Free Iowa Ia 2848 Template

Things You Should Know About This Form

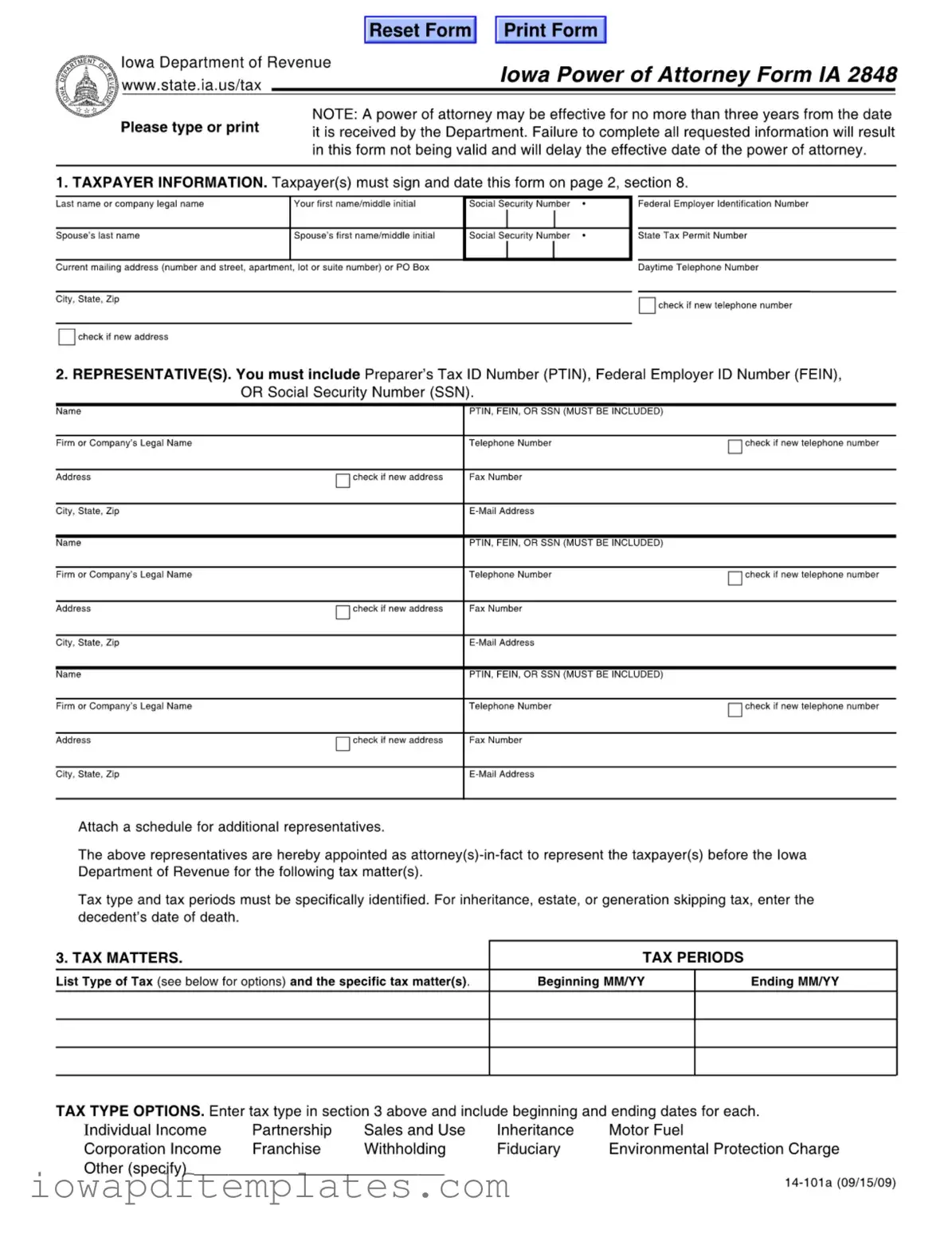

