Free Iowa Resale Certificate Template

Things You Should Know About This Form

What is the Iowa Resale Certificate form used for?

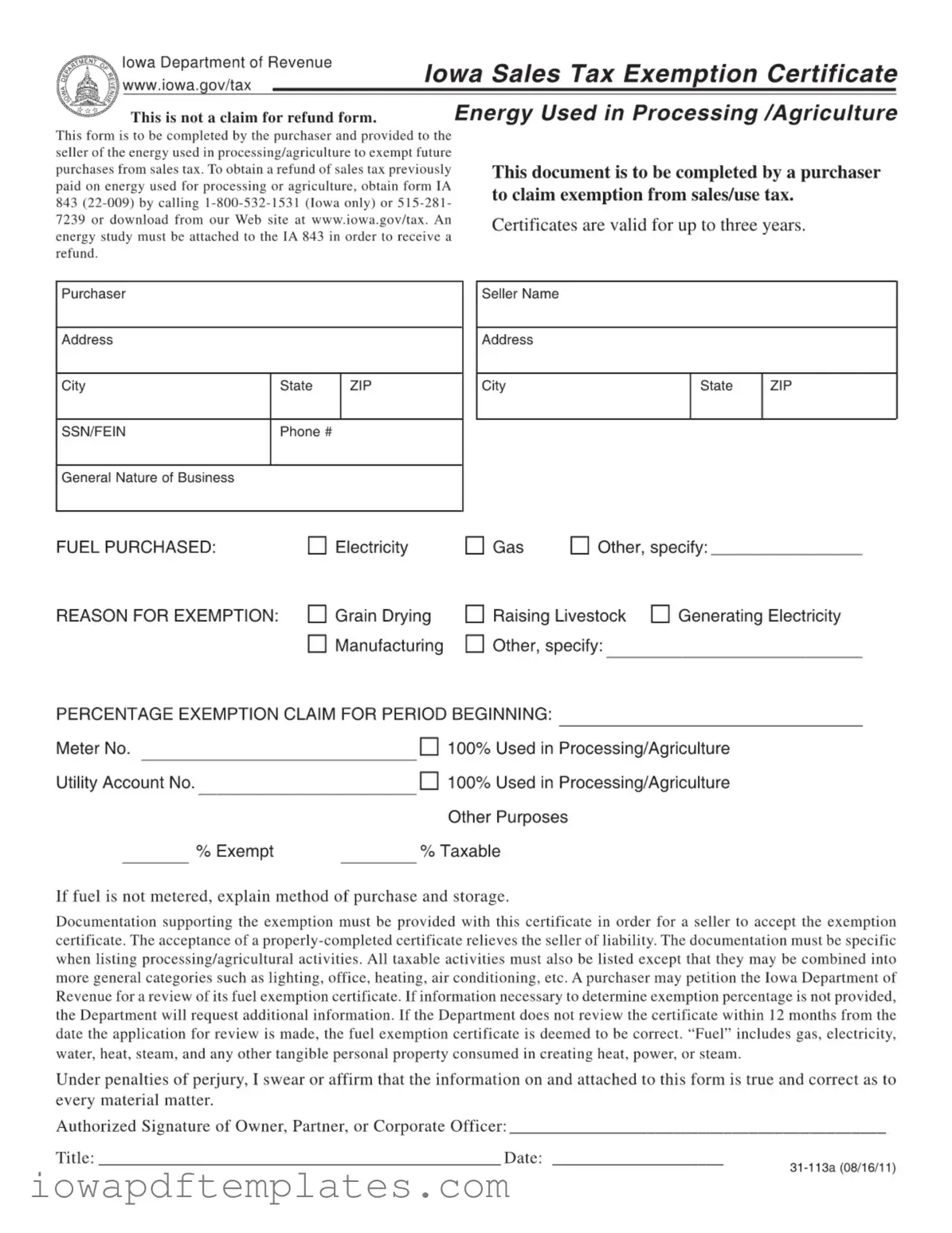

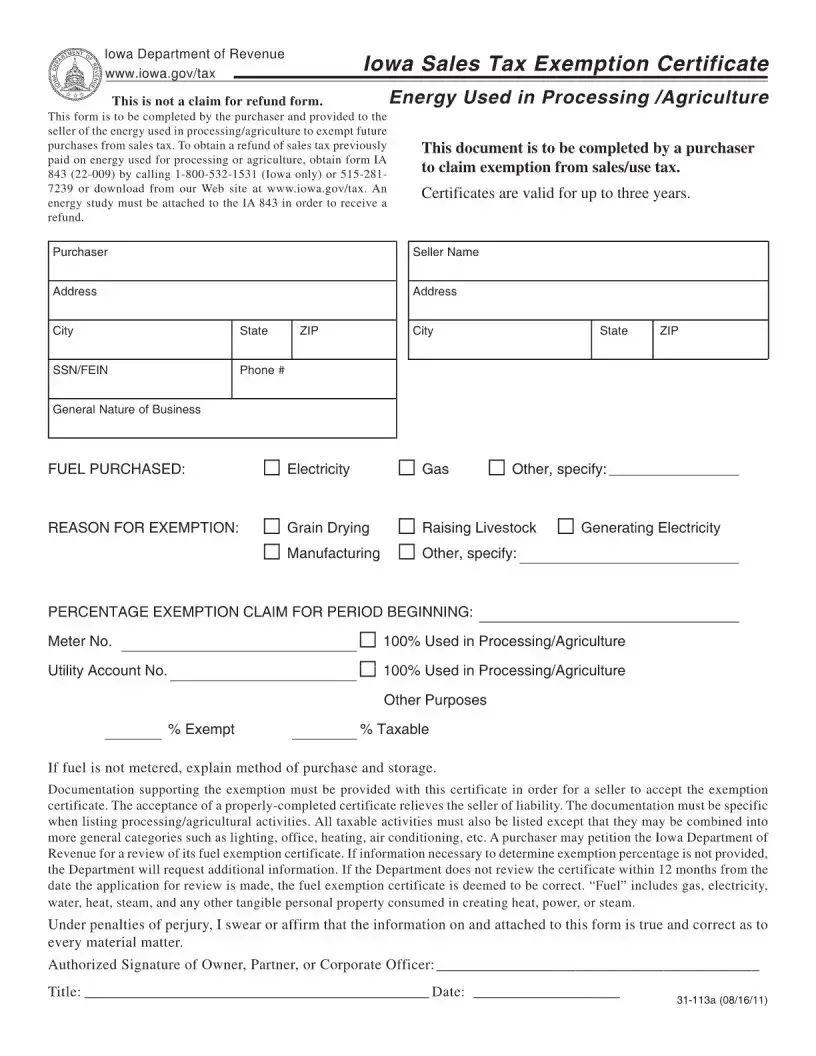

The Iowa Resale Certificate form is designed for purchasers to claim exemption from sales and use tax on energy used in processing or agriculture. By completing this form, buyers can exempt future purchases from sales tax, provided they use the energy for qualifying activities such as grain drying or livestock raising.

Who should complete the Iowa Resale Certificate?

This form should be completed by the purchaser of energy who intends to use it for exempt purposes. Typically, this includes businesses involved in agriculture or processing industries that utilize energy in their operations.

How long is the Iowa Resale Certificate valid?

The certificate is valid for up to three years from the date it is completed. After this period, a new certificate must be submitted to continue claiming the exemption.

What information is required to complete the form?

To properly fill out the Iowa Resale Certificate, the following information is typically required:

- Purchaser's name and address

- Seller's name and address

- Type of fuel purchased (e.g., electricity, gas)

- Reason for exemption (e.g., grain drying, manufacturing)

