Free Iowa W 4P Template

Things You Should Know About This Form

What is the Iowa W-4P form?

The Iowa W-4P form is a withholding certificate specifically designed for individuals receiving pension or annuity payments in Iowa. It allows recipients to specify how much state income tax should be withheld from their payments. This form is essential for ensuring that the correct amount of tax is deducted based on individual circumstances.

Who needs to fill out the Iowa W-4P form?

Individuals who receive pension or annuity payments and are Iowa residents should complete the Iowa W-4P form. This includes retirees from various sources such as private pensions, IRAs, and self-employed retirement benefits. It is particularly important for those who want to adjust their withholding based on their tax situation.

What are the eligibility requirements for exemptions?

To qualify for a partial exemption on the Iowa W-4P form, you must meet one of the following criteria:

- Be 55 years of age or older.

- Be disabled and receiving retirement income due to a documented disability.

- Be a surviving spouse or survivor of someone who would have qualified for the exemption.

Note that Social Security benefits do not qualify for this exemption.

What withholding choices do I have?

As an Iowa resident, you can choose how much tax to withhold from your pension or annuity payments. Your options include:

- No exemption, meaning tax will be withheld on the entire taxable amount.

- Exempting $6,000 from your taxable benefits each year.

- Exempting $12,000 if you are married and filing jointly, provided your spouse meets eligibility requirements.

If you do not select an option, a $6,000 exemption will be applied automatically.

How does the low income exemption work?

The low income exemption is available for certain taxpayers. For those aged 65 or older, you qualify if:

- You are single with an income of $24,000 or less.

- Your combined income is $32,000 or less if your filing status is not single.

For taxpayers under 65, the criteria include:

- Net income less than $5,000 and claimed as a dependent.

- Single with a net income of $9,000 or less and not claimed as a dependent.

- Combined net income of $13,500 or less if your filing status is not single.

Remember, only one spouse needs to be 65 or older to qualify for the exemption.

What happens if I choose to claim no exemption?

If you check the box to claim no exemption on the Iowa W-4P form, Iowa income tax will be withheld from the entire amount of your taxable benefits. This option is suitable for individuals who prefer to have a higher amount withheld to avoid potential tax liabilities at the end of the year.

What are the withholding rates?

Payers can choose between a flat withholding rate of 5% or use the published withholding formulas or tables provided by the Iowa Department of Revenue. This flexibility allows you to select the method that best fits your financial situation.

Where should I send the completed Iowa W-4P form?

Once you have filled out the Iowa W-4P form, return it to the individual or office responsible for handling your pension or retirement payments. If you are a federal employee, send it to the Office of Personnel Management (OPM). This ensures that your withholding preferences are properly recorded and applied to your payments.

Form Features

| Fact Name | Details |

|---|---|

| Purpose of the Form | The Iowa W-4P form is used to determine the amount of Iowa income tax to withhold from pension or annuity payments. |

| Residency Requirement | Iowa income tax is withheld only for residents of Iowa. Non-residents do not have state tax withheld. |

| Exemption Amounts | Iowa residents can exempt $6,000 from taxable benefits, while married filers can exempt up to $12,000. |

| Eligibility for Exemptions | To qualify for exemptions, individuals must be 55 years or older, disabled, or a surviving spouse of a qualified individual. |

| Low Income Exemption | Taxpayers aged 65 or older may qualify for an exemption based on specific income thresholds, which vary by filing status. |

| Withholding Rate | Payers can choose to withhold at a flat rate of 5% or use published withholding formulas. |

| Claiming No Exemption | If no exemption is claimed, Iowa income tax will be withheld from the entire amount of taxable benefits received. |

| Submission Instructions | The completed form should be returned to the entity managing the pension or retirement check, or to the Office of Personnel Management for federal employees. |

| Governing Law | The Iowa W-4P form is governed by Iowa Code Section 422.16 regarding income tax withholding. |

| Social Security Benefits | Social Security benefits are not covered under the exemptions provided by the Iowa W-4P form. |

Discover Other PDFs

Iowa Tags and Title - This form represents a formal request for title transfer in the case of leased vehicles.

A Lease Agreement is a legal document that outlines the terms and conditions between a landlord and a tenant regarding the rental of property. It details the rights and responsibilities of each party, helping to prevent misunderstandings and disputes. For a seamless rental experience, consider filling out the Lease Agreement form by clicking PDF Templates below.

Sellers Disclosure Iowa - Buyers should consider the disclosures alongside other inspection results.

Key takeaways

Filling out the Iowa W-4P form is an important step for managing your pension or annuity payments. Here are some key takeaways to keep in mind:

- Residency Matters: Only Iowa residents are subject to Iowa income tax withholding. If you are not an Iowa resident, you do not need to have state tax withheld from your pension or annuity payments.

