Printable Transfer-on-Death Deed Document for Iowa State

Things You Should Know About This Form

What is a Transfer-on-Death Deed in Iowa?

A Transfer-on-Death Deed (TODD) in Iowa allows property owners to transfer their real estate to a designated beneficiary upon their death. This deed is effective immediately upon signing but does not transfer ownership until the owner passes away. It allows the property owner to retain full control of the property during their lifetime, including the ability to sell or mortgage it.

Who can be named as a beneficiary in a Transfer-on-Death Deed?

Any individual or entity can be named as a beneficiary in a TODD. This includes family members, friends, or even organizations. However, it is essential to ensure that the beneficiary is legally capable of receiving the property. If you name multiple beneficiaries, specify how the property should be divided among them.

How do I complete a Transfer-on-Death Deed in Iowa?

To complete a Transfer-on-Death Deed in Iowa, follow these steps:

- Obtain the appropriate form for the Transfer-on-Death Deed.

- Fill out the form with accurate information, including the property description and beneficiary details.

- Sign the deed in the presence of a notary public.

- File the completed deed with the county recorder’s office where the property is located.

Make sure to keep a copy of the filed deed for your records.

Can I revoke or change a Transfer-on-Death Deed?

Yes, you can revoke or change a Transfer-on-Death Deed at any time before your death. To revoke the deed, you must complete a revocation form and file it with the county recorder’s office. If you want to change the beneficiary, you will need to create a new TODD and file it, ensuring the previous one is properly revoked.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences for the property owner. The property may be subject to estate taxes upon the owner’s death, depending on the total value of the estate. It is advisable to consult with a tax professional to understand any potential tax implications specific to your situation.

File Data

| Fact Name | Description |

|---|---|

| Definition | An Iowa Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed in Iowa is governed by Iowa Code § 557B. |

| Eligibility | Any individual who owns real property in Iowa can create a Transfer-on-Death Deed. |

| Beneficiary Designation | The deed allows the owner to designate one or more beneficiaries who will receive the property after the owner's death. |

| Revocation | Owners can revoke the Transfer-on-Death Deed at any time before their death, allowing for flexibility in estate planning. |

| Filing Requirement | The deed must be filed with the county recorder's office where the property is located to be effective. |

| Effect on Creditors | The property transferred via a Transfer-on-Death Deed is still subject to the owner's debts and creditors during their lifetime. |

| Tax Implications | The transfer of property via this deed does not trigger gift taxes, as the transfer occurs at death. |

| Survivorship | If multiple beneficiaries are named, the property will pass to the surviving beneficiaries upon the death of the owner. |

| Limitations | Transfer-on-Death Deeds cannot be used for certain types of property, such as property held in a trust or jointly owned property. |

Discover Other Common Forms for Iowa

Iowa Biennial Report - Some companies choose to include dissolution procedures in this document.

The New York Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in New York State. It outlines key details about the corporation, such as its name, purpose, and structure. Understanding how to complete this form correctly can pave the way for a smooth business launch—start filling out the form by accessing PDF Templates for guidance.

Sample Apartment Application - Signature to confirm accuracy of the provided information.

What Does Dpoa Mean - A Durable Power of Attorney can be an important element in safeguarding one’s legacy and wishes.

Key takeaways

When it comes to transferring property in Iowa, the Transfer-on-Death Deed (TODD) is a powerful tool. Understanding how to properly fill out and utilize this form can make a significant difference in estate planning. Here are some key takeaways to keep in mind:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon their death, bypassing the lengthy probate process.

- To ensure the deed is valid, it must be signed by the property owner in the presence of a notary public and recorded with the county recorder's office.

- It's important to provide clear and specific information about the property being transferred, including the legal description, to avoid any future disputes.

- Beneficiaries can be changed or revoked at any time before the property owner’s death, offering flexibility in estate planning.

