Free Iowa Income Tax Template

Things You Should Know About This Form

-

What is the Iowa Income Tax form IA 1040?

The Iowa Income Tax form IA 1040 is the official document used by residents of Iowa to report their income and calculate their state income tax liability. It must be filled out annually and submitted to the Iowa Department of Revenue.

-

Who needs to file the IA 1040 form?

Any Iowa resident who earns income must file the IA 1040 form. This includes individuals who are self-employed, receive wages, or have other sources of income. Specific filing requirements may vary based on income level and filing status.

-

What information is required to complete the IA 1040?

To complete the IA 1040, you will need:

- Your Social Security number (SSN)

- Your name and address

- Your filing status (e.g., single, married filing jointly, etc.)

- Income details, including wages, interest, and other income sources

- Information about any dependents

- Details regarding any deductions or credits you may qualify for

-

What are the filing statuses available on the IA 1040?

The IA 1040 offers several filing statuses, including:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er) with dependent child

Choose the status that best fits your situation, as it can affect your tax rate and eligibility for certain credits.

-

What deductions can I claim on the IA 1040?

You can claim various deductions on the IA 1040, including:

- Standard deduction or itemized deductions

- Retirement account contributions

- Health insurance premiums

- Alimony paid

- Tuition and textbook credits for dependents

Ensure you have proper documentation for any deductions claimed.

-

How do I calculate my taxable income?

To calculate your taxable income, start with your total gross income. From this amount, subtract any adjustments and deductions. The result is your taxable income, which will be used to determine your tax liability.

-

When is the IA 1040 due?

The IA 1040 is typically due on April 30 of the year following the tax year. For example, the 2020 IA 1040 was due on April 30, 2021. It is essential to file on time to avoid penalties and interest.

-

What if I owe taxes or need to request a refund?

If you owe taxes, you must pay the amount due by the filing deadline to avoid penalties. If you are due a refund, ensure you provide accurate banking information on the form to facilitate direct deposit.

-

Where do I mail my completed IA 1040 form?

Send your completed IA 1040 form to the Iowa Income Tax Document Processing at PO Box 9187, Des Moines, IA 50306-9187. Ensure you include any required documentation, such as W-2 forms.

-

Can I file the IA 1040 electronically?

Yes, you can file the IA 1040 electronically using approved tax preparation software or through a tax professional. Electronic filing can expedite the processing of your return and any refund you may be due.

Form Features

| Fact Name | Description |

|---|---|

| Form Title | The form is officially titled "2020 IA 1040 Iowa Individual Income Tax Return." |

| Filing Deadline | This form must be submitted by April 30, 2021, for the tax year 2020. |

| Filing Status Options | Taxpayers can choose from several filing statuses: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). |

| Exemptions | Taxpayers can claim personal credits for themselves, their spouse, and dependents, with specific amounts for each. |

| Income Reporting | Taxpayers must report various income types, including wages, interest, dividends, and business income. |

| Governing Law | The Iowa Income Tax form is governed by Iowa Code Chapter 422. |

| Refund or Amount Owed | Taxpayers will determine if they are owed a refund or if they need to pay additional taxes based on their total credits and tax liability. |

Discover Other PDFs

Iowa 123 - State-specific laws govern the execution and validity of the form.

How to Get Out of Child Support Debt - Clear contact information for the applicant and other involved parties aids in communication.

The New York Articles of Incorporation form is not only essential for establishing a corporation in New York State, but it can also be efficiently completed with the help of various resources, including PDF Templates that guide you through the process.

Iowa Sales Tax - Documentation regarding energy purchases is a fundamental part of the certification process.

Key takeaways

Filling out the Iowa Income Tax form can seem daunting, but understanding some key points can simplify the process. Here are essential takeaways to keep in mind:

- Complete Personal Information: Ensure that all personal details are accurately filled out. This includes your Social Security number, your name, and your spouse's information, if applicable.

- Choose the Correct Filing Status: Carefully select your filing status. This can significantly impact your tax calculations. Options include single, married filing jointly, and head of household, among others.