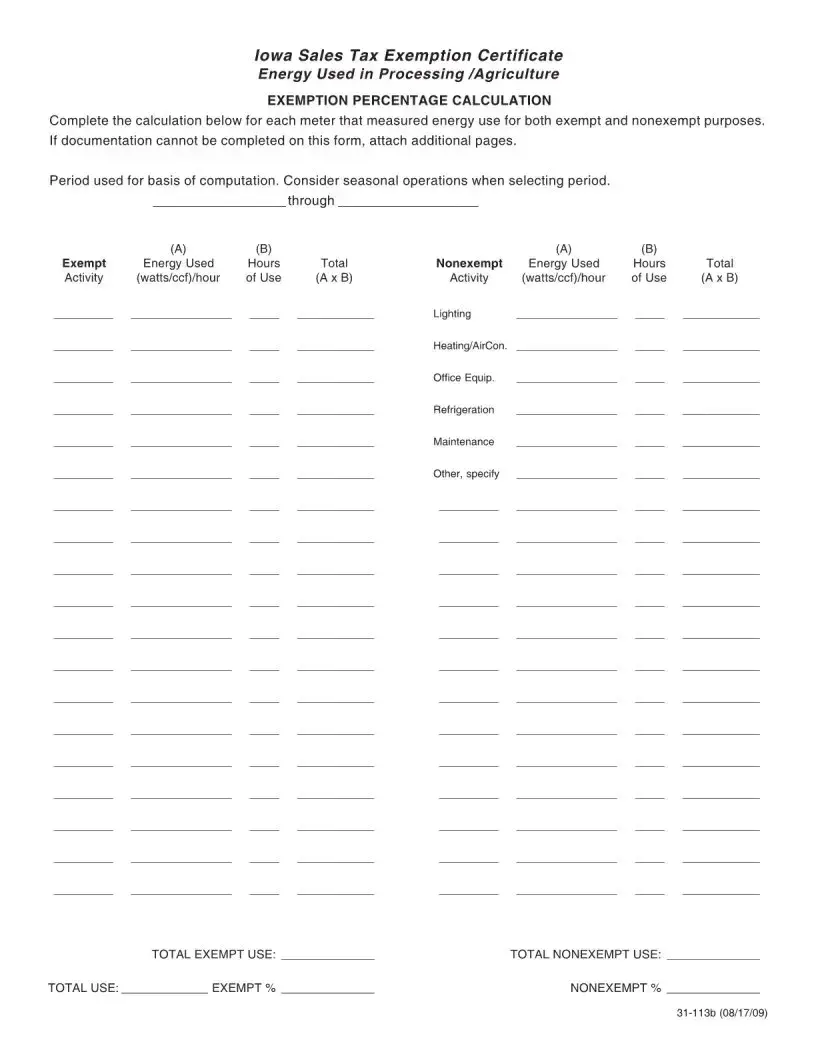

- Percentage of exemption claimed

- Details about energy usage, including meter numbers and utility account numbers

What documentation must accompany the Iowa Resale Certificate?

Documentation supporting the exemption must be provided alongside the certificate. This may include an energy study or other relevant information that details the processing or agricultural activities for which the exemption is being claimed.

What happens if the Iowa Department of Revenue does not review the certificate?

If the Department does not review the fuel exemption certificate within 12 months of the application for review, the certificate is automatically deemed correct. This means that the purchaser can continue to rely on the exemption without additional validation from the Department.

Can a seller refuse to accept the Iowa Resale Certificate?

Sellers can refuse to accept the Iowa Resale Certificate if it is not properly completed or if the necessary supporting documentation is not provided. Accepting a properly completed certificate relieves the seller of liability for sales tax on the exempt purchases.

What should a purchaser do if they need to obtain a refund for sales tax already paid?

To obtain a refund for sales tax previously paid on energy used for processing or agriculture, purchasers must fill out form IA 843. This form can be obtained by calling the Iowa Department of Revenue. An energy study must also be attached to the IA 843 to support the refund request.

What types of energy are included under the term "fuel" in this context?

The term "fuel" encompasses various forms of energy, including gas, electricity, water, heat, steam, and any other tangible personal property consumed in creating heat, power, or steam. It is essential to specify the type of fuel being purchased on the certificate to ensure proper processing of the exemption.

Form Features

| Fact Name | Description |

|---|---|

| Purpose | The Iowa Resale Certificate is used by purchasers to claim exemption from sales tax on energy used in processing or agriculture. |

| Form Completion | This form must be completed by the purchaser and provided to the seller to exempt future purchases from sales tax. |

| Validity Period | Certificates are valid for up to three years from the date of issuance. |

| Documentation Requirement | Documentation supporting the exemption must accompany the certificate for the seller to accept it. |

| Refund Process | To obtain a refund of sales tax previously paid, one must use form IA 843 and attach an energy study. |

| Governing Law | The use of this certificate is governed by the Iowa Code, specifically related to sales and use tax exemptions. |

| Petition for Review | A purchaser may petition the Iowa Department of Revenue for a review of their fuel exemption certificate if needed. |

Discover Other PDFs

Iowa State Taxes - Changes in filing status can have significant tax implications.

