Free Iowa Renters Rebate Template

Things You Should Know About This Form

What is the Iowa Renters Rebate form?

The Iowa Renters Rebate form is a document that allows eligible renters in Iowa to claim a reimbursement for a portion of the rent they paid during the previous year. This program is designed to assist low-income individuals and families, particularly those who are elderly or disabled. Completing this form accurately is essential to receive any potential benefits.

Who is eligible to apply for the Renters Rebate?

Eligibility for the Iowa Renters Rebate depends on several factors:

- Applicants or their spouses must be born before 1956 or be totally disabled.

- Applicants must have lived in Iowa during the previous year.

- Household income must be below a certain threshold, specifically less than $24,206.

If you do not meet these criteria, you will not qualify for the rebate.

What information do I need to complete the form?

When filling out the form, you will need to provide:

- Your name and address.

- Your birth date and Social Security number.

- Information about your spouse, if applicable.

- Your total household income from various sources.

- Details about the rent you paid, including rental addresses and dates.

Make sure to include any required proof of income and rent paid to avoid delays.

How do I calculate my estimated reimbursement?

To estimate your reimbursement, follow these steps:

- Add up all the rent you paid in Iowa for the year.

- Multiply that total by 0.23, but if the result exceeds $1,000, enter $1,000.

- Refer to the income table provided in the form to determine the applicable rate based on your total household income.

- Finally, multiply the result from the previous step by the rate to find your estimated reimbursement.

Ensure accuracy to receive the correct amount.

Where do I send my completed Renters Rebate form?

Once you have completed the form, mail it to:

Rent Reimbursement

Iowa Department of Revenue

PO Box 10459

Des Moines, IA 50306-0459

Be sure to include all necessary documentation to avoid processing delays.

How can I check the status of my refund?

You can check the status of your refund by visiting the Iowa Department of Revenue's website at tax.iowa.gov. Alternatively, you can call their customer service at 1-800-572-3944 for assistance. It’s important to keep track of your application to ensure timely processing.

Form Features

| Fact Name | Details |

|---|---|

| Eligibility Age | Applicants or their spouses must be born before 1956 or be totally disabled and born between 1956 and 2002. |

| Residency Requirement | Applicants must have lived in Iowa during the year for which they are claiming the rebate. |

| Filing as a Couple | Married couples living together must file a single claim, combining both incomes. |

| Income Limits | If total annual household income exceeds $24,206, the applicant does not qualify for the rebate. |

| Rental Address Requirement | The rental property must be subject to property tax to qualify for reimbursement. |

| Proof of Income | Applicants must provide proof of income, including Social Security and disability income. |

| Reimbursement Calculation | Eligible rent is multiplied by a rate based on total benefits and income to determine the estimated reimbursement. |

| Direct Deposit Option | Applicants can choose to receive their reimbursement via direct deposit by providing their bank account information. |

| Mailing Address for Claims | Completed forms should be mailed to the Iowa Department of Revenue, PO Box 10459, Des Moines, IA 50306-0459. |

| Legal Authority | The Iowa Renters Rebate program is governed by Iowa Code Section 425.1 et seq. |

Discover Other PDFs

What Does a Job Application Look Like - Provide your previous employers’ names for reference checks.

For entrepreneurs in Colorado, understanding the importance of the complete Articles of Incorporation process is vital to ensuring that their corporation is established legally and efficiently. This foundational document plays a critical role in defining the legal structure and purpose of a new business entity.

Iowa Power of Attorney - Clear identification of tax types helps streamline processing with the Department.

Key takeaways

Here are some key takeaways about filling out and using the Iowa Renters Rebate form:

- Complete the form carefully. Use blue or black ink only. Avoid using pencil or gel pens. Incomplete claims may cause delays.

- Eligibility is crucial. Make sure you or your spouse meet the age or disability requirements. If you do not qualify, do not proceed with the application.

- Provide accurate income information. Include all sources of income, even if they are not reported for Iowa income tax. Documentation is necessary.