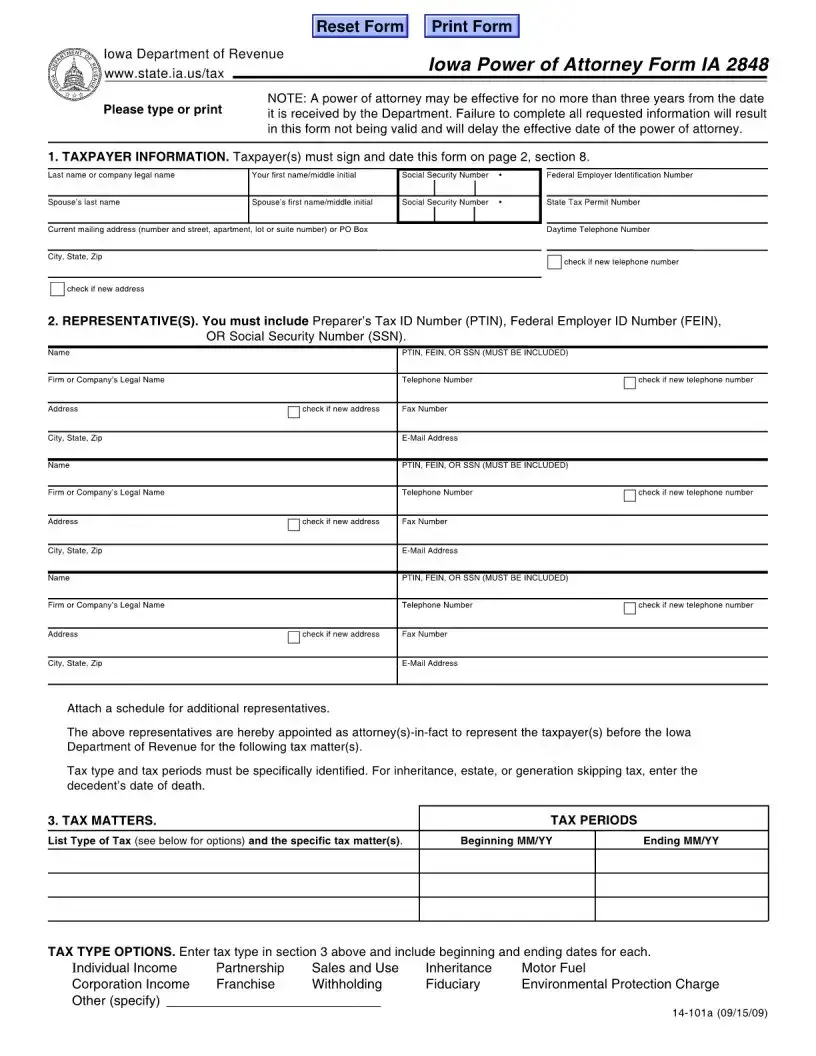

What is the Iowa IA 2848 form?