Iowa Master Electrician License Requirements - Each applicant must ensure that all relevant sections are completed accurately for the application to be processed.

To simplify the process of creating a Motor Vehicle Bill of Sale, you can utilize reliable resources like PDF Templates that provide standardized forms, ensuring all necessary details are captured accurately and legally.

Iowa 123 - It includes a declaration regarding medical treatments in the event of terminal conditions.

Key takeaways

Understanding the Iowa Resale Certificate form is essential for businesses involved in processing or agriculture. Here are some key takeaways to keep in mind:

- Purpose of the Form: The Iowa Resale Certificate is used to claim an exemption from sales tax on energy purchases specifically for processing and agricultural activities.

- Validity: Certificates are valid for a period of up to three years. It is important to keep track of expiration dates to ensure continued compliance.

- Documentation Required: When submitting the certificate, supporting documentation must be provided. This documentation should detail the specific processing or agricultural activities for which the exemption is claimed.

- Claiming Refunds: If sales tax has been paid on energy used for processing or agriculture, a refund can be requested using form IA 843. An energy study must accompany this form.

- Review Process: A purchaser can request a review of their fuel exemption certificate from the Iowa Department of Revenue. If the Department does not respond within 12 months, the certificate is automatically deemed correct.

- Types of Energy Included: The term "fuel" encompasses various forms of energy, including gas, electricity, water, heat, and steam, all of which may be eligible for exemption if used appropriately.

By adhering to these guidelines, businesses can effectively utilize the Iowa Resale Certificate to manage their tax obligations and ensure compliance with state regulations.

Sample - Iowa Resale Certificate Form

Similar forms

The Iowa Sales Tax Exemption Certificate for Energy Used in Processing/Agriculture is closely related to the general Sales Tax Exemption Certificate. Both documents serve the purpose of allowing purchasers to claim an exemption from sales tax on specific types of purchases. While the Iowa form is tailored for energy used in agricultural processing, the general Sales Tax Exemption Certificate can be used for a broader range of goods and services. This means that businesses in various sectors can utilize the general certificate to avoid paying sales tax, provided they meet the necessary criteria for exemption. Both forms require detailed information about the purchaser and the nature of the business, ensuring that the seller can verify the legitimacy of the exemption claimed.

In various legal contexts, individuals may encounter the comprehensive Release of Liability documentation as a crucial tool for mitigating risk. This form enables parties to acknowledge and accept the inherent dangers associated with specific activities, thereby protecting service providers from potential legal claims. By clearly outlining the terms and conditions, this document plays a vital role in legal agreements where liability is a significant consideration.

Another similar document is the Resale Certificate, which is utilized when a business purchases goods with the intention of reselling them. Like the Iowa Resale Certificate, the Resale Certificate allows the buyer to avoid paying sales tax on items that will not be consumed but rather sold to consumers. This document requires the buyer to provide their tax identification number and details about the items being purchased for resale. Both certificates relieve sellers from the responsibility of collecting sales tax on exempt purchases, provided the buyer presents a valid certificate at the time of sale.

The Manufacturer's Exemption Certificate is another document that shares similarities with the Iowa Resale Certificate. This certificate allows manufacturers to purchase specific items without paying sales tax, as these items are integral to the manufacturing process. Just as the Iowa Resale Certificate is designed to facilitate tax-exempt transactions for resale, the Manufacturer's Exemption Certificate serves a similar purpose but is focused on the manufacturing sector. Both documents require the purchaser to provide information about their business and the intended use of the items, ensuring compliance with tax regulations.

Finally, the Nonprofit Organization Exemption Certificate is akin to the Iowa Resale Certificate in that it allows qualifying nonprofit organizations to make tax-exempt purchases. Nonprofits can use this certificate to avoid paying sales tax on goods and services that support their charitable missions. Similar to the Iowa form, this certificate requires the organization to provide its tax-exempt status and details about the purchases being made. Both documents aim to facilitate tax relief for specific types of buyers, ensuring that they can operate effectively without the burden of sales tax on eligible purchases.