Free Iowa Ia 1040C Template

Things You Should Know About This Form

What is the Iowa IA 1040C form?

The Iowa IA 1040C form is a Composite Individual Income Tax Return. It is used by partnerships, Subchapter S corporations, trusts, and limited liability companies to file on behalf of nonresident partners, shareholders, beneficiaries, or members. This form allows these entities to report income earned in Iowa for the calendar year.

Who needs to file the IA 1040C form?

The IA 1040C form must be filed by partnerships, S corporations, trusts, or LLCs that have nonresident partners, shareholders, or members. These individuals must have Iowa-source income exceeding the standard deduction amount to be included in the composite return.

What is the due date for filing the IA 1040C form?

The IA 1040C form for the calendar year 2009 is due by April 30, 2010. If you need more time, an automatic 6-month extension is available if at least 90% of the tax due is paid by the original due date.

What attachments are required when filing the IA 1040C form?

A copy of federal Schedule K-1 for all Iowa nonresidents must be attached to the IA 1040C form. This is required regardless of whether the nonresidents are reporting income or remitting tax with this form.

How do I calculate the tax due on the IA 1040C form?

To calculate the tax due, you will first determine the composite taxable income by subtracting total deductions from total Iowa-source income. You will then apply the tax rate schedule provided in the form to calculate the tax owed. Be sure to check for any minimum tax requirements as well.

What are the penalties for late filing or underpayment?

If the return is not mailed by the due date and at least 90% of the correct tax is not paid, an additional penalty of 10% of the tax due will apply. If the return is filed on time but the payment is insufficient, a 5% penalty will be assessed.

Can I claim credits on the IA 1040C form?

Yes, you can claim nonrefundable credits on the IA 1040C form. You must complete and attach the IA 148 Tax Credits Schedule to report these credits. Personal exemption credits for 2009 are $40 for each partner, shareholder, or member included in the return.

Form Features

| Fact Name | Details |

|---|---|

| Form Purpose | The Iowa IA 1040C is used for filing composite individual income tax returns on behalf of nonresident partners, shareholders, beneficiaries, or members of partnerships, S corporations, trusts, and limited liability companies. |

| Filing Deadline | For the 2009 calendar year, the form must be filed by April 30, 2010. |

| Required Attachments | All federal Schedule K-1 forms for Iowa nonresidents must be attached to the return, regardless of whether they report income or remit tax. |

| Exemption Credits | Each individual whose Iowa-source income exceeds the minimum threshold allows for a $40 personal exemption credit. |

| Tax Rate Schedule | The tax is calculated based on a schedule that varies with income levels. Different rates apply as income increases. |

| Minimum Tax | Partners, shareholders, or members may be subject to Iowa minimum tax. This is similar to the federal alternative minimum tax. |

| Governing Law | The Iowa IA 1040C is governed by the Iowa Code, particularly sections related to individual income tax and composite returns. |

Discover Other PDFs

Do I Have to Claim Dependents on W4 - This form plays a critical role in ensuring that employees are properly classified for tax purposes.

Iowa Power of Attorney - Signing this form is a critical step in ensuring effective representation.

For those looking to ensure their legal decisions are respected, a valid Durable Power of Attorney document is indispensable. This form allows a designated individual to manage financial and legal matters effectively, even during periods of incapacity.

Iowa 470 4299 - Incomplete forms may result in delayed processing for healthcare service reimbursements.

Key takeaways

When filling out the Iowa IA 1040C form, keep these key takeaways in mind:

- Attach Federal Schedule K-1: Always include a copy of the federal Schedule K-1 for all Iowa nonresidents, regardless of income reporting.

- Filing Deadline: Submit the composite return for the 2009 calendar year by April 30, 2010. Extensions are possible if 90% of the tax due is paid on time.

- Eligibility for Composite Return: Nonresident partners, shareholders, or members must meet specific income thresholds to be included in the composite return.

- Calculate Deductions Carefully: Determine the allowed deductions based on income brackets. The standard deduction for 2009 is capped at $1,780 or the individual's Iowa income.

- Use the Tax Rate Schedule: Apply the correct tax rate from the provided schedule based on the composite taxable income.

- Monitor for Penalties and Interest: Be aware of penalties for late filing or underpayment, as well as interest accruing from the due date until payment is made.