- Report All Income: Accurately report all sources of income, including wages, dividends, and any other earnings. This step is crucial for determining your overall tax liability.

- Claim Exemptions and Credits: Take advantage of available exemptions and credits. These can reduce your taxable income and lower your tax bill, so be sure to review the instructions for eligibility.

- Submit on Time: The completed form must be submitted by April 30. Late submissions may incur penalties, so it is important to file promptly and include any necessary documentation.

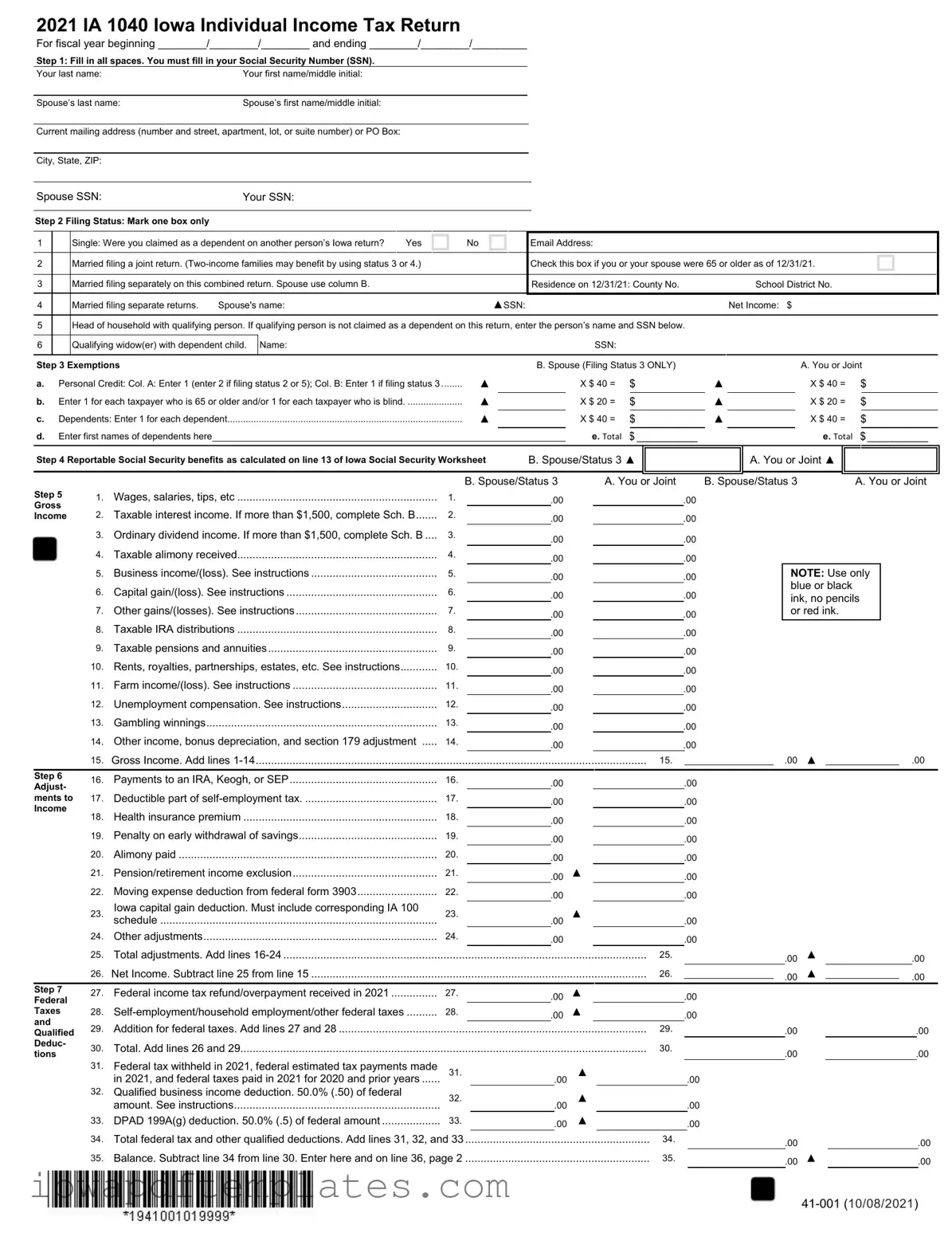

Sample - Iowa Income Tax Form

2021 IA 1040 Iowa Individual Income Tax Return

For fiscal year beginning ________/________/________ and ending ________/________/_________

