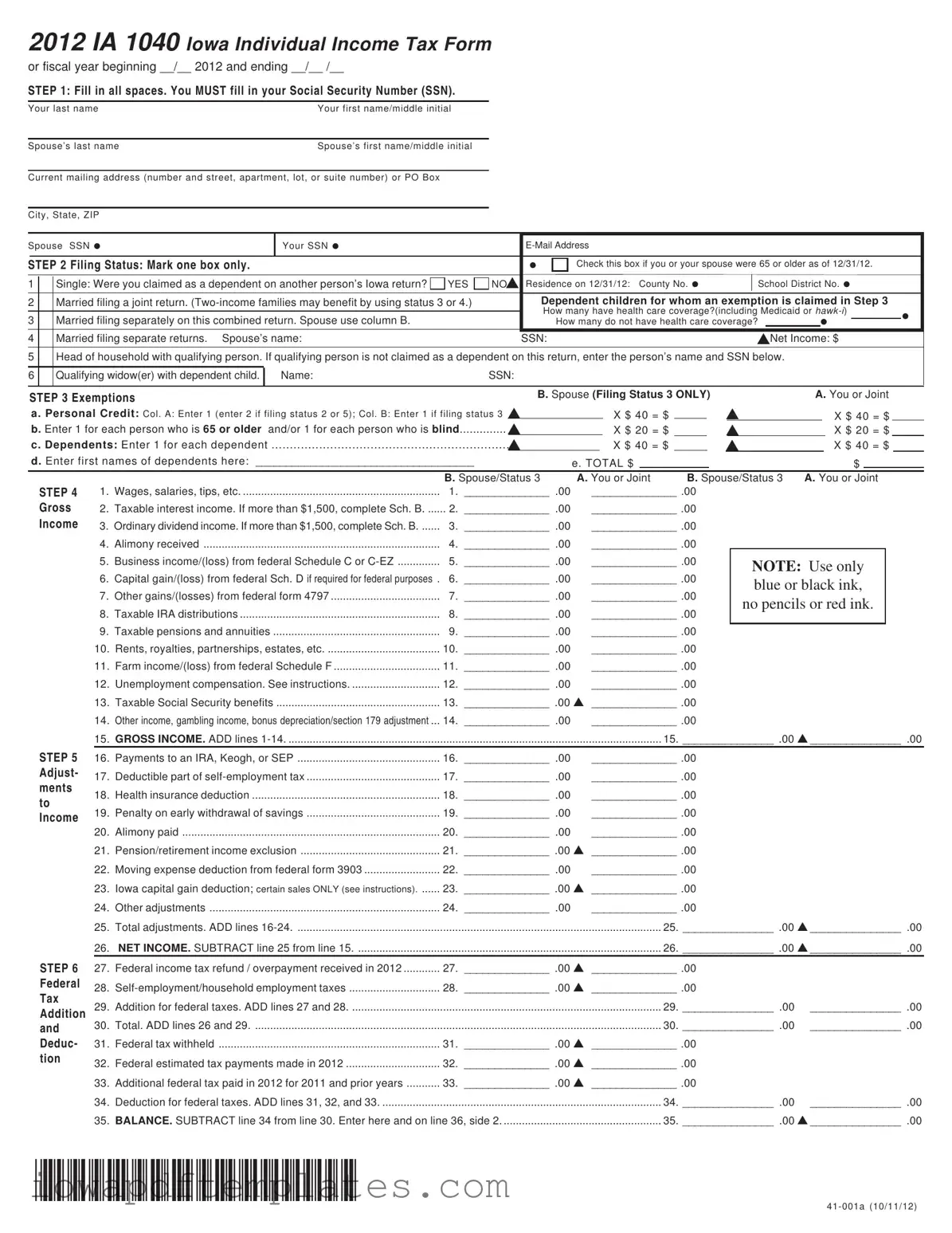

Free Iowa Ia 1040 Template

Things You Should Know About This Form

What is the Iowa IA 1040 form?