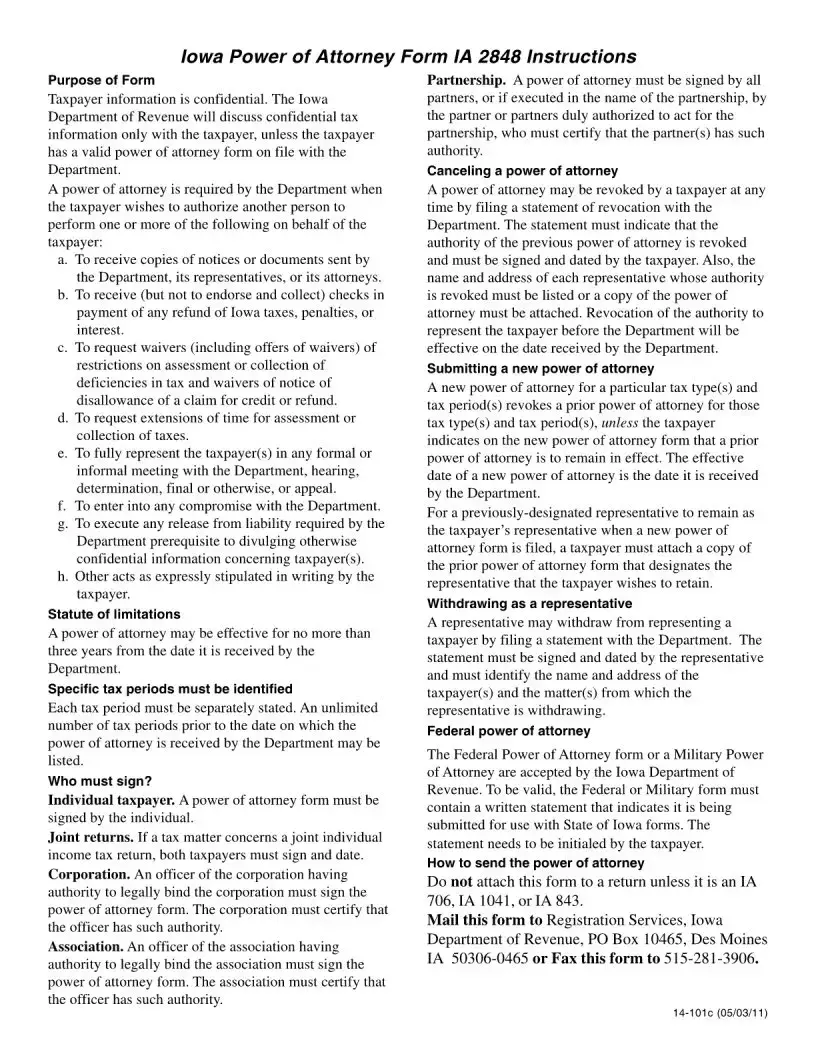

The Iowa IA 2848 form is a Power of Attorney document that allows a taxpayer to appoint a representative to handle their tax matters with the Iowa Department of Revenue. This form is essential for anyone who wants someone else to act on their behalf regarding tax issues.

Who needs to fill out the IA 2848 form?

Anyone who wishes to authorize another person or firm to represent them in tax matters should fill out this form. This includes individuals, businesses, and partnerships that need assistance with their tax filings or communications with the Iowa Department of Revenue.

How long is the IA 2848 form valid?

The power of attorney granted by the IA 2848 form is valid for up to three years from the date the Department of Revenue receives it. After that period, a new form must be submitted if continued representation is needed.

What information is required on the IA 2848 form?

The form requires several pieces of information:

- Taxpayer’s name and Social Security Number or Federal Employer Identification Number.

- Current mailing address.

- Information about the representative(s), including their name, address, and identification number.

- Specific tax matters and periods for which representation is authorized.

Can I authorize multiple representatives?

Yes, you can appoint multiple representatives on the IA 2848 form. Just make sure to provide all required information for each representative, including their identification numbers. If you have more than three representatives, attach a schedule with their details.