Step 1: Fill in all spaces. You must fill in your Social Security Number (SSN). |

|

Your last name: |

Your first name/middle initial: |

|

|

Spouse’s last name: |

Spouse’s first name/middle initial: |

|

|

Current mailing address (number and street, apartment, lot, or suite number) or PO Box: |

|

|

|

City, State, ZIP: |

|

Spouse SSN: |

Your SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 2 Filing Status: Mark one box only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Single: Were you claimed as a dependent on another person’s Iowa return? |

Yes |

|

No |

|

|

Email Address: |

|

|

|

||

|

|

|

|

|

|

|

|

|||||

2 |

Married filing a joint return. |

|

|

|

|

Check this box if you or your spouse were 65 or older as of 12/31/21. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Married filing separately on this combined return. Spouse use column B. |

|

|

|

|

|

|

Residence on 12/31/21: County No. |

School District No. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Married filing separate returns. |

Spouse's name: |

|

|

|

▲SSN: |

|

|

Net Income: $ |

|||

5Head of household with qualifying person. If qualifying person is not claimed as a dependent on this return, enter the person’s name and SSN below.

6 |

Qualifying widow(er) with dependent child. |

Name: |

|

|

|

|

|

SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Step 3 Exemptions |

|

|

B. Spouse (Filing Status 3 ONLY) |

|

|

|

|

|

|

A. You or Joint |

|

||||||||||||||||

a. Personal Credit: Col. A: Enter 1 (enter 2 if filing status 2 or 5); Col. B: Enter 1 if filing status 3. |

....... |

▲ |

|

|

X $ 40 = |

$ |

|

|

|

▲ |

|

|

|

X $ 40 = |

|

$ |

|

|

|||||||||

b. Enter 1 for each taxpayer who is 65 or older and/or 1 for each taxpayer who is blind |

▲ |

|

|

X $ 20 = |

$ |

|

|

|

▲ |

|

|

|

X $ 20 = |

|

$ |

|

|

||||||||||

c. Dependents: Enter 1 for each dependent |

▲ |

|

|

X $ 40 = |

$ |

|

|

|

▲ |

|

|

|

X $ 40 = |

|

$ |

|

|

||||||||||

d. Enter first names of dependents here |

|

|

|

|

|

e. TOTAL |

$ __________ |

|

|

|

|

|

e. TOTAL |

$ __________ |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Step 4 Reportable Social Security benefits as calculated on line 13 of Iowa Social Security Worksheet |

B. Spouse/Status 3 ▲ |

|

|

|

|

A. You or Joint ▲ |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

B. Spouse/Status 3 |

|

A. You or Joint |

B. Spouse/Status 3 |

|

|

|

A. You or Joint |

||||||||||||||

Step 5 |

|

1. |

Wages, salaries, tips, etc |

1. |

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Gross |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

2. |

Taxable interest income. If more than $1,500, complete Sch. B |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Income |

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

3. |

Ordinary dividend income. If more than $1,500, complete Sch. B |

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

4. |

Taxable alimony received |

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

5. |

Business income/(loss). See instructions |

5. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

NOTE: Use only |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

blue or black |

|

|

|

|

|||||||

|

|

6. |

Capital gain/(loss). See instructions |

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

ink, no pencils |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Other gains/(losses). See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

