ALL income tax withheld, enter “EXEMPT” here: _______________ and the year effective here: ________ Nonresidents may not claim this exemption.

|

Check this box if you are claiming exemption from Iowa tax based on the Military Spouses Residency Relief Act of 2009. |

|

||

|

If claiming the military spouse exemption, enter your state of domicile here: _____________________________ |

|

||

IF YOU ARE NOT EXEMPT, COMPLETE THE FOLLOWING: |

|

|||

|

1. Personal allowances |

1. ______________ |

||

2. |

Allowances for dependents |

2. ______________ |

||

3. |

Allowances for itemized deductions |

3. ______________ |

||

4. |

Allowances for adjustments to income |

4. ______________ |

||

5. |

Allowances for child and dependent care credit |

5. ______________ |

||

6. |

Total allowances. Add lines 1 through 5 |

6. ______________ |

||

7. |

Additional amount, if any, you want deducted each pay period |

7. ______________ |

||

|

|

|

|

|

I certify that I am entitled to the number of withholding allowances claimed on this certificate, or if claiming an exemption from withholding, that I am entitled to claim the exempt status.

Employee Signature: _________________________________________

Date: ___________________________

Employers: Detach this part and keep in your records unless more than 22 withholding allowances are claimed. If more than 22 allowances are claimed, complete the section below and send it to the Iowa Department of Revenue. See Employer Withholding Requirements on the back of this form.

Employer’s name / address: ______________________________________

___________________________________ FEIN: ____________________

TOP PORTION OF FORM– CENTRALIZED EMPLOYEE REGISTRY REPORTING FORM – EMPLOYER REPORTING REQUIREMENTS

An employer doing business in Iowa who hires or rehires an employee must complete this section. Submit online at www.iowachildsupport.gov. You may also mail this portion of the page to Centralized Employee Registry, PO Box 10322, Des Moines IA

(EPICS) Unit at |

Questions A through D |

|

|

|

|

A. Is a family health insurance plan offered through employment? This question does not |

C. Indicate the first day for which the employee is owed |

|

relate to insurability of employee’s dependents. |

|

compensation. |

B. Example: Is dependent insurance coverage offered upon hire or after six months of |

D. This information is needed for income withholding and |

|

employment? This question does not relate to insurability of employee’s dependents. |

garnishment purposes. |

|

BOTTOM PORTION OF FORM – IA

Exemption from Withholding: You should claim exemption from withholding if you are a resident of Iowa and do not expect to owe any Iowa income tax or expect to have a right to a refund of all income tax withheld. If you qualify, write "EXEMPT" and the year exempt status is effective. Exempt guidelines are: (1) You are exempt if you will earn $5,000 or less and are claimed as a dependent on another person’s return, or (2) You are exempt if you will earn $9,000 or less and are not claimed as a dependent on another person’s return, or (3) married and both spouses’ total is less than $13,500. See your payroll officer to determine how much you expect to make in a calendar year. Nonresidents may not claim this exemption.

Under the Military Spouses Residency Relief Act of 2009, you may be exempt from Iowa income tax on your wages if (1) your spouse is a member of the armed forces present in Iowa in compliance with military orders; (2) you are present in Iowa solely to be with your spouse; and (3) you maintain your domicile in another state. If you claim this exemption, check the appropriate box, enter the state other than Iowa you are claiming as your state of domicile, and attach a copy of your spousal military identification card to the IA

Taxpayers 65 years of age or older: You are exempt if you are single and your income is $24,000 or less or if you are married and your combined income is $32,000 or less. Only one spouse must be 65 or older to qualify for the exemption.

You must complete a new

FILING REQUIREMENTS/NUMBER OF ALLOWANCES

Each employee must file this Iowa

1.Personal Allowances: You can claim the following personal allowances:

•1 allowance for yourself or 2 allowances if you are unmarried and eligible to claim head of household status, plus 1 allowance if you are 65 or older, and plus 1 allowance if you are blind.

•If you are married and your spouse either does not work or is not claiming his/her allowances on a separate

•If you are single and hold more than one job, you may not claim the same allowances with more than one employer at the same time. If you are married and both you and your spouse are employed, you may not both claim the same allowances with both of your employers at the same time.

•To have the highest amount of tax withheld, claim "0" allowances on line 1.

2.Allowances for Dependents: You may claim 1 allowance for each dependent you will be able to claim on your Iowa income tax return.

