Printable Small Estate Affidavit Document for Iowa State

Things You Should Know About This Form

What is the Iowa Small Estate Affidavit form?

The Iowa Small Estate Affidavit form is a legal document that allows individuals to claim the assets of a deceased person without going through the formal probate process. This option is available when the total value of the deceased's estate is below a certain threshold, making it a simpler and quicker way to settle the estate.

Who can use the Small Estate Affidavit?

Typically, the Small Estate Affidavit can be used by heirs or beneficiaries of the deceased person. To qualify, the estate must meet specific criteria, including:

- The total value of the estate must be less than $100,000, excluding certain assets.

- The individual using the affidavit must be an heir or a person entitled to the property.

- A waiting period of at least 30 days after the person's death must have passed.

How do I complete the Small Estate Affidavit form?

Completing the Small Estate Affidavit form involves several steps:

- Gather information about the deceased's assets and debts.

- Obtain the Small Estate Affidavit form, which can usually be found online or at a local courthouse.

- Fill out the form with accurate details, including your relationship to the deceased.

- Sign the affidavit in front of a notary public to make it official.

Once completed, the affidavit can be submitted to financial institutions or other entities holding the deceased's assets.

What happens after I submit the Small Estate Affidavit?

After submitting the Small Estate Affidavit, the next steps will depend on the institutions involved. Generally, they will review the affidavit and may require additional documentation. If everything is in order, you should receive access to the deceased's assets. Keep in mind that some institutions may take time to process your request, so patience may be necessary.

File Data

| Fact Name | Description |

|---|---|

| Purpose | The Iowa Small Estate Affidavit is used to simplify the process of transferring small estates without going through probate. |

| Eligibility | This form is applicable when the total value of the deceased's estate is $100,000 or less, excluding certain assets. |

| Governing Law | The use of the Small Estate Affidavit in Iowa is governed by Iowa Code Section 635.1. |

| Who Can Use It | Heirs or beneficiaries of the estate can file the affidavit to claim assets directly. |

| Required Information | The affidavit must include details about the deceased, the estate's value, and the names of heirs. |

| Filing Process | The affidavit is typically filed with the institution holding the deceased's assets, such as banks or insurance companies. |

| Timeframe | The process can be completed relatively quickly, often within a few weeks, depending on the institution. |

| Limitations | This form cannot be used for estates that include real estate or for certain types of debts. |

| Legal Advice | While the form is straightforward, consulting a legal professional is advisable to ensure compliance with all requirements. |

Discover Other Common Forms for Iowa

Iowa Records Online - Some deeds require notarization to ensure authenticity and prevent fraud.

To ensure a smooth transaction when buying or selling your vehicle, it is essential to utilize a Motor Vehicle Bill of Sale. This legal document provides proof of the sale and contains vital information about the vehicle, including its make, model, and VIN. For those looking to easily complete this form, you can find the necessary template at PDF Templates.

Does a Bill of Sale Have to Be Notarized in Iowa - It is an important form in maintaining a transparent marketplace for snowmobiles.

Key takeaways

Filling out and using the Iowa Small Estate Affidavit form can be a straightforward process, but it is essential to understand its key components. Here are some important takeaways to keep in mind:

- Eligibility Criteria: To use the Small Estate Affidavit, the total value of the estate must not exceed $100,000, excluding certain assets like real estate.

- Required Information: The affidavit requires specific details, including the decedent’s name, date of death, and a list of assets and their values.

- Affidavit Signatures: The form must be signed by the individual claiming the estate, who is typically a spouse, child, or other close relative.

- Notarization: It is crucial to have the affidavit notarized. This adds a layer of authenticity and can help prevent disputes.

- Filing the Affidavit: Once completed, the affidavit should be filed with the appropriate county recorder’s office to initiate the transfer of assets.

- Use of Assets: After the affidavit is accepted, the claimant can access the decedent’s assets without going through a lengthy probate process.

Understanding these key points can help streamline the process and ensure that you are prepared to navigate the Small Estate Affidavit effectively.

