Free Iowa 470 4202 Template

Things You Should Know About This Form

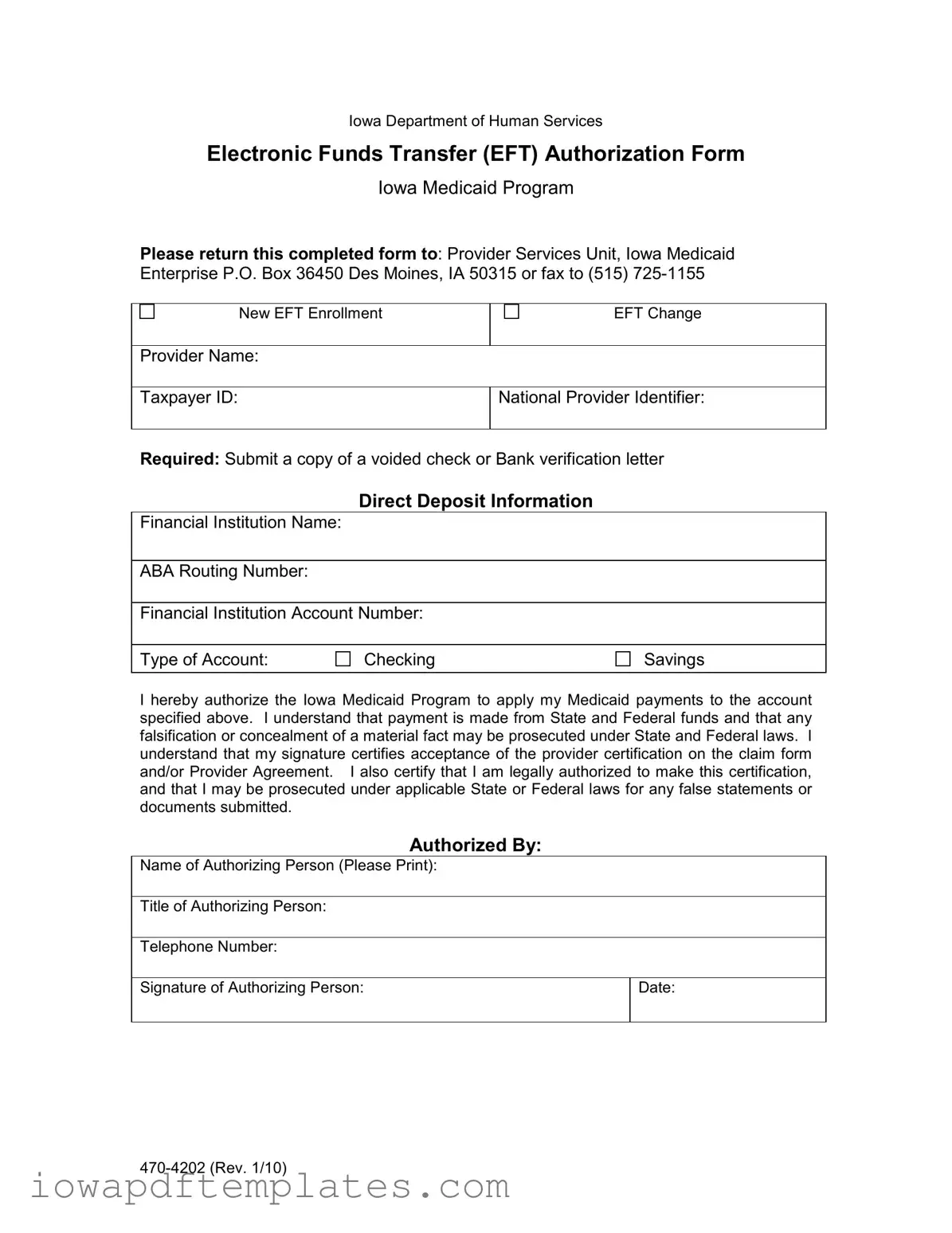

What is the Iowa 470 4202 form?

The Iowa 470 4202 form is the Electronic Funds Transfer (EFT) Authorization Form used by the Iowa Medicaid Program. It allows providers to authorize the direct deposit of Medicaid payments into their bank accounts.

Who needs to complete this form?

This form is required for any healthcare provider who wants to receive Medicaid payments via direct deposit. If you are a new provider or changing your banking information, you must complete this form.

How do I submit the completed form?

You can submit the completed Iowa 470 4202 form in one of two ways:

- Mail it to the Provider Services Unit, Iowa Medicaid Enterprise, P.O. Box 36450, Des Moines, IA 50315.

- Fax it to (515) 725-1155.

What information do I need to provide on the form?

You will need to provide the following information:

- Your provider name

- Taxpayer ID

- National Provider Identifier (NPI)

- Financial institution name

- ABA routing number

- Financial institution account number

- Type of account (checking or savings)

Do I need to include any additional documents?

Yes, you must submit a copy of a voided check or a bank verification letter along with the completed form. This helps verify your account information.

What happens if I provide false information?

Providing false information can lead to prosecution under state and federal laws. It is important to ensure that all details on the form are accurate and truthful.

Can I change my banking information after submitting the form?

Yes, if you need to change your banking information, you will need to complete a new Iowa 470 4202 form and submit it following the same process as before.