The Iowa IA 1040 form is the individual income tax return used by residents of Iowa to report their income and calculate their state tax obligations. This form is typically used for the tax year ending December 31, and it includes various sections for reporting income, claiming exemptions, and calculating deductions. Completing this form accurately is essential for fulfilling your tax responsibilities in Iowa.

Who needs to file the IA 1040 form?

Any Iowa resident who earns income and meets certain thresholds must file the IA 1040 form. This includes individuals who are self-employed, receive wages, or have other forms of income. Additionally, if you are married and filing jointly, both spouses must report their combined income on this form. It's important to review the specific income thresholds and requirements for your filing status to determine if you need to file.

How do I determine my filing status?

Your filing status on the IA 1040 form is determined by your marital status and family situation as of December 31 of the tax year. The options include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er) with dependent child

Choose the status that best reflects your situation to ensure you receive the correct tax benefits.

What information do I need to complete the IA 1040 form?

To complete the IA 1040 form, you will need various pieces of information, including:

- Your Social Security Number (SSN) and your spouse's SSN, if applicable.

- Your current mailing address.

- Your total income from all sources, including wages, interest, dividends, and any other income.

- Details about any dependents you are claiming.

- Information about any deductions or credits you may qualify for.

Gathering this information in advance can help streamline the filing process.

What are exemptions and how do I claim them?

Exemptions reduce your taxable income and can significantly lower your tax bill. On the IA 1040 form, you can claim exemptions for yourself, your spouse, and any dependents. The amount of the exemption may vary based on your filing status and specific circumstances, such as age or disability. Be sure to enter the correct number of exemptions in the designated section to maximize your tax benefits.

What should I do if I owe taxes?

If you find that you owe taxes after completing your IA 1040 form, you have several options for payment. You can pay online through the Iowa Department of Revenue's website, or you can send a check by mail. It’s important to pay any owed taxes by the due date to avoid penalties and interest. If you are unable to pay the full amount, consider contacting the Iowa Department of Revenue to discuss payment plans or options.

When is the IA 1040 form due?

The IA 1040 form is typically due on April 30 of the year following the tax year. For example, for income earned in 2012, the form was due on April 30, 2013. If you need more time to file, you can request an extension, but keep in mind that this does not extend the time to pay any taxes owed. It's essential to stay aware of deadlines to avoid late fees and penalties.

Form Features

| Fact Name | Description |

|---|---|

| Form Purpose | The Iowa IA 1040 form is used for filing individual income tax returns in Iowa. |

| Filing Deadline | The deadline for submitting the IA 1040 form is April 30, 2013, for the tax year 2012. |

| Social Security Number | Taxpayers must provide their Social Security Number (SSN) on the form. |

| Filing Status Options | There are several filing status options, including Single, Married Filing Jointly, and Head of Household. |

| Exemptions | Taxpayers can claim exemptions for themselves, their spouse, and dependents, which can reduce taxable income. |

| Income Reporting | Various types of income must be reported, including wages, interest, and business income. |

| Adjustments to Income | Adjustments, such as IRA contributions and health insurance deductions, can lower taxable income. |

| Tax Credits | Taxpayers can claim various credits, including the Iowa Earned Income Tax Credit and education credits. |

| Governing Laws | The IA 1040 form is governed by Iowa Code Section 422, which outlines individual income tax regulations. |

Discover Other PDFs

Sellers Disclosure Iowa - Real estate agents must ensure compliance with disclosure requirements during transactions.

To streamline your vehicle sale process and ensure all necessary documentation is in order, consider utilizing a PDF Templates that provide a comprehensive Motor Vehicle Bill of Sale form. This will help clarify the details of the transaction and protect the interests of both the buyer and seller.

Iowa Lead Safety - Failing to comply with disclosure regulations can lead to significant legal consequences.

Iowa Public Assembly Permit - Specify the date and time for the event to avoid scheduling conflicts with other activities.

Key takeaways

Ensure that all required fields are filled out completely on the Iowa IA 1040 form. Missing information, such as your Social Security Number, can lead to delays or issues with your return.

Choose the correct filing status carefully. Your options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er). The choice you make can significantly impact your tax liability.

