Printable Promissory Note Document for Iowa State

Things You Should Know About This Form

What is a Promissory Note in Iowa?

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined time or on demand. In Iowa, this document serves as a legal instrument that outlines the borrower's commitment to repay the loan under agreed-upon terms.

What information is typically included in an Iowa Promissory Note?

Key elements of an Iowa Promissory Note generally include:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any collateral securing the loan

- Conditions for default and consequences

- Signatures of both parties

Do I need a lawyer to create a Promissory Note in Iowa?

While it is not mandatory to hire a lawyer to draft a Promissory Note in Iowa, it is advisable to consult one if the terms are complex or if significant amounts of money are involved. A legal professional can help ensure that the document is enforceable and meets all necessary legal requirements.

How is a Promissory Note enforced in Iowa?

If a borrower fails to repay the loan as outlined in the Promissory Note, the lender has the right to take legal action to enforce the agreement. This may involve filing a lawsuit in a local court to recover the owed amount. The clarity of the terms within the note can significantly influence the outcome of such proceedings.

Can I modify an existing Promissory Note?

Yes, modifications to an existing Promissory Note can be made. Both the borrower and lender must agree to the changes, and it is recommended that any modifications be documented in writing and signed by both parties to maintain legal validity.

Is a Promissory Note the same as a loan agreement?

While both documents serve to outline the terms of a loan, they are not identical. A Promissory Note is primarily a promise to pay, whereas a loan agreement may include additional terms such as conditions for the loan, covenants, and more comprehensive details about the relationship between the parties.

What happens if I lose my Promissory Note?

If a Promissory Note is lost, the borrower should immediately notify the lender. Depending on the situation, the lender may require the borrower to sign an affidavit stating that the note has been lost. In some cases, a replacement note may be issued, but this process should be handled carefully to avoid any potential disputes.

File Data

| Fact Name | Details |

|---|---|

| Definition | An Iowa Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined future date. |

| Governing Law | Iowa Code Chapter 554 governs promissory notes in Iowa. |

| Parties Involved | The document involves at least two parties: the borrower (maker) and the lender (payee). |

| Payment Terms | The note must clearly state the amount to be paid and the payment schedule, including interest rates if applicable. |

| Signature Requirement | The maker must sign the note for it to be legally binding. |

| Consideration | There must be consideration, meaning something of value must be exchanged between the parties. |

| Default Terms | The note should outline what happens in the event of default, including late fees or acceleration of payment. |

| Notarization | While notarization is not required, it can add an extra layer of authenticity and can be beneficial in legal disputes. |

| State-Specific Format | The Iowa Promissory Note should follow a specific format to ensure compliance with state laws and ease of understanding. |

Discover Other Common Forms for Iowa

Iowa Legal Separation Forms - This document details the arrangement for living separately.

It is crucial to understand the implications of a Release of Liability document for various activities, as it protects organizers from unforeseen incidents while participants acknowledge the associated risks. By utilizing this form, individuals create a clear understanding of their consent to participate despite potential hazards involved.

Iowa Title Application - Take advantage of this form when you can’t be present for car registrations or sales.

Key takeaways

When filling out and using the Iowa Promissory Note form, several key points should be kept in mind to ensure clarity and legality.

- Understand the Basics: A promissory note is a written promise to pay a specific amount of money at a designated time. It serves as a legal document that outlines the terms of the loan.

- Include Essential Information: The form must clearly state the names of the borrower and lender, the principal amount, the interest rate, and the repayment schedule.

- Be Aware of Interest Rates: Iowa law allows for certain interest rates, but it’s important to ensure that the agreed-upon rate complies with state regulations to avoid legal issues.

- Signatures Matter: Both parties must sign the document for it to be legally binding. Without signatures, the note may not hold up in court.

- Keep Records: After completing the form, both the borrower and lender should keep a copy for their records. This can be crucial in case of disputes or misunderstandings.

By following these guidelines, individuals can effectively utilize the Iowa Promissory Note form to facilitate loans while ensuring compliance with legal standards.

