Free Iowa 54 130A Template

Things You Should Know About This Form

-

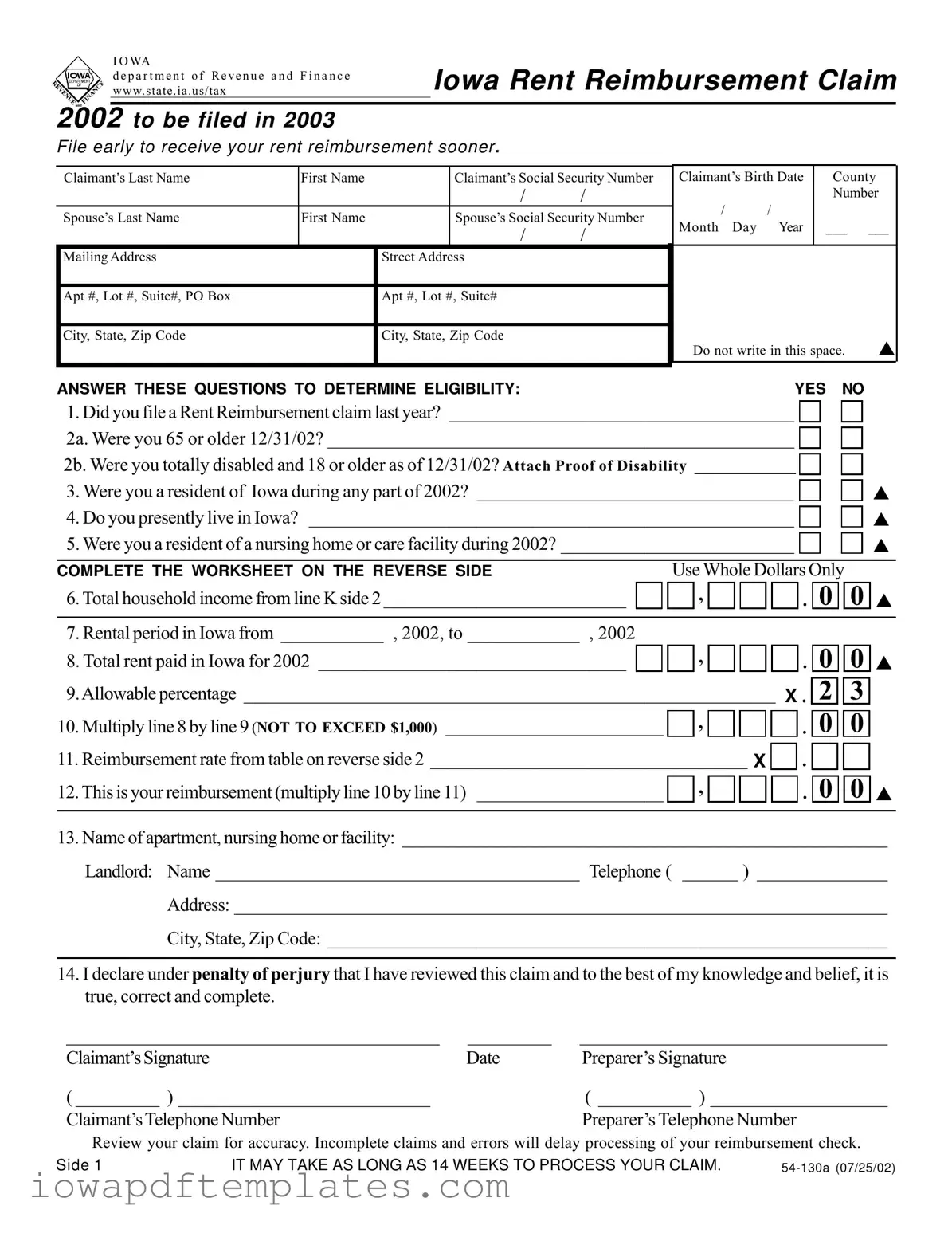

What is the Iowa 54 130A form?

The Iowa 54 130A form is a Rent Reimbursement Claim form used by residents of Iowa to apply for reimbursement of rent paid during the previous year. It is specifically designed for individuals who may qualify based on age, disability, or income levels. This form is typically filed in the year following the rental period.

-

Who is eligible to file the Iowa 54 130A form?

Eligibility for the Iowa 54 130A form generally includes individuals who meet the following criteria:

- Were 65 years or older as of December 31 of the previous year.