- Exemption Choices: You can choose to exempt a portion of your benefits from taxation. Iowa residents can exempt $6,000, while married filers can exempt up to $12,000. If no choice is made, a default exemption of $6,000 will apply.

- Eligibility for Low Income Exemption: Certain taxpayers aged 65 or older may qualify for a low income exemption from Iowa tax. This exemption is based on specific income thresholds, which vary depending on filing status.

- Submission Process: Once you have completed the Iowa W-4P form, return it to the entity that manages your pension or retirement payments. Federal employees should send it to the Office of Personnel Management.

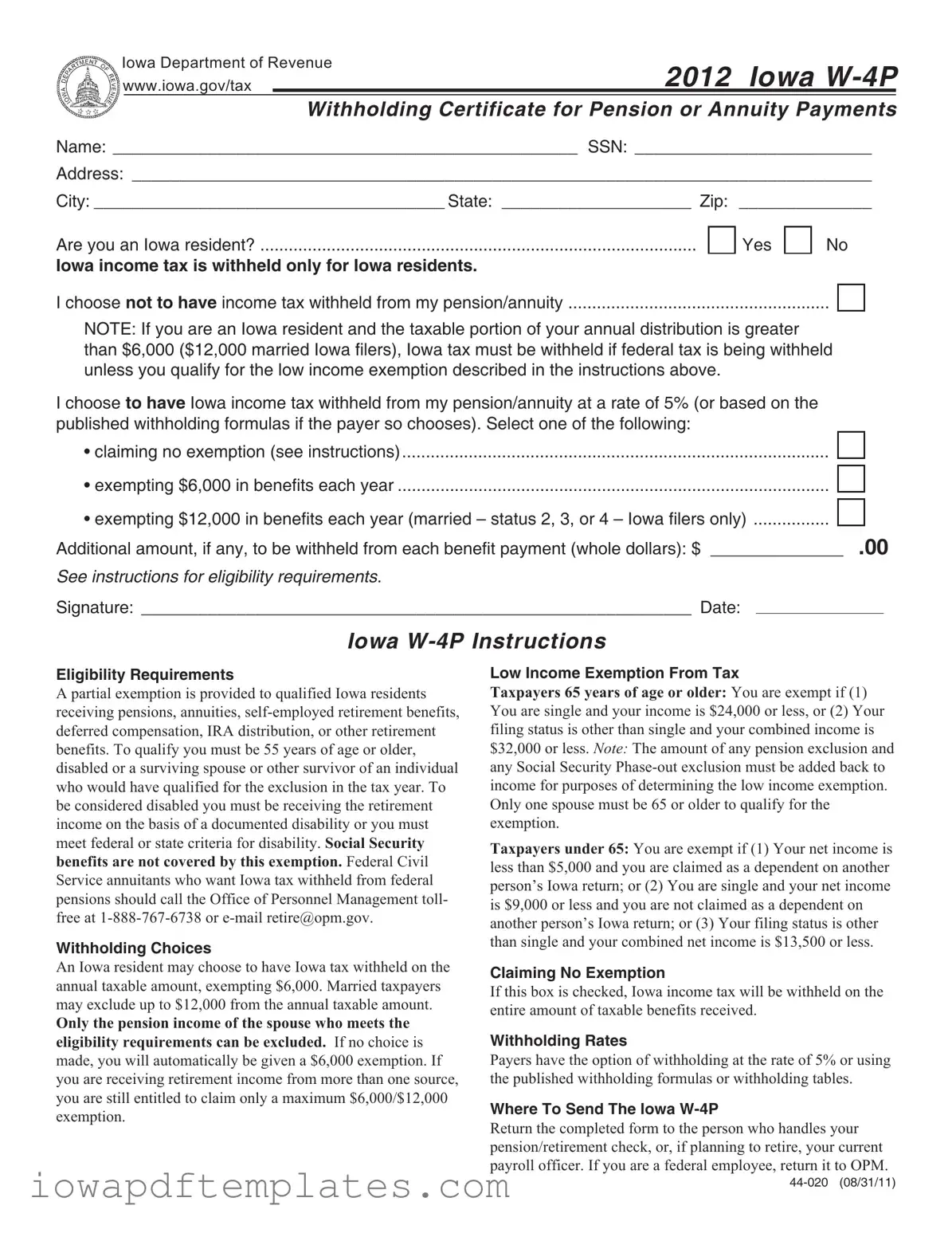

Sample - Iowa W 4P Form

Iowa Department of Revenue

www.iowa.gov/tax

2012 Iowa

Withholding Certificate for Pension or Annuity Payments

Name: _________________________________________________ SSN: _________________________

Address: ______________________________________________________________________________

City: _____________________________________ State: ____________________ Zip: ______________

Are you an Iowa resident? ............................................................................................