- Rental information must be precise. Ensure that the rental address is subject to property tax. If you lived in multiple locations, report all rent paid.

- Understand the reimbursement calculation. The form provides specific guidelines for calculating the rent eligible for reimbursement based on your total income.

- Submit the form on time. Include all required documents and mail it to the Iowa Department of Revenue. Check your refund status online or by phone if needed.

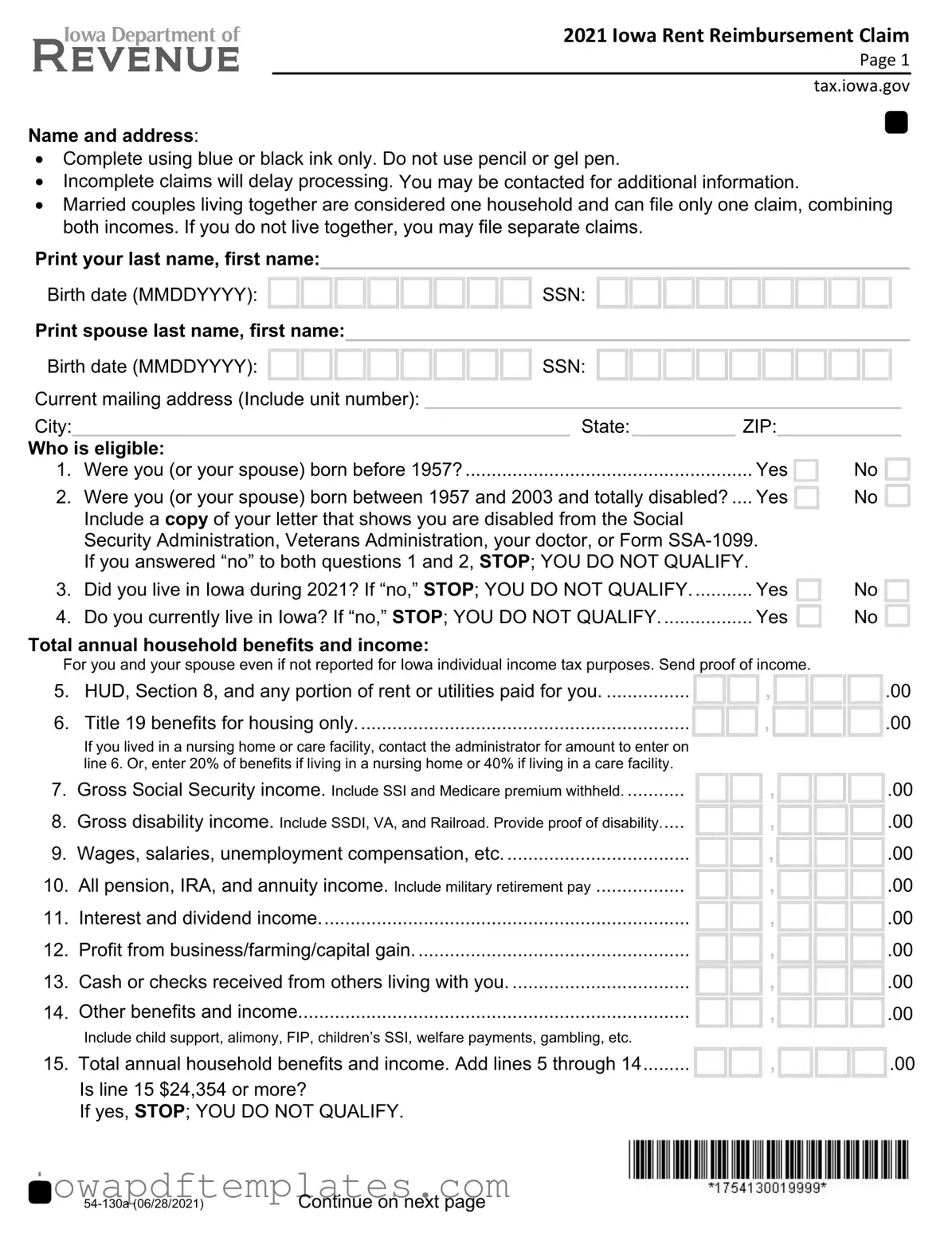

Sample - Iowa Renters Rebate Form

2021 IOWA RENT REIMBURSEMENT CLAIM

Page 1

tax.iowa.gov

Name and address:

•Complete using blue or black ink only. Do not use pencil or gel pen.