- Were totally disabled and 18 years or older as of December 31 of the previous year.

- Were residents of Iowa for any part of the previous year.

- Currently reside in Iowa.

- Did not receive reimbursement last year.

-

How do I complete the Iowa 54 130A form?

To complete the form, follow these steps:

- Fill in your personal information, including your name, Social Security number, and mailing address.

- Answer all eligibility questions accurately.

- Complete the worksheet on the reverse side to calculate your total household income.

- Determine your total rent paid and allowable percentage based on your income.

- Sign and date the form before submitting it.

-

What documents do I need to attach to the form?

If you are claiming total disability, you must attach proof of your disability. This could include documentation from a healthcare provider or government agency. Ensure all information is accurate to avoid processing delays.

-

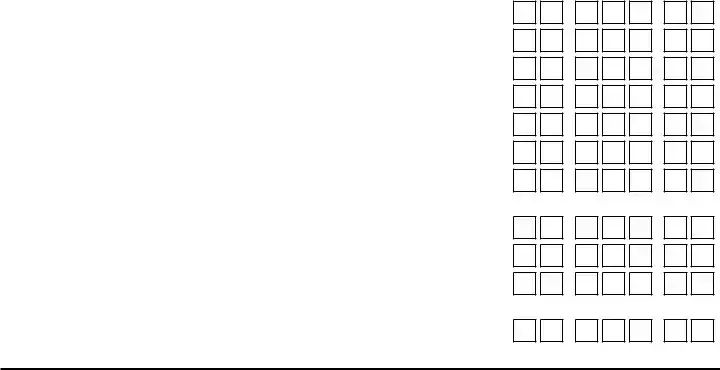

What is considered "total household income"?

Total household income includes the income of the claimant, the claimant’s spouse, and any monetary contributions received from others living in the household. This encompasses wages, Social Security income, pensions, and other forms of income as specified in the form.

-

How is the reimbursement amount calculated?

The reimbursement amount is calculated by multiplying the total rent paid by an allowable percentage based on your total household income. The maximum reimbursement is capped at $1,000. Refer to the reimbursement rate table included in the form for specific percentages based on income brackets.

-

When should I file the Iowa 54 130A form?

The form must be filed by June 1 of the year following the rental period. If you need more time, you may request an extension from the Director of Revenue and Finance, which could allow you to file until December 31 of the following year.

-

How long does it take to process the claim?

Processing your claim may take up to 14 weeks. To avoid delays, ensure that your claim is complete and accurate before submission. Incomplete claims or errors can significantly slow down the process.

-

Where do I send my completed Iowa 54 130A form?

Mail your completed form to the following address:

IOWA DEPARTMENT OF REVENUE AND FINANCE

RENT REIMBURSEMENT PROCESSING

PO BOX 10459

DES MOINES IA 50306-0459 -

How can I check the status of my reimbursement?

To check the status of your reimbursement, you can call the Iowa Department of Revenue. Be prepared to provide your Social Security number and date of birth for identification. The contact numbers are 1-800-572-3944 or 515-281-4966.

Form Features

| Fact Name | Description |

|---|---|

| Form Purpose | The Iowa 54 130A form is used to claim rent reimbursement for eligible residents of Iowa. |

| Filing Deadline | Claims must be filed by June 1, 2003, unless an extension is granted by the Director of Revenue and Finance. |

| Eligibility Criteria | Applicants must be at least 65 years old or totally disabled, reside in Iowa, and meet income limits. |

| Income Calculation | Household income includes wages, pensions, Social Security, and other monetary contributions. |

| Reimbursement Rate | The reimbursement rate varies based on total household income, with a maximum of $1,000 allowed. |

| Processing Time | It may take up to 14 weeks to process the claim after submission. |

| Governing Law | The Iowa 54 130A form is governed by the Iowa Code § 425.1 et seq., which outlines the rent reimbursement program. |

Discover Other PDFs

Iowa Tags and Title - Following instructions on the form will lead to a more efficient registration process.

Understanding the details of a lease is crucial for both landlords and tenants in California, and utilizing resources like the californiapdf.com/editable-residential-lease-agreement can aid in creating a well-structured Residential Lease Agreement that clarifies the terms of the rental arrangement.

Iowa 123 - The document outlines the role and limitations of the designated agent.