Take advantage of exemptions and credits. Be sure to claim personal exemptions for yourself, your spouse, and any dependents. These can reduce your taxable income and ultimately lower your tax bill.

Review your calculations and ensure accuracy. Double-check your income, deductions, and credits to avoid errors that could result in penalties or delayed refunds.

Sample - Iowa Ia 1040 Form

2012 IA 1040 Iowa Individual Income Tax Form

or fiscal year beginning __/__ 2012 and ending __/__ /__

STEP 1: Fill in all spaces. You MUST fill in your Social Security Number (SSN).

Your last name |

Your first name/middle initial |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Spouse’s last name |

Spouse’s first name/middle initial |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Current mailing address (number and street, apartment, lot, or suite number) or PO Box |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City, State, ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Spouse SSN • |

Your SSN • |

|

|

|

|

|

|

|

|

|||||||

STEP 2 Filing Status: Mark one box only. |

|

|

|

• |

|

|

Check this box if you or your spouse were 65 or older as of 12/31/12. |

|

||||||||

1 |

|

Single: Were you claimed as a dependent on another person’s Iowa return? |

YES |

NOs |

Residence on 12/31/12: County No. • |

|

School District No. • |

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||

2 |

|

Married filing a joint return. |

|

|

Dependent children for whom an exemption is claimed in Step 3 |

|

||||||||||

|

|

|

|

|

|

|

|

How many have health care coverage?(including Medicaid or |

• |

|||||||

|

|

|

|

|

|

|

|

|||||||||

3 |

|

Married filing separately on this combined return. Spouse use column B. |

|

|

|

|

How many do not have health care coverage? |

|

• |

|||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

Married filing separate returns. Spouse’s name: |

|

|

SSN: |

sNet Income: $ |

|

|||||||||

5 |

|

Head of household with qualifying person. If qualifying person is not claimed as a dependent on this return, enter the person’s name and SSN below. |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

Qualifying widow(er) with dependent child. |

|

Name: |

|

SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STEP 3 Exemptions |

|

B. Spouse (Filing Status 3 ONLY) |

|||||

|

|

|

|

|

|

|

|

a. Personal Credit: Col. A: Enter 1 (enter 2 if filing status 2 or 5); Col. B: Enter 1 if filing status 3 |

s |

|

|

X $ 40 = $ |

|

|

|

b. Enter 1 for each person who is 65 or older and/or 1 for each person who is blind |

