Free Ut 510 Iowa Template

Things You Should Know About This Form

What is the purpose of the UT 510 Iowa form?

The UT 510 Iowa form is essential for registering a vehicle in Iowa. It must be completed by the applicant before the registration process can begin. This form provides necessary information about the vehicle, its previous and current owners, and any applicable exemptions from the one-time registration fee. Ensuring that this form is filled out correctly is crucial for a smooth registration experience.

Who needs to fill out the UT 510 Iowa form?

Any individual or entity that is purchasing or transferring a vehicle in Iowa is required to fill out the UT 510 form. This includes:

- Individuals buying a vehicle from another person.

- Dealers purchasing vehicles for resale.

- Nonprofit organizations and government entities acquiring vehicles.

- Individuals transferring ownership through gifts or inheritance.

Completing the form accurately is important to ensure proper registration and compliance with state regulations.

What information is required on the UT 510 Iowa form?

The form requires several pieces of information, including:

- Details of the purchaser or registering owner, including name, address, and telephone number.

- Information about the previous owner.

- Vehicle details, such as make, model, year, and VIN.

- Purchase price and any trade-in allowances.

- Exemption reasons, if applicable, which must be checked and explained.

Providing complete and accurate information helps to avoid delays in the registration process.

Are there any exemptions from the one-time registration fee?

Yes, certain transactions are exempt from Iowa’s one-time registration fee. Some common exemptions include:

- Transfers by gift or without consideration.

- Purchases made by licensed dealers for resale.

- Vehicles registered and operated under specific conditions in Iowa Code Section 326.

- Transfers involving nonprofit or government organizations.

If you believe your transaction qualifies for an exemption, be sure to check the appropriate box on the form and provide any necessary explanations.

What should I do if I need assistance with the UT 510 Iowa form?

If you require assistance while completing the UT 510 form, several resources are available. You can:

- Contact the Iowa Department of Revenue for guidance.

- Visit their official website for additional information and resources.

- Consult with a local attorney or legal expert familiar with vehicle registration in Iowa.

Seeking help can ensure that you complete the form correctly and avoid potential issues with your vehicle registration.

Form Features

| Fact Name | Details |

|---|---|

| Form Purpose | The UT-510 form is used for vehicle title transfers in Iowa. |

| Governing Law | This form is governed by Iowa Code Section 321. |

| Transfer Requirements | Applicants must complete the form before the registration process can begin. |

| Exemption Criteria | Several criteria allow for exemption from Iowa's one-time registration fee. |

| Bill of Sale | A signed Bill of Sale may be required for the transaction. |

| Liability Declaration | The purchaser must declare the accuracy of the information under penalty of perjury. |

| Previous Owner Information | Details about the previous owner must be provided on the form. |

| Vehicle Description | The form requires information on the vehicle being purchased or traded. |

| Contact Information | Both the purchaser and seller must provide their contact details on the form. |

Discover Other PDFs

What Does a Job Application Look Like - This form serves as your initial introduction to potential employers.

Iowa Lead Safety - It is crucial for sellers to comply with federal lead disclosure laws.

To ensure a smooth transfer of ownership and to protect your interests, it is essential to use a Motor Vehicle Bill of Sale form, which you can easily obtain from PDF Templates. This document will provide you with a clear record of the transaction, detailing all necessary information about the vehicle and both parties involved.

Iowa Dot Districts - Support for electronic filing of the 810025 can enhance the speed of processing requests.

Key takeaways

When dealing with the UT 510 Iowa form, understanding its purpose and requirements is crucial for a smooth transaction. Here are some key takeaways to keep in mind:

- Purpose of the Form: The UT 510 form serves as a transaction certificate that must be completed before a vehicle registration can be processed in Iowa.

- Information Required: Applicants need to provide detailed information about both the purchaser and seller, including names, addresses, and contact numbers.

- Bill of Sale: A signed copy of the Bill of Sale may be required to validate the transaction, ensuring that both parties agree to the sale.

- Exemption Criteria: Certain transactions may be exempt from Iowa’s One-time Registration Fee. Applicants must check the appropriate box and provide necessary details to qualify for these exemptions.

- Signature Declaration: The form requires a declaration under penalties of perjury, emphasizing the importance of accuracy and honesty in the information provided.

- Timeliness: Completing the UT 510 form promptly is essential, as delays in submission may hinder the registration process and affect vehicle use.