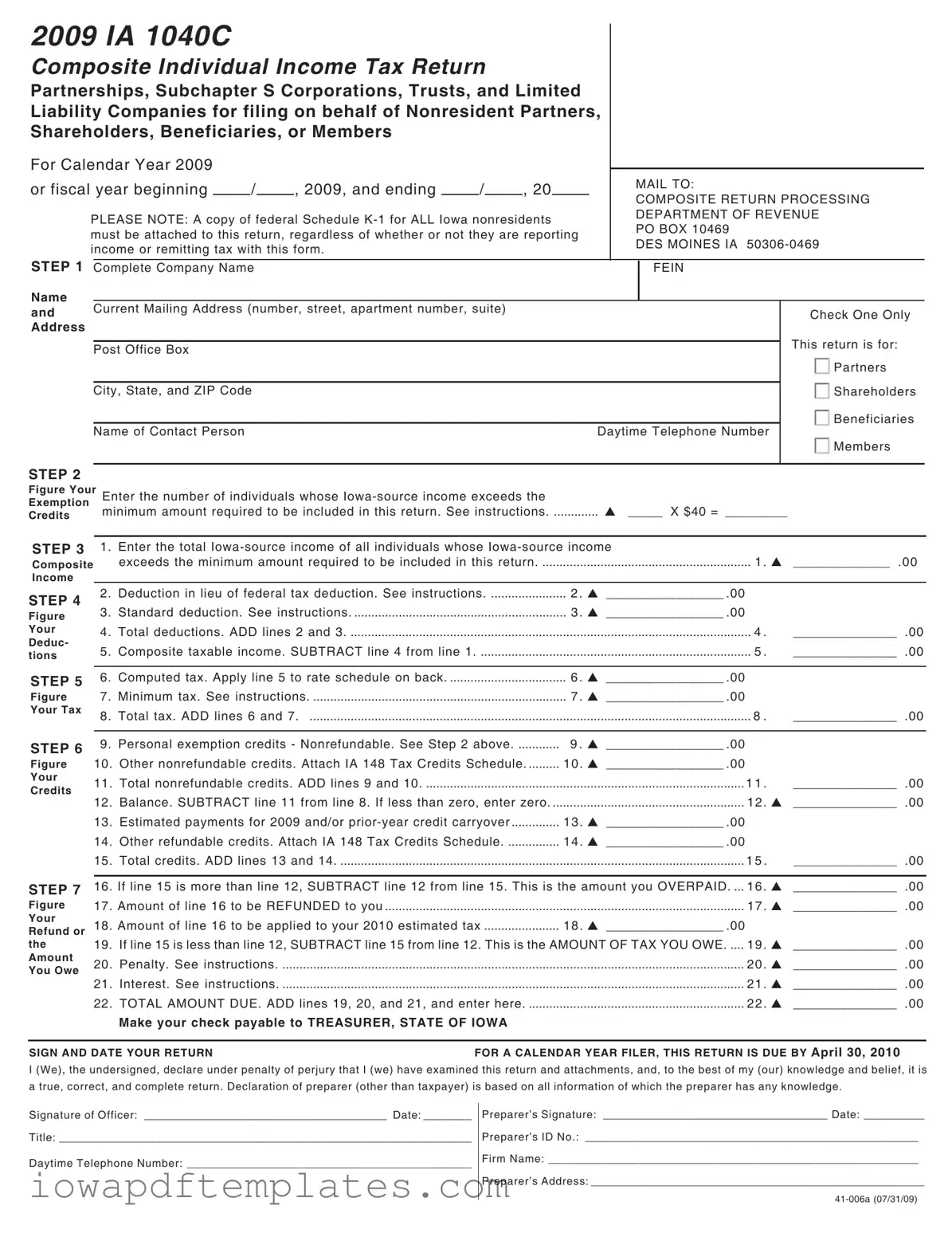

Sample - Iowa Ia 1040C Form

2009 IA 1040C

Composite Individual Income Tax Return

Partnerships, Subchapter S Corporations, Trusts, and Limited

Liability Companies for filing on behalf of Nonresident Partners,

Shareholders, Beneficiaries, or Members

For Calendar Year 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAIL TO: |

||

or fiscal year beginning |

|

/ |

|

, 2009, and ending |

|

/ |

|

, 20 |

|

|

||

|

|

|

|

|

|

COMPOSITE RETURN PROCESSING |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE NOTE: A copy of federal Schedule |

|

DEPARTMENT OF REVENUE |

||||||||||

|

PO BOX 10469 |

|||||||||||

must be attached to this return, regardless of whether or not they are reporting |

|

|||||||||||

|

DES MOINES IA |

|||||||||||

income or remitting tax with this form. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||