- Consulting with an estate planning attorney can provide valuable insights, especially when navigating complex family dynamics or unique property situations.

Sample - Iowa Transfer-on-Death Deed Form

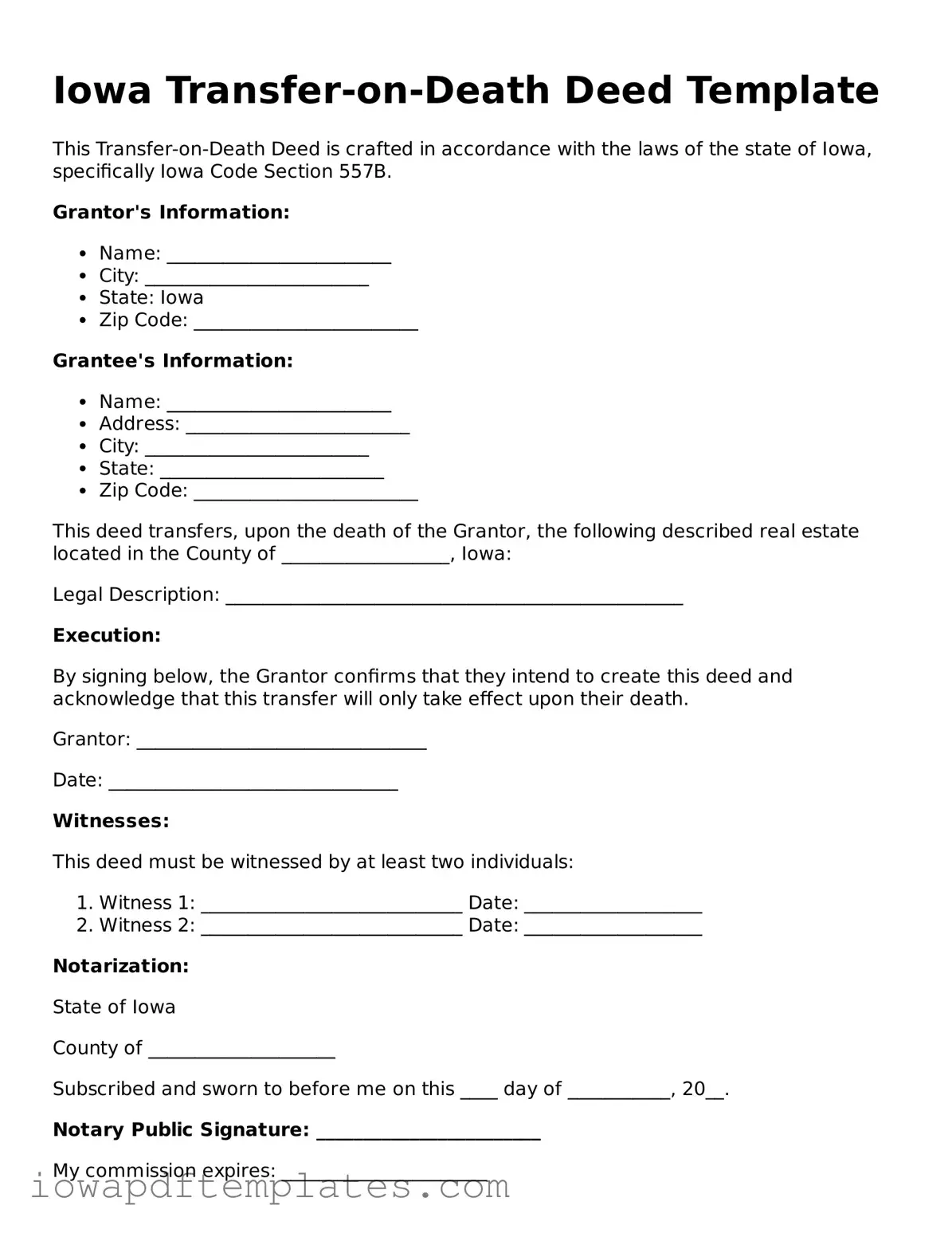

Iowa Transfer-on-Death Deed Template

This Transfer-on-Death Deed is crafted in accordance with the laws of the state of Iowa, specifically Iowa Code Section 557B.