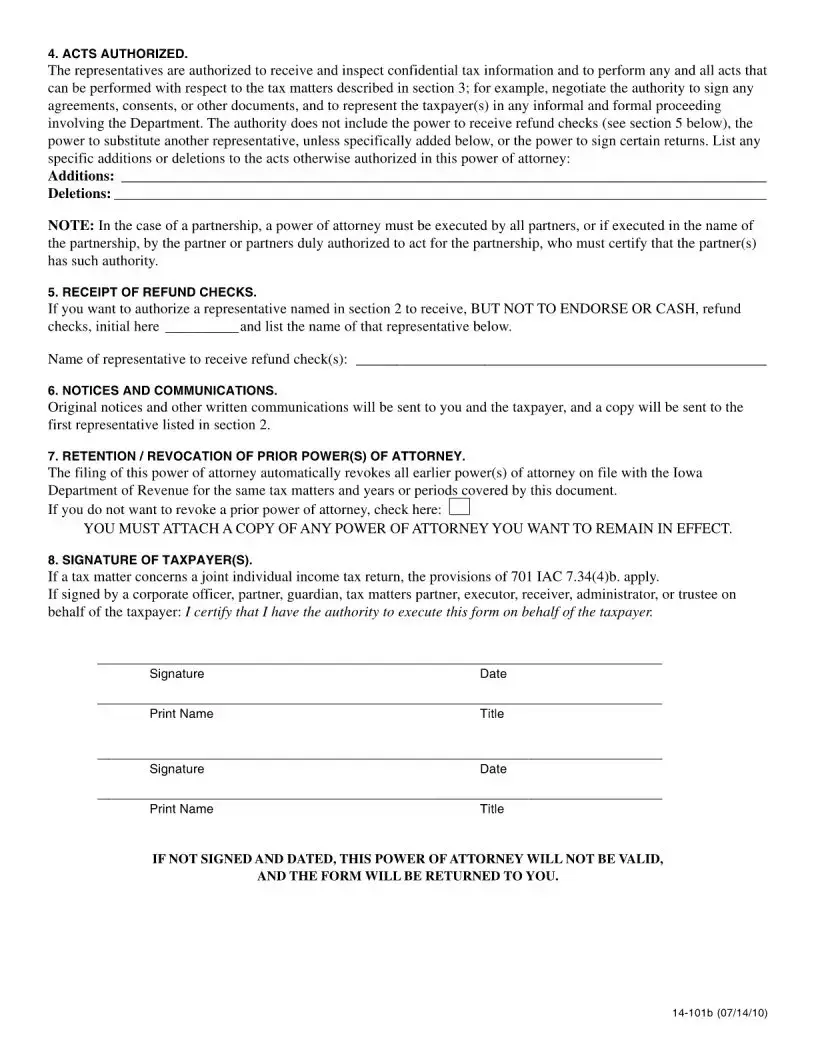

What if I want to revoke a previous power of attorney?

Filing the IA 2848 automatically revokes any earlier power of attorney for the same tax matters and periods. If you want to keep a previous power of attorney in effect, you need to check the appropriate box on the form and attach a copy of the previous document.

Can my representative receive refund checks?

Your representative can be authorized to receive refund checks, but they cannot endorse or cash them. If you want to allow this, you must initial the appropriate section on the form and provide the representative’s name.

What happens if I don’t complete the form correctly?

If the IA 2848 form is not filled out completely or correctly, it will not be valid. This could delay the effective date of the power of attorney. It’s important to double-check all information before submitting the form.

What should I do if I have more questions about the IA 2848 form?

If you have further questions, it’s a good idea to contact the Iowa Department of Revenue directly. They can provide guidance and clarify any uncertainties you may have about completing the form or the power of attorney process.

Form Features

| Fact Name | Details |

|---|---|

| Form Purpose | The Iowa IA 2848 form serves as a Power of Attorney, allowing designated representatives to act on behalf of taxpayers in tax matters before the Iowa Department of Revenue. |

| Validity Period | This power of attorney remains effective for a maximum of three years from the date it is received by the Department. |

| Required Signatures | Taxpayer(s) must sign and date the form on page 2, section 8, for it to be valid. |

| Representative Information | Each representative must provide their Preparer’s Tax ID Number (PTIN), Federal Employer ID Number (FEIN), or Social Security Number (SSN). |

| Tax Matters | Tax types and periods must be specifically identified in section 3, covering various categories such as individual income, sales and use, and more. |

| Revocation of Prior Powers | Filing this form automatically revokes any earlier powers of attorney related to the same tax matters and periods unless otherwise specified. |

Discover Other PDFs

How to Get Out of Child Support Debt - Engagement with this process is a significant step toward improved employment outcomes.

Iowa 470 3361 - Following the outlined instructions minimizes errors in the referral process.

To ensure a smooth transaction when buying or selling a vehicle in California, it is essential to utilize the California Vehicle Purchase Agreement. This document not only clarifies the details of the sale, including the vehicle's specifics and the agreed sale price but also provides protections for both parties involved. For those who need to formalize this process, you can download the document now to ensure all necessary terms are properly addressed.

Iowa State Income Tax Forms - The form includes options for single filers, married couples, and heads of household status.

Key takeaways

Filling out the Iowa IA 2848 form is a crucial step for taxpayers who wish to designate a representative to handle their tax matters. Here are some key takeaways to keep in mind:

- Complete Information is Essential: Ensure all required fields are filled out accurately. Missing information can invalidate the form and delay its effectiveness.