STEP 1 Complete Company Name |

|

|

|

|

|

|

|

|

FEIN |

|||

Name

and Current Mailing Address (number, street, apartment number, suite)Check One Only

Address

Post Office Box |

|

This return is for: |

|||

|

|

|

|

|

|

|

|

|

|

|

Partners |

|

|

|

|

|

|

City, State, and ZIP Code |

|

|

|

|

Shareholders |

|

|

|

|

|

Beneficiaries |

|

|

|

|

|

|

|

|

|

|

|

|

Name of Contact Person |

Daytime Telephone Number |

|

|

||

|

|||||

|

|

|

|

|

Members |

STEP 2

Figure Your

Exemption

Credits

Enter the number of individuals whose |

|

minimum amount required to be included in this return. See instructions |

_____ X $40 = _________ |

STEP 3 |

1. Enter the total |

|

|

Composite |

exceeds the minimum amount required to be included in this return |

1 . |

______________ . 00 |

Income

STEP 4

Figure Your Deduc- tions

STEP 5

Figure Your Tax

STEP 6

Figure

Your

Credits

STEP 7

Figure Your Refund or the Amount You Owe

2. |

Deduction in lieu of federal tax deduction. See instructions |

2 . |

_________________ .00 |

|

|

|

3. |

Standard deduction. See instructions |

3 . |

_________________ .00 |

|

|

|

4. |

Total deductions. ADD lines 2 and 3 |

|

4 . |

_______________ |

.00 |

|

5. |

Composite taxable income. SUBTRACT line 4 from line 1 |

|

5 . |

_______________ |

.00 |

|

|

|

|

|

|

|

|

6. |

Computed tax. Apply line 5 to rate schedule on back |

6 . |

_________________ .00 |

|

|

|

7. |

Minimum tax. See instructions |

7 . |

_________________ .00 |

|

|

|

8. |

Total tax. ADD lines 6 and 7. ................................................................................................................................. 8 . |

_______________ |

.00 |

|||

|

|

|

|

|

|

|

9. |

Personal exemption credits - Nonrefundable. See Step 2 above |

9 . |

_________________ .00 |

|

|

|

10. |

Other nonrefundable credits. Attach IA 148 Tax Credits Schedule |

10 . _________________ .00 |

|

|

|

|

11. |

Total nonrefundable credits. ADD lines 9 and 10 |

|

1 1 . |

_______________ |

.00 |

|

12. |

Balance. SUBTRACT line 11 from line 8. If less than zero, enter zero |

|

12 . |

_______________ |

.00 |

|

13. |

Estimated payments for 2009 and/or |

13 . _________________ .00 |

|

|

|

|

14. |

Other refundable credits. Attach IA 148 Tax Credits Schedule |

14 . _________________ .00 |

|

|

|

|

15. |

Total credits. ADD lines 13 and 14 |

|

1 5 . |

_______________ |

.00 |

|

|

|

|

|

|

||

16. |

If line 15 is more than line 12, SUBTRACT line 12 from line 15. This is the amount you OVERPAID. ... |

16 . |

_______________ |

.00 |

||

17. |

Amount of line 16 to be REFUNDED to you |

|

17 . |

_______________ .00 |

||

18. |

Amount of line 16 to be applied to your 2010 estimated tax |

18 . _________________ .00 |

|

|

|

|

19. |

If line 15 is less than line 12, SUBTRACT line 15 from line 12. This is the AMOUNT OF TAX YOU OWE |

19 . |

_______________ |

.00 |

||

20. |

Penalty. See instructions |

|

20 . |

_______________ |

.00 |

|

21. |

Interest. See instructions |

|

21 . |

_______________ |

.00 |

|

22. |

TOTAL AMOUNT DUE. ADD lines 19, 20, and 21, and enter here |

|

22 . |

_______________ .00 |

||

|

Make your check payable to TREASURER, STATE OF IOWA |

|

|

|

|

|

SIGN AND DATE YOUR RETURN |

FOR A CALENDAR YEAR FILER, THIS RETURN IS DUE BY April 30, 2010 |

I (We), the undersigned, declare under penalty of perjury that I (we) have examined this return and attachments, and, to the best of my (our) knowledge and belief, it is a true, correct, and complete return. Declaration of preparer (other than taxpayer) is based on all information of which the preparer has any knowledge.