What is the significance of my signature on the form?

Your signature certifies that you accept the provider certification on the claim form and/or Provider Agreement. It also confirms that you are legally authorized to make this certification.

Where can I find more information about the Iowa Medicaid Program?

For more details about the Iowa Medicaid Program, you can visit the Iowa Department of Human Services website or contact the Provider Services Unit directly.

Form Features

| Fact Name | Description |

|---|---|

| Form Purpose | The Iowa 470-4202 form is used for Electronic Funds Transfer (EFT) authorization for the Iowa Medicaid Program. |

| Submission Details | This completed form must be returned to the Provider Services Unit at the Iowa Medicaid Enterprise, either by mail or fax. |

| Required Documentation | Along with the form, a copy of a voided check or a bank verification letter is required for processing. |

| Governing Laws | The use of this form is governed by both State and Federal laws, ensuring compliance and preventing fraud. |

Discover Other PDFs

Iowa Next of Kin Law - In summary, the Iowa Cremation Authorization form facilitates respectful and legal cremation arrangements.

Understanding the significance of a well-drafted Release of Liability Agreement can be crucial for both event organizers and participants, ensuring that all parties are aware of the risks involved and their rights regarding potential claims.

Iowa 470 4299 - The form covers emergency health services ranging from acute pain to serious health risks.

Key takeaways

When filling out the Iowa 470 4202 form, consider these key takeaways:

- Purpose of the Form: This form is used to authorize electronic funds transfer (EFT) for Medicaid payments.

- Submission Method: Completed forms should be mailed to the Provider Services Unit or faxed to the specified number.

- Required Documentation: A copy of a voided check or a bank verification letter must accompany the form.

- Accurate Information: Ensure that all fields, including the financial institution name and account details, are filled out correctly.

- Authorization: The form must be signed by an authorized person, confirming their legal authority to make the certification.

- Understanding Consequences: Any falsification may lead to prosecution under state and federal laws.

- Type of Account: Clearly indicate whether the account is a checking or savings account.

- Keep Records: Retain a copy of the completed form for your records after submission.

Sample - Iowa 470 4202 Form

!!"#

$"!%& !!

/'01'22

'0134#

"!/$

1*5$

/2"!!$

65!!47)72

02/$

.).#/6$

02./6$

15.$

347#

#

465484 !!"#255 !!54

!6!!45!!0!2!!45

22256!!!0!22

!!45#4!42

!"!.#2542#22548!74&

!456!!2620!2252

!6!

/.48#""2"$

12.48#"$

124/6$

#.48#"$$

Similar forms

The Iowa 470-4202 form serves as an Electronic Funds Transfer (EFT) Authorization Form specifically for the Iowa Medicaid Program. A similar document is the IRS Form W-9, which is used to provide taxpayer identification information to businesses or individuals who are required to file information returns with the IRS. Both forms require the disclosure of identifying information, such as a Taxpayer ID or Social Security Number, and both are critical for ensuring accurate and timely payments. While the Iowa 470-4202 focuses on Medicaid payments, the W-9 is primarily concerned with tax reporting purposes.

Another comparable document is the Direct Deposit Authorization Form, commonly used by employers for payroll purposes. This form allows employees to authorize their employer to deposit their wages directly into their bank accounts. Like the Iowa 470-4202, it requires banking information, such as the account number and routing number. Both documents emphasize the importance of accurate information to facilitate smooth financial transactions, ensuring that funds are deposited correctly and efficiently.

The ACH Authorization Form is also similar, as it is used to authorize automatic payments or deposits through the Automated Clearing House (ACH) network. This form is commonly used for recurring payments, such as utility bills or loan payments. Both the ACH Authorization Form and the Iowa 470-4202 require consent for electronic transactions, highlighting the importance of secure and reliable methods for transferring funds. They also both necessitate the submission of bank details to ensure proper processing.

In the realm of healthcare, the CMS-855I form is another relevant document. This form is used by healthcare providers to enroll in Medicare and includes information about the provider's banking details for payment purposes. Similar to the Iowa 470-4202, the CMS-855I requires the provider to confirm their authority to submit the form and to provide accurate banking information. Both forms are essential for ensuring that healthcare providers receive their payments in a timely manner.

Additionally, the Medicaid Provider Agreement is a crucial document that establishes the relationship between the provider and the Medicaid program. While it does not focus on electronic funds transfer, it outlines the responsibilities and obligations of the provider in delivering services. Both the Iowa 470-4202 and the Provider Agreement require the provider's signature, affirming their commitment to compliance with program requirements and the accuracy of the information provided.

In understanding the various financial documents, it's important to note that clarity and legal compliance play vital roles in ensuring smooth transactions. For instance, the New York Motorcycle Bill of Sale form provides a structured way to record motorcycle ownership transfers, emphasizing the necessity of precise details for both parties involved. For more information on this critical document, visit https://nydocuments.com/.

Lastly, the State Vendor Registration Form shares similarities with the Iowa 470-4202, as it is used by vendors to register with state agencies for payment purposes. This form collects essential information, including banking details and taxpayer identification, to facilitate payments from state funds. Both documents serve the vital function of ensuring that the correct entities receive funds in a timely manner, reinforcing the importance of accurate information for financial transactions.