- Time Limit: The power of attorney granted through this form is effective for a maximum of three years from the date it is received by the Iowa Department of Revenue.

- Authorization Scope: The representatives appointed can access confidential tax information and perform various acts on behalf of the taxpayer, but they cannot endorse or cash refund checks unless specifically authorized.

- Revocation of Previous Powers: Submitting this form automatically revokes any prior powers of attorney related to the same tax matters and periods. If you wish to keep an existing power of attorney active, be sure to attach a copy of it.

By understanding these key points, taxpayers can navigate the process more smoothly and ensure their representation is properly established with the Iowa Department of Revenue.

Sample - Iowa Ia 2848 Form

Similar forms

The IRS Form 2848 is a widely recognized power of attorney form used for federal tax matters. Similar to the Iowa IA 2848, this form allows taxpayers to authorize individuals to represent them before the IRS. Both forms require detailed information about the taxpayer and the representative, including names, addresses, and identification numbers. The IRS Form 2848 also specifies the tax matters and periods for which the representative is authorized, ensuring clarity and compliance with federal regulations.

The California Form 3520 is another document that serves a similar purpose. This form is used for granting power of attorney for state tax matters in California. Like the Iowa IA 2848, it requires taxpayer information and representative details. The California form also allows taxpayers to specify the tax types and periods involved, making it a useful tool for managing state tax issues effectively.

The Florida Form DR-835 is comparable as it functions as a power of attorney for tax matters in Florida. This form also includes sections for taxpayer and representative information, along with the specific tax matters being addressed. Just like the Iowa IA 2848, it emphasizes the importance of completing all sections to ensure validity, thereby protecting both the taxpayer and the representative.

The New York Form POA-1 is similar in its function as a power of attorney for tax purposes in New York State. It allows taxpayers to appoint representatives to handle their tax affairs. Both the New York and Iowa forms require the taxpayer's signature and date for validation. This ensures that the authority granted is legitimate and recognized by the respective state tax authorities.

The Texas Form 05-102 is another power of attorney document that serves tax-related purposes. It requires detailed information about the taxpayer and the representative, similar to the Iowa IA 2848. Both forms also allow for the specification of tax types and periods, ensuring that the appointed representative has clear authority over the relevant tax matters.

For those looking to understand the transfer process of motor vehicle ownership, the https://nydocuments.com provides essential insights and resources that detail the necessary documentation, including the New York Motor Vehicle Bill of Sale form, which ensures a smooth and legally sound transaction between buyers and sellers.

The Illinois Form CRT-1 is designed for granting power of attorney for tax matters in Illinois. This form shares several similarities with the Iowa IA 2848, including the need for taxpayer and representative details, as well as the identification of specific tax issues. Both forms emphasize the importance of accurate completion to avoid delays in processing.

The Pennsylvania Form REV-854 is another comparable document. It functions as a power of attorney for tax purposes in Pennsylvania. Like the Iowa IA 2848, it requires specific information about the taxpayer and the representative, ensuring that both parties are clearly identified. This helps to streamline communication with the state tax department.

The Ohio Form IT 4 is similar in that it also serves as a power of attorney for tax matters. It allows taxpayers to authorize representatives to act on their behalf regarding tax issues. Both forms require the taxpayer's signature, ensuring that the authority granted is valid and recognized by the respective tax authorities.

The New Jersey Form POA is another relevant document. It allows taxpayers to designate representatives for tax matters in New Jersey. Much like the Iowa IA 2848, it requires detailed information from both the taxpayer and the representative. This helps to establish a clear understanding of the authority being granted and the specific tax issues involved.

Lastly, the Massachusetts Form M-2848 is comparable as it serves as a power of attorney for state tax matters in Massachusetts. This form, like the Iowa IA 2848, requires comprehensive information about both the taxpayer and the representative. It also emphasizes the need for clear specification of tax types and periods, ensuring that the appointed representative has the authority needed to address the taxpayer's concerns effectively.