Signature of Officer: ________________________________________ Date: ________

Title: ____________________________________________________________________

Daytime Telephone Number: _______________________________________________

Preparer’s Signature: _____________________________________ Date: __________

Preparer’s ID No.: _______________________________________________________

Firm Name: _____________________________________________________________

Preparer’s Address: _______________________________________________________

Instructions for Composite Iowa Individual Income Tax Return

Election of Composite Filing

Composite returns for the 2009 calendar year must be filed by April 30, 2010. An automatic

Filing Requirements

Nonresident partners, shareholders, members, or beneficiaries cannot be included in a composite return if the nonresident does not have more income from Iowa sources than the amount of one standard deduction for a single taxpayer plus an amount of income necessary to create a tax liability at the effective tax rate on the composite return sufficient to offset one personal exemption. See minimum filing requirements below under line 6.

In addition, the above individuals should not be included if they have incomes from Iowa sources other than from the partnership or other entity; these individuals are required to file Iowa individual income tax returns.

Line Instructions

1.Each nonresident partner’s, shareholder’s, or member’s Iowa

IA 1040C.

Beneficiaries of a trust do not have an Iowa

2.A deduction is allowed in lieu of the deduction for federal tax paid and is based upon the following schedule:

Amount shown on line 1 |

|

Deduction |

||

0 |

- |

$49,999 = |

No deduction |

|

$50,000 |

- |

$99,999 |

= |

5% of line 1 |

$100,000 |

- |

$199,999 |

= |

10% of line 1 |

Over |

$200,000 |

= |

15% of line 1 |

|

3.For 2009 the standard deduction allowed is the lesser of $1,780 or the income attributable to Iowa of the partner, shareholder, or member filing this composite return.

|

|

TAX RATE SCHEDULE |

|

|

|

|

|

|

|

But |

|

|

|

|

Of Excess |

Minimum |

Over |

Not Over |

|

|

Tax Rate |

|

Over |

Income |

$0 |

$1,407 |

$0.00 |

+ |

(0.36% |

x |

$0) |

Filing |

$1,407 |

$2,814 |

$5.07 |

+ |

(0.72% |

x |

$1,407) |

Requirement |

$2,814 |

$5,628 |

$15.20 |

+ |

(2.43% |

x |

$2,814) |

$2,669 |

$5,628 |

$12,663 |

$83.58 |

+ |

(4.50% |

x |

$5,628) |

$2,434 |

$12,663 |

$21,105 |

$400.16 |

+ |

(6.12% |

x |

$12,663) |

$2,397 |

$21,105 |

$28,140 |

$916.81 |

+ |

(6.48% |

x |

$21,105) |

$2,368 |

$28,140 |

$42,210 |

$1,372.68 |

+ |

(6.80% |

x |

$28,140) |

$2,285 |

$42,210 |

$63,315 |

$2,329.44 |

+ |

(7.92% |

x |

$42,210) |

$2,225 |

$63,315 |

over |

$4,000.96 |

+ |

(8.98% |

x |

$63,315) |

|

|

|

|

|

|

|

|

6.Use the tax rate schedule above to figure your tax on composite Iowa taxable income. Also listed are the minimum requirements for each tax rate.

7.Partners, shareholders, or members reporting income on the composite return may also be subject to Iowa minimum tax. The Iowa alternative minimum tax is imposed on most of the same tax preference and adjustment items treated as exclusions as for federal alternative minimum tax purposes. Please see form IA 6251 to determine if any Iowa minimum tax is due, and attach completed form if necessary.

9.Personal exemption credits for 2009 for each partner, shareholder or member is $40.

10.Enter the total of the nonrefundable credits from the IA 148 Tax Credits Schedule. The IA 148 Tax Credits Schedule must be attached.

13.Enter the total amount of 2009 estimated tax payments and any of the prior year’s refund applied to your estimated payments for 2009.

Although estimated payments are not required, 2010 estimated payments may be made on form IA 1040ES using the partnership’s, limited liability company’s, S corporation’s, or trust’s identification number.

14.Enter the total of the refundable credits from the IA 148 Tax Credits Schedule. Attach the IA 148 Tax Credits Schedule.

20.If you do not mail your return by the due date and at least 90% of the correct tax is not paid, you owe an additional 10% of the tax due. If you file your return on time but do not pay at least 90% of the correct tax due, you owe an additional 5% of the tax due.

21.Interest is added at a rate of 0.4% per month beginning on the due date of the return and accrues each month until payment is made.

Preparer’s ID Number

Enter preparer’s SSN, FEIN, or PTIN.