7. |

7. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

or red ink. |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

8. |

Taxable IRA distributions |

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

9. |

Taxable pensions and annuities |

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

10. |

Rents, royalties, partnerships, estates, etc. See instructions |

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

11. |

Farm income/(loss). See instructions |

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

12. |

Unemployment compensation. See instructions |

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

13. |

Gambling winnings |

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

14. |

Other income, bonus depreciation, and section 179 adjustment |

14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Gross Income. Add lines |

|

|

|

|

|

|

|

|

|

▲ ______________ |

|

|||||||||||||

|

|

15. |

|

|

|

|

|

15. |

_________________ |

.00 |

.00 |

||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 6 |

|

16. |

Payments to an IRA, Keogh, or SEP |

16. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||

Adjust- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ments to |

17. |

. ...........................................Deductible part of |

17. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

18. |

Health insurance premium |

18. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

19. |

.............................................Penalty on early withdrawal of savings |

19. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

20. |

Alimony paid |

20. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

21. |

Pension/retirement income exclusion |

21. |

|

|

.00 |

▲ |

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

22. |

..........................Moving expense deduction from federal form 3903 |

22. |

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

23. |

Iowa capital gain deduction. Must include corresponding IA 100 |

23. |

|

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

schedule |

|

|

.00 |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

24. |

Other adjustments |

24. |

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

25. |

......................................................................................................................Total adjustments. Add lines |

|

|

|

|

|

25. |

|

|

|

|

.00 |

▲ |

|

|

|

|

.00 |

|||||||

|

|

26. |

Net Income. Subtract line 25 from line 15 |

|

|

|

|

|

26. |

_________________ |

.00 |

▲ ______________ |

.00 |

||||||||||||||

Step 7

Federal

Taxes and Qualified Deduc- tions

27. |

Federal income tax refund/overpayment received in 2021 |

27. |

|

.00 |

▲ |

|

.00 |

||||

28. |

28. |

.00 |

▲ |

.00 |

|||||||

29. |

Addition for federal taxes. Add lines 27 and 28 |

|

|

|

|

|

29. |

|

|

||

30. |

Total. Add lines 26 and 29 |

|

|

|

|

|

30. |

|

|

||

31. |

Federal tax withheld in 2021, federal estimated tax payments made |

31. |

|

|

|

|

▲ |

|

|

|

|

|

in 2021, and federal taxes paid in 2021 for 2020 and prior years |

.00 |

.00 |

||||||||

|

|

||||||||||

32. |

Qualified business income deduction. 50.0% (.50) of federal |

32. |

|

|

|

|

▲ |

|

|

|

|

|

amount. See instructions |

|

|

.00 |

|

|

.00 |

||||

|

|

||||||||||

33. |

DPAD 199A(g) deduction. 50.0% (.5) of federal amount |

33. |

|

|

.00 |

▲ |

|

|

.00 |

||

34. |

............................................................Total federal tax and other qualified deductions. Add lines 31, 32, and 33 |