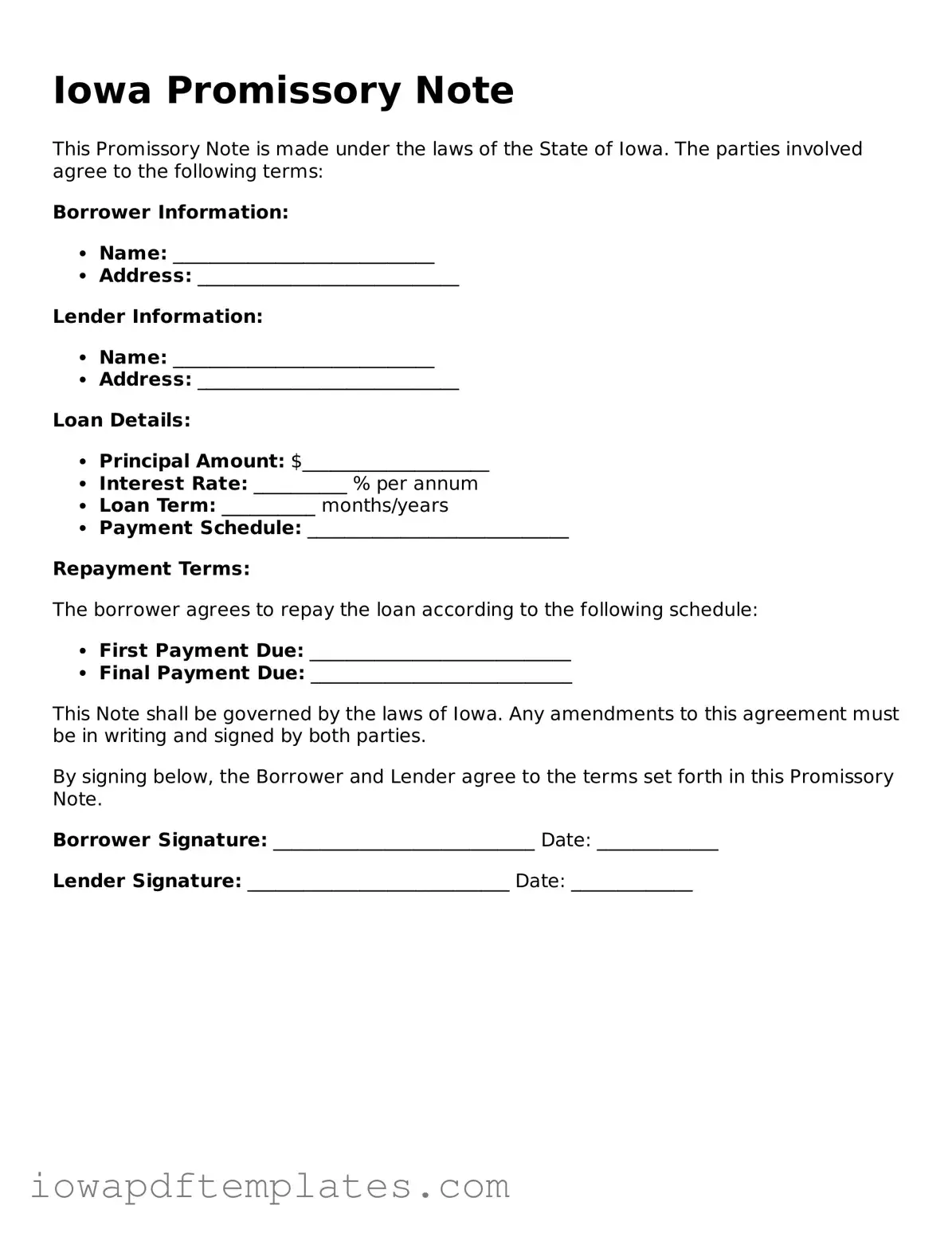

Sample - Iowa Promissory Note Form

Iowa Promissory Note

This Promissory Note is made under the laws of the State of Iowa. The parties involved agree to the following terms:

Borrower Information:

- Name: ____________________________

- Address: ____________________________

Lender Information:

- Name: ____________________________

- Address: ____________________________

Loan Details:

- Principal Amount: $____________________

- Interest Rate: __________ % per annum

- Loan Term: __________ months/years

- Payment Schedule: ____________________________

Repayment Terms:

The borrower agrees to repay the loan according to the following schedule:

- First Payment Due: ____________________________

- Final Payment Due: ____________________________

This Note shall be governed by the laws of Iowa. Any amendments to this agreement must be in writing and signed by both parties.

By signing below, the Borrower and Lender agree to the terms set forth in this Promissory Note.

Borrower Signature: ____________________________ Date: _____________

Lender Signature: ____________________________ Date: _____________

Similar forms

A loan agreement is a document that outlines the terms and conditions under which one party lends money to another. Similar to a promissory note, a loan agreement specifies the amount borrowed, the interest rate, and the repayment schedule. However, it typically includes more detailed provisions, such as collateral requirements and default consequences. Both documents serve to formalize the borrowing process, ensuring that all parties understand their obligations and rights. In essence, a loan agreement provides a broader framework for the loan than a simple promissory note.

A mortgage is another document that shares similarities with a promissory note. While a promissory note represents the borrower's promise to repay a loan, a mortgage secures that promise with real property. When a borrower signs a mortgage, they agree to use their property as collateral for the loan. This means that if they fail to repay the loan, the lender has the right to foreclose on the property. Both documents work together to protect the lender's interests while providing the borrower with the necessary funds to purchase a home.

An IOU, or "I owe you," is a less formal document that acknowledges a debt. Like a promissory note, it indicates that one party owes a specific amount of money to another. However, IOUs typically lack the detailed terms and conditions found in a promissory note, such as interest rates and repayment schedules. While an IOU can be a quick and simple way to document a debt, it may not provide the same level of legal protection as a promissory note, which is often more comprehensive and enforceable in court.

A personal guarantee is a document in which an individual agrees to be personally responsible for a debt or obligation. This is similar to a promissory note in that it creates a binding commitment to repay a loan. However, a personal guarantee often accompanies a business loan, where the lender requires an individual to back the loan with their personal assets. Both documents serve to enhance the lender's security, but a personal guarantee adds an extra layer of personal accountability for the borrower.

A California Residential Lease Agreement form is a legally binding document that outlines the terms of renting property in California, including details such as rent amount, deposit specifics, and lease duration. For those looking to establish a clear understanding between landlords and tenants, this form is essential. To learn more about how to create or edit this agreement, visit https://californiapdf.com/editable-residential-lease-agreement/.

A business loan agreement is specifically designed for business financing and shares key features with a promissory note. Like a promissory note, it outlines the amount borrowed, interest rates, and repayment terms. However, a business loan agreement typically includes additional clauses related to the operation of the business, such as financial covenants and performance metrics. This makes it a more comprehensive document, ensuring that the lender has a clear understanding of the business's financial health and operational commitments.

A lease agreement can also be compared to a promissory note, particularly when it comes to financial obligations. In a lease, one party (the lessee) agrees to pay rent to another party (the lessor) for the use of a property. Similar to a promissory note, a lease outlines the payment amount, due dates, and consequences for late payments. While the primary purpose of a lease is to govern the rental of property rather than a loan, both documents establish a clear expectation of payment and provide legal recourse in the event of default.