Similar forms

The Iowa IA 1040C form is similar to the federal Form 1065, which is used for partnerships to report income, deductions, and credits. Both forms require detailed reporting of income and expenses, ensuring that the entity’s financial activities are accurately reflected. Just as the IA 1040C requires a Schedule K-1 for each partner, the Form 1065 also mandates the issuance of K-1s to report each partner’s share of the partnership’s income, deductions, and credits. This ensures that income is properly allocated to partners for tax purposes, facilitating compliance with both state and federal tax regulations.

Another related document is the Iowa IA 1040 form, which is the standard individual income tax return for residents. While the IA 1040C is specifically designed for nonresidents filing a composite return, the IA 1040 is used by Iowa residents to report their personal income. Both forms require taxpayers to calculate their taxable income, deductions, and credits, but the IA 1040 focuses on individual taxpayers rather than entities. Additionally, the IA 1040 allows for personal exemptions and various deductions that may differ from those available on the IA 1040C.

The federal Form 1120S is another document that shares similarities with the IA 1040C. This form is used by S corporations to report income, deductions, and credits to the IRS. Like the IA 1040C, the Form 1120S requires the distribution of income to shareholders via Schedule K-1. Both forms aim to ensure that income is reported accurately at the entity level while allowing for the pass-through of income to individual shareholders or partners, thereby avoiding double taxation.

The Iowa IA 1065 form serves as a counterpart to the federal Form 1065, specifically for partnerships operating in Iowa. This form captures similar information, such as partnership income, deductions, and credits. Just like the IA 1040C, the IA 1065 requires the inclusion of K-1s for each partner, detailing their respective shares of the partnership’s financial results. The primary distinction lies in the fact that the IA 1065 is tailored to Iowa tax regulations, while the IA 1040C addresses the needs of nonresident partners in a composite return.

The Schedule K-1 (Form 1065) is another essential document that aligns with the IA 1040C. It provides detailed information about each partner's share of income, deductions, and credits from a partnership. Both the K-1 and the IA 1040C require that this information be reported accurately to ensure proper tax compliance. This documentation allows partners to report their income on their individual tax returns, whether they are filing in Iowa or at the federal level.

The Iowa IA 148 Tax Credits Schedule is also relevant, as it is used in conjunction with the IA 1040C to report nonrefundable tax credits. Similar to other tax credit schedules, it allows taxpayers to claim specific credits that can reduce their overall tax liability. Both the IA 148 and the IA 1040C work together to ensure that taxpayers receive any applicable credits while accurately reporting their income and tax obligations.

The federal Form 1040NR is comparable to the IA 1040C, as it is specifically designed for nonresident aliens to report their U.S. income. Both forms address the tax obligations of individuals who do not reside in the state or country where they earn income. While the IA 1040C focuses on Iowa-source income for nonresidents, the Form 1040NR serves a broader purpose by encompassing all U.S. income for nonresident aliens, ensuring compliance with federal tax laws.

When it comes to renting a property, understanding the various legal documents involved is crucial. A Lease Agreement clearly defines the relationship between a landlord and a tenant, specifying their rights and responsibilities to minimize disputes. To aid in this process, you might find it helpful to use templates for creating these agreements. For such resources, you can access PDF Templates that guide you through the necessary components of a lease while ensuring clarity and legal compliance.

The Iowa IA 6251 form is another document that aligns with the IA 1040C, as it addresses the Iowa alternative minimum tax. Both forms require taxpayers to calculate their tax liability while considering various preferences and adjustments. The IA 6251 specifically targets those who may be subject to minimum tax, similar to how the IA 1040C accounts for minimum tax obligations for partners and shareholders reporting income in Iowa.

The federal Form 8862, which is used to claim the Earned Income Tax Credit (EITC) after a previous disallowance, shares some similarities with the IA 1040C in terms of claiming credits. Both forms require taxpayers to provide specific information to support their eligibility for tax credits. While the IA 1040C focuses on nonrefundable credits for Iowa taxes, Form 8862 is aimed at ensuring that taxpayers can reclaim credits they were previously denied, thus promoting compliance and fairness in the tax system.

Finally, the Iowa IA 1040ES form is relevant as it is used for making estimated tax payments. Similar to the IA 1040C, the IA 1040ES is essential for taxpayers who expect to owe tax at the end of the year. Both forms require careful calculations to determine tax obligations, helping to ensure that taxpayers meet their financial responsibilities throughout the year rather than facing a lump sum at tax time.