3.Allowances for Itemized Deductions

(a)Enter total amount of estimated itemized deductions ..................................................................................... (a) $ _________________

(b)Enter amount of your standard deduction using the following information ................................................... (b) $ _________________

If single, married filing separately on a combined return, or married filing separate returns, enter $1,830 If married filing a joint return, unmarried head of household, or qualifying widow(er), enter $4,500

(c)Subtract line (b) from line (a) and enter the difference or zero, whichever is greater.................................... (c) $ _________________

(d)Additional allowance: Divide the amount on line (c) by $600, round to the nearest whole number and enter on line 3 of the IA

4.Allowances for Adjustments to Income: Estimate allowable adjustments to income for payments to an IRA, Keogh, or SEP; penalty on early withdrawal of savings; alimony paid; moving expense deduction from federal form 3903; and student loan interest, which are reflected on the Iowa 1040 form. Divide this amount by $600, round to the nearest whole number, and enter on line 4 of the IA

5.Allowances for Child/Dependent Care Credit: Persons having child/dependent care expenses qualifying for the federal and Iowa Child and Dependent Care Credit may claim additional Iowa withholding allowances based on their net incomes. If you have qualifying child and dependent care expenses and wish to reduce your Iowa withholding on the basis of this credit, you may claim additional withholding allowances for Iowa based on the following table. Married persons, regardless of their expected Iowa filing status, must calculate their withholding allowances based on their combined net incomes. Note that if net income is $45,000 or more, no withholding allowances are allowed for the Child and Dependent Care Credit, as taxpayers with these incomes are not eligible for the Iowa Child and Dependent Care Credit.

Withholding Allowances Allowed: IOWA NET INCOME |

ALLOWANCES |

IOWA NET INCOME |

ALLOWANCES |

IOWA NET INCOME |

ALLOWANCES |

$0 - $20,000 |

5 |

$20,000- $30,000 |

4 |

$30,000 - $44,999 |

3 |

Enter the number of allowances on line 5 of the IA

6.Total: Enter total of lines 1 through 5.

7.Additional Amount of Withholding Deducted: If you are not having enough tax withheld, you may request your employer to withhold more by filling in an additional amount on line 7. Often married couples, both of whom are working, and persons with two or more jobs need to have additional tax withheld. You may also need to have additional tax withheld because you have income other than wages, such as interest and dividends, capital gain, rents, alimony received, etc. Estimate the amount you will be

Changes in Allowances: You may file a new

Penalties: Penalties apply for willfully supplying false information or for willful failure to supply information which would reduce the withholding allowances. If you file as exempt from withholding and you incur an income tax liability, you may be subject to a penalty for underpayment of estimated tax. Employer Withholding Requirements: The employer must maintain records of the

Similar forms

The Iowa 44 019A form, known as the Centralized Employee Registry Reporting Form, shares similarities with the IRS Form W-4, which is used for employee withholding allowances. Both forms require employees to provide personal information, including their name, address, and Social Security number. They serve the purpose of determining how much tax should be withheld from an employee's paycheck. The W-4 allows employees to claim allowances based on their tax situation, while the Iowa form focuses on reporting new hires to ensure compliance with child support laws.

Another document similar to the Iowa 44 019A form is the Federal Form I-9, which verifies an employee's eligibility to work in the United States. Like the Iowa form, the I-9 requires employers to collect specific information from new hires, including personal details and identification documents. Both forms must be completed soon after an employee is hired, emphasizing the importance of timely reporting and compliance with federal and state regulations.

The Iowa 44 019A form is also akin to the Employee's Withholding Allowance Certificate (Form W-4) used in various states. This form allows employees to indicate their tax withholding preferences, including exemptions and allowances. Similar to the Iowa form, it requires employers to keep a record of the submitted forms to ensure accurate tax withholding. Both documents play a crucial role in managing payroll and tax obligations for employees and employers alike.

Additionally, the Iowa 44 019A resembles the New Hire Reporting form used in other states. These forms are designed to report newly hired employees to state agencies for child support enforcement. They share common elements, such as the need for employer information and employee details. Timely submission of these forms is critical for ensuring that child support obligations are met and that the necessary information is available to relevant authorities.

When preparing to establish a corporation in New York State, it is equally important to consider various reporting forms, such as the Iowa 44 019A, that ensure compliance with employment regulations. Just as the New York Articles of Incorporation form serves as a foundational document for corporations, understanding how to fill out forms related to employee verification can be crucial for business operations. To further assist with corporate documentation, you can find several resources, including PDF Templates that facilitate the creation of essential forms.

The form also has similarities with the State Unemployment Insurance (SUI) registration forms. Both documents require employers to provide information about their employees and are essential for compliance with state labor laws. While the Iowa 44 019A focuses on child support, SUI forms are geared toward unemployment benefits. Nevertheless, both are vital for maintaining accurate records and fulfilling employer responsibilities.

Moreover, the Iowa 44 019A shares characteristics with the Federal Employment Eligibility Verification form (Form I-9). Both forms require employers to verify the identity and employment eligibility of new hires. They must be completed shortly after hiring and maintained in the employer's records. This ensures compliance with federal regulations and helps prevent unauthorized employment.

Another related document is the State Tax Withholding form, which is used to determine state income tax withholding for employees. Like the Iowa 44 019A, it requires personal information from employees and is essential for accurate payroll processing. Both forms are submitted by employers and play a role in ensuring that tax obligations are met in a timely manner.

Lastly, the Iowa 44 019A is similar to the Employee Benefits Enrollment form. This document allows employees to select their benefits, such as health insurance and retirement plans. While the focus is different, both forms require detailed employee information and are critical for managing employee records. They help employers ensure that their employees receive the benefits they are entitled to while also fulfilling regulatory requirements.