s |

|

|

X $ 20 = $ |

|||

c. Dependents: Enter 1 for each dependent |

s |

|

|

X $ 40 = $ |

|

|

|

d. Enter first names of dependents here: ____________________________________ |

|

e. TOTAL $ |

|

||||

s

s s

A. You or Joint

X $ 40 = $

X $ 20 = $

X $ 40 = $

$

|

|

|

B. Spouse/Status 3 |

A. You or Joint |

B. Spouse/Status 3 |

A. You or Joint |

|||

STEP 4 |

1. |

Wages, salaries, tips, etc |

1. |

______________ .00 |

______________ .00 |

|

|

|

|

Gross |

2. |

Taxable interest income. If more than $1,500, complete Sch. B |

2. |

______________ .00 |

______________ .00 |

|

|

|

|

Income |

3. |

Ordinary dividend income. If more than $1,500, complete Sch. B |

3. |

______________ .00 |

______________ .00 |

|

|

|

|

|

4. |

Alimony received |

4. |

______________ .00 |

______________ .00 |

|

|

|

|

|

5. |

..............Business income/(loss) from federal Schedule C or |

5. |

______________ .00 |

______________ .00 |

NOTE: Use only |

|

||

|

6. |

Capital gain/(loss) from federal Sch. D if required for federal purposes . |

6. |

______________ .00 |

______________ .00 |

|

|||

|

blue or black ink, |

|

|||||||

|

7. |

Other gains/(losses) from federal form 4797 |

7. |

______________ .00 |

______________ .00 |

|

|||

|

no pencils or red ink. |

|

|||||||

|

8. |

Taxable IRA distributions |

8. |

______________ .00 |

______________ .00 |

|

|||

|

|

|

|

||||||

|

9. |

Taxable pensions and annuities |

9. |

______________ .00 |

______________ .00 |

|

|

|

|

|

|

|

|

||||||

|

10. |

Rents, royalties, partnerships, estates, etc |

10. |

______________ .00 |

______________ .00 |

|

|

|

|

|

11. |

Farm income/(loss) from federal Schedule F |

11. |

______________ .00 |

______________ .00 |

|

|

|

|

|

12. |

Unemployment compensation. See instructions |

12. |

______________ .00 |

______________ .00 |

|

|

|

|

|

13. |

Taxable Social Security benefits |

13. |

______________ .00 s ______________ .00 |

|

|

|

||

|

14. |

Other income, gambling income, bonus depreciation/section 179 adjustment ... |

14. |

______________ .00 |

______________ .00 |

|

|

|

|

|

15. |

GROSS INCOME. ADD lines |

|

|

15. _______________ .00 s _______________ .00 |

||||

STEP 5 |

16. Payments to an IRA, Keogh, or SEP |

16. |

______________ .00 |

______________ .00 |

|

|

|

||

Adjust- |

17. Deductible part of |

17. |

______________ .00 |

______________ .00 |

|

|

|

||

ments |

18. |

Health insurance deduction |

18. |

______________ .00 |

______________ .00 |

|

|

|

|

to |

|

|

|

||||||

19. |

Penalty on early withdrawal of savings |

19. |

______________ .00 |

______________ .00 |

|

|

|

||

Income |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

20. |

Alimony paid |

20. |

______________ .00 |

______________ .00 |

|

|

|

|

|

21. |

Pension/retirement income exclusion |

21. |

______________ .00 s ______________ .00 |

|

|

|

||

|

22. |

Moving expense deduction from federal form 3903 |

22. |

______________ .00 |

______________ .00 |

|

|

|

|

|

23. |

Iowa capital gain deduction; certain sales ONLY (see instructions) |

23. |

______________ .00 s ______________ .00 |

|

|

|

||

|

24. |

Other adjustments |

24. |

______________ .00 |

______________ .00 |

|

|

|

|

|

25. |

Total adjustments. ADD lines |

|

|

25. _______________ .00 s _______________ .00 |

||||

|

26. |

NET INCOME. SUBTRACT line 25 from line 15 |

|

|

26. _______________ .00 s _______________ .00 |

||||

STEP 6 Federal Tax Addition and Deduc- tion

27. |

Federal income tax refund / overpayment received in 2012 |

27. |

______________ .00 s ______________ .00 |

|

||

28. |

28. |

______________ .00 s ______________ .00 |

|

|||

29. |

Addition for federal taxes. ADD lines 27 and 28 |

|

29. |

_______________ .00 |

_______________ .00 |

|

30. |

Total. ADD lines 26 and 29 |

|

30. |

_______________ .00 |

_______________ .00 |

|

31. |

Federal tax withheld |

31. |

______________ .00 s ______________ .00 |

|

||

32. |

Federal estimated tax payments made in 2012 |

32. |

______________ .00 s ______________ .00 |

|

||

33. |

