Free Iowa Short Template

Things You Should Know About This Form

What is the Iowa Short Form Cash Rent Farm Lease?

The Iowa Short Form Cash Rent Farm Lease is a document that helps landowners and operators create a rental agreement tailored to their specific needs. This form outlines the terms and conditions of the lease, including the duration, payment details, and responsibilities of both parties. However, it does not replace legal advice regarding contractual relationships.

How long does the lease last?

The lease term is for a specified number of years, starting on March 1 of a given year. After the initial term ends, the lease automatically continues on a yearly basis unless either party terminates it through a written agreement or a statutory notice by September 1, effective the following March 1.

What are the payment terms for cash rent?

The operator agrees to pay the owner cash rent based on the type of land being rented. The lease specifies amounts for cropland, hay land, pasture, and any buildings or storage structures. Payment dates and amounts are also outlined, ensuring clarity on when rent is due.

Can the operator use the property for recreational activities?

Who is responsible for crop production expenses?

The operator is responsible for all crop production expenses. This includes costs related to planting, maintaining, and harvesting crops. Additionally, any costs incurred for lime application require the owner's prior written permission.

What happens if there is damage to buildings or structures?

If any buildings or structures on the property are damaged or destroyed, the owner has the option to replace them or provide a functional equivalent to the operator. This must be done within a reasonable timeframe, or adjustments may be made to the lease terms instead of replacement.

What are the operator's duties under the lease?

The operator must manage the farm efficiently and responsibly. This includes controlling weeds, maintaining terraces and waterways, and providing an annual report to the owner by December 15. Upon termination of the lease, the operator must return the property in good condition or compensate the owner for any damages.

Can the operator transfer their lease to someone else?

No, the operator cannot lease or sublet any part of the property without the owner's written permission. This clause ensures that the owner maintains control over who uses their land and preserves the integrity of the lease agreement.

What happens in case of a dispute between the owner and operator?

If any disputes arise that are not covered by the lease, either party can submit the issue for arbitration. A panel of three disinterested persons will be appointed, and their majority decision will be binding on both parties. This process provides a fair resolution without resorting to litigation.

Form Features

| Fact Name | Description |

|---|---|

| Purpose | The Iowa Short Form serves as a guide for owners and operators to create a tailored farm lease agreement. |

| Lease Duration | The lease typically lasts for a year, starting on March 1, and continues annually unless terminated by written notice. |

| Governing Law | This form is governed by Iowa law, particularly regarding lease termination and notice requirements. |

| Operator's Responsibilities | The operator must manage the farm efficiently, handle crop production expenses, and provide annual reports to the owner. |

| Owner's Rights | The owner retains the right to enter the premises for reasonable purposes and must pay property taxes and insurance. |

Discover Other PDFs

Iowa Cubs Mascot - We look forward to supporting your organization's initiatives.

The New York Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in New York State. It outlines key details about the corporation, such as its name, purpose, and structure. Understanding how to complete this form correctly can pave the way for a smooth business launch—start filling out the form by visiting the PDF Templates page to access the necessary resources.

Answer Iowa - Following these instructions carefully promotes a smoother legal experience.

Iowa Doc - State if your visiting privileges have ever been denied or suspended.

Key takeaways

Here are key takeaways about filling out and using the Iowa Short Form:

- This form serves as a guide for owners and operators to create a customized lease agreement.

- Legal advice is not provided by this form; consult a legal professional for contractual relationships.

- The lease term begins on March 1 and continues annually unless terminated by written agreement or statutory notice.

- Operators must keep records of contract acres as per county FSA records.

- Cash rent payments must be clearly defined, including due dates and amounts.

- USDA Commodity Program Payments typically go to the Operator unless otherwise agreed.

- Recreational use of the property requires written consent from the Owner.

- All crop production expenses are the Operator's responsibility, and prior approval is needed for any expenses incurred on behalf of the Owner.

- The Operator must maintain the property and provide an annual report to the Owner by December 15.

- Both parties have specific duties outlined in the lease, including the Owner's responsibility to pay taxes and the Operator's obligation to maintain the property.