Key takeaways

When filling out the Iowa 54 130A form, there are several important points to keep in mind. Here are key takeaways that can help ensure a smooth process:

- File Early: Submitting your claim as soon as possible can lead to quicker reimbursement. Aim to file early in the year.

- Eligibility Questions: Answer the eligibility questions carefully. These questions help determine if you qualify for the rent reimbursement.

- Accurate Information: Ensure all personal information, such as names and Social Security numbers, is correct to avoid delays.

- Complete the Worksheet: Use the worksheet on the back to calculate your total household income accurately. This is crucial for determining your reimbursement amount.

- Use Whole Dollars: When reporting income and rent amounts, only use whole dollar figures. Cents are not needed.

- Reimbursement Rates: Familiarize yourself with the reimbursement rate table. Your total household income will determine the percentage used for your reimbursement calculation.

- Review Before Submission: Double-check your claim for any errors or missing information. Incomplete forms can lead to processing delays.

- Know the Deadline: Claims must be filed by June 1, 2003. Extensions may be available, but it’s best to file on time to avoid complications.

By keeping these takeaways in mind, you can navigate the process of filling out and using the Iowa 54 130A form more effectively. Taking the time to ensure accuracy and completeness will help you receive your reimbursement in a timely manner.

Sample - Iowa 54 130A Form

I OWA

department of Revenue and Finance IOWA RENT REIMBURSEMENT CLAIM www.state.ia.us/tax

2002 TO BE FILED IN 2003

File early to receive your rent reimbursement sooner.

Claimant’s Last Name |

First Name |

|

Claimant’s Social Security Number |

Claimant’s Birth Date |

|

County |

|||

|

|

|

/ |

/ |

/ |

/ |

|

Number |

|

Spouse’s Last Name |

First Name |

|

Spouse’s Social Security Number |

|

|

|

|||

|

Month Day |

Year |

|

___ |

___ |

||||

|

|

|

/ |

/ |

|

||||

|

|

|

|

|

|

|

|

||

Mailing Address |

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt #, Lot #, Suite#, PO Box |

|

Apt #, Lot #, Suite# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, Zip Code |

|

City, State, Zip Code |

|

|

|

|

|

||

|

|

|

|

|

Do not write in this space. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANSWER THESE QUESTIONS TO DETERMINE ELIGIBILITY: |

|

|

YES |

NO |

|

||||

1.Did you file a Rent Reimbursement claim last year? _____________________________________

2a. Were you 65 or older 12/31/02? __________________________________________________

2b. Were you totally disabled and 18 or older as of 12/31/02? Attach Proof of Disability _____________

3.Were you a resident of Iowa during any part of 2002? __________________________________

4.Do you presently live in Iowa? ____________________________________________________

5.Were you a resident of a nursing home or care facility during 2002? _________________________

COMPLETE THE WORKSHEET ON THE REVERSE SIDE |

Use Whole Dollars Only |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.Total household income from line K side 2__________________________ |

|

|

|

, |

|

|

|

|

|

. |

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. Rental period in Iowa from ___________ , 2002, to ____________ , 2002 |

|

|

|

|

|

|

|

|

|

|

|

|

||

8. Total rent paid in Iowa for 2002 _________________________________ |

|

|

|

, |

|

|

|

|

|

. |

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9.Allowable percentage _________________________________________________________ X . |

2 |

|

3 |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

10. Multiply line 8 by line 9 (NOT TO EXCEED $1,000) ____________________________ |

|

, |

|

|

|

|

|

. |

0 |

|

0 |

|

||

11. Reimbursement rate from table on reverse side 2 __________________________________ X |

|

|

|

|

|

|

|

|||||||

|

|

. |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

12.This is yourreimbursement(multiplyline10 byline 11) ____________________ |

|

, |

|

|

|

|

|

. |

0 |

|

0 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.Name of apartment, nursing home or facility: ____________________________________________________

Landlord: Name _______________________________________ Telephone ( ______ ) ______________

Address: ______________________________________________________________________

City, State, Zip Code: ____________________________________________________________

14.I declare under penalty of perjury that I have reviewed this claim and to the best of my knowledge and belief, it is true, correct and complete.

________________________________________ |

_________ |

_________________________________ |

Claimant’sSignature |

Date |

Preparer’s Signature |

( _________ ) ___________________________ |

|

( __________ ) ___________________ |

Claimant’sTelephoneNumber |

|

Preparer’s Telephone Number |

Review your claim for accuracy. Incomplete claims and errors will delay processing of your reimbursement check.

