Printable Operating Agreement Document for Iowa State

Things You Should Know About This Form

What is an Iowa Operating Agreement?

An Iowa Operating Agreement is a legal document that outlines the management structure and operational procedures of a limited liability company (LLC) in Iowa. It serves as a blueprint for how the business will be run and helps protect the interests of the members involved.

Why do I need an Operating Agreement for my LLC?

Having an Operating Agreement is crucial for several reasons:

- It clarifies the roles and responsibilities of each member.

- It helps prevent disputes among members by providing clear guidelines.

- It can strengthen your LLC's liability protection by demonstrating that your business is a separate entity.

- Some banks and investors may require an Operating Agreement before providing funding.

Is an Operating Agreement required in Iowa?

While Iowa law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Without one, your business may be subject to default state laws, which may not align with your intentions for the company.

What should be included in an Iowa Operating Agreement?

Your Operating Agreement should cover several key elements:

- Identification of members and their ownership percentages.

- Management structure, detailing whether the LLC is member-managed or manager-managed.

- Voting rights and procedures for making decisions.

- How profits and losses will be distributed among members.

- Procedures for adding or removing members.

- Guidelines for handling disputes and dissolving the LLC if necessary.

Can I change my Operating Agreement after it is created?

Yes, you can amend your Operating Agreement at any time. It’s important to follow the amendment procedures outlined in the original document. Ensure all members agree to the changes and document them properly to maintain clarity and legal standing.

How do I draft an Operating Agreement?

You can draft an Operating Agreement in several ways:

- Use templates available online, which can provide a good starting point.

- Consult with a legal professional to tailor the agreement to your specific needs.

- Collaborate with your LLC members to ensure everyone’s input is included.

What happens if I don’t have an Operating Agreement?

If you don’t have an Operating Agreement, your LLC will be governed by Iowa’s default laws. This could lead to unintended consequences, such as disputes over management or profit distribution, as well as potential issues with liability protection.

Where can I find a sample Iowa Operating Agreement?

Sample Operating Agreements can often be found through legal websites, business formation services, or local chambers of commerce. However, it’s advisable to customize any sample to fit your specific situation and consult with a legal professional if needed.

File Data

| Fact Name | Description |

|---|---|

| Purpose | The Iowa Operating Agreement outlines the management structure and operational guidelines for an LLC in Iowa. |

| Governing Law | The agreement is governed by the Iowa Code, specifically Chapter 489, which pertains to the Iowa Limited Liability Company Act. |

| Members' Rights | It specifies the rights and responsibilities of the members, ensuring clarity in decision-making processes. |

| Customization | The form allows for customization based on the unique needs of the LLC, providing flexibility in governance. |

| Filing Requirement | While the Operating Agreement is not required to be filed with the state, it is crucial for internal governance and member relations. |

| Dispute Resolution | The agreement often includes provisions for resolving disputes among members, promoting smoother operations. |

Discover Other Common Forms for Iowa

Iowa Title Application - Delegate your vehicle affairs to a representative with this easy-to-complete form.

For those looking to formalize their transaction, using a Bill of Sale for a Tractor is an essential step to ensure all aspects of the sale are documented accurately, protecting both the buyer and the seller throughout the process.

Iowa Legal Separation Forms - It may cover financial obligations during the separation period.

Key takeaways

When filling out and using the Iowa Operating Agreement form, keep these key takeaways in mind:

- Identify the members: Clearly list all members of the LLC. This ensures everyone’s rights and responsibilities are documented.

- Define the purpose: State the business purpose of the LLC. This provides clarity on what the company aims to achieve.

- Outline management structure: Specify whether the LLC will be member-managed or manager-managed. This decision affects how decisions are made.

- Detail capital contributions: Clearly outline what each member is contributing to the LLC. This includes cash, property, or services.

- Establish profit distribution: Describe how profits and losses will be allocated among members. This prevents future disputes.

- Include voting rights: Specify how voting will work within the LLC. This includes what constitutes a quorum and how decisions are made.

- Address member changes: Outline procedures for adding or removing members. This ensures a smooth transition if changes occur.

- Set terms for dissolution: Define how the LLC can be dissolved. This provides a clear exit strategy for members.

- Consult legal advice: It’s wise to seek legal counsel when drafting the agreement. This helps ensure compliance with state laws.