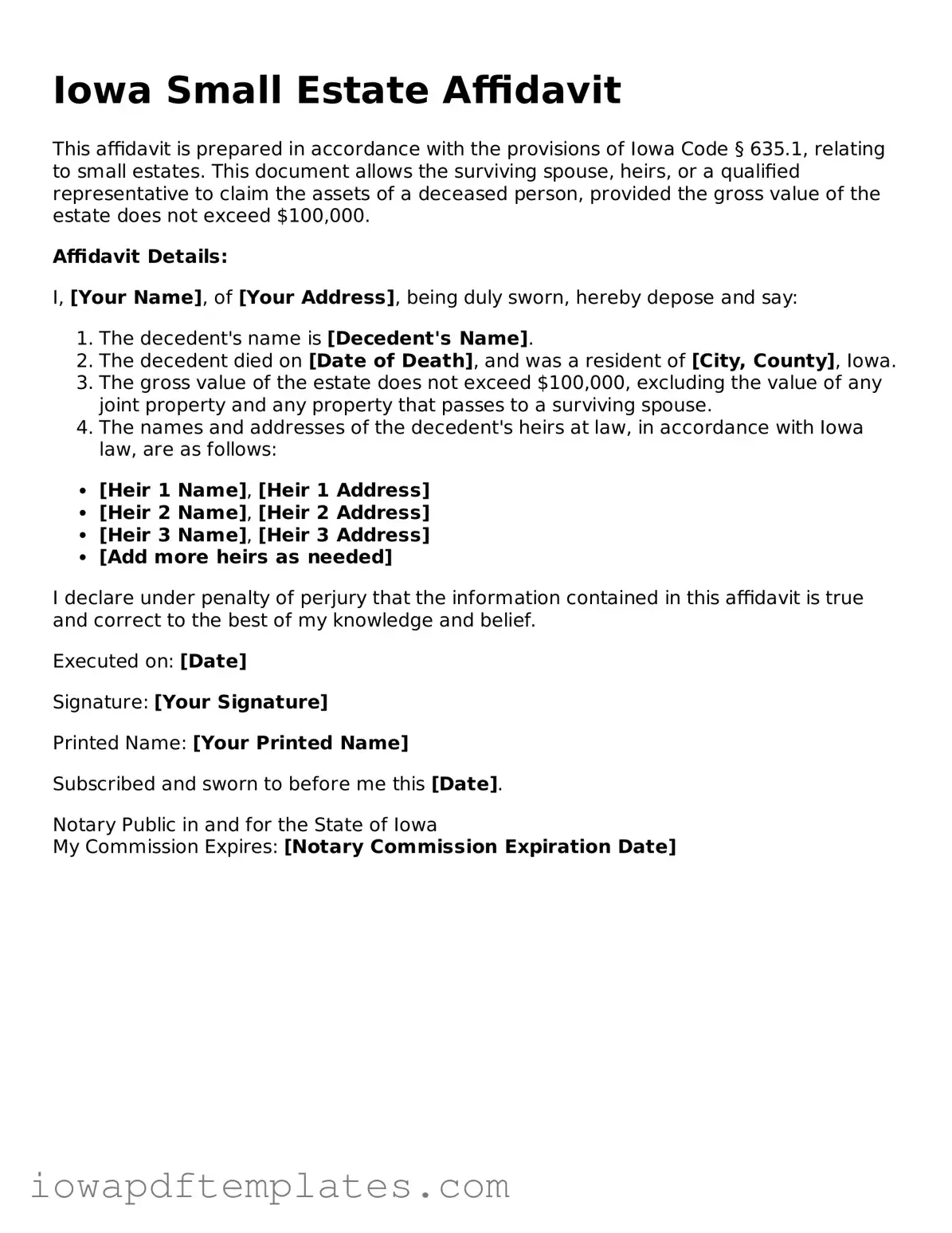

Sample - Iowa Small Estate Affidavit Form

Iowa Small Estate Affidavit

This affidavit is prepared in accordance with the provisions of Iowa Code § 635.1, relating to small estates. This document allows the surviving spouse, heirs, or a qualified representative to claim the assets of a deceased person, provided the gross value of the estate does not exceed $100,000.

Affidavit Details:

I, [Your Name], of [Your Address], being duly sworn, hereby depose and say:

- The decedent's name is [Decedent's Name].

- The decedent died on [Date of Death], and was a resident of [City, County], Iowa.

- The gross value of the estate does not exceed $100,000, excluding the value of any joint property and any property that passes to a surviving spouse.

- The names and addresses of the decedent's heirs at law, in accordance with Iowa law, are as follows:

- [Heir 1 Name], [Heir 1 Address]

- [Heir 2 Name], [Heir 2 Address]

- [Heir 3 Name], [Heir 3 Address]

- [Add more heirs as needed]

I declare under penalty of perjury that the information contained in this affidavit is true and correct to the best of my knowledge and belief.

Executed on: [Date]

Signature: [Your Signature]

Printed Name: [Your Printed Name]

Subscribed and sworn to before me this [Date].

Notary Public in and for the State of Iowa

My Commission Expires: [Notary Commission Expiration Date]

Similar forms

The Iowa Small Estate Affidavit form shares similarities with the Affidavit of Heirship. This document is often used when someone passes away without a will, and it helps establish the legal heirs of the deceased. Like the Small Estate Affidavit, it allows heirs to claim property without going through the lengthy probate process. Both documents require the affiant to provide information about the deceased and the heirs, ensuring that the rightful individuals can access the estate's assets efficiently.

Another document that resembles the Iowa Small Estate Affidavit is the Will. While a will outlines a person's wishes regarding asset distribution after death, it may not always be necessary if the estate qualifies for a small estate affidavit. Both documents serve the purpose of transferring property, but the Small Estate Affidavit is typically used when the estate is below a certain value, allowing for a quicker resolution without formal probate proceedings.

For those involved in activities that carry inherent risks, a clear understanding of the Release of Liability form is essential. This legal document serves to protect participants by ensuring they acknowledge the risks involved, thus safeguarding the interests of the organizing parties.

The Affidavit of Collection of Personal Property is also comparable to the Iowa Small Estate Affidavit. This document enables individuals to collect personal property without the need for probate, provided the estate meets specific criteria. Similar to the Small Estate Affidavit, it requires the affiant to affirm their right to the property and often involves a simplified process for transferring ownership of personal belongings, such as bank accounts or vehicles.

Lastly, the Petition for Probate is another document that bears resemblance to the Iowa Small Estate Affidavit. This petition is filed to initiate the probate process when a will exists. While the Small Estate Affidavit is used to avoid probate for smaller estates, the Petition for Probate addresses larger estates or those requiring court supervision. Both documents aim to facilitate the transfer of assets, but they differ in the procedural requirements and the size of the estate involved.