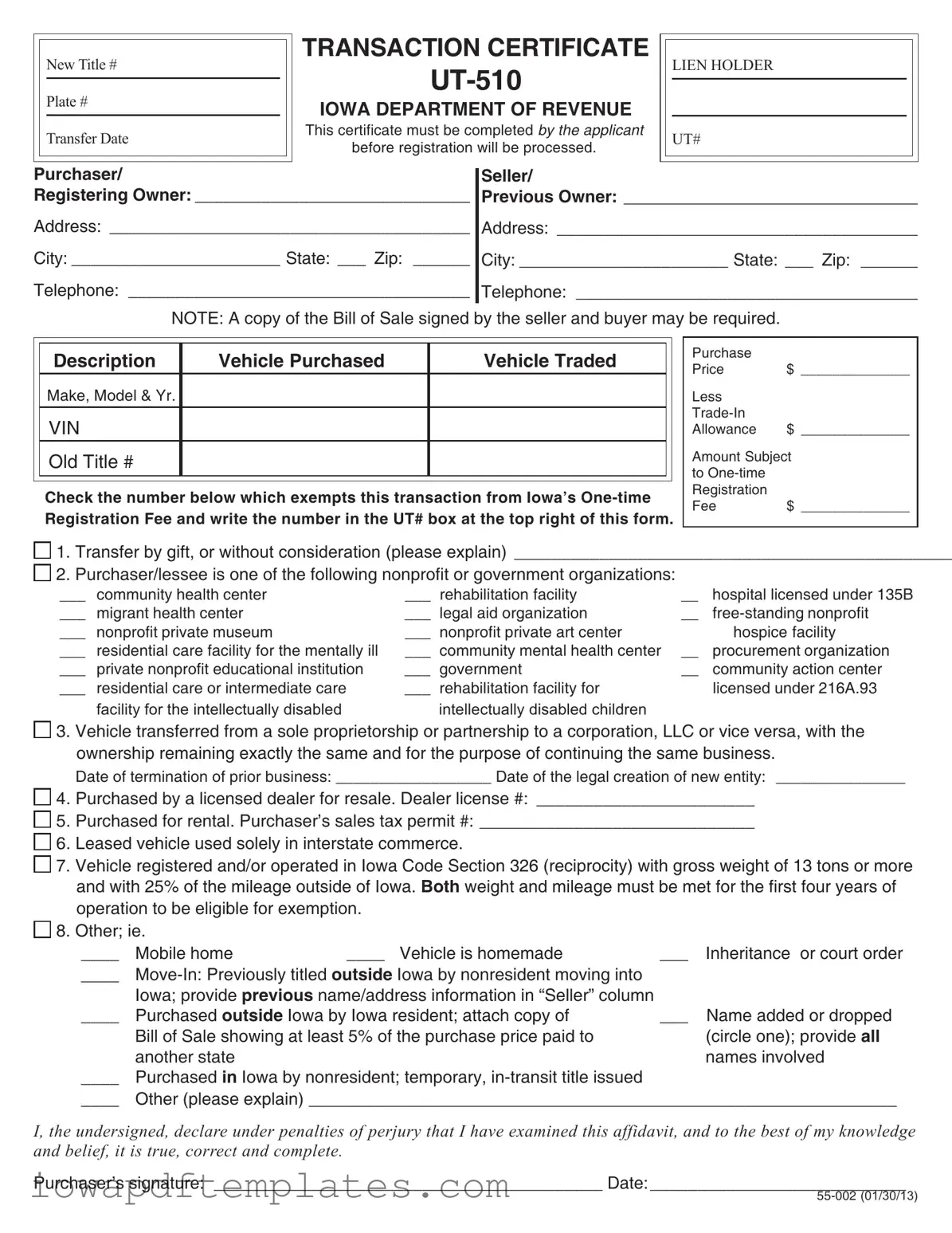

Sample - Ut 510 Iowa Form

NEW TITLE #

PLATE #

TRANSFER DATE

TRANSACTION CERTIFICATE

IOWA DEPARTMENT OF REVENUE

This certificate must be completed by the applicant

before registration will be processed.

LIEN HOLDER

UT#

Purchaser/ |

Seller/ |

Registering Owner: _____________________________ |

Previous Owner: _______________________________ |

Address: ______________________________________ |

Address: ______________________________________ |

City: ______________________ State: ___ Zip: ______ |

City: ______________________ State: ___ Zip: ______ |

Telephone: ____________________________________ |

Telephone: ____________________________________ |

|

|

NOTE: A copy of the Bill of Sale signed by the seller and buyer may be required.

Description |

Vehicle Purchased |

Vehicle Traded |

Make, Model & Yr.

VIN

Old Title #

Check the number below which exempts this transaction from Iowa’s

Purchase |

|

Price |

$ ______________ |

Less |

|

|

|

Allowance |

$ ______________ |

Amount Subject |

|

to |

|

Registration |

|

Fee |

$ ______________ |

1. |

Transfer by gift, or without consideration (please explain) ______________________________________________ |

|||||

2. |

Purchaser/lessee is one of the following nonprofit or government organizations: |

|

|

|||

___ |

community health center |

___ |

rehabilitation facility |

__ |

hospital licensed under 135B |

|

___ |

migrant health center |

___ |

legal aid organization |

__ |

||

___ |

nonprofit private museum |

___ |

nonprofit private art center |

|

hospice facility |

|

___ |

residential care facility for the mentally ill |

___ |

community mental health center |

__ |

procurement organization |

|

___ |

private nonprofit educational institution |

___ |

government |

__ |

community action center |

|

___ |

residential care or intermediate care |

___ |

rehabilitation facility for |

|

licensed under 216A.93 |

|

|

|

facility for the intellectually disabled |

|

intellectually disabled children |

|

|

3. Vehicle transferred from a sole proprietorship or partnership to a corporation, LLC or vice versa, with the ownership remaining exactly the same and for the purpose of continuing the same business.