Grantor's Information:

- Name: ________________________

- City: ________________________

- State: Iowa

- Zip Code: ________________________

Grantee's Information:

- Name: ________________________

- Address: ________________________

- City: ________________________

- State: ________________________

- Zip Code: ________________________

This deed transfers, upon the death of the Grantor, the following described real estate located in the County of __________________, Iowa:

Legal Description: _________________________________________________

Execution:

By signing below, the Grantor confirms that they intend to create this deed and acknowledge that this transfer will only take effect upon their death.

Grantor: _______________________________

Date: _______________________________

Witnesses:

This deed must be witnessed by at least two individuals:

- Witness 1: ____________________________ Date: ___________________

- Witness 2: ____________________________ Date: ___________________

Notarization:

State of Iowa

County of ____________________

Subscribed and sworn to before me on this ____ day of ___________, 20__.

Notary Public Signature: ________________________

My commission expires: ______________________

Similar forms

The Iowa Transfer-on-Death Deed form is similar to a Last Will and Testament. Both documents facilitate the transfer of property upon the death of the owner. However, while a will typically requires probate, a Transfer-on-Death Deed allows for the direct transfer of property without the need for this legal process. This can simplify the transfer and reduce associated costs and delays for the beneficiaries.

Another document comparable to the Transfer-on-Death Deed is the Living Trust. Like the Transfer-on-Death Deed, a Living Trust allows for the transfer of assets outside of probate. However, a Living Trust can manage assets during the grantor's lifetime and specify terms for distribution after death. This provides more control over how assets are handled, but it requires more initial setup and maintenance than a Transfer-on-Death Deed.

The Beneficiary Designation form also shares similarities with the Transfer-on-Death Deed. Both documents allow property owners to designate individuals who will receive their assets upon death. Beneficiary Designations are commonly used for financial accounts, insurance policies, and retirement plans. Unlike the Transfer-on-Death Deed, which applies to real estate, Beneficiary Designations can cover various asset types and can be updated more easily.

For those looking to establish clear guidelines for their business operations, a crucial document is a well-structured comprehensive Operating Agreement outline. This document not only delineates the responsibilities and roles of each member but also helps in mitigating potential disputes in the future.

A Joint Tenancy Agreement is another document that resembles the Transfer-on-Death Deed. In a Joint Tenancy, two or more individuals own property together, with the right of survivorship. This means that when one owner passes away, the surviving owner automatically inherits the property. While both documents facilitate the transfer of property upon death, a Joint Tenancy does not require a formal deed and can lead to complications if all owners do not agree on the terms.

The Power of Attorney is also related to the Transfer-on-Death Deed, although it serves a different purpose. A Power of Attorney allows an individual to designate someone else to make decisions on their behalf while they are still alive. This can include managing property and finances. In contrast, the Transfer-on-Death Deed only takes effect upon the owner’s death, transferring property directly to the designated beneficiaries.

Another similar document is the Transfer-on-Death Registration for vehicles. This form allows vehicle owners to designate a beneficiary who will inherit the vehicle upon their death. Like the Transfer-on-Death Deed, it bypasses probate, allowing for a smoother transfer process. However, this form is specific to vehicles, while the Transfer-on-Death Deed applies to real estate.

Lastly, a Declaration of Trust can be compared to the Transfer-on-Death Deed. A Declaration of Trust outlines how a person's assets will be managed and distributed after their death. Similar to a Transfer-on-Death Deed, it can help avoid probate. However, a Declaration of Trust is generally more comprehensive, covering a wider range of assets and providing ongoing management, whereas the Transfer-on-Death Deed focuses solely on the transfer of real property.