|

|

|

|

34. |

|

|

|||

35. |

Balance. Subtract line 34 from line 30. Enter here and on line 36, page 2 |

|

|

|

|

35. |

|

|

|||

.00.00

.00.00

.00 |

|

|

.00 |

.00 |

▲ |

|

.00 |

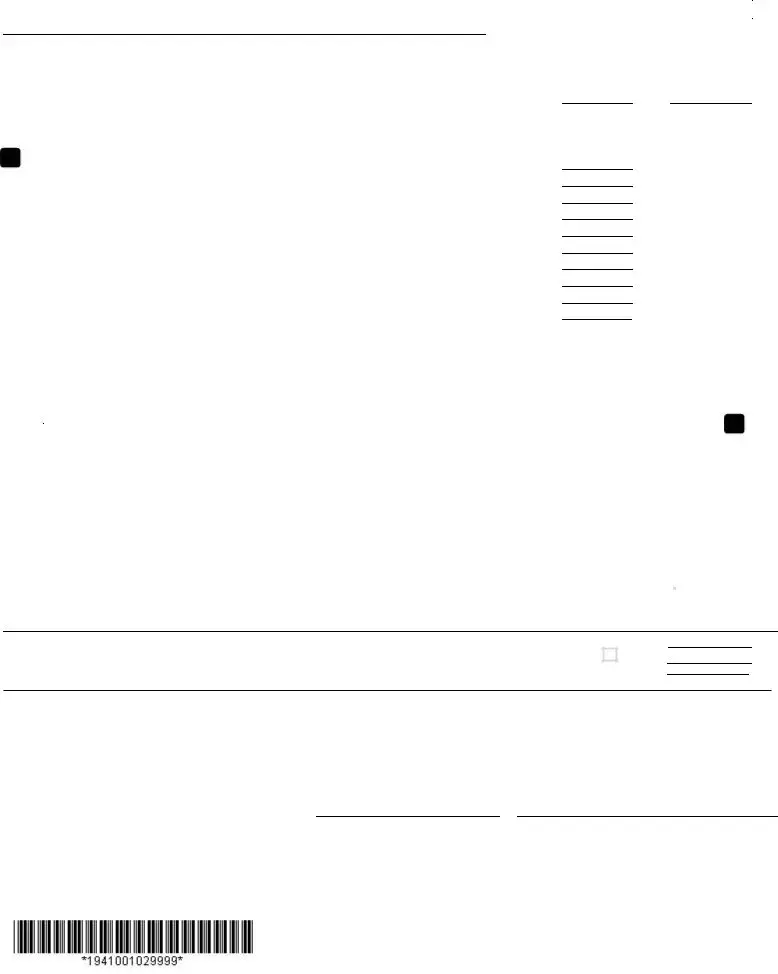

Step 8

Taxable

Income

|

page 2 |

|

B. Spouse/Status 3 |

A. You or Joint |

B. Spouse/Status 3 |

A. You or Joint |

||||||

36. |

BALANCE. From side 1, line 35 |

|

|

|

|

36. |

.00 |

|

.00 |

|||

37. |

Deduction. Check one box ▲ Itemized.(Include IA Schedule A) |

|

Standard |

|

........................................... |

37. |

|

.00 ▲ |

|

|

||

|

|

|

|

|

.00 |

|||||||

38. |

TAXABLE INCOME. SUBTRACT line 37 from line 36 |

|

|

|

|

38. |

|

|||||

|

|

|

|

______________ .00 |

|

________________ .00 |

||||||

|

|

|

|

|

|

|

|

|

||||

Step 9

Tax,

Credits, and Check- off Contri- butions

39. |

Tax from tables or alternate tax |

39. |

|

.00 |

▲ |

.00 |

|

40. |

Iowa |

40. |

|

|

▲ |

|

|

|

.00 |

.00 |

|||||

41. |

Iowa alternative minimum tax. Must include IA 6251 |

41. |

|

|

▲ |

|

|

|

.00 |

.00 |

|||||

42. |

Total tax. ADD lines 39, 40, and 41 |

|

|

|

42. |

|

|

|

|

|

|

|

|

|

|

43. |

Total exemption credit amount(s) from Step 3, side 1 |

43. |

|

.00 |

|

.00 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

44. |

Tuition and textbook credit for dependents |

44. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

45. |

Volunteer firefighter/EMS/reserve peace officer credit |

45. |

|

.00 |

▲ |

.00 |

|

46. |

Total credits. ADD lines 43, 44, and 45 |

|

|

|

46. |

|

|

47. |

BALANCE. SUBTRACT line 46 from line 42. If less than zero, enter zero |

|

|

47. |

|

||

48. |

Credit for nonresident or |

|

|

48. |

|

||

49. |

BALANCE. SUBTRACT line 48 from 47. If less than zero, enter zero |

|

|

|

49. |

|

|

50. |

|

|

|

50. |

|

||

51. |

BALANCE. SUBTRACT line 50 from 49. If less than zero, enter zero |

|

|

|

51. |

|

|

52. |

Other nonrefundable Iowa credits. Must include IA 148 Tax Credits Schedule |

|

|

52. |

|

||

53. |

BALANCE. SUBTRACT line 52 from line 51. If less than zero, enter zero |

|

|

53. |

|

||

54. |

School district surtax or EMS surtax. Take percentage from table; multiply by line 53 |

|

|

54. |

|

||

55. |

Total state and local tax. ADD lines 53 and 54 |

|

|

|

55. |

|

|

56.TOTAL state and local tax before contributions. Combine columns A and B on line 55 and enter here. ..................................................