•Incomplete claims will delay processing. You may be contacted for additional information.

•Married couples living together are considered one household and can file only one claim, combining both incomes. If you do not live together, you may file separate claims.

Print your last name, first name:

Birth date (MMDDYYYY):

Print spouse last name, first name:

SSN:

Birth date (MMDDYYYY):

SSN:

Current mailing address (Include unit number): ______________________________________________

City:________________________________________________ State:__________ ZIP:____________

Who is eligible: |

|

|

|

1. |

Were you (or your spouse) born before 1957? |

Yes |

No |

2. |

Were you (or your spouse) born between 1957 and 2003 and totally disabled? .... |

Yes |

No |

|

Include a copy of your letter that shows you are disabled from the Social |

|

|

Security Administration, Veterans Administration, your doctor, or Form

3. |

Did you live in Iowa during 2021? If “no,” STOP; YOU DO NOT QUALIFY |

Yes |

4. |

Do you currently live in Iowa? If “no,” STOP; YOU DO NOT QUALIFY |

Yes |

Total annual household benefits and income:

For you and your spouse even if not reported for Iowa individual income tax purposes. Send proof of income.

No No

5.HUD, Section 8, and any portion of rent or utilities paid for you.

6.Title 19 benefits for housing only................................................................................

If you lived in a nursing home or care facility, contact the administrator for amount to enter on line 6. Or, enter 20% of benefits if living in a nursing home or 40% if living in a care facility.

7.Gross Social Security income. Include SSI and Medicare premium withheld. ...........

8.Gross disability income. Include SSDI, VA, and Railroad. Provide proof of disability.....

9.Wages, salaries, unemployment compensation, etc....................................

10.All pension, IRA, and annuity income. Include military retirement pay

11.Interest and dividend income.......................................................................

12.Profit from business/farming/capital gain.....................................................

13.Cash or checks received from others living with you. ..................................

14.Other benefits and income............................................................................................

Include child support, alimony, FIP, children’s SSI, welfare payments, gambling, etc.

15. Total annual household benefits and income. Add lines 5 through 14.........

Is line 15 $24,354 or more?

If yes, STOP; YOU DO NOT QUALIFY.