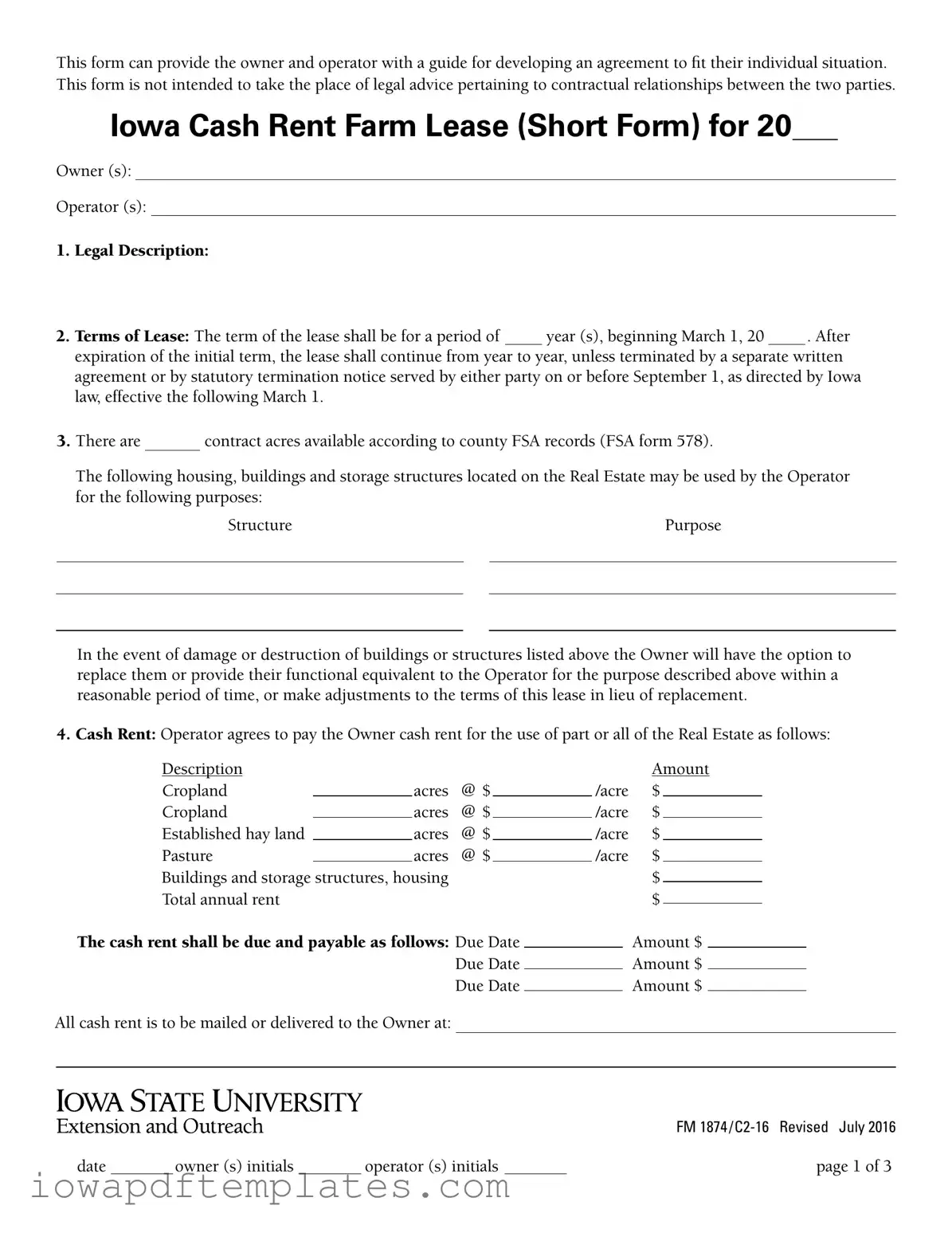

Sample - Iowa Short Form

This form can provide the owner and operator with a guide for developing an agreement to fit their individual situation. This form is not intended to take the place of legal advice pertaining to contractual relationships between the two parties.

IOWA CASH RENT FARM LEASE (SHORT FORM) FOR 20

Owner (s):

Operator (s):

1. Legal Description:

2. Terms of Lease: The term of the lease shall be for a period of year (s), beginning March 1, 20 . After

expiration of the initial term, the lease shall continue from year to year, unless terminated by a separate written agreement or by statutory termination notice served by either party on or before September 1, as directed by Iowa law, effective the following March 1.

3. There are |

|

contract acres available according to county FSA records (FSA form 578). |

The following housing, buildings and storage structures located on the Real Estate may be used by the Operator for the following purposes:

Structure |

|

Purpose |

|

|

|

|

|

|

|

|

|

In the event of damage or destruction of buildings or structures listed above the Owner will have the option to replace them or provide their functional equivalent to the Operator for the purpose described above within a reasonable period of time, or make adjustments to the terms of this lease in lieu of replacement.