Additional federal tax paid in 2012 for 2011 and prior years |

33. |

______________ .00 s ______________ .00 |

|

||

34. |

Deduction for federal taxes. ADD lines 31, 32, and 33 |

|

34. |

_______________ .00 |

_______________ .00 |

|

35. |

BALANCE. SUBTRACT line 34 from line 30. Enter here and on line 36, side 2 |

35. |

_______________ .00 s _______________ .00 |

|||

*1241001019999*

2012 IA 1040, page 2 |

|

B. Spouse/Status 3 |

A. You or Joint |

B. Spouse/Status 3 |

A. You or Joint |

||||||||||||||||

STEP 7 |

36. |

BALANCE. From side 1, line 35 |

|

|

|

|

|

|

|

36. |

_______________ .00 |

_______________ .00 |

|||||||||

Taxable |

|

37. Total itemized deductions from federal Schedule A |

37. |

______________ .00 |

______________ .00 |

} |

|

|

|

||||||||||||

Income |

|

|

|

|

|||||||||||||||||

|

Taxpayers with bonus depreciation/section 179 must use Iowa Schedule A. |

|

|

|

|

|

|

|

|

Complete lines |

|||||||||||

|

|

38. Iowa income tax if included in line 5 of federal Schedule A |

38. |

______________ .00 |

______________ .00 |

||||||||||||||||

|

|

ONLY if you itemize. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

39. BALANCE. Subtract line 38 from line 37 or enter the |

39. |

______________ .00 |

______________ .00 |

|

|

|

|||||||||||||

|

|

amount of itemized deductions from the Iowa Schedule A. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

40. Other deductions |

|

|

|

40. |

______________ .00 |

______________ .00 |

|

|

|

|

|

||||||||

|

41. |

Deduction. Check one box. s Itemized. Add lines 39 and 40. |

|

Standard |

|

|

41. |

_______________ .00 s _______________ .00 |

|||||||||||||

|

42. |

TAXABLE INCOME. SUBTRACT line 41 from line 36 |

|

|

|

|

|

|

42. |

_______________ .00 |

_______________ .00 |

||||||||||

STEP 8 |

43. |

Tax from tables or alternate tax |

43. |

______________ .00 s ______________ .00 |

|

|

|

|

|

||||||||||||

Tax, |

44. |

Iowa |

44. |

______________ .00 s ______________ .00 |

|

|

|

|

|

||||||||||||

Credits |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and |

45. |

Iowa minimum tax. Attach IA 6251 |

45. |

______________ .00 s ______________ .00 |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checkoff |

46. |

Total tax. ADD lines 43, 44, and 45 |

|

|

|

|

|

|

|

46. |

_______________ .00 |

_______________ .00 |

|||||||||

Contribu- 47. |

Total exemption credit amount(s) from Step 3, side 1 |

47. |

______________ .00 |

______________ .00 |

|

|

|

|

|

||||||||||||

tions |

48. |

Tuition and textbook credit for dependents |

|

48. |

______________ .00 s ______________ .00 |

|

|

|

|

|

|||||||||||

|

............................. |

|

|

|

|

|

|||||||||||||||

|

49. |

Total credits. ADD lines 47 and 48 |

|

|

|

|

|

|

|

49. |

_______________ .00 |

_______________ .00 |

|||||||||

|

50. |

BALANCE. SUBTRACT line 49 from line 46. If less than zero, enter zero |

|

|

50. |

_______________ .00 s _______________ .00 |

|||||||||||||||

|

51. |

Credit for nonresident or |

|

|

51. |

_______________ .00 s _______________ .00 |

|||||||||||||||

|

52. |

BALANCE. SUBTRACT line 51 from 50. If less than or equal to zero, enter zero |

|

52. |

_______________ .00 |

_______________ .00 |

|||||||||||||||

|

53. |

Other nonrefundable Iowa credits. Attach IA 148 Tax Credits Schedule |

|

|

53. |

_______________ .00 s _______________ .00 |

|||||||||||||||

|

54. |

BALANCE. SUBTRACT line 53 from line 52 |

|

|

|

|

|

|

|

54. |

_______________ .00 |

_______________ .00 |

|||||||||

|

55. |

School district surtax/EMS surtax. Take percentage from table; multiply by line 54. |

.............................................. |

|

55. |

_______________ .00 s _______________ .00 |

|||||||||||||||

|

56. |

Total Tax. ADD lines 54 and 55 |

|

|

|

|

|

|

|

56. |

_______________ .00 s _______________ .00 |

||||||||||

|

57. |

Total tax before contributions. ADD columns A & B on line 56 and enter here |

|

|

|

|

|

|

|

57. |

_______________ .00 |

||||||||||

|

58. |

Contributions. Contributions will reduce your refund or add to the amount you owe. Amounts must be in whole dollars. |