Iowa income tax is withheld only for Iowa residents.

Yes

No

I choose not to have income tax withheld from my pension/annuity .......................................................

NOTE: If you are an Iowa resident and the taxable portion of your annual distribution is greater than $6,000 ($12,000 married Iowa filers), Iowa tax must be withheld if federal tax is being withheld unless you qualify for the low income exemption described in the instructions above.

I choose to have Iowa income tax withheld from my pension/annuity at a rate of 5% (or based on the published withholding formulas if the payer so chooses). Select one of the following:

• claiming no exemption (see instructions) ..........................................................................................

• exempting $6,000 in benefits each year ...........................................................................................

• exempting $12,000 in benefits each year (married – status 2, 3, or 4 – Iowa filers only) ................

Additional amount, if any, to be withheld from each benefit payment (whole dollars): $ ______________ .00

See instructions for eligibility requirements.

Signature: __________________________________________________________ Date:

Iowa

Eligibility Requirements

A partial exemption is provided to qualified Iowa residents receiving pensions, annuities,

Withholding Choices

An Iowa resident may choose to have Iowa tax withheld on the annual taxable amount, exempting $6,000. Married taxpayers may exclude up to $12,000 from the annual taxable amount.

Only the pension income of the spouse who meets the eligibility requirements can be excluded. If no choice is made, you will automatically be given a $6,000 exemption. If you are receiving retirement income from more than one source, you are still entitled to claim only a maximum $6,000/$12,000 exemption.

Low Income Exemption From Tax

Taxpayers 65 years of age or older: You are exempt if (1) You are single and your income is $24,000 or less, or (2) Your filing status is other than single and your combined income is $32,000 or less. NOTE: The amount of any pension exclusion and any Social Security

Taxpayers under 65: You are exempt if (1) Your net income is less than $5,000 and you are claimed as a dependent on another person’s Iowa return; or (2) You are single and your net income is $9,000 or less and you are not claimed as a dependent on another person’s Iowa return; or (3) Your filing status is other than single and your combined net income is $13,500 or less.

Claiming No Exemption

If this box is checked, Iowa income tax will be withheld on the entire amount of taxable benefits received.

Withholding Rates

Payers have the option of withholding at the rate of 5% or using the published withholding formulas or withholding tables.

Where To Send The Iowa

Return the completed form to the person who handles your pension/retirement check, or, if planning to retire, your current payroll officer. If you are a federal employee, return it to OPM.

Similar forms

The Iowa W-4P form shares similarities with the IRS Form W-4, which is used by employees to determine how much federal income tax should be withheld from their paychecks. Both forms allow individuals to specify withholding preferences based on their financial situation. While the W-4 focuses on employment income, the W-4P is tailored for pension and annuity payments. Each form requires personal information and provides options for claiming exemptions or specifying additional withholding amounts.

Another related document is the Iowa W-4 form, which is specifically for employees working in Iowa. Similar to the W-4P, the Iowa W-4 allows employees to choose their withholding allowances and exemptions. Both forms aim to ensure that the correct amount of state tax is withheld from income. The Iowa W-4 is used for regular wages, while the W-4P applies to retirement benefits, reflecting the different sources of income.

The Federal Form 1099-R is also comparable to the Iowa W-4P. This form reports distributions from pensions, annuities, retirement plans, and other sources. While the W-4P is used to determine withholding preferences, the 1099-R provides the recipient with a summary of income received and taxes withheld during the year. Both documents are essential for individuals receiving retirement income, as they impact tax filing obligations.

The Iowa 1040 form, the state income tax return, is another document with similarities to the W-4P. Taxpayers use the 1040 to report their total income, including pensions and annuities. The information provided on the W-4P regarding withholding choices can affect the overall tax liability reported on the 1040. Both forms are crucial for ensuring compliance with tax regulations in Iowa.

Understanding the importance of a Durable Power of Attorney form in estate planning is essential for individuals seeking to designate someone who can make decisions on their behalf when needed. This legal document not only empowers the attorney-in-fact to handle financial matters but also provides peace of mind to the principal, knowing their interests will be safeguarded in times of incapacity.

The IRS Form 1040-SR is similar as well, designed specifically for seniors. Like the Iowa W-4P, it allows retirees to report income from pensions and annuities. The 1040-SR provides a simplified format, making it easier for older taxpayers to understand their tax obligations. Both forms help ensure that the correct amount of tax is withheld or reported based on retirement income.

Finally, the Iowa W-4E form, which is used for claiming exemptions from Iowa income tax withholding, is another related document. Similar to the W-4P, the W-4E allows individuals to indicate their eligibility for exemptions based on specific criteria. Both forms are designed to assist taxpayers in managing their withholding preferences and ensuring compliance with Iowa tax laws.