,

,

,

,

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Continue on next page |

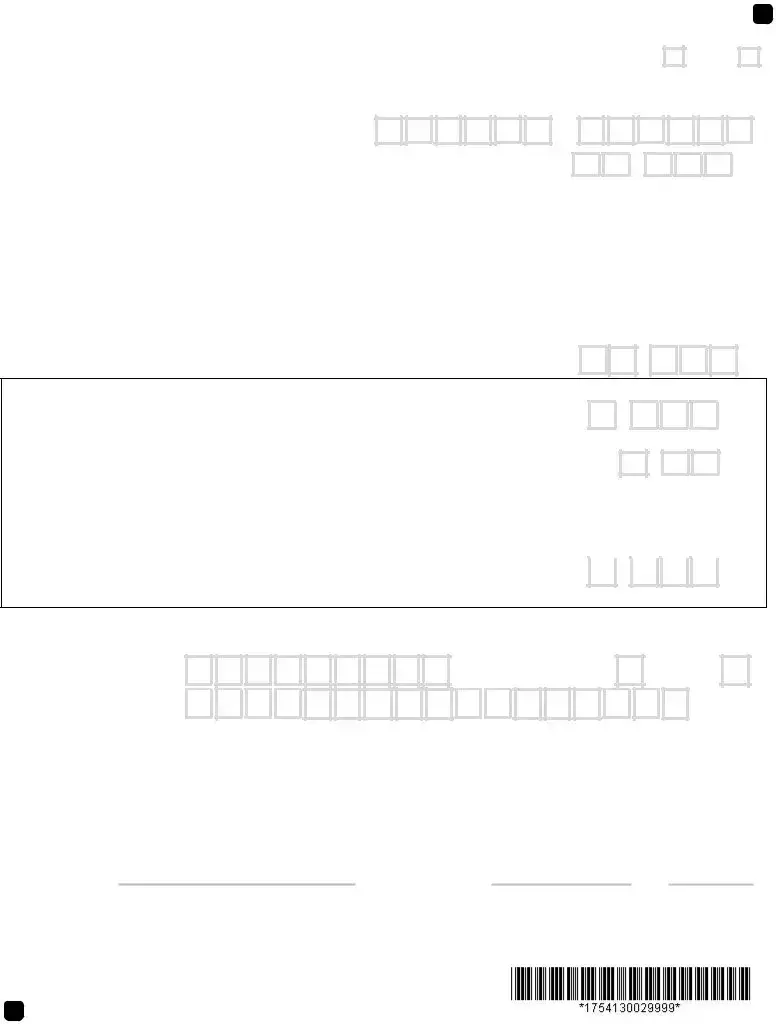

2021 IOWA RENT REIMBURSEMENT CLAIM, Page 2

Rental information: Complete the Statement of Rent Paid if you lived in more than one place.

16. Did you live in a nursing home or care facility? If yes, report Title 19 benefits on line 6. Yes

No

17.Rental address. The location where you lived must be subject to property tax. You are not eligible for rent reimbursement if the location or nursing home was not subject to property tax.

Dates you rented in 2021 (MMDDYY): from

to

Total Iowa rent you paid at this location...................................................

,

.00

Street (PO Box not allowed): ______________________________________________________

City: __________________________________________ |

State: |

ZIP: |

|||

Landlord or nursing home: |

|

|

|

|

|

Name:_________________________________________ |

Phone number: ( |

) |

|||

|

|

|

|

|

|

Address: ______________________________________________________________________

City: __________________________________________ State:_________ ZIP: ___________

If you lived in more than one location, complete the Statement of Rent paid for all other locations.

18. Total Iowa rent you paid in 2021. Add rent for all locations...........................

,

.00

This section optional: Complete lines 19 to 21 below, or allow the Department to compute for you.

19. Rent eligible for reimbursement. Multiply line 18 by 0.23, enter result. ......

,

.00

If more than 1,000, enter 1,000. Example: if line 18 = 3,900, multiply 3,900 x 0.23 = Enter 897 on line 19

20. Select rate from table below based on total benefits and income on line 15: |

X |

.

$0.00 - |

$12,545.99 |

enter 1.00 |

$18,450 - |

$21,401.99 |

enter 0.35 |

|||||||

$12,546 - $14,021.99 |

enter 0.85 |

$21,402 - |

$24,353.99 |

enter 0.25 |

||||||||

$14,022 - |

$15,497.99 |

enter 0.70 |

$24,354 or greater....STOP; you do not qualify. |

|||||||||

$15,498- |

$18,449.99 |

enter 0.50 |

|

|

|

|

|

|

|

|

|

|

21.Estimated reimbursement. Multiply line 19 by line 20. ...................................

Example: line 19 = 897, multiply 897 by 0.70 = 628, enter on line 21.

,

.00

Direct deposit information:

To receive direct deposit of your reimbursement to your account, complete lines A and B.

A.Routing number:

B.Account number:

Type: Checking

Savings

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this claim, and, to the best of my knowledge and belief, it is true, correct, and complete.

|

|

|

|

|

|

|

|

|

|

If deceased, |

|

Your signature: |

|

|

|

|

|

Date: |

|

|

|

date of death: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If deceased, |

|

Spouse signature: |

|

|

|

|

Date: |

|

|

|

date of death: |

||

Your phone number: ( |

) |

Preparer phone number: ( |

) |

|

|||||||

|

|||||||||||

Preparer name: |

|

|

Preparer signature: |

|

Date: |

||||||

►Include proof of income and rent paid. If under 65, also include proof of disability.