|

|

|

|

|

|

|||||||||||||

|

|

Fish/Wildlife 58a: s |

|

StateFair 58b: s |

|

|

Firefighters/Veterans 58c: s |

|

|

Child Abuse Prevention 58d: s |

|

|

Enter total. . |

58. |

_______________ .00 |

||||||

|

59. |

TOTAL TAX AND CONTRIBUTIONS. ADD lines 57 and 58 |

|

|

|

|

|

|

|

|

|

|

|

59. |

_______________ .00 |

||||||

STEP 9 Credits

60. |

Iowa income tax withheld |

60. |

______________ .00 s ______________ .00 |

||

61. |

Estimated and voucher payments made for tax year 2012 |

61. |

______________ .00 s ______________ .00 |

||

62. |

62. |

______________ .00 s ______________ .00 |

|||

63. |

Motor fuel tax credit. Attach IA 4136 |

63. |

______________ .00 s ______________ .00 |

||

64. |

Check One: |

Child and dependent care credit OR |

|

|

|

|

s |

Early childhood development credit |

64. |

______________ .00 s ______________ .00 |

|

65. |

Iowa earned income tax credit. See Instructions |

65. |

______________ .00 s ______________ .00 |

||

66. |

Other refundable credits. Attach IA 148 Tax Credits Schedule |

66. |

______________ .00 s ______________ .00 |

||

67. |

TOTAL. ADD lines 60 - 66 |

67. |

______________ .00 |

______________ .00 |

|

68. |

TOTAL CREDITS. ADD columns A and B on line 67 and enter here |

68. _______________ .00 |

|||

STEP 10 Refund or Amount You Owe

69. |

If line 68 is more than line 59, SUBTRACT line 59 from line 68. This is the amount you overpaid |

69. s _______________ .00 |

||||

70. |

Amount of line 69 to be REFUNDED |

........................................................................................................................................... |

|

REFUND |

70. s _______________ .00 |

|

|

For a faster refund file electronically. Go to www.iowa.gov/tax for details or mail return to |

|

|

|||

|

Iowa Income Tax - Refund Processing, Hoover State Office Bldg, Des Moines IA |

|

|

|||

71. |

Amount of line 69 to be applied to your 2013 estimated tax |

71. ______________ .00 s ______________ .00 |

|

|||

72. |

If line 68 is less than line 59, SUBTRACT line 68 from line 59. This is the AMOUNT OF TAX YOU OWE |

72. s _______________ .00 |

||||

73. |

Penalty for underpayment of estimated tax from IA 2210 or IA 2210F s |

Check if annualized income method is used |

73. s _______________ .00 |

|||

74. |

Penalty and interest |

74a. Penalty ______________ .00 s 74b. Interest _______________ |

.00 s ADD Enter total 74. _______________ .00 |

|||

75. |

TOTAL AMOUNT DUE. ADD lines 72, 73, and 74, and enter here. |

........................................................................ |

PAY THIS AMOUNT |

75. s _______________ .00 |

||

|

You can pay online at www.iowa.gov/tax or pay by mail to Iowa Income Tax - Document Processing, |

|

|

|||

|

PO Box 9187, Des Moines IA |

|

|

|||

STEP 11 POLITICAL CHECKOFF. This checkoff does not increase the

amount of tax you owe or decrease your refund.

s SPOUSE:

$1.50 to Republican Party |

$1.50 to Republican Party |

$1.50 to Democratic Party sYOURSELF: |

$1.50 to Democratic Party |

$1.50 to Campaign Fund |

$1.50 to Campaign Fund |

STEP 12

PLEASE

I (We), the undersigned, declare under penalty of perjury that I (we) have examined this return, including all accompanying schedules and statements, and, to the best of my (our) knowledge and belief, it is a true, correct, and complete return. Declaration of preparer (other than taxpayer) is based on all information of which the preparer has any knowledge.