57.Contributions will reduce your refund or add to the amount you owe. Amounts must be in whole dollars.

.00.00

.00 |

|

|

|

.00 |

|

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

.00 |

||

.00 |

▲ |

|

|

.00 |

|

56. |

|

|

|

.00 |

|

|

|

|

|||

|

Fish/Wildlife 57a: ▲ |

|

State Fair 57b: ▲ |

|

|

Firefighters/Veterans 57c: ▲ |

|

|

|

Child Abuse Prevention 57d: ▲ |

|

|

|

Enter here.... |

57. |

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||

|

58. TOTAL STATE AND LOCAL TAX, AND CONTRIBUTIONS. Add line 56 and line 57 and enter here |

|

|

|

|

|

|

58. |

▲ ________________ |

.00 |

|

||||||||||||||||||||||||||||||||||||||||

Step 10 |

59. |

Iowa Fuel Tax Credit. Must include IA 4136 |

|

|

|

|

|

|

|

59. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Credits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

60. |

Check One: |

Child and Dependent Care Credit |

|

|

|

OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

▲ Early Childhood Development Credit |

|

|

|

|

|

|

60. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

61. |

Iowa earned income tax credit. 15.0% (.15) of federal credit |

61. |

|

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

62. |

Other refundable credits. Include IA 148 Tax Credits Schedule |

62. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

63. |

Iowa income tax withheld |

|

|

|

|

|

|

|

63. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

64. |

Estimated and voucher payments made for tax year 2021 |

64. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

65. |

TOTAL. ADD lines 59 through 64 and enter here |

|

|

|

|

|

|

|

65. |

|

.00 |

▲ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

66. |

......................................................................................................TOTAL CREDITS. ADD columns A and B on line 65 and enter here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

66. |

________________ |

.00 |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Step 11 |

67. |

If line 66 is more than line 58, subtract line 58 from line 66. This is the amount you overpaid |

|

|

|

|

|

|

|

|

|

|

|

|

67. |

▲ |

|

.00 |

|

||||||||||||||||||||||||||||||||

Refund |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

68. |

Amount of line 67 to be REFUNDED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REFUND |

68. |

▲ |

|

.00 |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

68a. |

Routing number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

68b. Type Checking |

|

|

|

|

|

Savings |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

68c. |

Account number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

69. |

Amount of line 67 to be applied to your 2022 estimated tax |

69. |

|

|

|

.00 ▲ |

|

|

.00 |

|

|

||

|

|

|

|

|

|

|

|

|

||||||

Step 12 |

70. |

If line 66 is less than line 58, subtract line 66 from line 58. This is the AMOUNT OF TAX YOU OWE |

|

|

70. |

▲ |

||||||||

Pay |

|

|||||||||||||

71. |

Penalty for underpayment of estimated tax from IA 2210, IA 2210S, or IA 2210F. Check if annualized income method is used. ▲ |

|

▲ |

|||||||||||

|

71. |

|||||||||||||

|

72. |

Penalty and interest ▲ 72a. Penalty |

|

.00 |

|

▲ 72b. Interest |

|

.00 ADD. Enter total |

72. |

|

||||

|

73. |

TOTAL AMOUNT DUE. ADD lines 70, 71, and 72. Enter here |

|

|

|

|

|

PAY THIS AMOUNT |

73. |

▲ |

||||

.00

.00

.00

.00

Step 13

SIGN HERE

SIGN HERE

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this return, and, to the best of my knowledge and belief, it is true, correct, and complete.