4.Cash Rent: Operator agrees to pay the Owner cash rent for the use of part or all of the Real Estate as follows:

Description |

|

|

|

|

|

Amount |

|

Cropland |

|

acres |

@ $ |

|

/acre |

$ |

|

Cropland |

|

acres |

@ $ |

|

/acre |

$ |

|

Established hay land |

|

acres |

@ $ |

|

/acre |

$ |

|

Pasture |

|

acres |

@ $ |

|

/acre |

$ |

|

Buildings and storage structures, housing |

|

|

|

$ |

|

||

|

|

|

|

||||

Total annual rent |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

||

The cash rent shall be due and payable as follows: Due Date |

|

Amount $ |

|

||

Due Date |

|

Amount $ |

|

||

Due Date |

|

Amount $ |

|

All cash rent is to be mailed or delivered to the Owner at:

FM

date |

|

owner (s) initials |

|

operator (s) initials |

|

page 1 of 3 |

5.USDA Commodity Program Payments: Payments shall be paid to the Operator unless otherwise agreed on with the Farm Service Agency.

6.Recreational Use: Use of the real estate is not allowed for hunting or other recreational purposes without written consent of the Owner.

7.Division of Expense: All crop production expenses are the responsibility of the Operator. Cost of lime and application will be treated as follows:

8.Expenses: No expense shall be incurred by the Operator for or on account of the Owner without first obtaining written permission from the Owner. The Operator agrees to take no actions that might cause a mechanic’s or other lien to be imposed upon the Real Estate and agrees to indemnify the Owner if actions are taken by the Operator that result in such a lien being imposed.

9.Repair and Maintenance: Minor repairs for buildings and fences: Owner will furnish all materials and Operator

will provide the labor at no charge. New fence: Owner to furnish all materials and

10.Operator’s Duties: Operator agrees to operate the farm in an efficient and

11.Owner’s Duties: Owner agrees to warrant and defend the Operator’s possession against all persons as long as this lease remains in effect. The Owner will promptly pay real property taxes and carry insurance on his/her interest in the property.

12.Harvested Crop’s Aboveground Plants: Operator does not have the right to take any part of the harvested crop’s aboveground plant without the express written permission of the Owner. This includes burning or removing any crop residues from the property.

13.Transfer of Interest: The Operator agrees not to lease or sublet any part of the Real Estate nor assign this lease to any other person or entity, nor sublease any or all of the property described herein without prior written permission of the Owner. This lease shall be binding upon the heirs, assignees, or successors in interest of both parties. If the Owner should sell or otherwise transfer title to the Real Estate, the Owner will do so subject to the provisions of this lease.

14.Changes in Lease Terms: The conduct, representation, or statement of either party, by act or omission, shall not be construed as a material alteration of this lease until such provision is reduced to writing and executed by both parties as an addendum to this lease.

15.Right of Entry: The Owner reserves the right to enter the premises at any time for any reasonable purpose. Upon notice of the lease termination, the Operator agrees to permit the Owner or the Owner’s lessee or agent to enter the premise to do customary tillage and operations on any land from which the current crops have been harvested

date |

|

owner (s) initials |

|

operator (s) initials |

|

page 2 of 3 |

16.Owner’s Landlord’s Lien and Security Interest. The Operator acknowledges that a statutory Landlord’s Lien exists in favor of the Owner. The Operator also grants to the Owner a security interest in, but not limited to, all growing or mature crops on the Real Estate as provided in the Iowa Uniform Commercial Code. The Operator shall sign all documents and financing statements as requested by the Owner to perfect the Owner’s security interests.

At Owner’s request, the Operator shall provide the Owner a list of potential buyers for the crops grown on the farm. The Operator agrees to deliver and sell such crops only to those buyers listed. The Owner shall deliver a Notice of Security Interest to those buyers and only those buyers listed. The Operator shall not sell such crops to any buyer not listed without first obtaining written consent of the Owner.

17.Termination upon Default: If either party defaults in the performance of the existing rental agreement, the non-

defaulting party shall serve a notice of default upon the defaulting party. The defaulting party shall have days

to cure the default. Failure to cure within the required timeframe shall terminate the lease. If the lease terminates because the Operator failed to pay the rent due, all costs and attorney fees of the Owner to enforce collection or performance shall be added to the obligations payable by the Operator. The Operator shall also be liable for interest

on the unpaid rent at the rate of |

|

% APR. |

18.Other Provisions:

19.Arbitration: Any disputes between the Owner and Operator not covered by this lease may be submitted by either party for arbitration at a reasonable fee by three disinterested persons, one of whom shall be selected by the Owner, one by the Operator, and the third by the previously named two. If and when disputes are submitted, a majority decision of the arbitrators shall be binding upon the parties to the lease.