SIGN HERE |

|

|

|

s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Your Signature |

Date |

|

Check if Deceased |

Date of |

Death |

|

Preparer’s Signature |

Date |

||||

SIGN HERE |

|

|

|

s |

|

|

|

|

|

|

|

|

Spouse’s Signature |

Date |

Check if Deceased |

Date of |

Death |

|

Preparer’s PTIN |

Firm’s FEIN |

|||||

|

|

|

|

|

|

|

|

|

||||

*1241001029999* |

|

Daytime Telephone Number |

|

|

|

Daytime Telephone Number |

||||||

This return is due April 30, 2013. Please sign, enclose |

||||||||||||

|

|

|

||||||||||

MAILING ADDRESSES: See lines 70 and 75 above. |

|

|

Similar forms

The Iowa IA 1040 form is similar to the Federal Form 1040, which is the standard individual income tax return used by U.S. taxpayers. Both forms require personal information such as Social Security numbers, names, and addresses. They share similar sections for reporting income, deductions, and tax credits. The structure allows taxpayers to calculate their taxable income and determine their tax liability. However, the Iowa IA 1040 includes specific state-related questions and adjustments that are not present on the federal form.

The Illinois 1040 form is another state income tax return that shares similarities with the Iowa IA 1040. Like the Iowa form, it requires taxpayers to provide personal information, filing status, and income details. Both forms allow for exemptions and credits that can reduce the overall tax liability. However, the Illinois 1040 includes state-specific deductions and tax rates, reflecting the unique tax laws of Illinois compared to Iowa.

The California Form 540 is comparable to the Iowa IA 1040 as both are used for state income tax purposes. Each form requires taxpayers to report their income, deductions, and credits. Both forms include sections for claiming dependents and determining tax liability. The California Form 540 also features unique state-specific credits and deductions, which cater to California's tax regulations, differing from those in Iowa.

The New York State IT-201 form is similar to the Iowa IA 1040 in that it serves as the primary income tax return for residents of New York. Both forms require similar personal information and allow taxpayers to report various sources of income. They also feature sections for calculating deductions and credits. However, the New York IT-201 includes specific lines for state-related tax credits and adjustments that reflect New York's tax policies.

The Texas Franchise Tax Report is another document that, while different in purpose, shares the need for detailed income reporting. Similar to the Iowa IA 1040, it requires information about the entity's revenue and deductions. However, the Texas report is specifically for businesses and does not apply to individual income tax, which makes it distinct in its application but similar in its thoroughness of financial disclosure.

The Massachusetts Form 1 is akin to the Iowa IA 1040 as both are used for state income tax filing. Each form requires personal and financial information, including income sources and deductions. Both forms also allow for credits that can reduce tax liability. The Massachusetts form, however, includes specific provisions that pertain to state tax law, differing from Iowa's requirements.

The Florida Individual Income Tax Return is not applicable as Florida does not impose a state income tax. However, the absence of such a form highlights the differences in state tax structures across the U.S. In contrast, the Iowa IA 1040 is essential for residents to report income and calculate their tax obligations, showcasing the varied tax environments in different states.

The Pennsylvania Personal Income Tax Return is similar to the Iowa IA 1040 in that both forms require the reporting of income and claim deductions. Each form necessitates the inclusion of taxpayer identification details and allows for various credits. The Pennsylvania form includes specific lines for local taxes, which is a unique feature compared to Iowa's tax reporting requirements.

In addition to the aforementioned forms, individuals may find it beneficial to utilize a comprehensive Durable Power of Attorney for managing important decisions and financial affairs. This legal document, which allows an assigned agent to act on behalf of the principal, is essential in ensuring that one’s interests are safeguarded even during incapacitation. For more details, visit comprehensive Durable Power of Attorney document resources.

The New Jersey Resident Income Tax Return is comparable to the Iowa IA 1040, as both are used to file state income taxes. Each form requires personal identification information and provides sections for reporting income and claiming deductions. However, the New Jersey form includes specific provisions for local taxes and credits that reflect the state's unique tax regulations.

Finally, the Ohio IT 1040 form is similar to the Iowa IA 1040 as both are designed for individual income tax filing at the state level. Both require personal information and income reporting, including sections for exemptions and deductions. The Ohio form, however, has specific lines for various state credits and adjustments that differ from those in Iowa, reflecting the distinct tax laws of each state.