Following these guidelines will help create a comprehensive and effective Operating Agreement for your Iowa LLC.

Sample - Iowa Operating Agreement Form

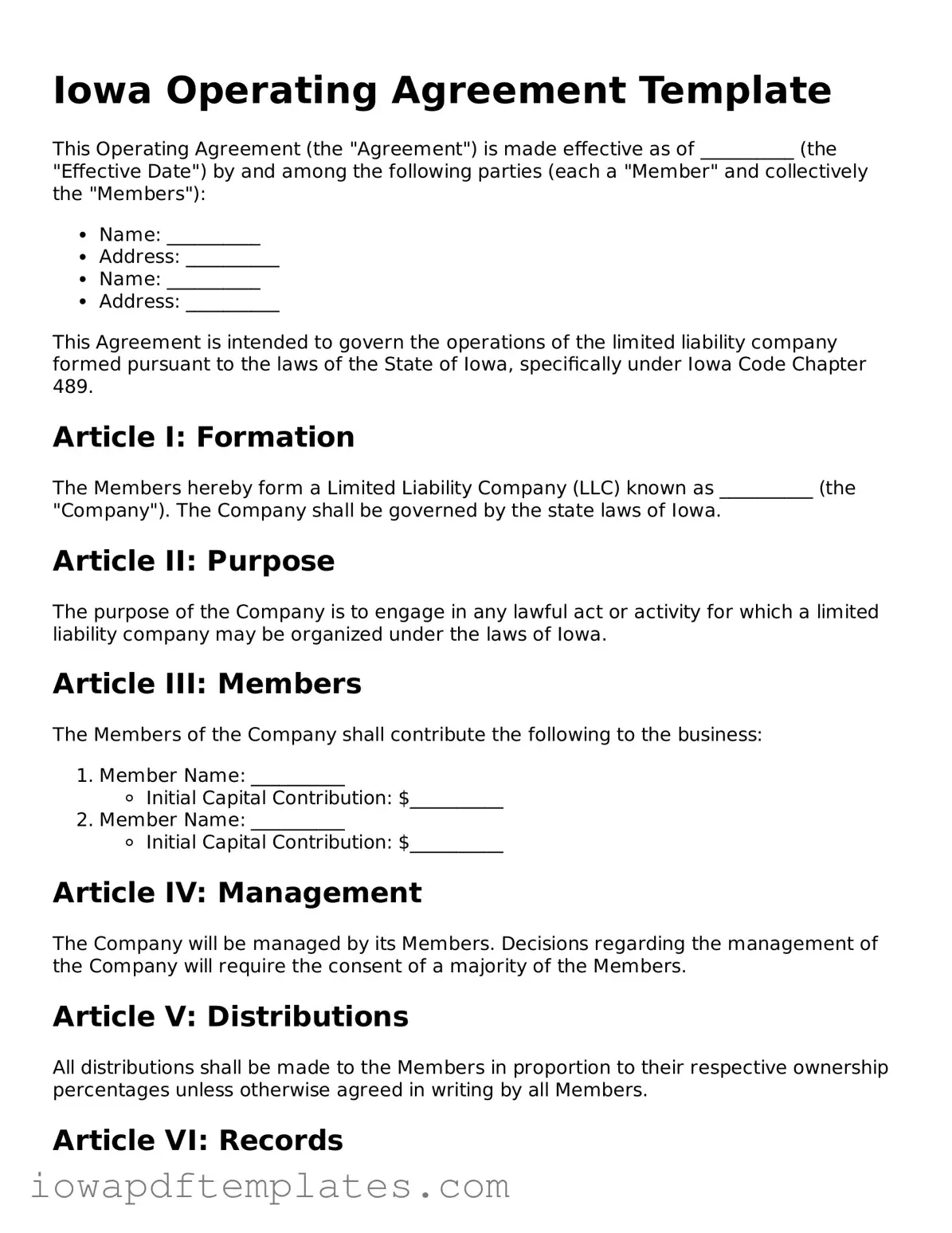

Iowa Operating Agreement Template

This Operating Agreement (the "Agreement") is made effective as of __________ (the "Effective Date") by and among the following parties (each a "Member" and collectively the "Members"):

- Name: __________

- Address: __________

- Name: __________

- Address: __________

This Agreement is intended to govern the operations of the limited liability company formed pursuant to the laws of the State of Iowa, specifically under Iowa Code Chapter 489.