|

Date of termination of prior business: __________________ Date of the legal creation of new entity: _______________ |

||||

4. |

Purchased by a licensed dealer for resale. Dealer license #: _______________________ |

||||

5. |

Purchased for rental. Purchaser’s sales tax permit #: _____________________________ |

||||

6. |

Leased vehicle used solely in interstate commerce. |

|

|

||

7. |

Vehicle registered and/or operated in Iowa Code Section 326 (reciprocity) with gross weight of 13 tons or more |

||||

|

and with 25% of the mileage outside of Iowa. Both weight and mileage must be met for the first four years of |

||||

|

operation to be eligible for exemption. |

|

|

||

8. |

Other; ie. |

|

|

|

|

|

____ |

Mobile home |

____ Vehicle is homemade |

___ |

Inheritance or court order |

|

____ |

|

|

||

|

|

Iowa; provide previous name/address information in “Seller” column |

|

|

|

|

____ |

Purchased outside Iowa by Iowa resident; attach copy of |

___ |

Name added or dropped |

|

|

|

Bill of Sale showing at least 5% of the purchase price paid to |

|

(circle one); provide all |

|

|

|

another state |

|

|

names involved |

|

____ |

Purchased in Iowa by nonresident; temporary, |

|

|

|

|

____ |

Other (please explain) ______________________________________________________________ |

|||

I, the undersigned, declare under penalties of perjury that I have examined this affidavit, and to the best of my knowledge and belief, it is true, correct and complete.

Purchaser’s signature: _________________________________________ Date: ___________________________

Similar forms

The UT-511 form is similar to the UT-510 in that both documents are used for vehicle title transfers in Iowa. The UT-511 specifically addresses the transfer of vehicles between individuals or entities, providing a structured way to record the details of the transaction. Like the UT-510, it requires information about the purchaser, seller, and vehicle details, ensuring that all parties involved are accurately documented. This helps to maintain a clear record of ownership and any associated liens.

Understanding the importance of a Release of Liability document is essential for anyone engaging in activities that involve potential risks. By utilizing this form, individuals can safeguard themselves from possible legal claims related to injuries or damages, ensuring they participate with full awareness of the associated risks.

The UT-512 form serves a similar purpose, focusing on the transfer of vehicles that are being gifted. This form captures the necessary information about the donor and recipient, similar to the UT-510. It also includes sections that explain the exemption from fees, which can be crucial for individuals transferring ownership without a monetary exchange. Both forms aim to facilitate the legal process of title transfer while ensuring compliance with Iowa regulations.

The UT-513 form is used for vehicle transfers involving a lien. This document requires detailed information about the lienholder, similar to what is required on the UT-510. Both forms ensure that any existing liens are acknowledged and addressed during the transfer process. This is important for protecting the interests of all parties involved and maintaining accurate records in the Iowa Department of Revenue system.

The UT-514 form is similar to the UT-510 in that it is designed for transactions involving leased vehicles. It captures information about the lessee and the leasing company, ensuring that the transfer of ownership is documented properly. Both forms require details about the vehicle and the parties involved, which helps to streamline the registration process and maintain accurate records for future reference.

The UT-515 form is intended for vehicle transfers related to estates. This document captures information about the deceased, the heirs, and the vehicle in question. Like the UT-510, it ensures that all necessary details are recorded to facilitate the transfer of ownership. This is particularly important for ensuring that the vehicle is legally transferred to the rightful heir, in compliance with Iowa laws regarding inheritance.

The UT-516 form is used when a vehicle is being transferred due to a divorce. This document captures the necessary information about both parties and the vehicle, similar to the UT-510. It ensures that the transfer is legally recognized and that both parties agree to the terms of the transfer. This helps to prevent future disputes regarding ownership and maintains clear records for the Iowa Department of Revenue.

The UT-517 form is applicable for vehicle transfers involving non-profit organizations. This document requires details about the organization and the vehicle, similar to the UT-510. It ensures that the transfer is compliant with specific regulations governing non-profit transactions. Both forms help to document the transfer process clearly, making it easier for organizations to manage their vehicle assets legally.

Lastly, the UT-518 form is used for temporary registrations. This form allows for the transfer of ownership for vehicles that are not yet fully registered. Like the UT-510, it requires information about the purchaser, seller, and vehicle. This form is particularly useful for individuals who need to use the vehicle immediately while waiting for full registration to be processed. Both forms serve to facilitate the legal transfer of ownership while ensuring compliance with state regulations.