Side 1 |

IT MAY TAKE AS LONG AS 14 WEEKS TO PROCESS YOUR CLAIM. |

Worksheet for line 6

2002 TOTAL YEARLY HOUSEHOLD INCOME

“Household income” includes the income of the claimant, the claimant’s spouse and monetary contributions received from other persons living with the claimant.

Use Whole DOLLARS Only

A. Wages, salaries, tips, etc. ________________________________________

B. Rent subsidy/utilities assistance____________________________________

C. Title 19 Benefits for housing only (see instructions) ____________________

D. Social Security income received in 2002 ____________________________

E. Disability income for 2002 _______________________________________

F.All pensions and annuities from 2002 _______________________________

G. Interest and dividend income from 2002 ____________________________

H. Profit from business and/or farming and capital gains

if less than zero, enter 0 (see instructions) ________________________

I.Actual money received from others living with you in 2002 (see instructions) _ J. Other income (read instructions before making this entry) _______________

K. ADD amounts on lines

This is your total household income

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

, |

. |

0 |

0 |

|

|

|

|

, |

. |

0 |

0 |

REIMBURSEMENT RATE TABLE FOR LINE 11

If your total household income from Line K above is:

$ 0.00 |

- |

9,060.99 |

enter 1.00 on Line 11, Side 1 |

9,061 |

- |

10,126.99 |

enter 0.85 on Line 11, Side 1 |

10,127 |

- |

11,192.99 |

enter 0.70 on Line 11, Side 1 |

11,193 |

- |

13,324.99 |

enter 0.50 on Line 11, Side 1 |

13,325 |

- |

15,456.99 |

enter 0.35 on Line 11, Side 1 |

15,457 |

- |

17,588.99 |

enter 0.25 on Line 11, Side 1 |

17,589 or greater |

no reimbursement allowed |

||

|

|

|

|

For assistance in completing this form, call

|

Where’s my refund check? |

Call |

|

|

|

You must provide claimant’s Social Security Number |

|

|

|

and date of birth when calling |

|

|

Mail this form to: |

IOWA DEPARTMENT OF REVENUE AND FINANCE |

|

|

|

RENT REIMBURSEMENT PROCESSING |

|

|

|

PO BOX 10459 |

|

|

|

DES MOINES IA |

|

|

Claims must be filed no later than June 1, 2003, unless the Director of Revenue and Finance |

||

Side 2 |

has granted an extension of the time to file through December 31, 2004. |

||

Similar forms

The Iowa 54 130A form is similar to the IRS Form 1040, which is the standard individual income tax return form used in the United States. Both forms require individuals to report their income and claim any applicable deductions or credits. The 1040 form helps determine the taxpayer’s overall tax liability, while the Iowa 54 130A focuses specifically on rent reimbursement for eligible residents. Both forms ask for personal information, such as Social Security numbers and income details, making them essential for accurate financial reporting and potential reimbursements or refunds.

For those navigating the intricate world of rental agreements, it is crucial to understand the significance of accurately filling out necessary forms. A Lease Agreement is among the most important documents that outline the relationship between landlords and tenants, detailing terms and conditions that help avoid disputes. To assist in this process, accessing resources like PDF Templates can provide ready-made solutions that simplify the creation and understanding of such agreements.

Another document comparable to the Iowa 54 130A is the HUD Form 50058, which is used for reporting information about families participating in public housing programs. Like the Iowa form, the HUD 50058 collects data on household income, family composition, and residency status. Both forms aim to ensure that individuals receive the financial assistance they are entitled to. The HUD form, however, is specifically tailored for those receiving housing assistance, while the Iowa form is for renters seeking reimbursement for their rent payments.

The Iowa 54 130A also bears similarities to the state’s Homestead Tax Credit application. Both documents require applicants to provide proof of residency and details about their income. The Homestead Tax Credit application helps homeowners reduce their property tax burden, while the Iowa 54 130A assists renters with reimbursement for rent expenses. Each form serves to alleviate financial pressure on individuals, albeit through different avenues of support.

Finally, the Iowa 54 130A is akin to the Supplemental Nutrition Assistance Program (SNAP) application. Both documents assess eligibility based on income and residency. While the Iowa form focuses on rent reimbursement, the SNAP application determines eligibility for food assistance. Each form requires detailed financial information, reinforcing the importance of accurate reporting to receive the benefits intended for low-income individuals and families.