We agree to the terms and conditions of this lease and we affix our signatures this |

|

day of |

|||

|

, 20 |

|

. |

|

|

Signature of Operator

Signature of

For (business entity)

Address

Telephone

Optional Notarization

Signature of Owner

Signature of

By (owner’s representative)

Address

Telephone

STATE OF |

|

, COUNTY OF |

|

|

|

|

ss: |

||

This record was acknowledged before me this |

|

day of, |

|

, by |

|||||

|

|

|

|

|

|

|

. |

|

|

Signature of Notary Public

page 3 of 3

The U.S. Department of Agriculture (USDA) prohibits discrimination in all its programs and activities on the basis of race, color, national origin, gender, religion, age, disability, political beliefs, sexual orientation, and marital or family status. (Not all prohibited bases apply to all programs.) Many materials can be made available in alternative formats for ADA clients. To file a complaint of discrimination, write USDA, Office of Civil Rights, Room

Similar forms

The Iowa Cash Rent Farm Lease (Short Form) shares similarities with the Agricultural Lease Agreement, which is a more comprehensive document outlining the terms and conditions between a landlord and a tenant for the use of agricultural land. Both documents detail the responsibilities of each party, including rent payments, maintenance of the property, and rights regarding crop management. However, the Agricultural Lease Agreement often includes more specific clauses on crop rotation, soil management practices, and detailed provisions for dispute resolution, making it a more thorough option for those looking to establish a long-term farming relationship.

For those looking to engage in a vehicle transaction, the important ATV Bill of Sale form serves as a vital resource in documenting the sale and transferring ownership of an all-terrain vehicle in Colorado.

Another document akin to the Iowa Short Form is the Crop Share Lease Agreement. This type of lease differs primarily in its payment structure, where the landlord and tenant share the crop yield instead of a fixed cash rent. Like the Iowa Short Form, the Crop Share Lease Agreement outlines the responsibilities of both parties regarding planting, maintenance, and harvesting. However, it places a greater emphasis on the equitable division of crops and related expenses, which can be beneficial in fluctuating market conditions.

The Farm Operating Agreement is also comparable. This document serves as a blueprint for how a farm will be run, detailing the roles and responsibilities of each party involved. Similar to the Iowa Short Form, it covers financial arrangements, management duties, and operational guidelines. However, the Farm Operating Agreement may include more detailed provisions regarding the decision-making process, allowing for clearer communication and expectations among partners.

In addition, the Farmland Lease Agreement is a common document that resembles the Iowa Short Form. This agreement typically focuses on the rental terms for agricultural land, including payment details and duration. While both documents serve the same fundamental purpose, the Farmland Lease Agreement may include additional provisions for land use, conservation practices, and specific obligations concerning land stewardship, which can help protect the property’s long-term viability.

The Custom Farming Agreement is another document that aligns closely with the Iowa Short Form. This agreement is designed for situations where one party provides labor and equipment to farm the land owned by another party, with payment made based on the services rendered rather than a traditional lease. Both agreements address the roles and responsibilities of the parties involved, but the Custom Farming Agreement often includes detailed provisions regarding the management of inputs, outputs, and the sharing of risks associated with farming.

Similar to the Iowa Short Form is the Livestock Lease Agreement. This document governs the leasing of land specifically for livestock grazing and related activities. While both agreements outline the terms of use and responsibilities of the parties, the Livestock Lease Agreement typically includes specific provisions regarding animal management, feed costs, and pasture maintenance, which are essential for the successful operation of livestock farming.

The Sharecropping Agreement is another related document. This agreement allows a tenant to farm land owned by another party in exchange for a portion of the crop produced. Like the Iowa Short Form, it establishes the rights and obligations of both parties. However, the Sharecropping Agreement often includes more detailed provisions regarding the division of labor, costs, and crop management, making it a more intricate arrangement for those engaged in shared farming efforts.

Lastly, the Farm Partnership Agreement resembles the Iowa Short Form in that it outlines the terms of a partnership for farming operations. Both documents address roles, responsibilities, and financial arrangements. However, the Farm Partnership Agreement typically includes more comprehensive provisions regarding profit sharing, decision-making authority, and the dissolution of the partnership, which can help prevent disputes and ensure a smooth operation.