Article I: Formation

The Members hereby form a Limited Liability Company (LLC) known as __________ (the "Company"). The Company shall be governed by the state laws of Iowa.

Article II: Purpose

The purpose of the Company is to engage in any lawful act or activity for which a limited liability company may be organized under the laws of Iowa.

Article III: Members

The Members of the Company shall contribute the following to the business:

- Member Name: __________

- Initial Capital Contribution: $__________

- Member Name: __________

- Initial Capital Contribution: $__________

Article IV: Management

The Company will be managed by its Members. Decisions regarding the management of the Company will require the consent of a majority of the Members.

Article V: Distributions

All distributions shall be made to the Members in proportion to their respective ownership percentages unless otherwise agreed in writing by all Members.

Article VI: Records

The Company shall maintain complete and accurate records of its business and affairs, which shall be available for inspection by any Member during normal business hours.

Article VII: Indemnification

The Company shall indemnify any Member against all expenses and liabilities incurred in connection with the Company, to the fullest extent permitted by Iowa law.

Article VIII: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Signatures

The undersigned Members hereby execute this Operating Agreement as of the Effective Date.

- Member Signature: _______________ Date: __________

- Member Signature: _______________ Date: __________

Similar forms

The Iowa Operating Agreement is similar to the Limited Liability Company (LLC) Operating Agreement used in many states. Both documents outline the management structure and operational procedures of an LLC. They establish roles and responsibilities for members and managers, ensuring that all parties understand their duties. This agreement serves as a foundational document, helping to prevent disputes by clearly defining how decisions are made and profits are distributed.

Another document that parallels the Iowa Operating Agreement is the Partnership Agreement. This agreement is essential for partnerships, detailing the terms of the partnership, including profit sharing, responsibilities, and decision-making processes. Like the Operating Agreement, it aims to provide clarity and structure, helping partners navigate their relationship and responsibilities effectively.

The Corporate Bylaws document is also akin to the Iowa Operating Agreement. While it applies to corporations rather than LLCs, both documents serve to govern the internal workings of the business. Corporate Bylaws outline the roles of officers, procedures for meetings, and rules for shareholder voting, similar to how the Operating Agreement lays out member roles and decision-making processes for an LLC.

The Shareholders' Agreement is another related document. This agreement is often used in corporations to define the rights and obligations of shareholders. It covers issues such as share transfers, voting rights, and dispute resolution. Like the Operating Agreement, it aims to protect the interests of all parties involved and ensure smooth operation of the business.

When drafting important documents for your business, such as the Articles of Incorporation, it's essential to access reliable resources that can guide you through the process; for this, you may refer to PDF Templates to obtain the necessary forms and templates tailored for your specific needs.

The Joint Venture Agreement shares similarities with the Iowa Operating Agreement as well. This document outlines the terms of a partnership between two or more parties who agree to work together on a specific project. It details contributions, profit sharing, and management roles, similar to how an Operating Agreement defines member responsibilities and profit distribution within an LLC.

A Non-Disclosure Agreement (NDA) can also be compared to the Iowa Operating Agreement in terms of protecting sensitive information. While the Operating Agreement focuses on the operational aspects of an LLC, an NDA safeguards proprietary information shared between parties. Both documents are crucial in maintaining trust and ensuring that all parties are clear on their obligations.

The Employment Agreement is another document that shares a functional similarity with the Iowa Operating Agreement. This agreement outlines the terms of employment for individuals within a business, including roles, responsibilities, and compensation. While the Operating Agreement governs the overall structure of the LLC, the Employment Agreement specifies the relationship between the company and its employees.

The Asset Purchase Agreement is also somewhat similar. This document outlines the terms under which one party agrees to purchase assets from another. Like the Operating Agreement, it includes details about the parties involved, the assets being transferred, and the terms of the sale. Both documents are crucial for ensuring that all parties understand their rights and obligations.

Finally, the Membership Certificate can be compared to the Iowa Operating Agreement. This document serves as proof of membership in an LLC and often accompanies the Operating Agreement. While the Operating Agreement outlines the operational procedures, the Membership Certificate signifies ownership and membership rights, reinforcing the agreement's terms.