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your signature |

Date |

Check if deceased |

Date of death |

|

Preparer's signature |

Date |

||

|

|

|

|

|

|

|

||

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's signature |

Date |

Check if deceased |

Date of death |

|

Preparer's PTIN |

Firm's FEIN |

||

Daytime telephone number |

Daytime telephone number |

This return is due May 2nd, 2022. Sign, enclose

PO BOX 9187, Des Moines IA

Similar forms

The Iowa Income Tax form is similar to the federal IRS Form 1040. Both forms serve the primary purpose of reporting income and calculating tax liability for individuals. They require personal information such as names, Social Security numbers, and filing status. Both forms also have sections for reporting various types of income, deductions, and credits, making them essential for accurate tax reporting. The structure of both forms guides taxpayers through a series of steps to ensure that all necessary information is included, ultimately leading to the calculation of the total tax owed or refund due.

The Illinois Individual Income Tax Form (IL-1040) shares similarities with the Iowa form. Like Iowa's form, it collects personal information, income details, and deductions. Taxpayers in Illinois also select their filing status and report various sources of income. The IL-1040 includes credits and exemptions similar to those found on the Iowa form, allowing taxpayers to reduce their overall tax liability. Both forms aim to ensure compliance with state tax laws while providing a straightforward process for taxpayers.

In addition to the various state income tax forms, it's essential for individuals engaged in asset transactions to have the appropriate documentation, such as a Bill of Sale form, which acts as a critical record of ownership transfer. This legal form serves to authenticate transactions, detailing important aspects such as the description of the item, its condition, and the agreed-upon sale price, ensuring clarity between the parties involved.

The California Resident Income Tax Return (Form 540) is another document akin to the Iowa Income Tax form. Both forms require detailed personal information and include sections for reporting income from multiple sources. California's form, like Iowa's, allows for the selection of filing status and exemptions, which can impact the tax owed. Additionally, both forms provide a pathway for claiming various credits, ultimately helping taxpayers calculate their final tax obligations or refunds.

The New York State Resident Income Tax Return (Form IT-201) is similar to the Iowa form in that it serves as a comprehensive tool for reporting income and calculating state taxes. Both documents require taxpayers to provide personal information and income details. They also offer options for deductions and credits, making it easier for individuals to reduce their tax burden. The overall structure and purpose of both forms align closely, as they guide residents through the tax filing process.

The Texas Franchise Tax Report is another document that shares some similarities with the Iowa Income Tax form. While Texas does not have a state income tax, the Franchise Tax Report requires businesses to report revenue and calculate taxes owed. Both forms involve detailed reporting of financial information, although the Iowa form is focused on individual income. Each form aims to ensure compliance with tax regulations, albeit for different types of taxpayers.

The Florida Individual Income Tax Return, although Florida does not impose a state income tax, is similar in that it focuses on reporting income and tax obligations. The form would be relevant for those who may have other tax obligations, such as federal taxes. Like Iowa's form, it requires personal information and details about income sources. Both forms aim to provide clarity and structure in the tax reporting process, even though Florida's is less commonly used due to the absence of a state income tax.

The Massachusetts Resident Income Tax Return (Form 1) mirrors the Iowa form in its collection of personal and income information. Taxpayers in Massachusetts also report various income sources and select their filing status. The form includes sections for deductions and credits, allowing for a comprehensive calculation of tax liability. Both forms aim to facilitate compliance with state tax laws while providing a clear framework for taxpayers.

The Pennsylvania Personal Income Tax Return (Form PA-40) is another document that resembles the Iowa Income Tax form. Both forms require personal information and detailed income reporting. Pennsylvania taxpayers also have the opportunity to claim deductions and credits, similar to the options available on the Iowa form. Each form is designed to ensure that taxpayers accurately report their income and calculate their tax obligations.

The Ohio Individual Income Tax Return (Form IT 1040) shares characteristics with the Iowa form as well. Both forms require taxpayers to provide personal information and report various types of income. They also allow for the selection of filing status and the claiming of deductions and credits. The structure of both forms guides taxpayers through the necessary steps to ensure accurate tax reporting and compliance with state laws.

Finally, the New Jersey Resident Income Tax Return (Form NJ-1040) is similar to the Iowa Income Tax form. Both documents require comprehensive personal and income information. New Jersey taxpayers also select their filing status and can claim various deductions and credits, just like in Iowa. The design and purpose of both forms align closely, as they serve to facilitate the tax filing process for residents of their respective states.