Mail to: Rent Reimbursement, Iowa Department of Revenue, PO Box 10459, Des Moines, IA

Similar forms

The Iowa Renters Rebate form shares similarities with the federal Form 1040, which is the standard individual income tax return used by U.S. taxpayers. Both forms require individuals to report their income and determine eligibility for certain benefits. Just as the Iowa Renters Rebate assesses total household income to establish qualification for a rebate, the Form 1040 calculates taxable income to determine tax liability or refund eligibility. Both forms necessitate accurate reporting and supporting documentation, and errors or omissions can lead to delays in processing or denial of claims.

Another document comparable to the Iowa Renters Rebate form is the Supplemental Nutrition Assistance Program (SNAP) application. Like the Renters Rebate, the SNAP application requires applicants to provide detailed information about their household income and expenses to assess eligibility for benefits. Both documents aim to support low-income individuals and families, ensuring they receive necessary assistance. The information collected is subject to verification, and both programs emphasize the importance of accurate and complete submissions to avoid complications in processing.

The Low-Income Home Energy Assistance Program (LIHEAP) application also resembles the Iowa Renters Rebate form. Both documents focus on assisting individuals and families with limited financial resources. Applicants must provide information regarding their income and living situation. LIHEAP, like the Renters Rebate, requires proof of income and residency, which helps determine the level of assistance that can be provided. The goal of both programs is to alleviate financial burdens for those who qualify.

The Social Security Administration's Application for Benefits mirrors the Iowa Renters Rebate form in that both require comprehensive personal and financial information. When applying for Social Security benefits, individuals must disclose income, living arrangements, and any disabilities. This information is critical in assessing eligibility for various types of benefits. Both forms prioritize accuracy and completeness, as any discrepancies can result in delays or denial of benefits.

The Veterans Affairs (VA) Disability Compensation claim form is another document similar to the Iowa Renters Rebate. Both forms require applicants to provide personal information and documentation of income. The VA form assesses eligibility for benefits based on service-related disabilities, while the Renters Rebate evaluates financial need based on household income. Both processes involve a thorough review of submitted information to ensure that assistance is directed to those who truly qualify.

In New York, as individuals navigate the intricate process of establishing a corporation, they must pay careful attention to the Articles of Incorporation form, which serves as a foundational document detailing the corporation's name, purpose, and structure. For anyone interested in streamlining this process and ensuring compliance, resources such as PDF Templates can provide essential guidance and templates to facilitate accurate completion of the required forms.

The Federal Housing Administration (FHA) loan application is akin to the Iowa Renters Rebate form in that both require detailed financial disclosures. FHA loans are designed to assist low-to-moderate income individuals in obtaining home financing. Applicants must provide information on income, employment, and debts, similar to the income verification process in the Renters Rebate. Both documents aim to facilitate access to housing assistance, albeit in different forms.

The Application for Temporary Assistance for Needy Families (TANF) also shares characteristics with the Iowa Renters Rebate form. TANF provides financial assistance to families in need, requiring applicants to disclose income, household composition, and living expenses. Both forms are designed to evaluate financial need and ensure that assistance is allocated to eligible families. The verification process in both programs is critical to maintaining the integrity of the assistance provided.

The Child Tax Credit application, part of the federal tax return process, resembles the Iowa Renters Rebate in that both require detailed information about household income and family size. The Child Tax Credit aims to provide financial relief to families with children, while the Renters Rebate focuses on assisting those who pay rent. Both forms require accurate reporting to determine the amount of benefit received, reflecting the importance of financial information in both programs.

Lastly, the Medicaid application parallels the Iowa Renters Rebate form in that both require extensive personal and financial information to determine eligibility. Medicaid provides health coverage to low-income individuals and families, necessitating income verification similar to the Renters Rebate. Both documents emphasize the importance of accurate and complete submissions, as any errors can impact the level of assistance provided.